Welcome to the fourth and final week of the Milelion launch competition! Hard to believe a month has already gone by, but thank you so much for your participation and questions. Your readership means everything to me.

This week’s winner, C., has the following questions

1) Is the DBS Altitude AMEX for hotels/Flights still the best after 6 months ?

2) How about when I’m overseas ? Do I still stick with these cards for their category ?

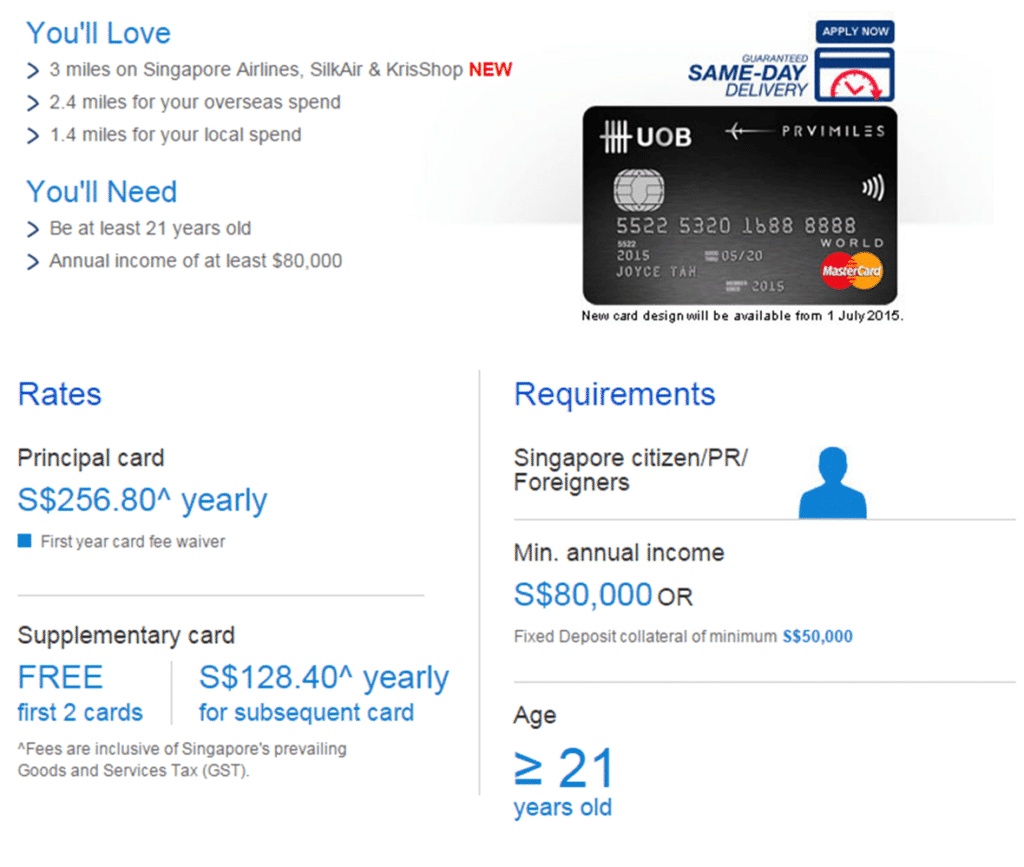

I believe the best general spending card is the UOB PRVI Miles Amex ?3) What if I only earn 30k a year, just enough for the basic credit cards in the market. What cards would you recommend me to use ? Especially for the ‘online’ and ‘hotels/flights’ category ?

To answer Q1- it depends on what category you’re looking at. With the 50% earning promotion, the DBS Altitude AMEX is currently the best general spending card to use locally- the 1.8 miles per S$1 it generates is ahead of the 1.4 miles the ANZ Travel Visa and the UOB PRVI Miles cards generate. The 50% earning promotion lasts for 6 months from the date you get the card, after which you’re back to 1.2 miles per S$1.

However, even after the promotion ends the DBS Altitude AMEX still earns you 3 miles per S$1 on online hotel + airfare expenditures. No doubt you can do better on that (eg the DBS Woman’s World Card will give you 4 miles per S$1 on online transactions, of which certain OTA and airlines will qualify), but it’s still a useful card to keep for that reason.

I’ve also sort of dealt with Q2 in answering Q1- the “gold standard” for general spending in Singapore has been reduced to 1.4, after the PRVI Miles cut from 1.6. Given that UOB has also cut the annual fee for the UOB PRVI MC to S$256.80. there’s really no reason why you should go for the AMEX version anymore.

Q3 is the intriguing one- what is your gameplan if you only qualify for the basic cards? You can still play the miles and points game with only the “basic” card, but you have to pay more attention because

1. There are no good general spending cards at the $30,000 income bracket. It sucks, but that’s the facts of life. The lowest income you’d need for what I would consider to be a general spending card would be $50,000 for the DBS Altitude Visa (which, when launched ,used to be $80,000) or the Citibank Premiermiles Card

2. The basic cards only provide category spend bonuses. This isn’t a bad thing per se, but you’ll need to keep a few more cards in your pocket and remember which one to use in which situation

I’ve compiled the game plan below. All these cards can be obtained with a minimum of S$30,000 annual income

| Online Spending- general |

|

| Online spending- shopping |

|

| Online Spending-air tickets |

|

| Online spending- hotels |

|

| Dining |

|

| Anywhere with Paywave (eg Burger King, Giant, Cold Storage etc) |

|

| General Spending |

|

A few points about the above

- the DBS Woman’s card mentioned here is not the same as the DBS Woman’s World card I’ve been mentioning elsewhere. That card has a higher income requirement and earns 4 miles per S$1 on online spending, versus the 2 miles for the basic card

- if you encounter a merchant who does not accept AMEX, then the cards all pretty much become the same- you’re looking at 0.4 miles per S$1 (dismal, I know)

As you can see from above, you can still generate very decent miles from these cards, if you monitor which card you use when.

Your best bet is still to try your luck applying for the higher income cards (eg PRVI Miles, Altitude etc). The worst the bank can say is no. If you’ve got an account with them, if you’ve got a solid credit history, if the marketing team is trying to hit sign up targets… who knows? The MAS only sets a minimum income requirement for credit cards (S$30,000), so the it’s perfectly lawful for the bank to give you a S$50,000 credit card when you earn between S$30,000-S$49,999.

At the end of the day it’s in the bank’s interest to issue more cards- they earn when you spend with them anyway. I know some banks like to have artificially high income requirements to create the image of faux exclusivity (I’m looking at you, OCBC Voyage), but over time those requirements come down as the buzz wears off and product managers are pressed to boost the income flow from a card offering.

[…] This is a good, flexible rewards card which I recommended as part of the suite of entry-level credit cards. […]