One question I get asked very often is about using credit cards for bill payments.

Now, intuitively you won’t be able to pay for a credit card bill with another credit card. Because this would create a wonderful cycle where I could

(1) Pay my DBS Altitude Card bill with my UOB PRVI Miles card and earn miles on my PRVI

(2) Pay my UOB PRVI Miles Card bill with my DBS Altitude Card and earn miles on my DBS Altitude

(3) Etc, etc

To be fair, people are trying to do this all the time (ie earn points from thin air). It’s called manufactured spend. It’s when you find a way of using your card, but not paying any money. For a while it was apparently possible to do this in Singapore via Qoo10 (no longer possible, I tried!).

For some reason, Banks consider recurring bill payments to be transactions not worthy of earning points .From the T&C of DBS, for example

2.5 DBS Points will not be awarded for AXS and SAM terminals/online/iBanking bill payment transactions, fund transfer transactions, cash advances, annual fees, interest, late payment charges, all fees charged by DBS, instalment payment plans, preferred payment plans and other miscellaneous charges imposed by DBS (unless otherwise stated in writing by DBS).

From the T&C of UOB’s PRVI Miles card

UOB PRVI Miles World MasterCard and PRVI Miles Visa Cardmembers will also not earn UNI$ for the following transactions: Bill Payment Establishments registered under the following MCC: 6300 Insurance Underwriting, Premiums 6399 Insurance – Default

However, most of the major banks eg UOB, DBS, Citibank, ANZ have their own bill payment schemes which allow you to earn points for certain recurring bill payments. These cover certain merchants, mainly telcos and town councils.

One important point to note about these bill payment services is that you need to register in order to get your points. Suppose I use my UOB card to pay my M1 phone bill online through M1’s online portal. I will not earn any points. To repeat: the only way to earn points on paying my M1 phone bill with my UOB card is to register via the UOB Bill Payment Service

