On this site we’ve covered a lot of ways that you can earn miles through your everyday spend. But what if you’re still short and need to buy additional miles? Well, there are illegitimate and legitimate ways of going about that, but since we are all law abiding straight shooting citizens, we shall only discuss the legitimate options here (back alley, 10 minutes, trenchcoat and dark glasses)

When analyzing the new UOB PRVI Pay feature, I went a bit overboard and put together every opportunity I could think of to buy miles in order to see how the PRVI Pay measures up. Here’s what I made-

[table id=4 /]

(1) The HSBC website says that $1=0.4 miles for tax payment facility, but I have received reports that VI holders have received 1/1.25 mpd as per their relationship bonus

(2) The income requirement to get a HSBC Premier MC is $30,000, but you need $200K in deposits to open a HSBC Premier account

(3) OCBC Voyage Option 1 involves paying $488 to get 15,000 Voyage miles. These can be converted to Krisflyer miles at a 1:1 ratio but are technically more valuable than Krisflyer miles as they can also be used to pay for revenue fares at a fixed value per mile.

(4) SQ charges US$40 per 1,000 miles purchased. Price shown here is reflective of current exchange rates. The only way I could justify paying this is if I needed the miles right this minute, as SQ will credit them instantly

In the PRVI Pay article I decided to focus more on just PRVI Pay, but I think it’s good to have a separate article where we walk through the different options for buying miles and the pros and cons of each.

Things to consider when choosing among miles buying options

Not all the options in the table will be available to everyone. Therefore, just because a cheaper way of buying miles exists doesn’t imply you should rule out everything that costs more.

Which methods do I qualify for?

Basic, almost stupid question, but still important.

Unfortunately, you will need to command a pretty high income if you want to take advantage of some of the better miles buying deals. The cheapest deal now (if we ignore the bigass Citibank promo that, unfortunately, isn’t open to everyone) is 1.14 cpm via the SCB VI tax payment facility. If you spend more than $2K in a month on your SCB VI and put your tax bill on the card, you’ll earn 1.4 mpd for an admin fee of 1.6%. That requires you to earn a minimum of $150K a year though.

In fact, if I look at all the options available, the cheapest price you can access with an entry-level income is 1.75 cpm via the tax payment facility on the HSBC Visa Platinum/Revolution cards (HSBC Premier Mastercard has a $30K income requirement and lets you buy miles @ 1.25 cpm, but you need $200K in deposits with the bank to qualify for a Premier account). And even then the miles you can buy is limited by the amount of your tax bill.

A Cardup/iPayMy combination with UOB PRVI is probably your best bet if you need to buy a large quantum of miles and don’t earn in the 6 digits. Fortunately, UOB PRVI just reduced its income requirement from $80K to $50K so this method has become more accessible. Unfortunately, as I pointed out before, using Cardup/iPayMy requires a bona fide business expense like a tuition fee bill, condo management fee, tax bill etc. You can’t just send money to yourself.

You can send money to yourself via the UOB PRVI Pay feature, though. UOB doesn’t give two craps what you’re getting the money for- drugs, booze, humanitarian reasons. You just tell them how much and where to deposit the money, they bill your card for that amount + the 2% admin fee, you earn 1 mpd and everyone is happy. Assuming you’re ok with paying 2 cpm (see below)

What’s the limit I can buy/ how often can I exercise this option?

Another key question, because annual fees can only be paid once a year. Once I’ve paid the $192.60 on my DBS Altitude and got my 10K miles, I can’t do it again for another year (I could get the Visa and AMEX versions and pay the annual fee twice, of course, if I were so inclined).

You’ll also note that I’ve distinguished between “welcome gift” and “annual fee” in the table above. A welcome gift is a one time opportunity to purchase miles, which is subsequently not available. An annual fee can be paid each year. To my knowledge, HSBC VI does not give you renewal miles when you pay Year 2’s annual fee. SCB VI apparently offers 20,000 miles for paying Year 2’s annual fee, but that works out to 2.94 cpm which is too high for my liking. This should give people doubts about holding the card beyond the first year, unless you really dig the benefits.

