Google Analytics tells me that my readership is currently 70% male and 30% female. I solely attribute that to the fact I have not yet posted shirtless photos of myself (after which we should very comfortably get the male % up to 90-ish)

But in case any of my female readers are seeing this, or in case any men want to advise their sisters/ gfs /wives /mothers /grandmothers about their optimal credit card miles strategy I want to say a few choice things on UOB’s latest female-focused promotion.

You may have read in the papers that UOB has a fancy new Lady’s Solitaire rose gold card available for those willing to spend S$45,000 on their existing Lady’s cards between 30 Jun and 30 Sept.

Words cannot describe how bad a deal this is.

Somewhere along the line banks have started thinking that people assign value to the material the card is made of, rather than the benefits of the card itself. I blame the AMEX Centurion for starting this trend, what with their fancy metal card and what not. That “metal card as a benefit” feature gradually filtered to Singapore banks, first with ultra-exclusive credit cards like the DBS Insignia and UOB Privilege Reserve Visa Infinite, then to the mass affluent with the OCBC Voyage. Now it seems that UOB wants to offer this as a “reward” to its highest spenders, as opposed to, oh, I don’t know, actual card benefits.

Remember that unlike DBS, UOB only allows women to apply for its Lady card series. And that’s just fine because they’re plain awful. Right off the bat it seems like this card is targeting a very specific subset of women, i.e those who can drop at least S$3,000 on shopping every month (unless you’re for whatever reason spending S$3,000 on taxis, in which case you might want to try Uber). Therefore although the potential value to miles collectors certainly exists, in reality the narrow categories of spending and the T&C limit how many miles you can practically earn from this. Remember that any spending outside the 10X categories nets you 0.4 miles per S$1.

In a very egalitarian move, UOB is offering the holders of all 3 tiers of Lady’s cards the opportunity to upgrade their plebish plastic cards to an awe-inspiring rose gold card (is it really rose gold, btw? Or is it just a metal card that’s painted rose gold) when they spend S$45,000 within a 3 month period. What additional benefits does the metal Lady’s Solitaire card have over the plastic version, you may ask?

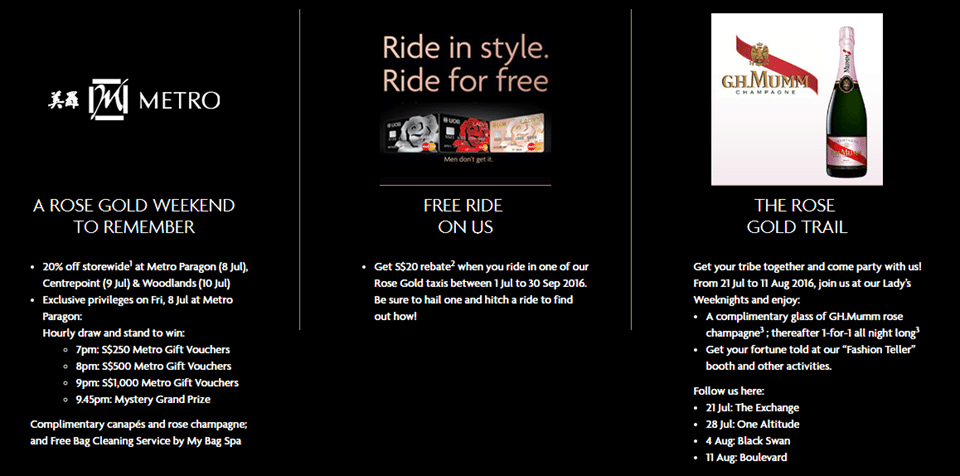

- 20% off storewide at Metro Paragon (8 Jul), Centerpoint (9 Jul) and Woodlands (10 Jul) with complimentary canapes and rose champagne

- A S$20 rebate when you ride in a Rose Gold taxi (which is UOB marketing speak for any regular taxi) from 1 Jul to 30 Sept (and limited to first 200 members who register. Nice, UOB)

- An invitation to UOB Lady’s Weeknights with one free glass of champagne and get your fortune told at the free

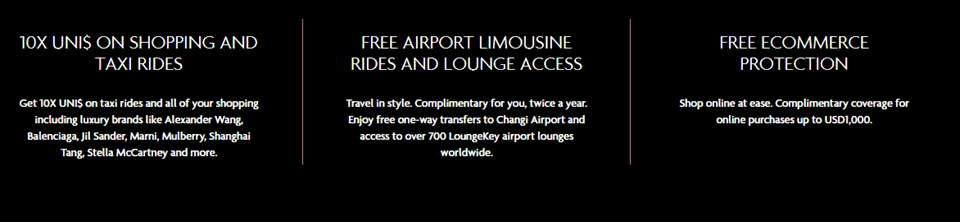

fortune tellerfashion teller (I’m not inventing that. That’s what they wrote in their marketing materials) - US$1,000 complimentary fraud protection for online purchases

- 2 free airport transfers and lounge access per year

I wish I were making this up.