UOB Bill Payment Service

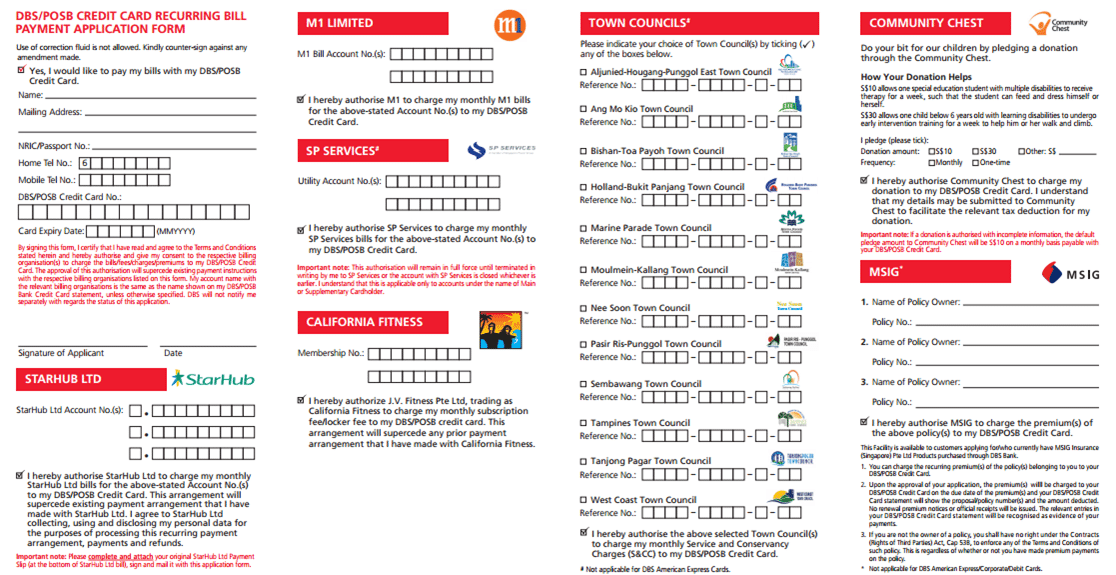

DBS Recurring Bill Payment

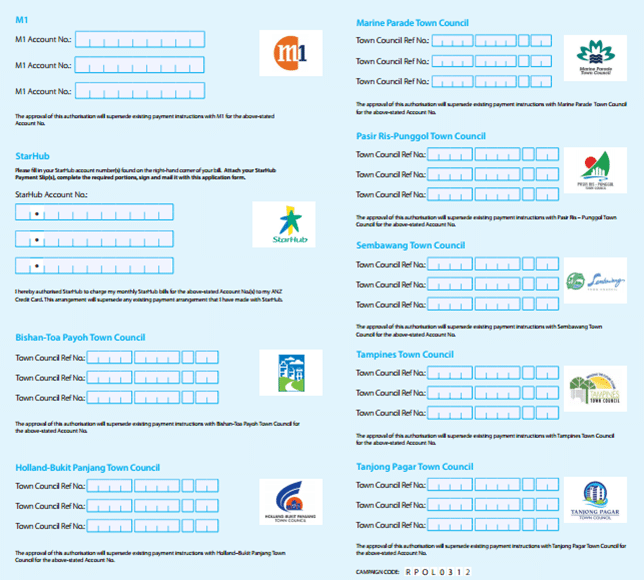

Citibank OneBill

ANZ Recurring Payment

As a general note- the options you have do appear to vary by card issuer, eg DBS and ANZ do not appear to have Singtel, only DBS has MSIG, only Citibank has ACE etc.

Alternatives

DBS Woman’s World Card

According to Lionel on the comments, it is possible to earn 4 miles per $1 when you use your DBS Woman’s World Card to make bill payments for telcos online. I wouldn’t be surprised if this were the case, given how generous DBS is in their interpretation of “online spend” for this card. the T&C for the UOB Preferred Platinum Visa and the Citibank Rewards card explicitly exclude any bonus awarded for online bill payments.

Citibank Rewards Card

Mark from TheShutterWhale says that Citibank Rewards does award bonus points for online telco payment, and people online have reported getting a bonus for this too.

What is interesting is that with the new e-AXS machines it is possible to make payment for pretty much any bill using your credit card, and earn the corresponding online bonuses. See this thread on FT for more details, but to summarise

http://www.axs.com.sg/axsEstation.php

– MasterPass wallet account has to be registered

– Email address and password are required to login to MasterPass

– Able to pay for all bills except for credit card, loans and HDB eServices

Others

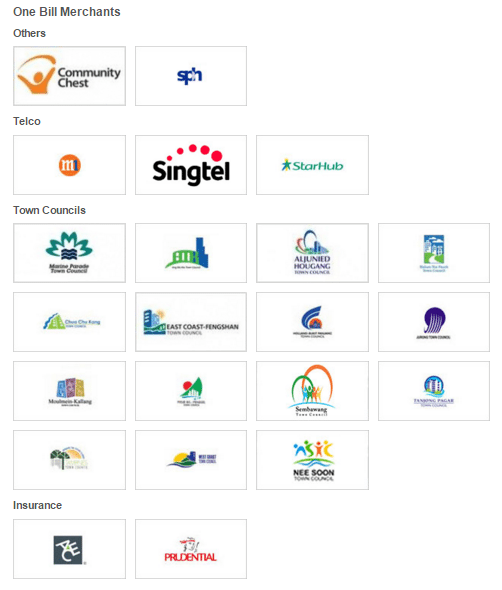

Maybank Horizon Platinum Card says they will give 4 miles per $1 for spending with local telecommunication groups, so that’s something you may want to consider too