Where tax payment facilities eg HSBC/SCB are concerned, I can’t simply go to them and say “hey, my tax bill is $500K, gimme.” I have to submit copies of my tax bill and they’ll give me miles based on that actual amount. No Citibank Rewards/AXS prepaying the gahmen’s working capital balance here (shhhh)

The only truly “unlimited” options (well, they’re limited by your credit limit) are

- Buying at 1.9 cpm via UOB RVI’s Pay anything feature (but you need a huge chunk of income to access the UOB RVI…)

- Buying at 2 cpm via UOB PRVI Pay (but is 2 cpm a good price?)

- Buying at 1.86/2.17 cpm via Cardup/iPaymy and UOB PRVI/DBS Altitude (but requires a bona fide bill)

- Buying at 5.51 cpm via SQ (lube up)

Should I be buying miles?

Maybe we should have started with this question.

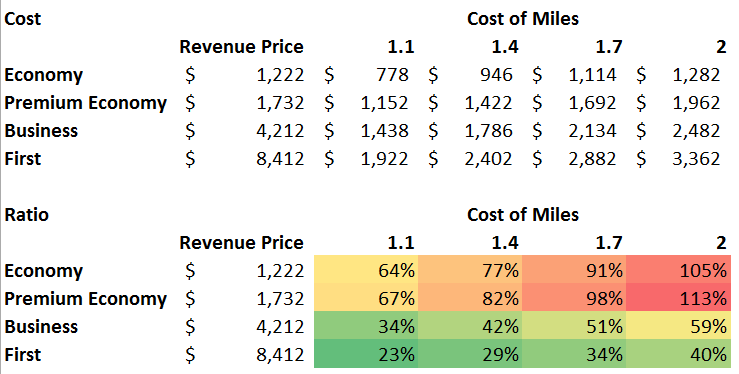

Buying miles can certainly be a much cheaper option of getting business and first class flights. Take Singapore to Sydney, for example. Revenue tickets would cost you

- Economy- $852 to $1,592

- Premium Economy- $1,732

- Business-$4,212

- First-$8,412

If you use miles, on the other hand, you’d pay

- Economy-56,000 miles + $162

- Premium Economy- 90,000 miles + $162

- Business- 116,000 miles + $162

- First- 160,000 miles + $162

So depending on what price you pay for miles, there are potentially some sweet deals to be had. Here’s how buying a ticket compares to buying miles and redeeming, in the example of Sydney.

First and most important observation: this chart shows why it is totally not worth it to redeem miles for economy or premium economy. If you pay 2 cpm and redeem those miles for economy, you’re potentially paying even more than you would have if you bought that ticket outright. You can see that buying miles to redeem on business and first class is so much sweeter, even at the 2 cpm mark.

Second, this chart doesn’t reflect the value of certainty. Award flights may not always be available for immediate confirmation on the dates you need and for the number of seats you need. So, depending on how much you value certainty, you’d need to adjust the miles figures to reflect the cost you incur when you can’t get immediate confirmation. Waitlisting is, shall we say, not fun.

Third, you need to account for the value of miles you’d earn had you bought revenue tickets. This effectively acts as a rebate on the revenue ticket price, and will reduce it ever so slightly.

But, assuming you find yourself in a situation where instantly-confirmable award space is available, it absolutely makes sense to go the buying miles route. You’ll need to factor in the time lag between the time you buy the miles and booking the ticket though, during which the space may vanish (SQ doesn’t do award holds).

Should I be buying miles speculatively?

The previous question assumed that you had a planned use for miles in mind already. If that’s the case, and if the award space exists, you’d be a fool to pay full price rather than buying miles.

But what if you don’t have an upcoming trip planned? What if you’re pretty well-stocked already? This is a more complicated question.

Most of the miles laojiaos will tell you that you absolutely should not buy miles speculatively. And I’d tend to agree with them. Miles are the worst investment to hold. There is no deposit insurance. They do not earn interest. They can only be devalued, sometimes with short or little notice. Miles are only as valuable as airlines’ willingness to accept them. They’re pretty much a fiat currency. Earn and burn etc etc.

I would nuance that by saying you normally shouldn’t buy miles speculatively, but if an excellent opportunity comes around and you’re quite certain you’ll travel in the next 6 months then I wouldn’t feel too bad for loading up.