I could tell you the many many reasons why this is such a hilariously bad promotion. In fact, I will because it’s Monday morning and I’m in a ranty mood

- Charging a $182 premium for the metal card (annual fee $588) over the plastic version of the Lady’s Solitaire card (annual fee $406.60) is a purely cynical move because the incremental benefits are so tiny. No UOB, US$1,000 protection against online fraud does not count as a benefit for which I’ll pay $182 more. Nor do 2 free airport transfers and lounge accesses a year (I can’t find the T&C online so there might even be minimum spend requirements to enjoy that)

- This promotion requires registration and is only open to the first 1,000 people who hit the spending figure (and in typical UOB annoying promo style you have no way of knowing if the cap has been hit already). If someone is spending $45,000 on your card in a 3 month period I think basic common sense says your customer services team will want to start proactively reaching out to her and get her on a priority banking scheme, not make her jump through hoops to get your attention. So I can’t even begin to figure out how this makes sense

- Some quick math- spending S$45,000 on the UOB PRVI would get you 63,000 miles, assuming it was all local spend at 1.4 miles per $1. Spending that same S$45,000 on the UOB Lady’s card would earn you much, much fewer miles (0.4 miles per S$1. Sure, you can point to the 2/4 miles per S$1 category spend bonuses offered by the Lady’s card/Lady’s solitaire cards, but remember the min $3k max $5k requirement and the likelihood you’re going to spend that much on just shopping/taxis in a month)

I can only conclude that UOB has decided to target that sub-segment of super affluent women who don’t really care about miles or points, but do value the idea of having a status symbol flashy metal card. Because there is no rational reason why you’d otherwise take them up on this offer.

Some time ago I had a chat with someone in the cards department at OCBC. I asked him plainly how the bank could justify having a product like the OCBC World Elite card, which despite its S$1,605 annual fee has close to 0 benefits. His response was in equal parts telling and sad. “Because our research shows us that there are people who will pay just to have something exclusive that makes them feel good about themselves, even if the practical benefits are limited”

To those ladies who have been richly blessed in life, please don’t celebrate that status by getting a faux-exclusive credit card with high annual fees and 0 benefits. There are smarter cards to put your spending on. To guys- the only way to stop banks from having these terrible female-focused promotions is to warn your lady friends about them.

The men don’t get it. Luckily for them.

UOB is fking terrible. Worst customer service on the street.

I wish DBS matched what UOB offer, I would move to DBS without thinking.

well to be fair their prvi miles cards have the best market rate for general spend (alongside ANZ).

Are you sure “men don’t get it” isn’t just a marketing ploy?

Surely banning people from applying for this card solely because of their gender would be a massive legal issue for UOB? Or are there no such discrimination laws in Singapore?

yeah i’m very sure that the UOB lady’s card is women only. i don’t think it’s a legal issue at all, or grounds for discrimination. discrimination laws are more relevant to areas like employment etc. I mean going by that line of logic you could argue that it’s “discriminatory” to have ladies nights in bars (and people have put forth that argument before), it’s “discriminatory” to make only men do NS etc etc.

Ladies’ Nights is an example of price discrimination based on gender and this concept is outlawed in several European countries. National Service for men only is definitely highly discriminatory as well.

There are no such discrimination laws in Singapore.

P.S. I’m a lawyer and an academic at NUS Law.

I’m one of your female readers, Aaron! Just a quick shoutout! 🙂

I spend a disproportionate amount of time crawling through travel hacks websites and credit card forums. Well these days I also add MileLion to my list of daily must-read sites! Meanwhile, I just waitlisted myself on 35 bookings on SQ (that’s reasonable, right?) after learning a few tips from your earlier posts! Keep ’em coming!

no way, a female reader!

35 bookings is entirely reasonable given that it’s SIA. you might want to see if CX has any availability too because you can waitlist on Asiamiles without any miles in your account (then transfer from DBS/UOB to asiamiles if something opens up).

I received an invitation from UOB to sign up for the Solitaire Card. May consider doing so solely for the complimentary Pan Pacific Hotels and Resorts Discovery Black membership.

is that worth the annual fee though? i’ve been rather unimpressed by the discovery hotel program by what i’ve read online so far.

The T&C “The total Bonus UNI$ awarded to each Cardmember from qualifying spend will be capped at UNI$9,000 for each statement cycle.”

So if the minimum spend to get the 10x bonus is $3,000, the effective number of UNI$ for $3,000 is 12,000, which is equivalent to 4,800 miles which makes the earn at 1.6 mpd. Did I get my calculations right?