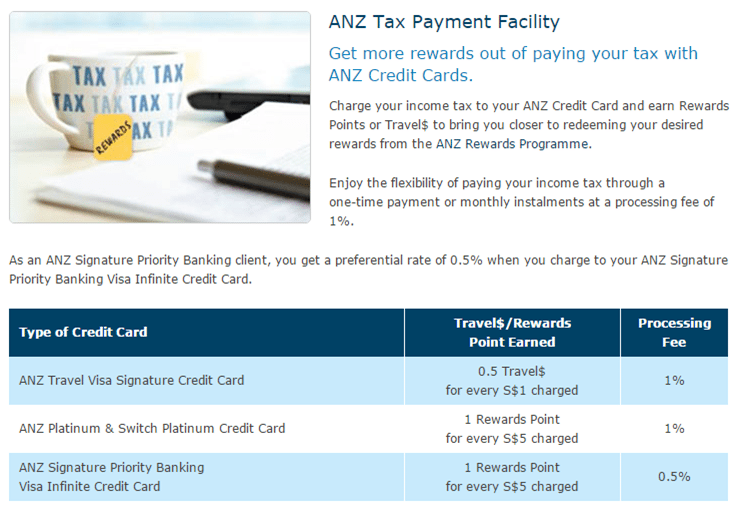

Also, if you’ve got an IRAS bill to pay, ANZ offers the ability to pay your bill and earn points. That said, I don’t think it’s a great deal- you pay a processing fee of 1% and you earn 0.5 miles per $1 on your ANZ Travel Visa Signature card. 0.5 miles is perhaps worth 2-2.5 cents, so even though you are coming off 1-1.5 cents better in this scenario I still don’t like the idea of having to pay ANZ for the privilege of giving them more swipe fees.

Conclusions

Personally, I have never used any of these options. My company pays my phone bill, I’m still living with my parents so the utilities bill isn’t my concern, and my insurance premiums I pay in 1 lump sum each year to save a bit of money. But if you’re in a situation with lots of monthly recurring bills, this might be useful.

Does anyone know of any other schemes that let you earn points for paying bills?

cover photo by theeerin

I pay my Singtel bills with Citibank Rewards for 4 miles per S$1. Not sure why it works but hey I’m not complaining. Heard the AXS eStation has opened up a whole new can of (good) worms too!

awesome- i did not know that. i just assumed from the T&C that they wouldn’t allow it. i’ll update the article accordingly.

btw I saw your post on the no forex fee BOC VI card- looks like one of my christmas wishes came true!

Citibank Rewards card used to offer 4 miles for income tax via AXS. Heard it lasted only till this year. ANZ is the only card I know of now still accepts income taxes.

Another way for DBS Woman card is to use a master pass wallet account.

http://www.flyertalk.com/forum/singapore-airlines-krisflyer/1076196-best-credit-cards-kf-miles-accrual-master-thread-327.html

Quote “Now u can earn points when you pay bills at the AXS e-station website only with MasterCard!! All bills including IRAS, insurance, SP Services all can!! 10x points with DBS Woman’s card because its an online transaction, need OTP. http://www.axs.com.sg/axsEstation.php – MasterPass wallet account has to be registered – Email address and password are required to login to MasterPass – Able to pay for all bills except for credit card, loans and HDB eServices – 16-digit card number and OTP are required to effect payment – Able to pay for all bills except for credit card, loans and HDB… Read more »

Thanks for pointing this out. I’m following this conversation on FT too. It seems that the Citibank Rewards card is granting 10X points for payments made on e-axs, which is great. One forum member has tried the DBS Woman’s World card to see whether he will earn 10X and is due to reply middle of next month when the 9X bonus supposedly posts. I have a good feeling about that one though.

So, like Mark says, it appears the AXS estation is the answer to everything then.

Hi Aaron, its the masterpass wallet, not the direct payment to axs that grants the 10x Rewards. Instead of going via DBS Woman -> E-AXS. Use DBS-Woman -> Masterpass -> Anything that support Masterpass which include AXS for the 10x rewards.

https://masterpass.com/SP/Merchant/Home

Hi Lionel what is different paying direct to AXS and paying via masterpass ? In the statement will you see payment via masterpass ?

Hi Rio, The merchant code will be different, which will counted as a 4 miles point when using DBS woman card.

To clarify, its should be the top up to your Masterpass wallet, that earns you the point. Pay a close attention to the t&c as this may change anytime.

@Rio, that’s what I had guess, since the money theoretically route through master pass to axs. Anyway, given the post is from 15 Dec 2015, I believe the news should be accurate. I am going to make some payments through my masterpass the see how it goes. 4 points is always better than earning that miserable 1 point.

“For a while it was apparently possible to do this in Singapore via Qoo10 (no longer possible, I tried!)”

wow i didnt know about this ? kind to explain ?

I also use DBSWC to pay my starhub bill online and so far get 10x point.

With this AXS things i am thinking of cancelling my giro auto deduction for my income tax payment but i dont want trouble me

One more clarification. Even though Prudential is listed as one of the merchants under the UOB Bill Payment Service, if you charge the bill to the PRVI Miles MasterCard, you will not get any UNI$. This is because the T&C for the PRVI Miles MasterCard specifically says no UNI$ will be awarded for insurance payments, and this supersedes the T&C of the Bill Payment Service. Unfortunately, this wasn’t very clear on the UOB website, and I found this out the hard way. To UOB’s credit though, after I called to complain, they acknowledged that there was a gap in the… Read more »

thanks Jon. it’s good to hear they honored their T&C for those few payments you made. do you think the e-axs workaround would suffice in this case?

