Back in December 2019, AXS stopped accepting GrabPay or the GrabPay Mastercard as a payment method. This was a major downer, because it killed off the best way to earn cashback or miles on bill payments that otherwise wouldn’t earn them.

But here’s the good news: Effective 10 May 2021, GrabPay payments via AXS have been re-enabled. GrabPay is once again accepted for all AXS transactions, except credit card bills and loan payments.

This works across both the e-Station (desktop browser) and m-Station (mobile app), with a per transaction payment limit of S$500.

Using GrabPay with AXS

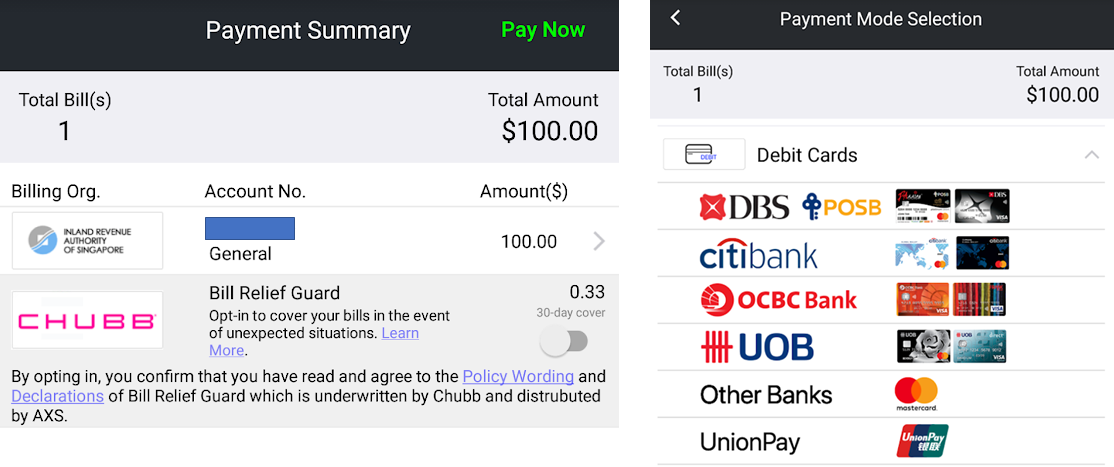

To make an AXS payment with GrabPay, simply select the billing organization and enter your details as per normal. On the payment selection screen, select “credit card”, then “other banks”.

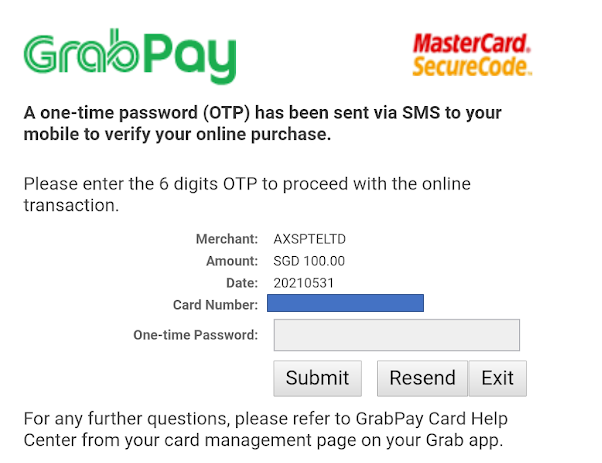

Enter your GrabPay Mastercard details, then the OTP.

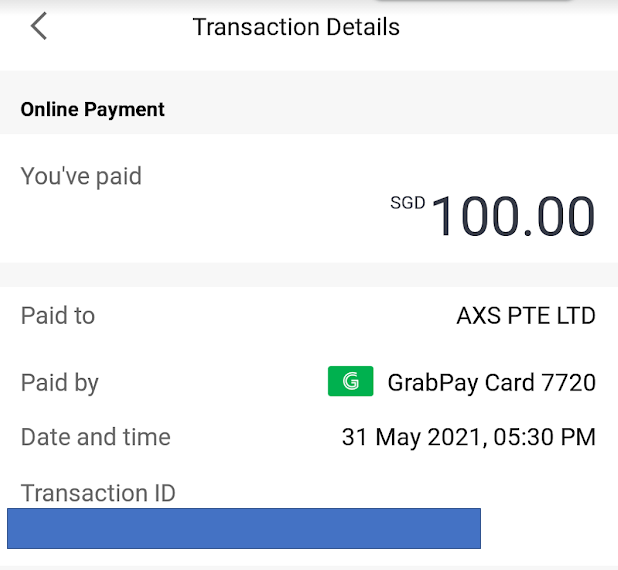

That’s it. You’ll see the transaction reflect in the “recent transactions” section of the Payment tab in the Grab app. My IRAS account balance was updated immediately.

