In today’s Straits Times there’s an article by Yasmine Yahya entitled “Have air miles will…land you on the wait list”

The writer’s thesis statement goes as follows:

Seat redemption can be frustrating, whereas cashback cards can get you free ice cream

She argues that cashback cards are preferable to miles given that snagging award seats is difficult, and waitlisting disrupts your vacation planning. Although she acknowledges that cashback cards give inferior rewards value, her stance is that the convenience and certainty of cashback outweighs the loss.

It’s probably no great plot twist that I disagree, and I’m going to explain why in excessively long detail.

But perhaps let’s start with what she got right

Waitlists are a confusing, opaque and stressful process

My guestwriters and I have written extensively about the pains of the Krisflyer waitlist. There’s no two ways about it- the Krisflyer waitlist is a painful, arduous process. People lose sleep over it. They clog up the reservations hotline with requests for chasers. They do pilgrimages to the ION Orchard service centre in the hope that pleading their case in person will unlock new mercies (it doesn’t).

The writer summarises her problem as such-

My husband and I tend to be able to plan our holidays only about six months in advance, because of our work schedules. But then, the available award seats would have been taken up, and everyone else looking to redeem miles would end up on a wait list, which can take ages to clear.

Online forums are rife with stories from people who say they have had to physically show up at the airline’s ticketing office and cause a scene in order to clear the wait list and secure the seats they wanted to redeem. Many manage to do so just two weeks before departure. That’s a nail-biting wait if you have already booked accommodation, restaurants and tours, which, if you’re a control freak and mega planner like me, you would have done months ago.

And I completely agree. As someone who loves planning things in advance, I find the waitlist to be immensely frustrating because it’s limbo.

I personally feel that SQ has a long way to go in managing customer expectations around the award waitlist. Don’t get me wrong- all things equal I’d rather there be a waitlist than no saver availability at all. And of course I know that award seats will necessarily be scarce because they’re not meant to offer last-seat availability (SQ used to have last-seat availability with the Full award level, but you’d need a ridiculous 315K miles for a one way SIN-SFO business ticket).

However, the inconsistency and lack of heuristics involved in clearing the waitlist generates a lot of unnecessary ill-will. Those who write in get the same stock response from the PR department- that award seats are limited and peak periods will have worse availability than off-peak. Imagine how annoyed they must be when they bite the bullet, buy a revenue ticket and see the seat next to them empty.

When asked by a reporter if SIA or any of its partner banks could do something to address the frustrations so many have faced over this demand-supply imbalance, the airline’s senior vice-president of marketing planning Tan Kai Ping said: “We have inventory set aside for redemptions… When you hear about people not being able to get seats, it’s because everybody wants to go to London on a night flight during the school holidays around Christmas. There’s one flight and one plane but that plane always has no seats.”

I think that means I shouldn’t expect the odds of claiming an award seat to tilt in my favour any time soon.

