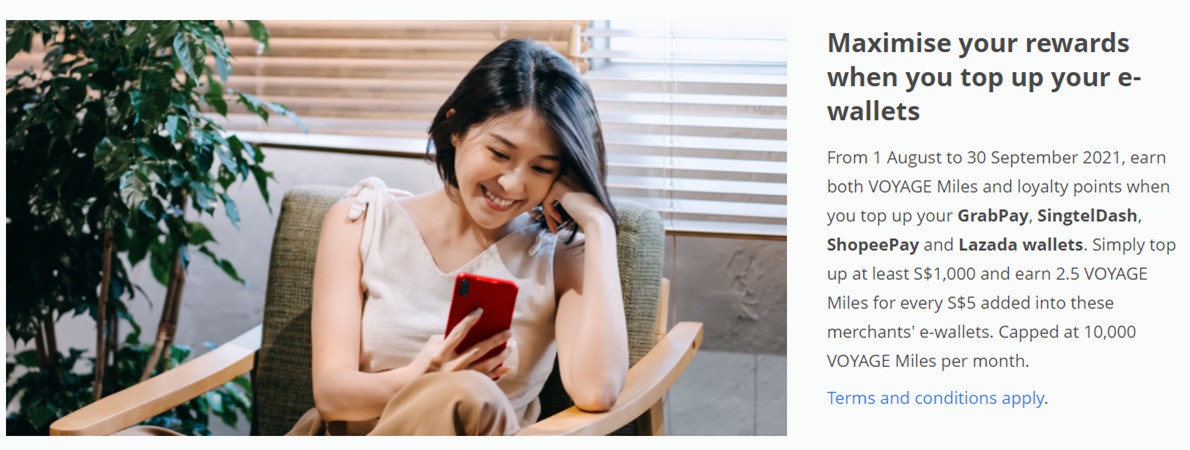

For the months of August and September, OCBC VOYAGE and Premier Visa Infinite cardholders can earn VOYAGE miles and OCBC$ for topping up e-wallets like GrabPay and Singtel Dash.

This is a rare opportunity indeed, as topping up e-wallets is explicitly excluded from rewards by virtually every bank out there (including OCBC, under normal circumstances).

Earn rewards for topping up e-wallets

From 1 August to 30 September 2021, OCBC VOYAGE and Premier Visa Infinite cardholders will earn VOYAGE Miles and OCBC$ respectively when they top up at least S$1,000 per month to any of the following e-wallets:

- GrabPay (MCC 6051)

- Lazada Wallet (MCC 6540)

- ShopeePay (MCC 5262, 6540)

- Singtel Dash (MCC 6540)

No registration is required, and cardholders will automatically earn rewards as follows:

| 💳 OCBC e-Wallet Top Up Campaign | |||

| Card | Earn Rate | Min. Top Up | Cap |

OCBC VOYAGE OCBC VOYAGE (all versions) |

2.5 VM per S$5 (0.5 mpd) |

S$1K per mo. | S$20K per mo. |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

15 OCBC$ per S$5 (1.2 mpd) |

S$1K per mo. | S$20K per mo. |

OCBC VOYAGE cardholders will earn the equivalent of 0.5 mpd, while Premier Visa Infinite cardholders will earn the equivalent of 1.2 mpd. Do remember that OCBC awards VM/OCBC$ in blocks of S$5, so a S$19.99 transaction earns the same rewards as a S$15 one.

The maximum rewards that can be earned each month are 10,000 VMs and 60,000 OCBC$ (24,000 miles) respectively, which works out to S$20,000 of top-ups monthly. Considering that the maximum GrabPay wallet balance is S$5,000 and the annual GrabPay transaction limit is S$30,000, that’s plenty.

Rewards will be credited to your account within 2 months from the end of the promotion period, i.e. by 30 November 2021.

T&Cs can be found here for the OCBC VOYAGE and OCBC Premier Visa Infinite.

What alternatives exist for GrabPay top-ups?

I’m aware this promotion covers more than just GrabPay, but it’ll invariably get the most attention as it’s the most flexible of the four e-wallets.

The following credit cards still offer rewards for GrabPay wallet top ups.

| Card | Earn Rate |

AMEX SIA Business Card AMEX SIA Business CardApply |

6.8 mpd (Until 30 Sept, if registered for AMEX Offer. Otherwise 1.8 mpd) |

AMEX True Cashback Card AMEX True Cashback CardApply |

1.5% cashback |

CIMB World Mastercard CIMB World MastercardApply |

1.5% cashback |

UOB Absolute Cashback Card UOB Absolute Cashback CardApply |

1.7% cashback |

Even if you don’t qualify for an AMEX SIA Business Card (only available to SME business owners), you could still earn up to 1.7% cashback on your top-ups. In my opinion, that’s much better than the 0.5 mpd on the VOYAGE (unless you value miles at a whopping 3.4 cents each).

The math is more favorable with the OCBC Premier Visa Infinite, as I’d definitely take 1.2 mpd over 1.7% cashback.

Rewards aside, VOYAGE cardholders could use this promotion to clock spending towards the S$60,000 required each year for an annual fee waiver (S$30,000 for Premier customers). Do note that this promotion will not count towards the minimum spend required for limo rides, however.

What should I use my GrabPay balance for?

Once you’ve topped up your GrabPay balance, be careful how you use it! Don’t waste it on GrabFood or Grab rides, or spend it at merchants where you could already earn 4 mpd with other credit cards (the same logic applies for any other e-wallet, really).