No idea. Only one way to find out for sure 🙂

I have been thinking about the E-AXS bill payment, and figured that DBS Woman (and maybe citibank rewards) is probably going to restrict awarding points for exas eventually. I figured that I should get the HSBC advance CC as a back up plan. HSBC advance CC seems to be really generous in offering that rewards points, doesn’t seems harmful to keep multiple cards that offer points for online transaction 😀

@Lionel,

are you sure that we can earn miles using Masterpass. I set up my Masterpass account tied to a local bank credit card, and when I tried to pay at eStation using Masterpass, after the transaction, i got the usual SMS from my bank alerting me that $XXXX was charged to my card and the Merchant is AXS Pte Ltd. Since the merchant is AXS, I’m not sure if the bank (the blue local bank) will still credit the points ?

I have been trying to figure this out as well given the news on flyertalk is so new. I am waiting for 16 Jan to see how it goes, to me its either 0 points of 4 points, I am not comfortable with just clocking 1 pts. There is definitely some hype on flyer talk on this with some people saying its possible. My guess is that is an oversight from DBS. Looking at DBS stance/attempt history to narrow/prevent people from getting points from bills, even if it works, it shouldn’t last long before DBS clamp down on this. I… Read more »

@Lionel,

I have tried with UOB. Will let everyone know if it works when I get my statement in 2 weeks. Correct me if I am wrong but DBS is not an option for me as this method requires a wallet funded with a MasterCard and for DBS, the only option is the women’s card but I’m a guy. I will also try with the Citi Rewards card as well.

Regds

Eddie.

gender is no barrier to woman’s card ownership!

I think Lionel is right on this- the soonest the 10X bonus for dbs woman’s can be confirmed is mid jan. in the meantime one poster reported not getting a bonus for using citirewards MC to pay via axs so either he’s doing it wrong (ie not using masterpass) or something else funny is going on. i’d wait for a few more positive datapoints before acting

If this is ok I think we can also pay using AXS M-Station. The ios/google playstore app…

@Aaron,

someone just reported on Flyertalk a few days ago that he paid insurance using AXS charged to the C Rewards MC. (not MCPass). 10X points awarded ! I’ve just tried it, so can confirm again in a few days.

Eddie

thank you sir! I saw this too, monitoring that thread like a hawk. do let me know what happens with you

You can get the woman’s card even if you are a guy. UOB is the most restrictive online card, I would recommend the less restrictive options like Citi Rewards and HSBC Advance. Lots of people really like DBS Woman, but I can see DBS stance to prevent people to clock miles through bills and other necessity spending, hence I am planning to move away in 2016. You can combine any of them with imagine or fevo card for extra benefits. Not going into details here but you should get the idea eventually on pair a cards benefit with another.

Fevo has just too many inherent problems and horror stories for me to even consider it.

As for Imagine, I’m somewhat keen but not sure if I can use Imagine to fund my Masterpass wallet ?

I have just added my amex rewards to Masterpass, but unable to pay any bills to e-axs using the amex card via Master Pass. Reason given is that merchant does not accept amex.

[…] may want to read this article about bill payments as […]

The 16th of every month point reward is for 15th-15th or last month? Meaning the whole December?

Any update on the AXS masterpass. I have read FT and can’t find any answer.

on FT there is 1 person who reported getting the bonus. i’d feel a bit more comfortable with a few more datapoints though.

16th of every month 9x is awarded for previous month spending. eg i spend $100 online in November, in Nov i get the base of 40 miles, in Dec 16th i get the balance 360 miles

I am sorry for the late follow up. I got the opportunity to share the good news since my DBS Woman card is new. This is my first month spending which means that it is easy for me to calculate the points! TLDR: DBS Woman award point for both E-AXS and Singtel Online billing portal I had receive a total of 1429 DBS points with a total spending of 724.23 dollar. Seems like paypal payment of 10.30 is only counted as 1 point. Doing the maths. 724.23 dollar – 10.30 give me 713.93 dollar. Divided this value by 5 give… Read more »

@Lionel

for the DBS card via eAXS option, did you use the MC option or the MCPASS option ?