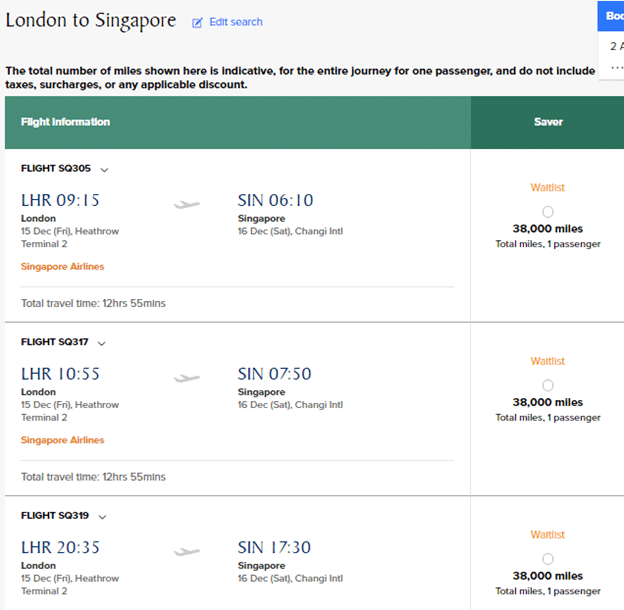

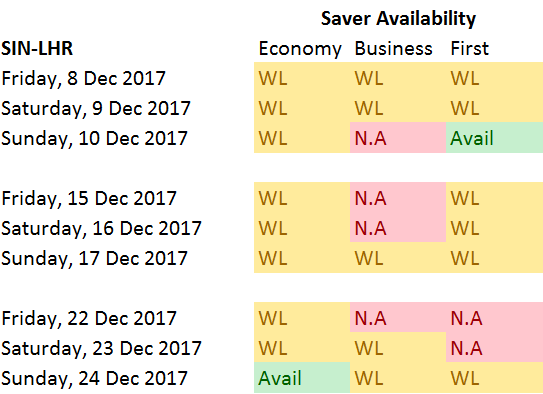

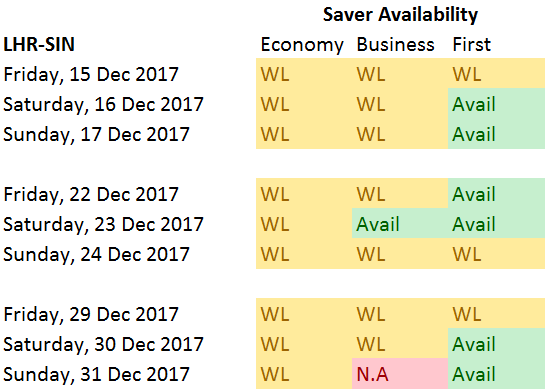

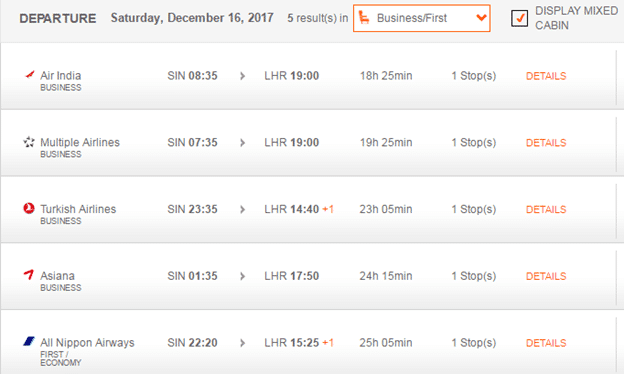

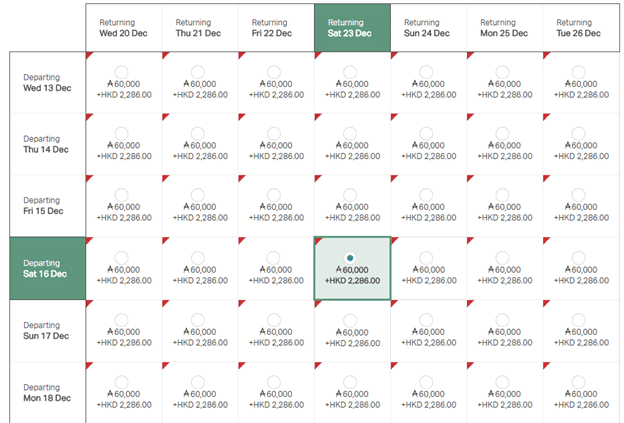

Is she right? In one sense, yes. Based on the example that Tan Kai Ping gave, I went to look at SQ’s saver award availability for 2 tickets to London around the Christmas period.

Here’s what I found-

To say that’s far from ideal is an understatement. If you want to maximise your leave by flying out/back as early/late as possible, you’re staring at a whole lot of waitlist. And if you don’t have any status with SQ, good luck to you.

So in that sense I understand the frustration of the writer. It seems like a bit of a bait and switch, like Homer buying all those Itchy and Scratchy dollars at Itchy and Scratchy Land, only to find out that he can’t spend them on anything.

https://www.youtube.com/watch?v=dErRj6V8_xQ

But that’s where my agreement with the writer ends.

I want to discuss some of the pointers and implicit assumptions she made and why I feel she’s mistaken.

Krisflyer miles aren’t just for flying with SQ

First, even if you can’t find SIN-LHR direct flights with SQ, there’s nothing stopping you from getting creative with routings. Maybe you can fly to Manchester, then take a short budget flight to London. Or go to Paris/Zurich/Frankfurt/Munich/anywhere sufficiently close. I get that it shouldn’t have to be that way, but the option still exists.

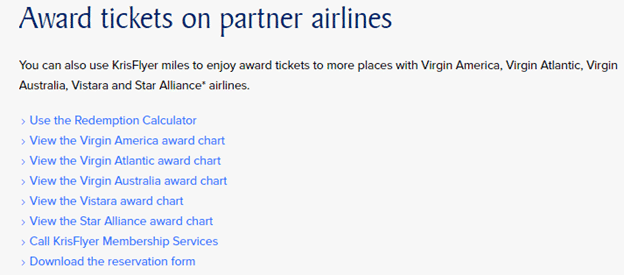

Second, the writer has completely overlooked an important aspect of frequent flyer programs and alliances- the ability to book partner awards.

Unfortunately, many people will go through their entire lives thinking their Krisflyer miles can only be used for travel with SQ. And who can blame them? SQ’s site does not allow searching for partner award space, nor hint that it’s an option. It buries this deep within the submenus.

If you want to redeem any partner award, be it Star Alliance/Virgin Australia/Virgin America/Virgin Atlantic/Vistara, you need to call up membership services to get it done.

Given that most people won’t be savvy enough to do a check of Star Alliance award space before calling in (although it’s super easy to do via the United or Aeroplan websites), they’ll be guessing at dates, airlines and routes in the dark with a customer service officer who can only search airline by airline, date by date. This is an extremely time consuming and soul sapping process.