Case in point: the current insane Citibank Premiermiles visa offer to buy miles at 0.76 cents each is something I don’t think we’ll see again for a long time, so I’d definitely go for that if it were open to me.

I would also say that you should ideally have a healthy miles balance in your frequent flyer account to give yourself flexibility to make plans on the fly- there’s nothing more annoying (or nail biting) than to see award space on your perfect dates, transfer your points over and have a few nerve wracking days of F5-ing the screen waiting for them to appear. What’s healthy? For me that’s around the 100-150K mark, but I know it will be different for everyone (and that there will be those who believe in keeping even smaller amounts on hand).

Conclusion

For better or worse, SQ hasn’t attempted to monetize Krisflyer by selling miles on the cheap, like the US airlines have done. Therefore the best options for buying miles, at least for now, are offered through the banks. I hope this article gives you a better understanding of what’s out there, and what is (and isn’t) worth springing for.

This is a super article. Exactly my problem. Getting enough ways (at a reasonable price) to get enough points for a whole family of four in business class.

And as a result I am so close to deciding on OCBC voyage 500K miles for $10K annual fee.

Seow. Ha

Glad you find it useful! I think the other problem will be finding 4 award seats in business saver…

How about buying SPG points and converting to miles?

Can. But not always on sale. Wanted to show the options that are available year round to Singaporeans. Plus I feel it’s quite easy to earn krisflyer miles in sg but super hard to earn spg. So I feel very xintong to convert spg points to anything else

A good idea, but you can only buy 30K per calendar year. Only good if you’re slowly building up your war chest.

One of the subjective factor in ‘revenue vs award’ worth factor is the total amount of $ spent for tickets. For number of people, including me, there is some absolute number with hard stop. I would not spend $3000 on airline ticket regardless it is for F or Y-. My hard stop on SIN-SFO-SIN roudtrip route is $1900 regardless it comes as full revenue ticket transaction or as an opportunity to buy miles and redeem. If there is an option to buy miles for $2500 to redeem ticket in Business I instead would buy Economy for $1500 because $1000 difference… Read more »

This is a perenial problem I have with seeing how people value miles. Getting 6-8cpm “value” because you can redeem for Business/First and the published rates translate to that value is a rather flawed analysis that makes a big assumption that I would pay that much for Business/First in the first place. Yes I value Business more than Economy, naturally, but I am definitely not paying $4,000+ for a Business roundtrip to Sydney (and Sydney is my hometown). There are also other things to think about, and as someone from Sydney I do pay attention to that route. Good Economy… Read more »

Well said.

My simple point is, if you get “value” of 8cpm and purchase it at 2cpm, that’s saying you are paying $1k for your business return ticket SG – Sydney, which is $300-$400 more than your economy ticket in your example.

Will I pay this amount for an upgrade without miles? Probably yes. So I may buy miles for 2cpm.

To add to your argument, if I was truly indifferent between a $1k business ticket vs a $600 economy ticket, then the “value” i derive from the mile is 2cents, not 8cents, and thus buying it at 2cpm I get 2cents in value.

hear hear. you might like my latest post. 1 cpm is way too low for me though…

It is not the cpm but rather than absolute value in terms of money one is willing to spend for the particular route. So cpm is relative matter depending on route.

Would you, personally spend whatever amount of miles on SIN-BKK route in C on TG/SQ knowing that you can fly round trip for $80 with AirAsia?

Interesting that you bring this up now. Last week I just booked two tickets to BKK. Price was not the only consideration as I hate carrying anything other than the bare minimum onto a plane, plus I refuse to compromise on having an aisle seat. When you add up the LCC ancillary charges, it doesn’t look like such a good deal anymore. Added to that, I need to synchronise the tickets with someone else’s work schedule, so the timing isn’t completely flexible. And finally, I really dislike Don Muang airport, which at times resembles a refugee camp. I would happily… Read more »

1cpm is a hangover from my thoughts a while back, and was driven because at the time I had a way to buy miles at 1cpm 🙂 But when I did the maths, it turned into a number that I thought was appropriate for me when I traveled. Bear in mind I never updated my thoughts on this after the SQ “devluation” which at 1cpm actually worked in my favour except for the following: (1) certain sweet spots like HKG and Philippines because of those countries’ YQ rules, and (2) I need more miles which is tricky to build up… Read more »

Agreed. It is pretty much the same way if I would say ‘I am saving $2000/mo by taking MRT/bus to work’.