A few points to note:

- AXS payments do not count towards the various GrabPay Power Up promos or Challenges

- GrabRewards points will not be awarded for AXS transactions

- The maximum transaction you can make with the GrabPay Mastercard on AXS seems to be capped at S$500. If your bill is more than this, split it up into multiple transactions

- If you make ad-hoc payments to IRAS while on a GIRO payment plan, your subsequent month’s deduction will be reduced by that amount. For example, if my monthly installment is S$1,000 and I pay S$300, GIRO will deduct S$700 (assuming my ad-hoc payment is received before the deduction date)

Why use GrabPay with AXS?

The simple reason to use GrabPay with AXS is because it lets you earn miles or cashback on transactions that otherwise wouldn’t qualify. For example:

- Condo fees

- Memberships

- Insurance premiums

- IRAS tax

- Season parking

- Town councils

- Utility bills (but keep in mind some credit cards still earn points for this)

The key is topping up the GrabPay wallet with the right card. While the vast majority of credit cards no longer offer rewards for GrabPay top-ups, there are three exceptions I’m aware of:

| Card | Earn Rate |

AMEX SIA Business Card AMEX SIA Business CardApply |

1.8 mpd |

AMEX True Cashback Card AMEX True Cashback CardApply |

1.5% cashback |

UOB Absolute Cashback Card UOB Absolute Cashback CardApply |

1.7% cashback |

It’s very simple.

- Top up your GrabPay wallet with one of the above cards

- Use your GrabPay Mastercard to make payment via the e-Station or m-Station for your bill

- You’ve effectively earned 1.5/1.7% cashback or 6.8 mpd on your bill

The main thing to note is that Grab imposes the following transaction limits:

- Single transaction limit: S$5,000

- Daily transaction limit: S$5,000

- Monthly transaction limit (calendar month): S$10,000

- Annual transaction limit (calendar year): S$30,000

I hold an AMEX Singapore Airlines Business Card, and intend to use the full S$1,000 cap from the AMEX offer on income tax payments. It’s a whopping 6.8 mpd, at no cost to me. That’s even better than Citibank’s otherwise excellent PayAll offer- nothing beats free!

That card won’t be for everyone (since you need an ACRA business number to register), but you can otherwise use the UOB Absolute Cashback Card to save up to S$510 per year (1.7% of S$30,000) on transactions that would normally have to be paid in full. I’ve written about this card in more detail here.

New UOB Absolute Cashback Card: 1.7% cashback with no caps, no exclusions

Conclusion

The revival of GrabPay on AXS is fantastic news, as it’s basically a 1.7% discount of all your bills should you have the UOB Absolute Cashback Card. I’d give this card a ringing endorsement now, especially if you don’t qualify for the AMEX Singapore Airlines Business Card.

If only the Citi Rewards were alive to see this.

Hi Aaron, I think the Amex HighFlyer promo you are referring to, is for a cap of 5,000 HighFlyer points (i.e. $1000 spend, not $5000 as in the article).

yeah, brainfart. $1k.

Hi Aaron, thanks for sharing the great news!

Question: Let’s say my income tax is on monthly Giro and deduction date falls on 7th of every month. If I made the monthly payment via AXS a few days in advance, is it true that the Giro deduction will not carry out, since I paid for that month already?

No, the GIRO deduction will continue until the tax is fully paid.

According to mainly miles

https://mainlymiles.com/2021/05/03/paying-your-income-tax-by-monthly-instalment-with-cardup-and-ipaymy/

He says:

You’ll have to keep the GIRO arrangement with IRAS in place, which might seem a little counterintuitive, but don’t worry – provided your account credits via CardUp make it into your IRAS account first, the GIRO will not be deducted.