Eddie

I used the masterpass, though I don’t think it matters 😉

thanks Lionel for confirming this!

So to recap:

DBSWC: Use MPASS

C Rewards: ?? yet to be confirmed, although I used MC since it was reported on FT that someone got 10X using MC option.

some people on FT say that Citibank rewards can be used to get the bonus as well.

again,having not tested either of these i’m just going on what i’m reading online. i will try paying IRAS bill in March with axs.

Ahh, last year this time..

Nothing lasts forever 🙂

Yes it’s really sad.

Something weird is going on. I tried using DBS WWMC to pay Starhub via AXS Masterpass and got 0 points. Paying directly to Starhub does earn points.

I found Citibank Prestige does collect standard points for Starhub via AXS Masterpass.

Citibank Rewards T&Cs exclude ‘government’ so I’m not sure that would work for IRAS via AXS. I don’t have the card to test at the moment.

4 miles/$ for IRAS sounds like the Holy Grail 🙂

@Phil,

I can confirm that i did get the 10X with Citi R using MPASS option, paying my taxes.

When did you paid your StarHub bill ? If your transaction was posted in January, you will only see this on the first statement after February 16th. The bonus points are only reflected in your account after 16th of the following month, so it would be the first statement after 16/2. (thats how it works with dbs)

Eddie.

@Eddie, Thanks that sounds quite useful. I’ll get applying for Citi R!

I only made Starhub payment in January, but we’re supposed to receive 1x point immediately and that didn’t post. I received 1x from some other transactions so it seems to be working as expected. I’ll look out after 16th Feb anyway.

Thanks!

I can double confirm that I didn’t receive 1x or 9x points for Starhub via AXS e-station Masterpass.

DBS CC bill lists the transaction as “AXS PAYMENT” so that is inline with their T&Cs.

Did anyone else get anything?

Hi Phil

I just received my very first statement for my DBS WWM and I can also confirm that I didn’t receive any points for my Starhub and SP Services payments via AXS e-station Masterpass.

The transactions showed up as “AXS Payment”.

Do recheck on 16th when 9x points are credited…

Phil

someone confirming in HWZ that paying bill in AXS using masterpass or mastercard dont get DBS point, but i believe you can always use “third party mastercard”

@Rio

Not sure which post you are referring to but maybe that person forgot the fact that for DBS, the bonus points are only awarded from 16th of the following month. So if they charged in January, they will only see it from 16th Feb, regardless of their billing cycle. DBS also told me that if 16th is not a week day, it will be the following weekday.

Eddie

@Rio You can refer to the screenshot I had posted in my post.

With reference to the above discussion on payment of Starhub bill, is it confirmed that using DBS WWMC to pay via AXS Masterpass or MC option will not get 10X points?

What about paying directly to Starhub bill online portal payment? Crowd-sourced document says 10X points will be awarded.

Thank you

In my experience paying Starhub directly with DBS WWMC gets 10x, but via AXS Masterpass does not.

Citi Rewards is currently working for 10x on AXS Masterpass.

Hi,

I just saw this comment on the Woman’s Card T&C (link below), as have recently applied for this card to pay my IRAS .

T&C: http://www.dbs.com.sg/iwov-resources/pdf/cards/credit-cards/womans-world-mastercard/womans_card_tnc.pdf

4. Online retail spend includes retail transactions made via DBS MasterPass.

5. DBS Points shall not be awarded for AXS and Sam online/ibanking bill payment transactions, and EZ-Reload (Auto Top-Up) transactions.

Has the T&C changed to prevent payment of IRAS via this card, or this was previously worded the same way as well? Thanks!

I think AXS has been excluded for a while and the recent MasterPass changes don’t change that.

The $2K monthly limit means this isn’t a good card for IRAS even if points were awarded.

According to AXS e-station link (http://www.axs.com.sg/axsEstation.php), it is possible to pay bills via Masterpass and Mastercard, except “for credit card, loans and HDB eServices”. So according to the wording there, IRAS bill payment by either should be permissible, and direct Mastercard (POSB/DBS or otherwise) bill payment will definitely qualify as an online transaction since “OTP are required to effect payment”? I guess the issue is even if direct Mastercard payment qualifies as an online transaction, this has been removed from list of 10x points by DBS, based on the DBS T&C? But the question is whether when you use Masterpass… Read more »

DBS T&Cs are very clear that there are no points for AXS. I tried and even using Masterpass AXS is listed in your bill. Masterpass is not like Paypal.

