I’m the sort who feels physical pain every time I see anyone take out a debit card to pay for something. Unless you’re an undischarged bankrupt, someone without an active income or a student (and even then maybe not), there’s no reason for you to not use a credit card for your payments.

So why am I writing about a debit card?

It’s tough for Singapore credit card holders who want to use their cards overseas. We don’t have credit cards that come with no foreign transaction fees, so every time we spend overseas we get hit by multiple fees (I’ve written about the various fees here). If you’re gullible enough to fall for (or get scammed into) the “convenience” of DCC and pay in SGD, you could pay upwards of a 7% spread.

DBS has an interesting new product available called the multi currency account (MCA). The debit card that accompanies this account allows you to incur no foreign exchange fees when you pay in Australia Dollar, Canadian Dollar, Euro, Hong Kong Dollar, Japanese Yen, New Zealand Dollar, Norwegian Kroner, Sterling Pound, Swedish Kroner, Thai Baht and US Dollar.

In theory it’s very simple. Suppose I want to go to the USA because I have a pressing need for my cellphone to be searched and my cavities to be frisked.

I need to buy USD for my expenses there. Normally, I’d pop down to the moneychangers at the Arcade. But what DBS proposes is that I do an SGD transfer into my DBS MCA to buy USD beforehand. Subsequently, when I need to pay for something in the USA, I can

- Use my DBS MCA debit card and incur no further fees (paying in USD)

- Go to an ATM to withdraw physical USD if the merchant doesn’t accept cards (and pay an ATM withdrawal fee of S$5)

It’s conceptually similar to you going to the Arcade, buying USD, putting it in a bank and withdrawing it when you need it. The theory is that this keeps you from having to physically change money and lug around a huge amount of cash on your travels. And I buy that, that’s a genuine point of concern for me whenever I travel.

The question here, then, is two fold

- How does the exchange rate offered by DBS compare to the rates offered by brick and mortar moneychangers?

- Is it worth forgoing the bonus points offered by credit cards by paying with the DBS Multicurrency debit card (no forex fees but no points)?

Let’s break it down-

Exchange Rate Comparison

Your alternative to using the MCA is to head down to the moneychangers to swap physical cash. So how much of a premium are you paying to DBS for this service?

DBS forex rates can be found here. Now, I’m assuming that the rates published on that page are the same rates you’ll get when transferring using an MCA account. If so, you have the following (1 March 2017)

- 1 USD= $1.4179

- 1 GBP= S$1.7614

- 1 Euro= S$1.5021

- 1 AUD= S$1.0924

- 100 JPY= S$1.2526

For comparison, I found the following rates at the Arcade

- 1 USD= S$1.406

- 1 GBP= S$1.75

- 1 Euro= S$1.49

- 1 AUD= S$1.085

- 100 JPY= S$1.2470

This implies a premium of approx

- USD- 0.8%

- GBP- 0.7%

- Euro- 0.8%

- AUD- 0.7%

- JPY- 0.4%

It’s really much better than I expected, assuming the rates published on the DBS site are the same ones you’ll get for your MCA (I don’t have an MCA account, but if anyone wants to confirm feel free to leave a comment)

The other value I see here is that suppose you forget to change money before you head to the airport. You can then open up the DBS App and get the currency you need without being gouged by the airport moneychangers.

No fees and no points

The other downside of using the MCA debit card is that you won’t earn any points on your overseas spend.

Let’s recap what you could potentially get if you used your credit cards overseas

- UOB Visa Signature- 4 mpd, subject to a min spend of S$1,000 and max spend of S$2,000 per statement period

- Standard Chartered Visa Infinite– 3 mpd, subject to min spend of S$2,000 per statement period

- UOB PRVI Miles- 2.4 mpd

- DBS Altitude, Citibank Premiermiles- 2 mpd

- ANZ Travel Visa Signature– 1.4 mpd unless Australia/NZ then 2.8 mpd

Assuming you’d be generating 4 mpd, and taking a conservative valuation of 2 cents per mile, you’re giving up 8 cents of value when using a debit card. Of course, you’ll need to minus away the spread and forex fees incurred when using a credit card, so perhaps net net you’ll be giving up 4-5 cents of value in total.

The equation changes somewhat if you’re using a 2/2.4 mpd card, obviously. You get 4-4.8 cents worth of miles, but then after fees you maybe come out 1-2 cents ahead.

