Sometimes reboots work and give you gems like Chris Nolan’s Batman series (let’s pretend the third movie doesn’t exist). Othertimes, reboots take a beloved piece of work like Total Recall and totally Colin Farell it.

Singapore Airlines and AMEX have taken out full page ads in today’s papers to proudly announce the reboot of their cobranded portfolio. Unfortunately, this reboot is more like the latter.

EDIT: now that I think about it, it’s not really a Total Recall situation because the original movie was actually good. This is more rebooting The Fantastic Four. Crap before, crap afterwards.

Here are the main changes-

Singapore Airlines Krisflyer Gold Credit Card

Let’s first deal with the big insult that SQ puts front and center in the ad

“The American Express Singapore Airlines Krisflyer Credit Card. It’s the new travel hack to fly Singapore Airlines”

No. Stop. It is not.

To hear AMEX/SQ trot out the term “travel hack” as if they have the slightest idea what it’s about is just insulting to the hobby I know and love.

The best “travel hack” the AMEX cobranded cards had was to get the old Krisflyer Ascend card with the first year fee waiver, spend $1 to get 5,000 miles, use the 4 lounge vouchers, use the 1 night free Millennium Hotels voucher in a very expensive city, upgrade your Millennium Hotels status to gold for free and cancel the card at the start of the next year when the annual fee became due. All that for $1 of spending? THAT is a travel hack.

Anyway.

The Singapore Airlines Krisflyer Gold Credit Card has been renamed the Singapore Airlines Krisflyer Credit Card. Also, it is no longer gold. I probably should have started by stating that.

| Before | After | |

| $1 Local Spend | 0.6 miles | 1.1 miles |

| $1 Overseas Spend | 0.6 miles | 1.1 miles/ 2 miles (during Jun & Dec only) |

| $1 SQ/MI Spend | 1.25 miles | 2 miles |

| Annual Fee | $117.70 | $176.55 |

| Special Features | 50% bonus miles when you charge >$5,000 per year Further 50% bonus miles with minimum spend of $12,000 in a year 5,000 bonus miles on first spend | $150 cashback for use on SQ tickets when you spend $12,000 on your card by 30 Jun 17 5,000 bonus miles on first spend 3,000 bonus miles with $700 spend in first 6 months |

The miles earning rate is much improved from the anemic old product. It was ridiculous that SQ’s own co-branded card was offering less than half of what the market leading UOB PRVI Miles card did, with no bonus on overseas spending.

Even if you navigated the complicated tier of 50% bonuses on the original product, you’d still be lagging behind someone who had applied for a run-of-the-mill Citi Premiermiles or DBS Altitude offering.

That said, the new earning rate of 1.1 miles per S$1 of local spend is still not good enough. Back in the day when miles credit cards required incomes of $50,000 and up (I still remember when DBS Altitude launched- it needed $80,000 min income), SQ and AMEX could get away with this by positioning the card at young professionals who had just started work and had >$30,000 income, but not enough for a PRVI or Altitude or Premiermiles.

Now that DBS Altitude has cut its income requirement to the bare minimum, there is no such advantage remaining. In fact, the DBS Altitude offers a far superior value proposition to the relaunched Singapore Airlines Krisflyer Credit Card, with 1.2 miles and 2 miles on local and overseas spending, with no minimum spend or time of year restrictions. Oh, and you get 8,000 bonus miles with a minimum charge of $1,000 a month for 2 months after applying.

The other point of amusement for me, at least with the old version of the card, was that it wanted to match the American system of giving 1 mile for every US$1 of spend. Back then, the USD was about 1.6 to the SGD, so they said ok, 1 mile for every S$1.60 of spend. But in the many years that followed as the SGD strengthened they never adjusted that peg. They then found themselves offering 0.625 miles per S$1 in a world where everyone else was offering 1.2 miles at a minimum. Well done.

Not that the new version is much better.

EDIT: Some people have pointed out that by spending $700 on the card you could get 5,000 activation miles + 3,000 bonus miles for a total of 8,000 miles. I suppose this is something you might want to look at for those of you who are first time applicants. Of course you could just as easily get 5,000 miles by spending $1 on the card, but even then you’d be hard pressed to generate 3,000 miles on the back of $699 spend anywhere else.