“4. Online retail spend includes retail transactions made via DBS MasterPass.

5. DBS Points shall not be awarded for AXS and Sam online/ibanking bill payment transactions, and EZ-Reload (Auto

Top-Up) transactions.”

http://www.dbs.com.sg/iwov-resources/pdf/cards/credit-cards/womans-world-mastercard/womans_card_tnc.pdf

I thought IRAS installments only for GIRO?

Citibank cards currently a better bet for earning points on AXS, though your milage may vary.

Please don’t spread the wrong word, I got all the points for my bill payment to AXS and direct to Singtel. See the screenshot I posted for verification and do the maths yourself.

Which card did you use? I used DBSWC but didnt receive and when I verified with the customer agent, she said this is for bill payment and 0 points are awarded.

Thanks for confirming Phil. I just to pay via Masterpass, and when the 2FA OTP verification popped up, the merchant was clearly listed as AXS Pte Ltd. I went ahead to just guinea pig it, but I guess it will not work. This has also been confirmed by members in hardwarezone. On the installment point, I spoke with IRAS operator, and they said even if you have the approved GIRO payment scheme in place, as long as you make a payment before the 6th of each month (GIRO deduction date), you will be reducing the GIRO amount payable for that… Read more »

@Jason

Thanks, that is great news on the IRAS GIRO!

I am almost, but not quite, looking forward to my next tax bill.

Hi Jason,

So did you get my points out of it?

Hi, I got a Singapore Power bill to pay via AXS. If I was to use masterpass to pay, which card could get points? please advise – very confusing reading all the above.

i need to admit i do not know much about the masterpass situation because i’ve not used it before. some people are reporting success here

I got my points using DBS Woman MC by Master Card.

Hey Aaron, guys,

Has anyone attempted to pay their IRAS bill for this year using Citi Rewards MC +/- via Masterpass through e-AXS and received 4x points?

In reply to Daniel above, it appears that DBS cards (including the DWWMC) do not receive points for payments via AXS, even if it’s via Masterpass.

@Chris,

Yes, Citi works for me. 10X credited within a week. It doesn’t matter if u use via MP or Citi MC card directly. Both will get. Else use DWWMC to fund Fevo and pay using Fevo.

Yes, I can confirm 10x awarded. Not sure how long this one will last…

i just saw this in the T&C for DBS Woman’s world card

Online retail spend includes retail transactions made via DBS MasterPass.

But I thought the Citibank rewards card is only for businesses where shoes, bags etc are their main business and excludes all other e commerce sites? So if taxes can get 10 points/4 miles – cos iras or axs don’t sell shoes or bags, then would that not apply to other types of transactions?

In addition to Daniel’s question, would you or anyone here know if the 10x rewards is limited only to Citi Rewards MC? Would it be possible to receive 10x rewards using Citi Rewards Visa as well?

You can’t use C Rewards Visa on eAXS via MPass.

Your best bet is to pay telco bills directly on the telco website using the C Rewards Visa.

Thanks for the reply, guys!

Just to confirm, this is for IRAS tax bills for 2016?

Anyone got awarded 4X Miles for IRAS, Starhub Bills paid across E MasterPass via AXS? At the same time any idea if Insurance Premium paid use which card is better?

Hi guys so for IRAS as long as we paid IRAS Tax giro monthly full before 6th each month (using mastercard), they will deduct 0 SGD from bank account that set for giro ?

Yes, that has been my experience.

Here is some more updates and evidence regarding how DBS Woman Award points for AXS transaction. On Mar 28, I made a payment using the 2miles per dollar DBS Woman Card (not the world MC version) of 317.15 through e-axs. You can verify the transaction here here. https://drive.google.com/file/d/0B3YFxjWKiGZcSE5nTjVFSi1VUW8/view?usp=sharing On 16 April, the card was awarded 257 rewards points, which is equivalent to 514 miles. You can view a screenshot of the rewards here. https://drive.google.com/file/d/0B3YFxjWKiGZcbmZtWE9WWVRCZHc/view?usp=sharing Putting in some maths, the total miles accumulated should be 634 miles. not 514 miles. Notice there is no expiring points on Mar 2017. This means… Read more »

you sir, are a legend.

