Let’s make one thing straight- DCC is, at best, a worthless service. At worst, it is a scam.

DCC, in its purest form, tells you something you could Google or check through a currency app in seconds- how much your foreign transaction costs in your home currency. You’re free to laugh at the rate on offer and reject it.

But in its most insidious, DCC is a cynical way for unscrupulous merchants to earn additional money from customers. This happens when the merchant proactively chooses the DCC option for you, without your consent. And this happens a lot.

If you travel even occasionally and use your card overseas, you will probably have been subject to DCC at some point in time. Even if you don’t use your card at all overseas, you’re still subject to DCC when you use online merchants like AirBnB, which automatically convert foreign transactions into the currency of your credit card.

I had a very frank interview with the Straits Times where I laid out plain what DCC is, why it’s nothing but a money grab by merchants, and what consumers can do to protect themselves. Do I expect DCC to be outlawed because of this? Hardly. But I hope it at least alerts more people so they can take measures to protect themselves from this scam.

“But it’s convenient!”

Believe it or not, DCC marketing materials actually talk about the benefits for merchant customers who use DCC. Never before have I seen such a fine example of doublespeak.

In the Straits Times article I’ve addressed all three points, but to summarize- DCC is often done in an nontransparent method when customers are not given a choice of currency, and with iBanking which lets you view your transactions within days, the immediacy argument doesn’t hold water either.

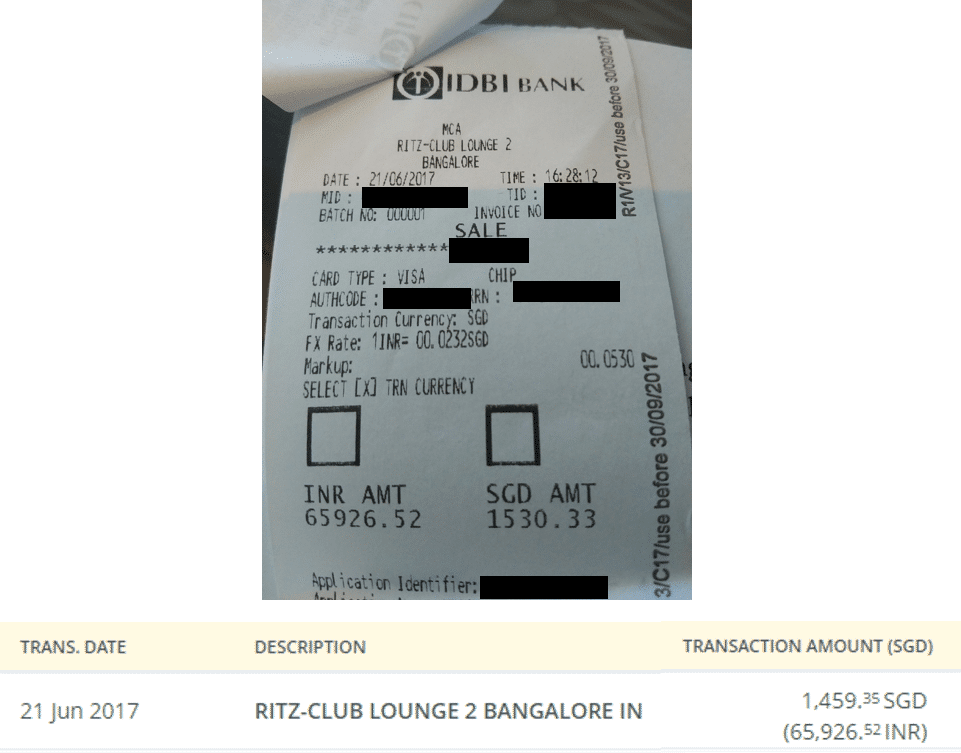

Here’s a perfect example of how DCC doesn’t have any benefits for the customer, at all. I was at the Ritz Carlton Bangalore and swiped my UOB Visa Signature card, which gives 10X (4 mpd) points on overseas spending.