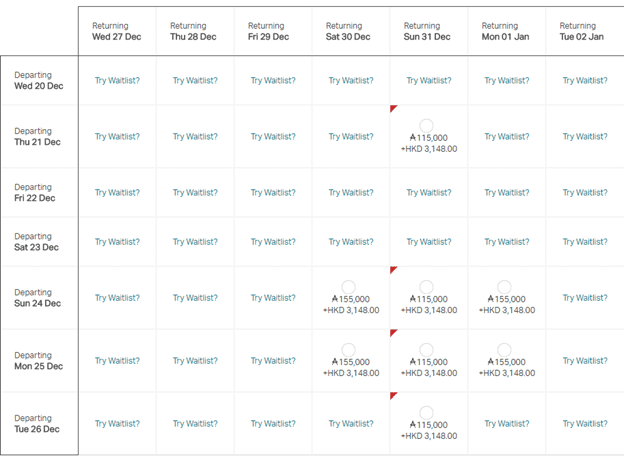

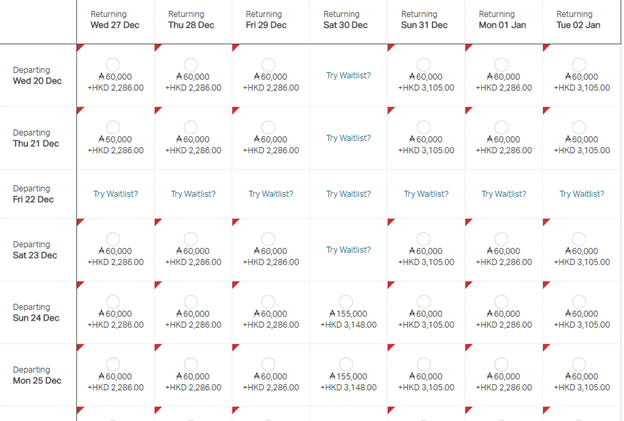

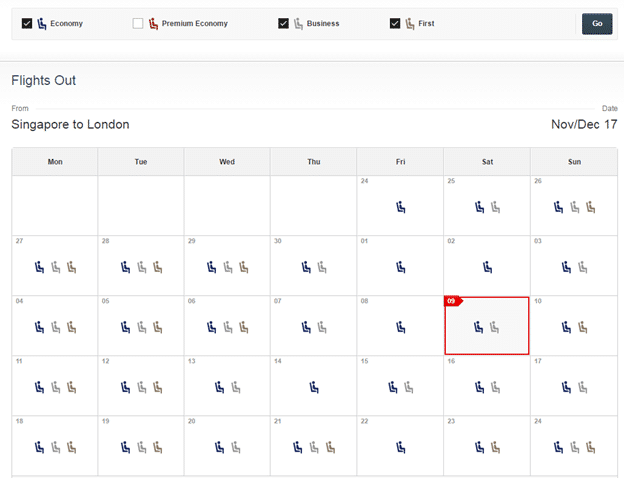

But it doesn’t have to be this way. Let’s look again at the example of Singapore to London during the Christmas period. Suppose we really want to fly this route, but need instant confirmation.

If we have Krisflyer miles, we can book a round trip Star Alliance (*A) partner award ticket to London for 90/160/215K miles in economy/business/first respectively (vs 76/170/230K with SQ- that’s right, it’s cheaper to book a *A partner business class ticket than an SQ one post the devaluation)

