Miles are the worst investment that you can possibly hold. They do not earn interest. They are not subject to any sort of investor protection. And over the long term, they are the one investment that is guaranteed to lose value (as we saw with Alaska’s unannounced devaluation of Emirates first and business class awards).

My dad used to tell me he was saving up all his Krisflyer miles for retirement to travel the world. I thought that sounded like a good idea 10 years ago, but now I’m not so sure.

That’s because your miles have no value until you spend them. And I believe Krisflyer is overdue for a devaluation. I have no hard evidence for this other than my gut. But my gut is telling me that we are likely to see a devaluation very soon.

Why?

The last significant devaluation was some time ago

Depending on how you define devaluation, there have been several devaluation events over the past 10 years (as this was way before my time, I am trying to piece this together from whatever I can google, so feel free to let me know if I’ve got it wrong)

2007-Devaluation of existing award chart. Unfortunately the links in this post are no longer working so I can’t work out the amount.

2008– introduction of Standard and Full award levels, one way awards made available at 50% of round trip

2012– redemption amounts for Saver, Standard and Full award levels are adjusted, SQ finally opens up saver redemption for the new cabin products (6 years after they were introduced!)

Given that 2012 was the last time they did a devaluation, it would seem that we are due for another one shortly.

Introduction of premium economy

The introduction of a new cabin product is often grounds for a revision of the award chart. In an ideal situation, you’d have premium economy awards priced somewhere inbetween economy and business awards with both economy and business award prices remaining the same, but what is more likely to happen is that a new (devalued) awards chart will be introduced with the spin that they have enhanced the program by allowing redemptions for PY.

The premium economy product is still being rolled out and is expected to be completed sometime in the next 12 months. It could be the case that SQ is waiting for the rollout to finish before doing the award chart adjustment. My fear with this is that they will change the (already ridiculous) Y to J policy so that only customer who have purchased premium economy tickets can upgrade to J.

Influx of cheap miles from US-based credit cards

Our American friends have always had it better than us when it came to miles earning opportunities (Krisflyer co-brand card signup bonus of 5,000 miles for us whereas sign up bonuses of 20,000-30,000 miles are the norm in the states!), but at least they stuck to their own America-based programs. Well, “stuck” being the operative word. In 2014, both Chase Ultimate Rewards and Citi ThankYou points added Krisflyer as a transfer partner

Before this, the main options American credit card holders had to redeem SQ awards was to do it the long way round- through Star alliance partners like UA or US Airways (when it existed). And SQ was not in the habit of opening up premium cabin award space to partners.

SQ’s done well for itself in the sense that it’s increased the value of its Krisflyer currency by making it the de facto legal tender currency for redemption of aspirational awards like Suites and First. So when American credit card holders want to redeem that product, they have to convert their points to Krisflyer miles (which earns Krisflyer revenue from Chase/Citibank purchasing Krisflyer miles) instead of redeeming through other Star Alliance FFPs (for which the reimbursement rates are really low)

Because of financial pressure

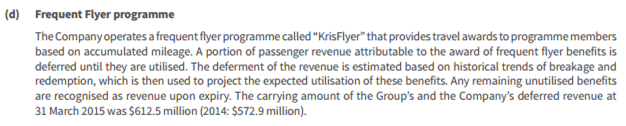

SQ’s loyalty is not to you. It is to its shareholders. And those shareholders like seeing a lean balance sheet.

Check out this interesting disclosure from the annual report. SQ recognises outstanding Krisflyer miles as a liability on its balance sheet. The outstanding liability as of 2015 was S$612.5M, up 7% from 2014. Here’s the historical trend

| 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | |

| Deferred revenue (S$M) (oustanding Krisflyer miles liability) | 612.5 | 572.9 | 532.5 | 497.0 | 445.1 | 460.1 |

| YOY Growth* | 7% | 8% | 7% | 12% | -3% |

*does anyone with a better understanding of accounting want to explain this data? Intuitively I would have thought that the value would decrease in years where there were devaluations (2012) or jump more in years where the Krisflyer program got new transfer partners (2014) as more people exchanged UR/TY points for Krisflyer miles

The easiest way for an airline to tighten up its balance sheet is to devalue its miles. Remember that there is no regulation surrounding this, and it is entirely up to the airline how they want to value their liability. If they make award flights more costly, that liability goes down. Sure, it upsets customers, but which airline are Singaporeans going to switch to?

Stealth Devaluations

Of course, some can argue that devaluations have already been taking place. And they’re right, in a way.

Higher Surcharges on Award Tickets

As the examples above show, Krisflyer charges very high surcharges on award tickets. Despite the dramatic decrease in oil prices, these surcharges have only shown a marginal decline in recent years. The higher the cash co-pay on your award, the less valuable it is.