Singapore Airlines Krisflyer Ascend Card

Ah, my good friend the Ascend Card, which gave me so much and asked so little in return. I’ve already covered the main changes but for the sake of being complete I’ll mention them again here.

| Before | After | |

| $1 Local Spend | 0.8 miles | 1.2 miles |

| $1 Overseas Spend | 0.8 miles | 1.2 miles/ 2 miles (during Jun & Dec only) |

| $1 SQ/MI Spend | 1.6 miles | 2 miles |

| Annual Fee | $256.80 | $337.05 |

| Special Features | Accelerator feature which gives 300 bonus miles for every $500 spend above $1,000 4 lounge access vouchers 1 free night at Millennium Hotels 5,000 bonus miles on first spend | 5,000 bonus miles on first spend 5.000 bonus miles with $1,000 spend in first 6 months Double miles accrual voucher with $15,000 spend by 30 Jun 17 KF Elite Gold status with $15,000 spend on SQ/MI tickets within 12 months of approval 1 free night at Millennium Hotels (since devalued) 4 lounge access vouchers |

The double miles voucher is probably the most new interesting feature so we’ll look at that

Double KrisFlyer Miles Accrual Voucher

They say: Spend above S$15,000 on your Card at singaporeair.com from now till 30 June 2017 to be rewarded with a Double KrisFlyer Miles Accrual Voucher (capped at 5,000 bonus KrisFlyer miles).

But wait: To be fair, SQ has made the 5,000 cap quite clear. 5,000 isn’t a lot. If you value your KF miles at 2 cents each (or perhaps more, depending on your redemption pattern), you’re talking about $100. Here is SQ’s table explaining the inherent limitations on the bonus

Needless to say, the general/overseas spend rates are still terrible. Bonusing overseas spend only in Jun and Dec? Really AMEX/SQ? That doesn’t make sense even from your point of view. The whole purpose of incentivising overseas spend is to allow you to earn margin from the forex transaction fees you charge. Those fees are the same in Jun and Dec as they are the rest of the year. Why only encourage people to spend in Jun and Dec then?

Next!

Singapore Airlines Solitaire PPS and PPS Credit Cards

These cards, to me, were always the biggest slap in the face to SQ’s most loyal customers. Here are people who spend at least $25,000 on your premium cabin products each year. And what do you give them?

| PPS Card | Before | After |

| $1 Local Spend | 1 mile | 1.3 miles on first $3,800 1.4 miles on every $1 above $3,800 |

| $1 Overseas Spend | 1 mile | 1.3 miles on first $3,800 2 miles on every $1 above $3,800 |

| $1 SQ/MI Spend | 2 miles | 2 miles |

| Annual Fee | $267.50 | $551.05 |

| Special Features | 10,000 bonus miles with min $50,000 annual spend 5,000 bonus miles with first spend 10,000 bonus miles with $10,000 spend in first 3 months | 5,000 bonus miles with first spend 10,000 bonus miles with $2,000 spend in first 6 months 50% discount miles redemption voucher with $75,000 spend by 30 Jun 17 Double miles accrual voucher with $15,000 spend by 30 Jun 17 |

| PPS Solitaire Card | Before | After |

| $1 Local Spend | 1 mile | 1.3 miles on first $3,800 1.5 miles on every $1 above $3,800 |

| $1 Overseas Spend | 1 mile | 1.3 miles on first $3,800 2.4 miles on every $1 above $3,800 |

| $1 SQ/MI Spend | 2 miles | 2 miles |

| Annual Fee | $267.05 | $551.05 |

| Special Features | 20,000 bonus miles with $10,000 spend in the first 3 months 10,000 bonus miles with a spend of >$50,000 in a year 10,000 additional bonus miles with a spend exceeding $100,000 in a year | 5,000 bonus miles with first spend 15,000 bonus miles with $3,000 spend in first 6 months Upgrade voucher to First Class with min $50,000 spend by 30 Jun 17 50% off redemption voucher with $75,000 spend by 30 Jun 17 |

First thought: holy double annual fee, batman.