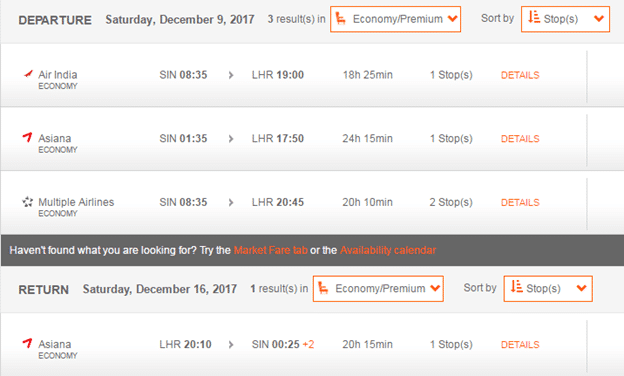

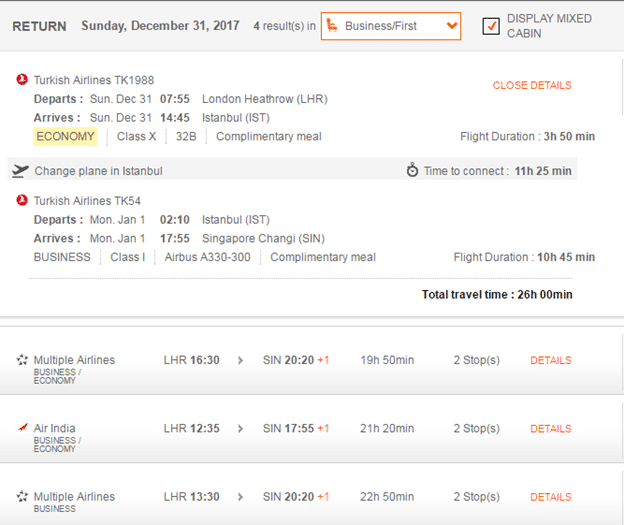

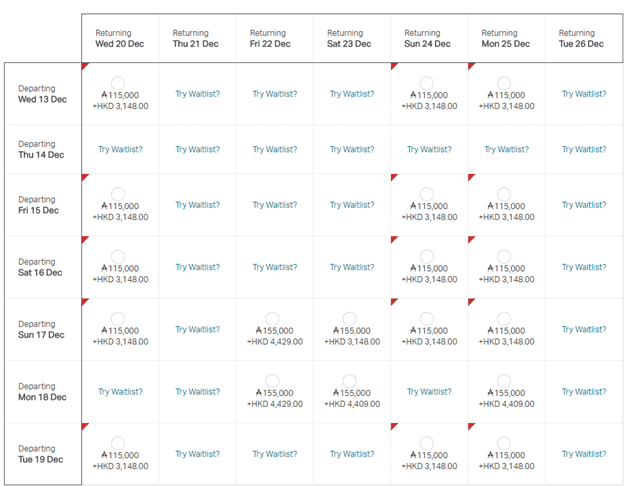

So let’s look at the Star Alliance availability via Aeroplan (you need to create a free account to search for award space, but you do not need any miles in your balance. You can also try United’s search engine which does not require an account). I ran the same search for 2x award tickets during the Christmas period.

You can see that there are one stop options to London with Air India and Asiana on the 9th outbound, and 1 stop options with Asiana on the 16th return. I get that the layover is a bit longer than most people would care for, but if you have more flexibility…

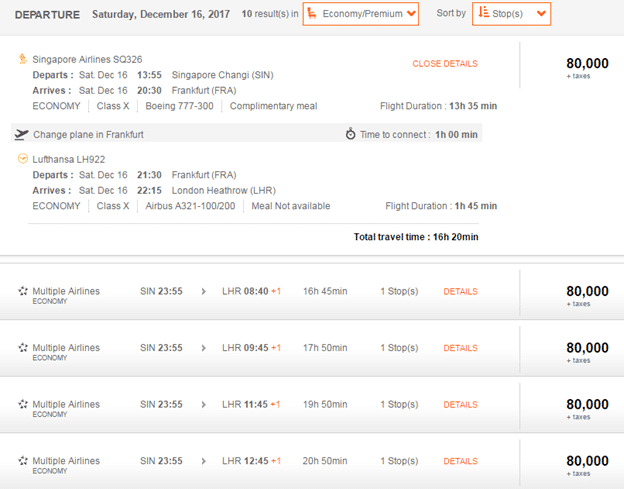

Then you can do a shorter 1 hour layover in Frankfurt on the outbound flight on the 16th

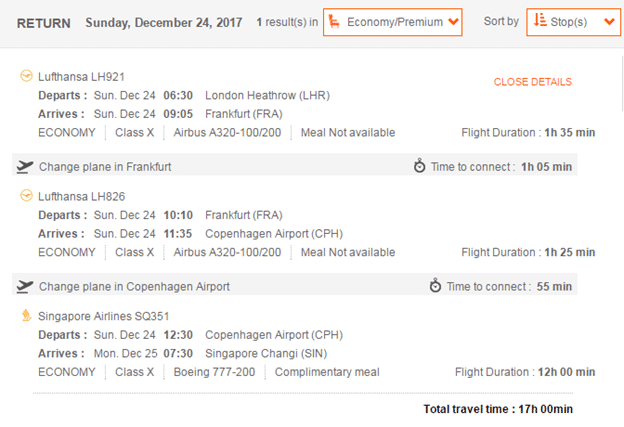

And similarly short layovers on the flight back to Singapore.

If business/first class is more your thing, you have options too as the search result below shows.

Once you get the flight numbers and dates you want, simply call up SQ membership services and feed this to them over the phone. They’ll issue your ticket and take payment for taxes over the phone.

I need to emphasise that none of this is perfect- some routes involve 2 stops, others 1 with a long layover, others mixed cabin bookings. But if getting there is your most important priority and direct flights with SQ aren’t available, then it’s certainly better to lock in one of these while waiting for the waitlist to clear.

Krisflyer isn’t the only option. What about Asiamiles?

And while we’re at it, why are we pretending like Krisflyer is the only option we have in Singapore? All the banks in Singapore also partner with Asiamiles, and your bank points transfer at the same ratio as Krisflyer. This means we can run the same search with Cathay Pacific and its Oneworld award partners.

I see good availability in CX economy for 2X standard seats (Cathay’s cheapest tier of awards is called standard) to London for departures and returns post 16th December.

Same goes for business class, although post Christmas is a bit tighter.

First Class award space is very limited on these dates, so we won’t go into that.