Reduced Saver Award Availability

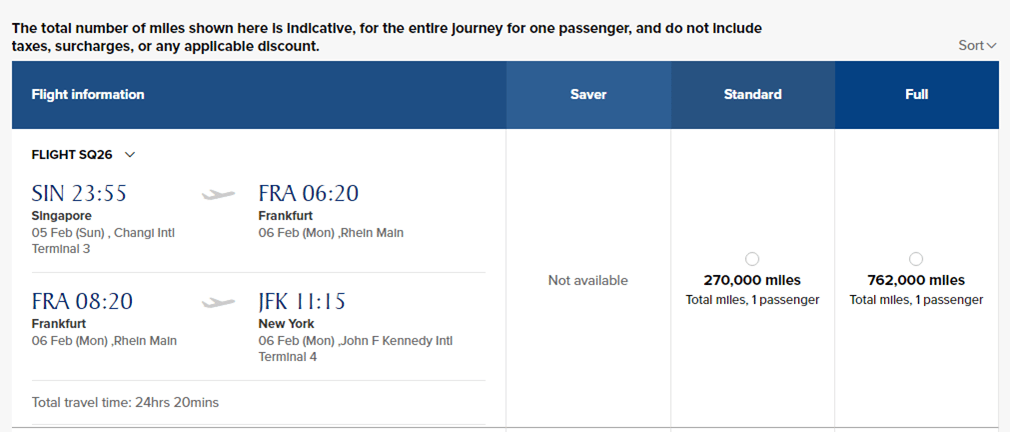

Or what about award seat availability? Certain routes are almost impossible to get saver awards on, no matter how far you book in advance. Try everyone’s favorite SQ25 route for example. This is the situation for booking almost 1 year out- 5th Feb 2017. No saver award availability, not even for waitlist (to be fair, if you look at the weekday departures 1 year out you might be able to find some saver waitlist, but nothing for instant confirmation. The general point about saver availability being harder and harder to find still holds)

Shifts towards a revenue-based program

This has been a long concern on my mind, given the developments we’ve seen in the US of United and Delta going revenue-based.

A revenue-based program has 2 aspects- the earning side and the redemption side.

On the redemption side: In 2013, Krisflyer announced that you could now use your Krisflyer miles to pay for your revenue tickets.

Although this was spun as a positive introduction of choice and flexibility, it worried me to no end, because the value given to your miles when using them as currency was ~1 cent, below the value you’d get even for economy class redemptions.

This valuation has been followed in the other noteworthy Krisflyer developments in the interim- both Tigerair and Scoot vouchers can be redeemed using Krisflyer miles, also at the paltry value of ~1 cent each. Does this mean that SQ over the long term is looking to bring their program more in line with this valuation?

No airline has (yet) dared to convert to a revenue-based redemption program (airlines which run revenue-based redemptions (eg Jetblue) started off that way) and I highly doubt SQ will be the first. But SQ’s moves so far indicate that they see 1 cent per mile as the “ideal” value.

On the earning side: The recent developments on the co-branded card front where SQ offers the opportunity to get Krisflyer Elite Gold status by spending S$15,000 on SQ tickets in the space of slightly over a year may also be an attempt to test out how receptive people are to a revenue-based approach to status earning. We’ve seen this happen with PPS already where they put a S$25,000 minimum spend requirement in place

Conclusion

I could be totally wrong about this. And I hope I am. But the signs increasingly point towards Krisflyer doing some sort of devaluation in the near future. SQ likes to spin these things, so I imagine there will be a genuine improvement in the program to accompany the rest of the “enhancements”. My guess is they will open up premium economy for redemption.

The moral of the story is this: earn and burn. If you have a good store of Krisflyer miles now, you should actively be looking for a redemption opportunity for your next holiday. Holding on to miles is a losing proposition.

This has been a very sad and depressing article. Please now enjoy some photos of a cute shihtzu.