Can confirm?

Yes, so long as it is in time, GIRO will not take place or will GIRO less (if you did not pay the full GIRO amount). If not in time for current month, it will take effect for next month.

so long as your ad hoc payment is made before the giro deduction date (give it 3-4 days to be safe), the deduction will be adjusted accordingly.

example: my NOA is $1,200. I opt for giro, so I owe them $100 each month. If I pay $40 adhoc payment, I will only have a $60 giro deduction. if I pay $130 adhoc payment, I will have no deduction this month, then $70 giro deduction next month.

Hi Aaron, i think this is not true. Just sharing, i paid my taxes on the 1st but on the 6th they still debit from my bank account as usual. I wonder if others have the same experience?

thanks for sharing, i think 1st may be too late though.

what happened for me is I made a payment on 20 march 2021 that was more than enough to cover april’s deduction, and in April there was no giro deduction.

Why they restrict to $500 per transaction?

no idea, but it’s not that big a restriction if you can break up your payments into multiple transactions

Hi Aaron, great content as always – I was just wondering, for someone who does not have any of the above 3 credit card mentioned, an alternative would be to top up your GPMC using your usual credit cards (e.g. UOB One, Citi Premier Miles), which obviously won’t earn you any miles/cashback.

However, when you then use the GPMC to pay your income tax or road tax, you will earn GrabRewards points, which is better than nothing.

yeah, i guess that’s valid too! Just need to be mindful of GrabPay’s exclusion list: https://help.grab.com/passenger/en-ph/360038831171-What-are-the-transactions-that-DO-NOT-qualify-for-GrabRewards-points

Hi Aaron,

I did a “test” payment to IRAS and there is no GrabRewards points. Not surprising as it was indicated in your post above. I was wondering, since UOB Absolute has no exclusion, one can pay direct to IRAS (etc) without going through GPMC and still get the 1.7% cashback?

Anyway, keep up the great job you are doing now 😀

if you’re asking about IRAS, they dont take card payments. the only way is to go via AXS.

Ok, sorry, my bad. AXS does not accept AMEX.

Hi Aaron! Assuming my tax payable is $10k, can I do multiple transactions of $500 till it hits $10k?

of course you can. there’s no limit (unless grab blocks your card because you’re making the same transaction over and over again- may trigger fraud alert)

Does it work with just Grabpay ? (don’t have GPMC)

i don’t recall seeing a grabpay option. but you don’t need a physical GPMC- if you have grabpay, you should have the virtual mastercard in your account too

Thanks ! I give it a try

hahah love the final sentence. Long live CRV at least for everything online purchase

Hi, just sharing experience. I just did tax payment with Grabpay mastercard via AXS and there was no limit of $500 per transaction; I could make payment of a few thousand dollars at one go. However, AXS rejected the transaction a few times when I tried selecting debit card as the payment method, but it went through when I changed the selection to “Credit Card” instead. Hope this helps the rest…

Thanks for the info, i was having the same problem

Thanks for the info, this just worked for me too!

Just tried using the AXS app to pay for insurance payment and there was no grabpay option. Even the credit and debit card options all have to select specific banks and grab pay wasn’t one of them.

select “other bank”

thank you!

Seems restrictions for grab pay card on AXS has increased, my transaction for 1.2k went through. So it might be higher now.

Does this still work? Been trying since yesterday (8 Oct) and it stopped working

It works. I just made a payment to insurance yesterday using Grappay card via AXS. However, Grabpoints are no longer awarded for AXS transactions. Hence, it’s no difference from using any other credit card.

The difference is when you use your absolute cash back card of uob or Amex cash back card to top up Into grabpay wallet . You will save 1.7/1.5% there already

I don’t think it’s working anymore right? it says “Only Debit Cards are accepted” after following all the aforementioned steps.

You should select ‘Credit card’ / Other banks and that will work. I just did it.

AXS message about “Only Debit Cards are accepted” is misleading.

Is there a way to increase the $30,000 spend per calendar year?

Does AXS machine using Grabpay /Grabpay Master Card still work for CPF Topup and IRAS income tax?