Second thought: these are your most loyal customers, and you’re telling me you can’t offer a local/overseas earn rate as good as the UOB PRVI Miles card?

The 2 new features are described below-

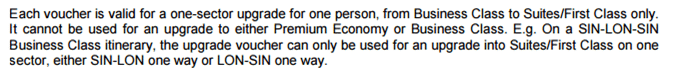

Upgrade to Singapore Airlines Suites or First Class

They say: Enjoy a complimentary one-sector upgrade to the Singapore Airlines Suites or First Class when you spend above S$50,000 on your Card at singaporeair.com by 30 June 2017.

But wait: This only applies to revenue tickets. Also, changes are not allowed to any bookings this voucher is applied to. And by the way, it’s already an unpublished benefit that Solitaire PPS Club members get a birthday upgrade.

Side note: can we also take a moment to laugh at the phrasing of this

SQ does not fly to LON. There is no such airport code as LON. SQ flies to LHR. Seriously guys, get your stuff right.

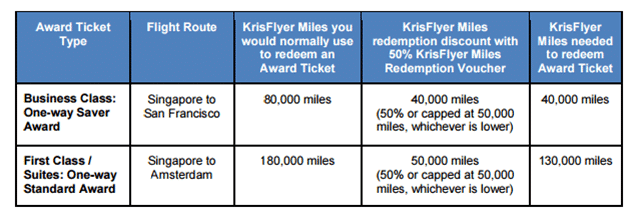

50% KrisFlyer Miles Redemption Voucher

They say: Receive a 50% KrisFlyer Miles Redemption Voucher when you spend above S$75,000 on your Card by 30 June 2017. This voucher entitles you to a one-off 50% saving (capped at 50,000 KrisFlyer miles) when you redeem your KrisFlyer miles for an eligible redemption award booking

But wait: The maximum discount is 50,000 miles! SQ explains as much in their T&C document here

So while 50,000 miles is not to be sniffed at, it’s nowhere near as generous as the publicity materials make it sound (shocking news: marketing materials overpromise!)

And also, since you need to call the Krisflyer hotline to redeem this voucher, you are not entitled to the 15% discount on online bookings (see how SQ has prices SIN-SFO one way J as 80,000 miles and not 63,750 miles)

Oh, and the T&C say that no changes or cancellations are allowed for award bookings made under this voucher. Enjoy!

Conclusion

It’s impossible to view this as anything other than a tacit acknowledgement from AMEX and SQ that their cobranded offering was hopelessly uncompetitive compared to the Banks’ offerings.The sad part is, even after the change, the Banks have much better miles-earning cards.

A secondary purpose of this exercise was to justify higher annual fees- something I don’t think you should pay in the first place (unless it represents a chance to buy miles at below 2 cents each). My experience with American Express is that they do not waive annual fees, but other people have reported success. YMMV.

If you take nothing else away from this TL;DR article, just promise me that you will stay far away from these awful, awful cards. Get a DBS Altitude. Get a UOB PRVI. Get a Citi Premiermiles. Hell, I’ll even allow you to talk to the OCBC Voyage salesperson. But don’t waste your valuable spending putting any money on these craptacular cobranded cards.

Abuse the term “travel hacking” at your own risk, AMEX and SQ.

Thanks for the review and the breakdown! Looking at the current ad, I still prefer the old Ascend which I did sign up for it and cancelled it also (following your travel hack). The funny thing, SQ and AMEX don’t seem to know that their cards suck, and still spend so much money to promote them.

thanks marcus! i’m guessing SQ and amex are relying on the fact that a lot of people will go wow, cobranded card, must be good!

Wow they really pissed you off with declaring it as a travel hack. Shots fired left and right!

I promise to stay away from AMEX.

I don’t have a UOB card at the moment but mostly because I don’t like filling up forms and I can’t pool miles with my other cards. Right now I am on the fevo and am trying to cut down on dining expenses! 😛

I am a grumpy, grumpy man.