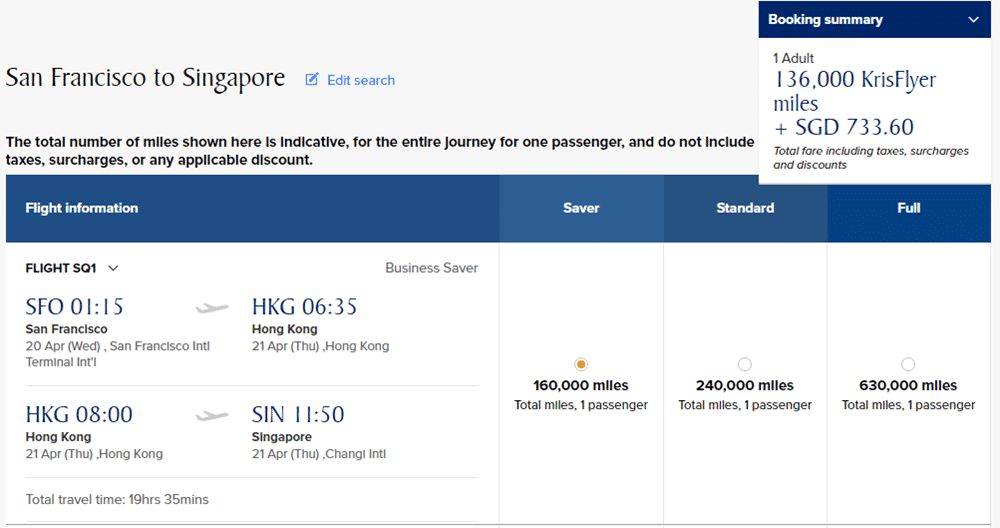

This article is most depressing indeed, sigh pie. Had delayed redeeming SFO-HKG-SIN to save a little but the loophole has now been closed. Cute ?

Hopefully the Changi Priority Pass and LHR *A lounge hops next week will cheer things up.

1) still saving up your miles for that star alliance round the world award? 2) barring timing and transit issues, the beauty of competition from gulf carriers and the number of other carriers flying through changi is the ability to mix and match to one’s requirements. SQ doesn’t have to be the be all and end all, whether for redemptions or otherwise. 3) as an aside, buinsess class one way tickets returning from certain out bound destinations to SG on SQ seem to be getting more competitive in price. For example, from a search done the past week, biz in… Read more »

1) yes, but keeping the points on the credit card side so I have at least the flexibility of transferring points to asiamiles if it all goes south before i make the booking 2) if your currency is in SQ miles, it does behoove you to select SQ metal when redeeming. as i mentioned elsewhere there really is no incentive for you to use krisflyer miles to redeem for star carriers. (well maybe with one exception) i’ll even wager that a good % of krisflyer members don’t know you can do this. currencies like lifemiles are much more flexible in… Read more »

4) Also there seems to be an idea that airlines will have to devalue miles every couple of years, and the value of miles can only decrease in the long run. Will mileage earn rates keep pace to compensate for devaluations? otherwise what’s in it for people to continue accruing miles.

4) interesting point. I think you see that more in the USA where the sign up bonuses have gotten larger. I’m struggling to think whether that has really happened in Singapore. I’ve only been doing this hobby for 2-3 years but I know when the PRVI miles card first launched they were advertising 1.6 miles per $1 for local spend, and altitude has 1.6 miles with monthly spend >$2K and 1.2 miles otherwise (or was it 1.4? someone help me). Since then the rates have come down (1.4 miles and 1.2 miles for prvi and altitude local spend respectively). In… Read more »

Has anyone learned more details about the RTW F redemption for SQ? Thinking if I should save up for that or just burn it on SQ 25.

Thank you for allowing us to appreciate the cute cute shihtzu after the sad article.

Hi Aaron,

If it happens, will the devaluation be instant or will SQ give you a couple of months to clear ur miles at the current chart?

there should be at least some notice given. SQ is not in the habit of unannounced devaluations. for now.

Hi Aaron,

I have currently 82k miles with SQ, about 15K miles in DBS and 10K in citibank.

Should i redeem them asap( for may 2017 travel) or I wait till redemption in 2018?

tough question really. i dont think waiting till 2018 is a good idea, i think if you’re going to travel anyway and see availability in a route and cabin you like, jump on it now

hi there, I’ve noticed for the same route, the miles required to redeem biz class on SQ has gone up. has your prediction really come true?

no devaluation has taken place yet. can you tell me what you’re seeing?

It has come to pass

https://www.singaporeair.com/en_UK/sg/ppsclub-krisflyer/latestnews/PEY-annc/

I suppose it could have been worse

holy moley.

you copied this from flystaytravel. you pathetic little worm.

not sure if serious.

Its here….. got the krisflyer mail. No more 15% online redemptions plus change in miles required.

I know! And it hurts! It burns! (Like Gollum tied with Elvish rope) Aaron would you be so kind as to do a comparison between Krisflyer and Asia Miles? For those of use who haven’t converted.

Gotta spend more on redeeming flights but reduced in surcharge if i read correctly. Has yet to redeem any miles since i started miles gaming. Hope its not much of a devaluation.

[…] hard to fault them in this one. Mile Lion has a more complete history of Singapore Airlines KrisFlyer devaluations, if you are […]

Do you think its possible to make multiple dummy bookings for a route now to get ticketed, then just keep changing the dates on the same ticket until i need to fly? Was thinking of doing so since I travel 3-4 times a year on SIN-LHR, and I have plenty of miles to make a shitton of dummy bookings.

yes. so long as it’s just a date change there won’t be an issue. you will be tying up a bit of working capital in fees though, especially for LHR with the APD