Instead, conserve it for situations where earning rewards with regular credit cards is impossible. I’m thinking of insurance premiums, government transactions, IRAS income tax, town council bills, condo fees and the like.

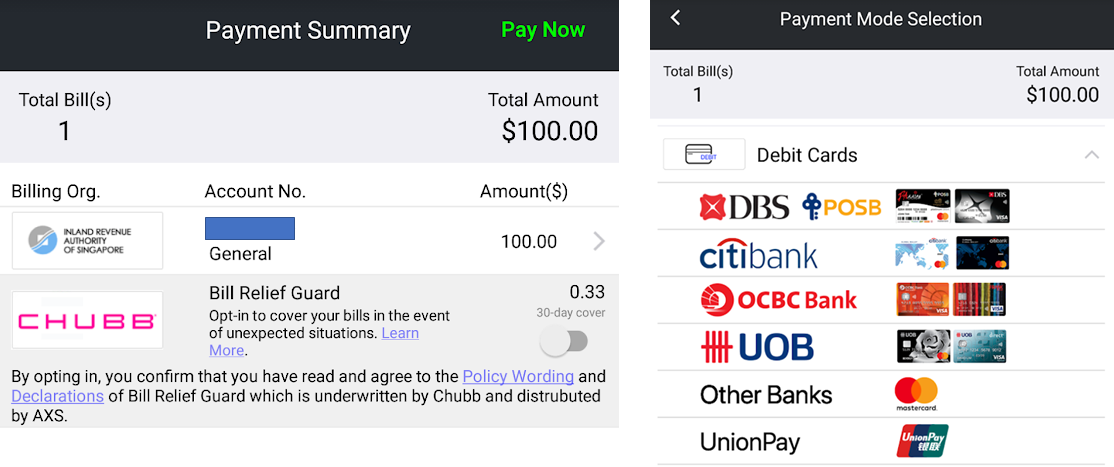

AXS machines recently started accepting GrabPay once more, which is a great opportunity to earn rewards on bill payments. To make an AXS payment with GrabPay, select the billing organization and enter your details as per normal. On the payment selection screen, select “debit card”, then “other banks” (if this fails, select “credit card” then “other banks” and try again).

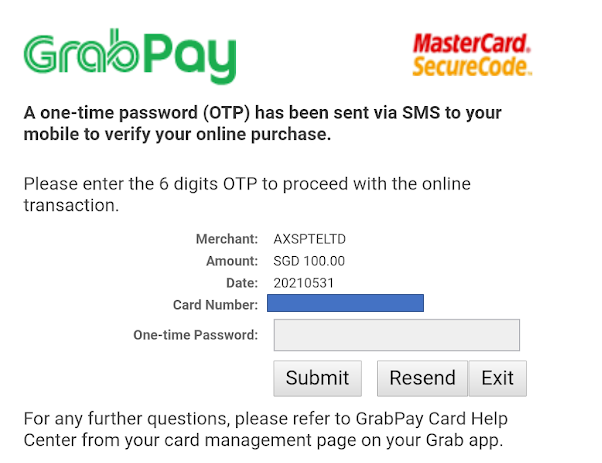

Enter your GrabPay Mastercard details, then the OTP.

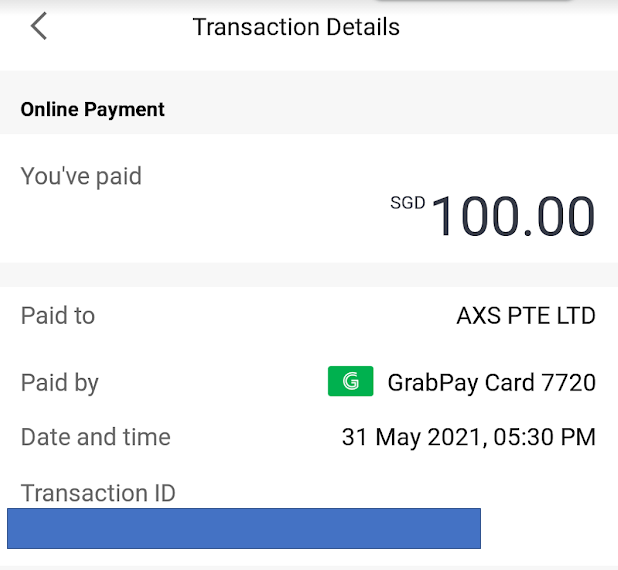

That’s it. You’ll see the transaction reflect in the “recent transactions” section of the Payment tab in the Grab app.

A few points to note:

- AXS payments do not count towards the various GrabPay Power Up promos or Challenges

- GrabRewards points will not be awarded for AXS transactions

- The maximum transaction you can make with the GrabPay Mastercard on AXS seems to be capped at S$500. If your bill is more than this, split it up into multiple transactions

Conclusion

This promotion is arguably more useful for Premier Visa Infinite cardholders than VOYAGE members, but in any case it’s a seldom-seen opportunity to earn rewards for e-wallet top ups (and clock spending towards the annual fee waiver).

Don’t jump the gun just yet as the campaign only starts on 1 August.

The challenge is not enough GPMC limit. Only 30k per year which is quickly digested when paying income via AXS (get 1.7% from UOB Amex Absolute). Any hack for second GPMC? Children?

not a whole lot you can do, since the $30k is an MAS requirement. i suppose you could get your kids to sign up for one as well, or your grandma.

You have to select credit card on AXS, it will not accept GPMC on debit card mode.

Payphones used to be able to take coins

CIMB World Mastercard will be excluding GrabPay top ups in September.

No more $500 limit for grab master on axs, I tried for a $1.5k and it went through.

If only it is perm..