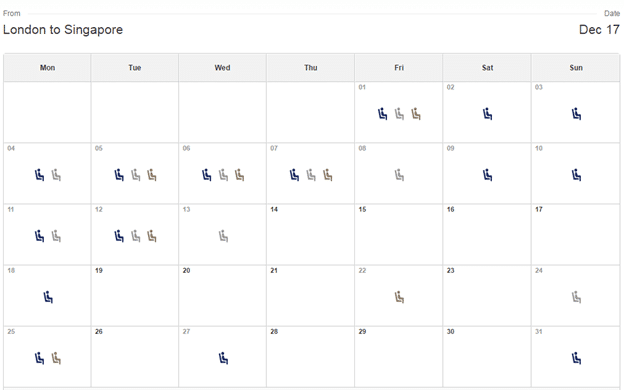

Remember that Asiamiles don’t just get you CX awards, they also open up Oneworld award space. I’d advise you use the Qantas award engine because it offers maximum flexibility, letting you see a range of dates for a range of cabins. Here’s what December looks like, inbound and out. The different seat colors correspond to different award class space (legend at the top)

Return award space is more patchy, but there are definitely options.

My takeaway here is that if Krisflyer is a dead end, there’s nothing stopping you from getting instantly confirmable award flights through Asiamiles instead. If you’re new to Asiamiles, I recommend you have a read of the intro guide I write a month or so ago– it will get you up to speed on the basics.

So the Krisflyer waitlist is terrible, but with a bit more research you can still get the dates and routes you want.

Miles cards do not earn you miles. They earn you points that can be converted into miles

The next mistake the writer has made is confusing the idea of airline miles and bank points.

With the exception of the cobranded Krisflyer AMEX cards, no credit cards give you Krisflyer miles per se. Instead, you earn points with the bank that can be converted into Krisflyer miles.

For example, when you spend with your DBS Altitude Visa card, every $5 spent locally gives you 3 DBS points, which can be converted into 6 Krisflyer miles. Hence the earning rate of 1.2 miles per dollar.

Similarly, spending on the UOB PRVI Miles card gives you UNI$, spending on the Citibank Premermiles card gives you Premiermiles, spending on the HSBC Advance visa gives you Rewards points.

Why am I highlighting this? Because your bank points don’t have to be converted to miles. If you so wished, you could convert your UNI$ or DBS Points to shopping vouchers and cash rebates, albeit at a poor rate.

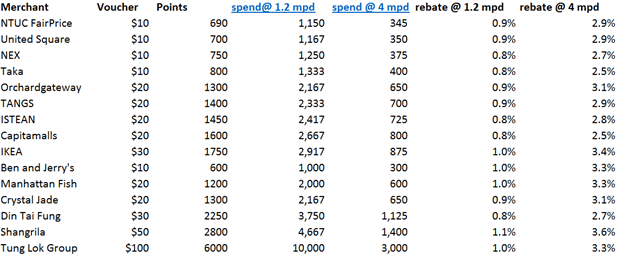

I went to pull some examples from the DBS rewards catalogue and put them in an ugly looking spreadsheet.

This table is showing various voucher options from the DBS rewards portal, the denomination and the number of points needed to redeem. It also shows you how much you’d have to spend to earn said voucher, depending on the type of card you use.

I want to draw your attention to the last 2 columns, which show how your effective rebate varies depending on card used. In all likelihood, your rebate will be a blended percentage somewhere in the middle.

If you use just the DBS Altitude and only spend locally, you’ll be earning the equivalent of a ~1% rebate when you convert your DBS points to vouchers. If you use the DBS Woman’s card for your online spending and put a bit of foreign spending on your DBS Altitude, you’ll be closer to the ~3-3.5% rebate in the last column.

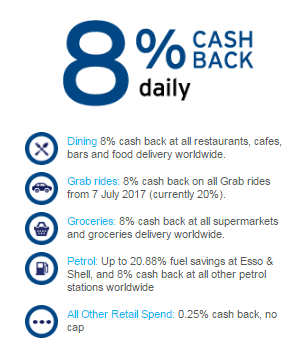

I know that cashback cards can offer anywhere between 3-8% rebates in their bonus categories. But I want to point out that these are subject to minimum spends and caps, and therefore you need to take some sort of haircut in considering the value*.

(*the equation will be further complicated when you factor in bank accounts like the UOB One which require you to spend a certain amount on their cashback card to fully max out your interest. I’m not going to delve into this, but I’m sure sharper minds than me can)

Now, I don’t want anyone to think I’m endorsing converting DBS points/UNI$ into shopping vouchers. I’m not. It’s a terrible, terrible idea, considering what alternative value you can get. What I’m trying to say is that by opting for a miles card, you get the best of both worlds- if you end up spending more than you envisioned, you can cash out with miles. If not, you can still get some vouchers for your trouble. I’m even going to go out on a limb and say that if you’re not sure whether you can hit the minimum spend on your cashback card, you might be better off putting the spending on a miles card and cashing out via vouchers than risking earning 0.3% cashback.

It is harder to adopt a “best of breed” strategy with cashback cards because of minimum spend requirements

The writer, to her credit, has already stated she knows that cashback cards give inferior value. But I want to dig a bit deeper into why.