Other points to note

No partial payments are allowed. If you do not have sufficient foreign currency balance in your MCA, the entire transaction will be billed in SGD. Suppose my MCA has $1,000 SGD and $100 USD, and I try to buy something that costs $150 USD. The entire $150 USD amount will be converted into SGD and deducted from my $1,000 SGD balance in that case

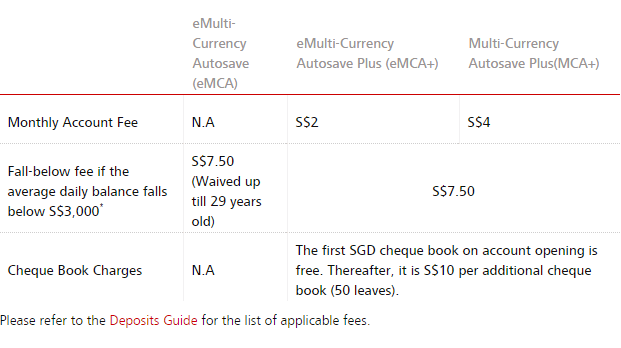

There is a minimum average daily balance of S$3,000 required in the account, otherwise a S$7.50 fall below fee applies.

I think this account would be great for you if you’re determined not to incur additional forex fees overseas, even for earning miles.

Thanks for the post Aaron! Actually in the past I’ve used DBS’s multi-currency account to do my forex exchange for overseas expenditure – what I do is transfer SGD fm my POSB account into the MCA and choose the currency that it will be transferred in, then do a manual withdrawal at their branches. Very good exchange rates with one of the lowest spreads around. However recently in December they informed me that commission will now apply – not sure if this will apply with the debit card?

i understand that in the past it was possible to transfer SGD to USD (for eg) and then go to a branch to physically withdraw currency. but from reading HWZ I think that is no longer possible.

if you withdraw your USD overseas via an ATM you will pay an overseas withdrawal fee, but no further spreads (As there’s nothing to spread- your funds are in USD already).

so was i pointing to the right dbs rates in my article? if so that’s really quite impressive- quite close to the arcade rates.

oops I mean currency exchange* not forex exchange haha

Great article as usual Aaron.

For a card without miles, this debit card seems to have very limited use cases.

For overseas ATMs, there’s a fee, which coupled with the generally Low withdrawal limits of ATMs overseas means the cimb debit card will probably be cheaper.

For overseas spend in USD or CNY, you’d be better off with ICBC’s dual currency cards, which allow you to pay on credit, and settle in foreign currency at any of their branches, or through their multi currency account.

ah thanks for reminding me of the icbc cards. i still have my USD one from that time they were giving away free money. now might be a good time to refresh my memory on how it actually works…

Hi, one question here..you mention the transaction will be converted to sgd if the purchase is more than your deposit. Let’s say you have forgotten and has zero deposit, it will be fully converted to sgd as well?

If yes, then what is the point of transferring and converting the amount in the first place?

that is a very interesting point that i hadn’t considered. i do not know. my first guess was that if you didn’t have sufficient funds in your USD account then it would be taken from your SGD account and it’d work like a normal overseas purchase, eg forex fees and visa conversion rates rather than dbs. but i dont see anything in the t&c that says that so i can’t confirm.

I suppose you’ll have control over what exchange rate to be used if you changed it yourself. Otherwise you’ll be subject to the prevailing rate if you let the bank auto convert for you

There is an interesting option to withdraw large amount at withdraw large amount of cash (if required) in one transaction instead of doing multiple withdrawals (a lot of ATMs in US for example won’t allow withdrawal of more than $300 per transaction) and paying $5 for each. A lot of people do not know that there is such thing, called ‘cash advance’, when you go in bank’s branch (only, ATM won’t work), give them a card and they will do such a transaction. People have not heard about this because it does not make any financial sense with credit cards… Read more »

Can the conversion be done in reverse? For example I convert sgd into $1000 usd but used only $500 usd, can the remaining $500 usd be converted back to sgd?

What is the point?

yes, at the prevailing rates.

Today was told at DBS branch that very important factor is which account is selected as a Primary Withdrawal Account for ATMs. In other words, if you have not specifically designated non-SGD account for withdrawal, even if you have such account, money will be coming from SGD account.

Hi Aaron, you’ve pointed to the right DBS rates in your helpful article. It’s the Selling TT/OD rate that DBS will use. I’ve done the conversion a few times and noticed that DBS rounds up that rate to 3 decimal points (while the published rate has up to 4 decimal points). The greatest benefit for me (I don’t like carrying cash) is when I’m short of foreign cash (one of the 12 currencies) when overseas and don’t want to be fleeced by the ATM/foreign bank’s rate (plus fee). The Arcade is 10,000 km away, the money changer overseas charges a… Read more »

thanks for letting me know re: the rates! yeah, I guess this is a convenience play. I’d be game so long as the spread vs arcade isn’t too high.