Im pretty sure its a bug on their system. with only bonus points awarded, they even updated their T&C points “includes retail transactions made via DBS MasterPass.” Matter of time they stop awarding this.

I did the same with wmc shows AXS PAYMENT. No immediate points was awarded. Guess have to wait till 16th of next month to see.

DBS wmc is very contradicting. Say no points will be awardsed for payment via axs then say masterpass can earn you points.

Has anyone been awarded UNI$ by paying SP Services bill using e-AXS using UOB PPV or UOB Signature? Thanks.

That’s very unlikely since there is a fix amount of category you can earn your points for uob ppv online. Its also very hard to test/gurantee the earned points without a fresh card.

I only have C Rewards Visa so that won’t work on e-AXS for IRAS payment. If I were to get the “Fever” card and use it to pay IRAS via e-AXS, can I top it up using my C Rewards Visa and get awarded with 10X points? Or only D WWMC works in this case? Does the “Fever” card work for GE/Pru life insurance payments via e-AXS?

Does the method of using Masterpass linked to DBS WWMC card paying on eAXS still work to get 10x points? My 2016 income tax is due soon and I hope to get some advice on the best way to do this since it is quite a high figure. Does it matter whether I make a single payment, or should I do it by monthly instalment?

Last tested on 22 April that DBSWWMC will only award 9x point. Haven’t tested seen but I can dig up my rewards point and do some calc. This will probably be the final time cause I will probably go DBSWWMC -> Top Up -> E-AXS instead.

Dont ask me about Citibank rewards card, there is a Visa and Master version, get a clean account and throw in 1 dollar and you to test yourself.

@lionel. Same result as yours. 9x. Glad to have someone to back my calc. Did it via MP and E-AXS.

By the way what does that “Top up” means?

Basically it means find your way to do an online transaction to another accoun/card and use that account/card to pay for stuff.

This method u can only get 2.1%. Might as well use scb singpost.

I am sorry that’s 15% to 23% rebate if your talking about exchanging business to – first class ticket. Enjoy your scb method because all scb cards are just terrible to even consider.

Hai i pay my income tax use Mastercard via AXS on 1/6 but i saw that on 6/6 IRAS still do GIRO via my bank ? I thought if u already pay , IRAS wont do any giro later? or is it because i pay too late ?

Any experience, when do i need to pay latest in order to avoid being charged by IRAS GIRO ?

i think what has happened here is that IRAS has just taken the money from your account because as of a certain date you still had a GIRO-able balance outstanding. so your income tax will now have a credit balance. Thank you for your contribution towards nation building.

Hi Aaron and everyone.

Sorry but I’m abit confused with all of the above with using the Woman’s World Card to pay for IRAS income tax via axs e station and getting the points for that.

Could I confirm if it works and you can get pts using that card?

Thanks!

Or should I be using the Woman’s World card linked to masterpass to pay for income tax? Would that earn me the additional 9x pts from the card

Thanks!

Citi Rewards doesn’t give 10x Rewards for eAXS via MasterPass! Just paid on 4th, today I see, didn’t even get 1X points!

I had a problem, anyone tried paying their iras income tax on different dates? I had already clocked 1.1k on my dbs woman, to get the full benefits, I had to pay the remaining amount from july. Any one done this before?

I think with the newly released TnC for DBS woman’s card. We can’t get points when making payment for IRAS income tax already 🙁

On another note. reckon its worth to try using UOB Priv Miles Mastercard with masterpass? Would we still get points?

Okay nvm, guess I will go with Priv Miles instead. @.@

Do we get points when we use Priv Miles Lionel? Need to go via masterpass way @ AXS E Station?

I havent tried, so I am reading the T & C right now.

If it works, please do update 🙂

AXS payment is not awards according to point iii

http://www.uob.com.sg/assets/pdfs/cards/Terms_and_Conditions_Governing_UOB_PRVI_Miles_Card.pdf

Guess that route is closed. :/

Another thought that comes to mind is whether the merchant name plays apart in points awarding.

If it goes via masterpass, what would the merchant name be like on the statement.