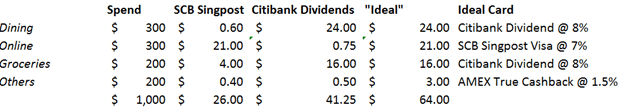

Let’s take the example of someone spending $1,000 a month on credit cards, broken down into 30% on dining, 30% on online (shopping, movie tickets, air tickets etc) and 20% on groceries and 20% on everything else.

Suppose he wants to earn cashback. He chooses the Citibank Dividend card, which promises the following

To earn those rates, he needs to spend a minimum of $888 a month. If he spent anything below that, he’d earn a flat 0.25%.

Because of the minimum spending requirement, it is difficult for this person to optimize his spending, that is, to use the “right” card for each category.

What do I mean? Well, in an ideal world, he’d be using the Citibank Dividends card for groceries and dining (8% cashback), the SCB Singpost Visa for online (7%) cashback, and the AMEX True Cashback card for everything else (1.5%). This allows him to optimize within each category.

But he can’t do this, because he’d need to spend at least $600 a month on his SCB Singpost Visa before he can enjoy the 7% cashback on online spend. And he’s already pledged $888 of his $1,000 monthly spending to the Dividend. Therefore, instead of the “ideal” $64, he’ll end up with something like $41.

The major miles earning cards do not require minimum spend requirements to earn the promised headline miles.

DBS Altitude will give you 1.2 mpd from the first dollar of local spend. Citibank Premiermiles will give you 1.2 mpd from the first dollar. UOB PRVI will give you 1.4 mpd from the first dollar. Even specialised spending cards like the Citibank Rewards and DBS Woman’s World card cap upwards, not downwards. You earn 4 mpd on every $1 spent online with the DBS Woman’s World card, up to a maximum of $2,000 per month. This difference in approach allows you to pick and choose best of breed miles cards for each category.

Once you have to pay an annual fee on a cashback card, you’re back to square minus one

I’ve mentioned this before but it bears repeating- the only way a cashback card can make sense is if the annual fee is waived.

If you pay an annual fee on a cashback card, you’re starting from a net negative position.

Suppose you pay the $171.20 annual fee on the AMEX True Cashback card. At 1.5% cashback, you’d have to spend $11,413 just to get back to where you started! That’s to say, you only start making a net gain from the 11,414th dollar.

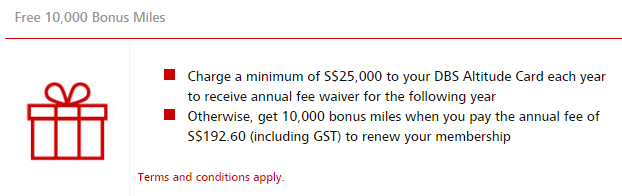

With miles cards, you’re hedged against this. If you spend above a certain amount, your annual fee is waived. If you don’t, you get bonus miles for paying the annual fee. An example is the DBS Altitude which waives your annual fee with a minimum annual spend of $25K, or offers you 10,000 miles for paying the annual fee of $192.60.

Therefore, if you use cashback cards you need to be hypervigilant about annual fees, and either get them waived or cancel the card. Paying annual fees on a cashback card does not make sense.

Conclusion

So when the writer says

“When I use my cashback card at Fairprice at the end of a long week and find out from the cashier auntie that I can take home my tub of Haagen Dazs for free, that is just priceless”

I can’t help but die a little bit inside. Because trading your miles for a tub of Haagen Dazs ice cream is like Esau trading his birthright for a bowl of stew.

I get there are common objections to joining the miles game- I don’t spend enough, it’s too complicated, I’ve been taught from young that nothing beats cash. But the only acceptable objection to me is if you don’t travel at all. And in that case, I’d advise you reach out to your friends to see if you can get some quid pro quo arrangement, because I know a lot of people who would pay a small fee to get to spend more on their miles earning cards.

And trust me, Haagen Dazs tastes better like this

That last line – a sucker punch!

Btw, I guess you meant Voila? Damn autocorrect!

(Unless Viola is your gf’s name)

The last is a sucker-punch!

I guess you meant Voila!

Ah. I’m not going to live this one down am I

thank you. My thoughts exactly.

Not to mention the horror of the tracking.. I think tracking miles is fun, but tracking my UOB YOLO for just 1 month was even worse. Can’t imagine ever having more than 1 cashback card.

interestingly enough YOLO has a campaign with my affiliate network offering $40-50 per new sign up…

eh chelsea go see the UOB PP Amex thread. someone just got successfully approved. got pic somemore.

Sian I never check thread replies cos no alerts ;_; Hey btw check your email leh – got potential opportunity there maybe?

didn’t get any email, what are you referring to?

what??? just?? i sent them an application a loooong time ago and it disappeared. i thought they weren’t issuing anymore!

thankfully, lately i spy lots of visa paywave at restaurants, so…. 😉

Strait times writer is too silo. Most likely her thinking is only kris flyer. Airmiles is not her hobby but something to write for the sake of her job

Trained to just write from a press release from a ministry or just ask safe questions to a powerful man. Singapore journalism. Sigh.