This obviously is flawed logic because implies that $2000/mo on taxi/uber is the _only_ option to get to the work. Which obviously is not the case – you can use number of other transportation means.

The same way with airlines – getting from A to B via redemption ticket is not the _only_ way to get there and we all know this.

SCB VI application is not so stringent. Esp when you opt for a lower credit limit.

There’s another type that would not buy miles at whatever price because they view premium cabins as a treat not a necessity. So while they may maximize all miles earning opportunities, cash outlay for miles is just too much for them.

Like me.

Great read and thanks for the analysis!

Couple of points on HSBC VI tax payment – they will not increase your credit limit (even temporarily) if your tax bill is larger than your credit limit – but you can pre pay your card and put it into credit to pay the bill.

On renewal, last year I got nothing after months of complaining, but this year I did actually get some miles for renewal (was told it was a one off)

Nice article !

Since you mentionned the DBS Altitude via Cardup, may be worth to mention that the Citibank PM Visa will work in the same way.

Just for the sake of exhaustivity ?

added!

I think to be comprehensive, you should also include buying Avianca Lifemiles during the promo periods, which would be cheaper than some of the options listed.

but that’s not the same as krisflyer miles. what we’re talking about here is buying krisflyer miles, because i imagine 90%+ of readers will want to redeem SQ. lifemiles can only redeem short/regional SQ premium cabin.

It seems that award space for SQ’s newer products are beginning to appear on the Lifemiles search results. For example, SQ uses the 777-300ER to Haneda, and it is possible to book this on Lifemiles. Are you able to verify this, or have you heard from anyone else regarding this observation? Thanks.

i’ve not checked this route specifically, but there’s always the possibility that (1) this is phantom award space (2) this is a route operated by a 772 that has since been retrofitted with SQ’s new long haul (2006) j product, and therefore is available via lifemiles (772 award space was traditionally open to *A partners as it was sq’s crappy spacebed aircraft)

Hi Aaron, with regards to lifemiles, I noticed that even with the maximum 140% promo, it is still not worthwhile to redeem SQ flights even on short distances. For example SIN-BKK business cost 40k krisflyer miles. It 60k lifemiles. The extra 20k miles would offset the promo. Correct me if I’m wrong.

I think most people would use Lifemiles on long distance, non-SQ metal to make it worthwhile.

Great write up by Aaron for those who are looking at options to redeem miles for Singaporeans. As what Aaron has mentioned, the article mainly serves the purpose of exploring ways to earn miles to be credited into Krisflyer to redeem flights on SQ.

There’s of course more than 1 way of buying miles. However, if you’re talking about using other options such as Lifemiles, the focus should shift towards redeeming miles on other carriers, since SQ generally do not release much award space there except for regional flights.

Great article as usual. But the numbers show the price you pay for loyalty to SQ. For that Sydney flight, to fly business class, direct, by BA is about 600 less. And for those willing to do a stop, MAS is 2.3 vs 4.2 on SQ. Granted that is not comparing apples with apples but for such a huge difference, I would take the opportunity to visit the lounge in KL! So for those willing to fly non-SQ there is a different set of figures for calculation as you would be comparing price paid for miles against a lower actual… Read more »

SQ is under tremendous pressure on profits and many do not foresee an uptick in the medium term unless they wield the knife like qantas or cathay. The lowest hanging fruit is the krisflyer mile and monetization is looming ….

I just noticed that Priv Miles Payment Facility can also offer 12 month instalment with 2% processing fee while enjoying the miles rebate, the EIR is around 3.6% p.a., which is not bad for taking up a 12 mth ‘personal loan’.

One thing which I am unclear, but is there anything to prevent you from using your IRAS Notice of Assessment with multiple banks? Could I sign up with both Standard Chartered AND HSBC? To my knowledge, there is no actual funds flow from these banks to IRAS when you sign up for these facilities? I could very well be missing something obvious here?!?!

nothing to prevent you from doing that. I did that with SCB and HSBC this year

[…] For comparison’s sake, here’s the other ways you could be buying miles […]

[…] The UOB PRVI Payment facility is currently one of the easiest ways to purchase miles legally. […]