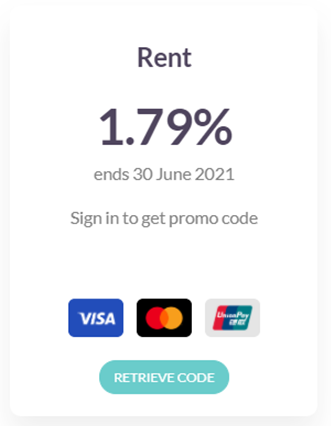

CardUp has further reduced its admin fee for rental payments from 1.9% to 1.79%, valid for all payments scheduled on or before 31 December 2021. This allows users to buy miles from as little as 1.1 cents each, depending on their credit card

|

|

| Use code: SAVERENT179 |

How does CardUp’s discounted fee work?

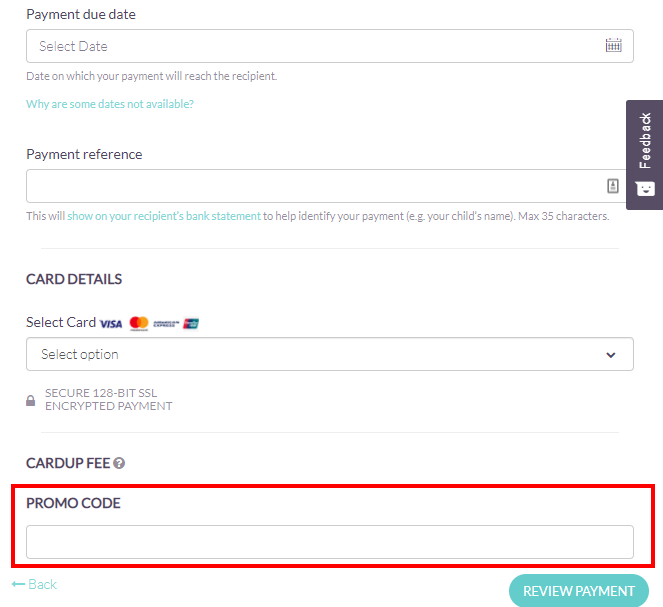

To enjoy the 1.79% fee, use the code SAVERENT179 when setting up your payment. If you have existing payments scheduled, there’s no need to cancel them- you can edit them in the dashboard to add this promo code instead.

No minimum payment is required, but it must be set up on or before 31 December 2021, with a due date on or before 5 January 2022. This code is valid with any Singapore-issued Visa or Mastercard.

If this is your first payment with CardUp, you have the following additional options:

- Save S$20 off the admin fee for your first payment of S$1,000 or more with the promo code MILELION

- Enjoy an admin fee of 1.6% on your first two recurring payments of at least S$500 with the promo code HOLIDAY16ML

The full T&C of this promotion can be found here.

How much do miles cost with this promotion?

Here’s what a 1.79% fee means for your cost per mile with various credit cards. The cost goes down to as little as 1.1 cents each, which is a fantastic price to buy miles at even if your valuation happens to fall towards the lower range of the spectrum.

| Card | MPD | CPM @ 1.79% |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.10 |

DBS Insignia DBS Insignia |

1.6 | 1.10 |

UOB Reserve UOB Reserve |

1.6 | 1.10 |

OCBC Premier, PPC, BOS VOYAGE OCBC Premier, PPC, BOS VOYAGE |

1.6 | 1.10 |

SCB Visa Infinite SCB Visa Infinite |

1.4* | 1.26 |

| 1.4 | 1.26 | |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.26 |

Citi Prestige Citi Prestige |

1.3 | 1.35 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.35 |

Citi PremierMiles Citi PremierMiles |

1.2 | 1.47 |

SCB X Card SCB X Card |

1.2 | 1.47 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.47 |

OCBC 90N OCBC 90N |

1.2 | 1.47 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.47 |

BOC Elite Miles BOC Elite Miles |

1.0 | 1.76 |

| *With minimum S$2K spend per statement month, otherwise 1.0 mpd |

||

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

|

CardUp FAQ Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

Rental payments can be a very cheap source of miles in Singapore, and if you happen to hold one of the higher earning general spending cards, it’s definitely an option to consider.

Do remember to scheduled your payments on or before 31 December 2021 to take advantage of this offer, and if you’re using the old SAVERENT19 code, edit the rest of your payments in the dashboard to save more.