When i saw the article not the papers yesterday, i was oh dear, milelion is going to have busy weekend…’

Haha, anyway one of the reason, i hear most for people not doing miles is that they dont value biz class at all, they travel, but economy class on SIA is more than enough.

If we factor that in, i think Cashback might be better?

what else am i supposed to do while i await true love’s first kiss?

yeah, i think someone did the numbers and said that if you want to fly economy class on SQ (or worse, redeem for scoot/tiger vouchers) then you might as well do cashback

After recent devaluation Y redemption starts to make economic sense.

After recent devaluation Y redemption starts to make economic sense.

i need to run the numbers again on this. i’d say that Y redemption would make more economic sense than before, but whether it makes economic sense in totality…

Lol clearly the ST writer is still a travel hack noob! She should read Aaron’s blogs before writing her article. If she did she would sing praises for air miles than cashbacks. ??

Love the conclusion man. Though Haagen Dasz does sound priceless at a super small local scale. I would trade the amazement when I get free Caviar any day! beluugaaa ???

Btw this is the same reporter who covered the launch of the uob krisflyer account and basically uncritically regurgitated the uob press release. (Something every single MSM also did… )

yeah that’s the thing I feel a bit conflicted about. on the one hand i’d expect more critical journalism instead of a fawning puff piece that lifts generously from the press release. on the other, these guys are clearly not fanatics. they don’t spend hours reading flyertalk, or fiddling with expertflyer/awardnexus. they see this as just another financial product. i wouldn’t expect them to be able to apply the same level of analysis as those on FT/HWZ would. I mean, if you asked me to write about, say, a new real estate launch, I’d just take whatever they gave me.

Professional journalists need to be held to a higher standard. You have your byline on it so how can you justify reproducing the press release ? Plus all newspapers assign their reporters to specialise in different fields. So if the food reporter says a certain char kway teow is really good, most readers would trust this judgement was made based on having tasted competing ckts and not simply on a press release. And we trust this as a society – look at the number of press writeups that are pinned up at such stalls.

I have the same opinion. Even if they do not possess specialised knowledge in that field, why cant they just take the little effort of adding, “however, according to experts..”, or “however, according to frequent customers..” etc ?

We are never going to see the day when they write, “however, according to popular blog Milelion, cashback is not an advisable option… “.

Hahaha too many enemies in the press alr. Soon will get doxxed

This article has merits.

It’s undeniable that airlines, including SQ, are selling miles with all doors opened, some even sweetened it with bonus to entice buyers but leaving a bottleneck for them to get back as tickets. Virtually all airlines will recognise miles as their currencies, as good as cash but almost none can hold it as a reality.

it’s interesting you mention that because lucky over at OMAAT had a piece recently on what AA was doing- http://onemileatatime.boardingarea.com/2017/04/28/no-american-award-seats/ his point is that if you make miles available for sale and encourage people to buy them in great quantities, then restrict award space, that’s very shady behavior. if the ST article were devoted to calling out SQ for restricting award space, I’d fully get behind that. I just don’t agree with the conclusion that we should switch over to cashback because award seats are hard to find. and i’m sure SQ’s PR department would send the usual form letter… Read more »

Aaron you are the BEST…………first your response to UOB – Krisflyer card and now to the ST reporter. ST reporter seems like an amateur and the UOB gang is trying to trick the public into giving cash at zero percent!!!!! I wonder what FIDREC or MAS will say for advertisements that is bias towards returns and hides in small prints those critical conditions to get those returns!!!!

Enjoyed your articles and sense of humour. In full agreement with your analysis and thank you for creating the awareness through this site.

thanks peter. will be interesting to see what ocbc makes of all this, after their recent transparency-in-advertising campaign. For the record, ST reporter might be noob, but that’s why sites like this exist- to help all see the light!

Ocbc? Give it up.. Ocbc and uob are alike.. 2 small conservative local banks still in their own world..

Esau giving up his birthright for a bowl of stew! Hahaha! What an analogy! Which church do u go to? Not sure if your Pastor is gonna approve….? Lol good, fun read.

Haha there’s a great clip of John Piper on desiringgod that you should listen to where he talks about the insanity of Esau giving up his birthright for a bowl of oatmeal. Oh, how that man emotes…

ahhh of the reform theological school of thought! nice:)

Thanks Aaron! Was doing my research about the next holiday and getting REALLY frustrated with SQ waitlist. Great timing! Going to ditch SQ biz class endless wait period and try Thai Airway business instead.

Hey Aaron I’m also a Miles support and agree with you.

But on the point of cash back cards where you note it’s hard to achieve actually it’s quite easy if the family works together on a single account holder and supplementary card to the rest. This pooling method will also allow achieving the minimum requirements quite easily. I have friends who do this. So while I don’t preach or practice this. There are ways to make cash back cards work for you in this essence I think.