Merchant remain the same whether its on Masterpass or not Masterpass. Citibank Visa top up to Magic Master card is seems viable, then use magic master card to pay the income tax. However, my income tax is more than 1k, so I am not very sure if I can pay it in batches.

Oh! That would be another interesting way to proceed. My income tax also above 1k too. that’s why I’m keen to make some miles out of it.

I’m unfamiliar with this process though. Could you elaborate? I never tried this top up process before. What is this magic master card about?

Lionel, have you tested whether income tax can be paid in batches? I’d think that in theory it seems to be okay but it would be good to have confirmation if you have indeed done it before.

Premier Miles not Rewards, sorry forgot to state the card.

I was just looking through this thread – how does the Citibank Premier Miles Visa card fit into the plan of “Citibank Visa top up to Magic Master card is seems viable”. I thought that the Citibank PM card only gives 10X for online travel spending and not online general spending?

Lionel, I tried using the PremierM card and it’s been 6 days but still no points posted. Are u sure about this ? I used it to fund my magic card.

It’s on this site, dig around and you can find it!

I just called up DBS to ask if i use my DBS Woman World card for my Recurring Bills, will that give me 10x rewards and the CSO said no as the merchant code say M1 will appear on the statement instead of passing a third party and considering as an online banking transaction =(

yeah, not too surprised about that. You may want to sign up for dbs’s recurring bill payment plan, you earn some reward points that way. m1 is covered

Yes ive done that using my DBS Altitude Card as that will earn me 1.2 miles.. Thanks!

So according to all the updates here, just to confirm my understanding:

1) Citi Rewards Master Card

pay IRAS Bill via AXS Online or Kiosk

Admin Charge involved?

10X Rewards / 4Mile Points earned?

2) Or must it be via Master Pass?

3) Or must we divert to using a miles card like UOB Priv or Citi Premiere Miles Card?

Hihi everyone, just to let u know I used my DBS woman world card to pay by bills through eAxS last month via masterpass and I just got my 9x points ?

thanks. will start keeping a list in the other article

Thanks Maggie for the information – what type of bills did you pay through eAXS?

Hi Peter, I paid my M1 and SP Services bills through eAXS.

Thanks so much Maggie!

Hey there Maggie, your 9x points were reflected in the statement of the following month?

hi guys, citi rewards work for me but I have maxed out the reward points for the yr… fevo top up doesn’t work anymore.. are there any more ways for tax payment?

thanks

Citi rewards with 2 variant also maxed out?

hi, i have maxed out the master card,, which is the other variant – visa? how to use that ? on axs?

Monkeygod, when you say citibank rewards card “work for me”, can you elaborate as to what types and modes of payments were successful in getting the 10x points?

mastercard through AXS. got 10x but its a cap of 120k / card/yr

120k /card/year? I don’t think that’s right…

What do you mean by fevo top up doesnt work anymore?

May i know will i get awarded if i use DBSWWMC to pay for NTUC life insurance (annual payment)? if no, what are the best option to pay for it?

Not sure if they have any restrictions on insurance, have to check the latest TnCs. If not allowed, you always have the option to topup M1 prepaid MC and use that to pay at AXS.

Hello!

Could I just double check if there was any way to earn miles via topping up of Ezlink card for day to day travel?

Thanks!

I use fevo + WW

Does it still work? Thought we won’t earn points via the fevo card anymore ?

The bit about 4 miles for S$1 for telco spend with Maybank Horizon is gone from their website. I assume then that Maybank is back to awarding the normal number of miles, ie 1.2 miles per dollar, for telco bills.

thanks for this update

a little confuse with what needs to be done.. so what’s the best credit card to use for recurring household bills like the SP Services, Pasir Ris – Punggol Town Council and Viewqwest internet?

I just got my FEVO Card, but can’t seem to figure out how top it up so I can earn miles when using the WW card.

Which platform does everyone use?

Thanks!

Easiest way is to top up online using http://www.fevocard.com

Fevo app. Simple, and fast.

So what’s the latest update on bill payments? can we still earn miles from it?

What’s the best way to maximize the miles for recurring bills?

Citibank no longer awards miles for bill payments via AXS, sadly.

fYMfMN pjgyivijmgkm, [url=http://zojeebvxgxdq.com/]zojeebvxgxdq[/url], [link=http://oemdnwycvscs.com/]oemdnwycvscs[/link], http://gajqsbckrgor.com/