Thanks Aaron, I really hated that they used the term travel hack as well. What were they thinking?

my guess is one person in the copy department in the agency that did the ads must have had a brainwave

The ascend card previously had 35,000 miles bonus when you spend $10,000. It wasn’t indicated in your table. Does the revamped card still have this promo?

i didn’t mention that because it was part of the full fee offer, not a default option (although I think they stopped giving the first year fee waiver after a while so maybe that became the default option…) i’m not sure if this still exists, it certainly isn’t mentioned on the new site. Full Fee Offer 1 Pay an annual fee of S$256.80 (inclusive of 7% GST) Earn 15,000 Bonus KrisFlyer miles when you spend S$5,000 in the first 3 months upon Card approval OR Earn 35,000 Bonus KrisFlyer miles when you spend S$10,000 and above in the first 3… Read more »

Not sure if I’m reading the website properly, but there’s no mention of the need to pay the (new) annual fees to enjoy the current bonuses for new sign up for the ascend card. (i.e. 5000 sign up bonus + 5000 for $1000 spend + other peripherals added)

but then again, there’s no mention of a first year fee waiver

Anyone can confirm?

correct me if i’m wrong, i can still apply for the krisflyer amex (blue card), opt for first year waiver, spend $1 to get 5000 miles and cancel it 1 year later right?

U can’t if u had a bite of the cherry before. The benefit is once in a lifetime according to the amex telemarketer I spoke to an hour ago.

I am (was) an existing ascend card holder. Just called an hour ago to cancel the card. Does not make senses to keep the card even though they waived off my annual fees. Just waiting to be slapped an annual fee the next round with totally no benefits at all. Crazy- what are they thinking off?? At least give me something (even a new card design) before ripping me off…

I think they meant “hack” as a noun

(Horse Training, Riding & Manège) an old, ill-bred, or overworked horse

Its bad enough that the benefits are so bad, but when you also consider that you can’t use Amex cards in many places it becomes an even bigger joke.

Does it make sense to apply for the cards, get the bonus miles and cance them after one year?

My key takeaway in all of this is… that blue card looks really cool. I can frame it and put it in a wall. Beside the VERY innovative UOB YOLO card.

don’t forget your frequently used uob pref plat mastercard too!

But that doesn’t have the card number all stacked up in one neat pile. And the security code’s at the back of the card.

Such a hassle.

I previously shared that my Krisflyer Amex Ascend’s AF could be waived. Didn’t spend that much on it. May I add the caveat that they didn’t send me my 4 lounge vouchers. Called the CSO, they said yes it was due to the waiver. Time to cancel this one…

i have heard on the grapevine of some people getting their annual fee waived but still getting the vouchers. I assume that was an oversight more than anything though.

[…] So this is weird. American Express is advertising to travel hackers. (HT: Milelion) […]

Thanks for the review Aaron. This website is very informative. I have the Amex Krisflyer Gold Card since a few years back before I discover Milelion and become more literate in accruing miles. I tried to cancel this card this year before the rebranding, but the CSO gave me a waiver, so I kept it anyway. I agree that Amex SIA cards are generally not as competitive as other credit cards in the market now, but for those who already have this card, FYI your first ever transaction on Grabcar using this card will give you additional 500 miles. I… Read more »

glad to hear it helps! i didnt know about the grabcar bonus, definitely a bonus for those who already have the card anyway.

[…] rules. And those of us who abide by them, earning our miles through flying with SQ and using its awful cobranded cards, are the ones who lose out. That to me is why this practice isn’t […]

LON is the IATA code for all of London’s airports eg LHR, LGW, LCY etc

Technically is correct

haha fine. but SQ does not serve LON.

[…] Used at milelion.com/2016/05/05/american-express-reboots-sq-cobra… […]

Hi Aaron, I just noticed that Shopback is having a new $50 cashback promo for signing up for the AMEX Krisflyer credit card through their app. Went to check out the card for fun and saw that they have a new sign up offer for 7,500 bonus miles after spending $2,500 within the first 3 months (so 15,250 miles and $50 cashback for $2,500 spend with a first year fee waiver – sounds pretty good) . I’ve got some big ticket spending coming up due to my wedding, so I’m now considering whether to sign up and charge some of… Read more »

Do I have to be a member of PPS Solitaire Club to be eligible for the The American Express® Singapore Airlines Solitaire PPS Credit Card