Aaron, you mentioned partner awards using Asiana as an example. My understanding in this new KF world is that Asiana redemptions have YQ surcharge (I specifically asked about partner awards when I was looking for Japan/Korea; FYI ANA redemptions appear to not charge YQ). Makes it slightly tricky to compare. KF mentioned at the change that YQ surcharges on partner redemptions would not change. It would be good if a list could be compiled of partner redemptions with YQ surcharges, obviously bearing in mind some geopolitical anomalies (eg HKG, Philippines & Brazil have regulatory limits on YQ)

Hi Tim, how do you redeem SQ miles on ANA flights? Thanks!

ST writers ran out of juice

Hi Aaron, I love your blog (and your sense of humor) but I’d like to make a counterargument for why it makes sense for many people to use cashback cards instead of miles cards that has nothing to do with waitlist availability. For simplicity I’ll do a single card comparison first then discuss multicard strategies later. On the miles side, you could put all your spending on the UOB PRVI card and earn 1.4mpd. Alternatively, you could put all your spending on OCBC 365 card which should easily result in an average cashback rate of at least 3%, i.e. 3… Read more »

Miles are indifferent from vouchers. If retailers put up a treadmill to shoppers with vouchers then they will close down by the dozens. Why is the same not happening to the airlines? Simply, too many suckers and tilt the balance against the miles chasers. At the end, value is subjective. This article argues the impediment to have miles converted to tickets as freely as shopping vouchers are unworthy than cashbacks.

I agree that, as Jeriel frequently posts about, it really comes down to how you value each mile. It’s nice to compare the price of the revenue ticket to the number of miles it takes, but miles usually have more restrictions on their use. Revenue tickets sometimes go on sale, especially if you don’t limit yourself to SQ. Miles are also subject to devaluation, typically at a rate much faster than inflation. If I wanted to take a J flight to tokyo, I could book it with 80K krisflyer miles, or I could have taken advantage of the MAS promo… Read more »

Not sure if i want to do that again tho.

i am booked for a flight next friday on the promo j flight to korea landing at 7 am and i have a connecting at 11am. and i am worried about the delays. Sigh.

Mh66

On-time: 60%

Avg. Delay: 82 min

that’s good analysis there julian. a few points from me. 1. you need to consider the annual fee point i made about cashback cards. with miles cards you’re insulated insofar as you get miles when you pay the annual fee (UOB PRVI aside), but with cashback cards you get nothing 2. getting a blended 7% cashback rate through using multiple cards overlooks the fact that each cashback card has a minimum spend requirement to enjoy the headline cashback rate. so you’re looking at quite a high spend. so i’m not convinced on this point, because 7% requires a best of… Read more »

Using your example of $1000( and the various spending) I’m able to get about $25 rebate on ocbc credit card. If I split using different miles card for the various spending.( not talking about HSBC advance because we need to park $$ inside) $300 dining i use DBS altitude i get 360 miles, $300 online i use DBS womans i get 1200miles, groceries i pay with UOB pref plat visa for paywave i get 1200miles, Others I pay with DBS altitude i get 240 miles. In one month I’ll get 3000 miles. To redeem for SQ business class(170K) to europe… Read more »

I lol-ed at your Esau analogy. Thanks for making my otherwise boring day Aaron!

Hi Aaron, Thank you for all your write ups. I learnt a lot from your website. I went to look into the Aeroplan and Qantas Frequent Flyer and found that Oneworld tickets generally require more miles than Star Alliance. Below are 2 examples of J redemption for 1 person: 1. Return ticket (KIX) 22-30 Mar 2018 Qantas: SIN to KIX: CX 636 transit to CX 566 KIX to SIN: CX 503 transit to CX 635 Total points (or miles?) required: 106,000 Aeroplan (I chose Asiana so that there is a transit similar to CX above. Else SQ would also cost… Read more »

Well the problem with what you’re doing is it’s not a fair comparison. You shouldn’t be looking at aeroplan and qantas for pricing, you should look at it for availability. Ultimately when you call sq and book award space on some other star alliance carrier you will pay as per sq’s award chart. Ditto for cathay and asiamiles. The prices you see quoted on aeroplan and qantas are if you’re booking with air canada/qantas miles respectively

Thank you Aaron!

Thanks for the excellent write-up. I don’t think its fair to say the ST writer was wrong for preferring cashback to miles though. The convenience and certainty of cashback cards matter more to many people, especially those that mostly fly on budget airlines and economy anyway and would hardly pay a cent more for business class.

Hi Lets take uob one card as an example as it currently gives 3.33% cashback for $1000 generic spend per month. That is equivalent to $399.60 cashback per year. UOB also promises an automatic fee waiver if $12000 min spend is reached. For a generic miles card that gives 1.2mpd, $12k spend yields 14 400 miles. I do not own a miles card but if I am not wrong, 14k miles is good at most for a Bali trip which also is in the region of $400? Do please enlighten if my calculations are wrong. I AM wondering if I… Read more »

or you can take a budget flight for $200 and save $200 for something else

[…] of the relatively small rebate % as well as the multitude of conditions attached. I spell out more problems with cashback cards here, but to […]

[…] of the relatively small rebate % as well as the multitude of conditions attached. I spell out more problems with cashback cards here, but to […]