The terminal popped up with the following options

- INR 65,926.52

- SGD 1,530.33

Now, let’s leave aside the fact that INR 65,926.52 was about S$1,420 at spot exchange rates. The DCC option would have meant me paying even more than UOB would have charged me, plus not earning any foreign currency spending bonus.

You see that UOB ended up charging me S$1,459.35, much less than the DCC-ed rate. It’s almost hilarious that such a scam can possibly exist, until you realise it’s very real, and is costing thousand upon thousands of unsuspecting customers money every day.

At least I was given a clear choice that day when paying the bill. There have been many, many, many other times when no currency choice was given to me, normally by unscrupulous merchants looking to profit from the DCC margins.

Here’s a correspondence I had with Avis a couple of years back after they DCC-ed my car rental charges without giving me a choice

We also apologize for the confusion regarding currency conversions. If you use a credit or charge that is issued by a financial institution outside of the United States, the full amount of your charges will be converted to the card account’s billing currency by us unless you submit a written request in advance (prior to the pickup date and time) to have the currency conversion performed by your card issuer, or, specify at the time of pickup (prior to the contract being printed).

Unfortunately, it can not be done after the contract has been printed or at time of returning the vehicle. Our conversion will be based on a conversion rate published by Reuters and will incorporate a processing charge no higher than 4% applied to all amounts relating to this transaction. This charge will replace the currency conversion processing charge applied by your card issuer.

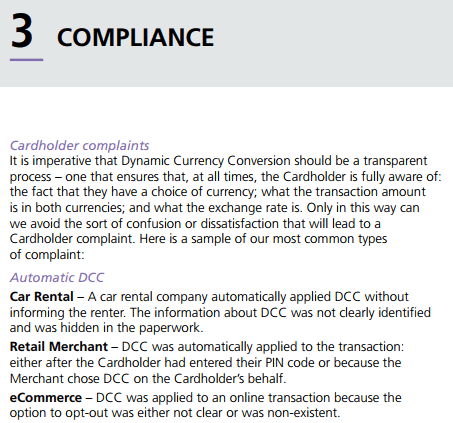

Now, such “back office DCC” behavior is clearly against the compliance rules governing DCC. Mastercard even gives it as an example of a common complaint they receive (check out page 18 here).

But the compliance mechanisms lack bite, and merchants continue to get away with it scot-free (I am happy to know however that there is a class action lawsuit ongoing in the States against companies which do such things (you can read the text of the complaint here))

“DCC Improves Customer Satisfaction” (and you’ll earn a lot of money too)

It’s illuminating to read how different payment solutions providers market DCC to merchants. Here’s a sample-

What do you notice? Marketing materials emphasize the additional money that merchants can earn by “offering” (because it’s more often than not forced upon the customer) DCC. Any illusions that DCC “improves customer satisfaction”, in the words of the marketing materials, are so out of touch with reality it’s bizzaro.

Read this choice excerpt from the First Data marketing materials-

-

According to trade publication The Nilson Report, “More often than not, cardholders can expect as good or even a slightly better FX [foreign exchange] price from DCC than they get from the existing association method. They will certainly get better disclosure of conversion fees.”

-

Detractors who are indignant (and often misinformed) about the exchange rate margin associated with each DCC transaction overlook the charges consumers pay if they had chosen another payment method. These include: using a hotel or airport currency conversion service, or charging purchases to their foreign card and allowing the card issuer to convert the transaction using an undisclosed and often inflated exchange rate. In addition, the card issuer may charge them a conversion fee long after the transaction has occurred. ATM withdrawals with a foreign-issued card are often subject to similar charges, in addition to the standard non-customer ATM fees. In all of these cases, the total charges and fees may likely exceed the standard DCC margin.

-

Millions of satisfied cardholders have made educated, informed decisions to use DCC because they desire the convenience of dealing in a familiar currency, plus the transparency of knowing the exact billing amount at the time of purchase. The continuing increase in consumer adoption of DCC illustrates the popularity of this service among foreign travelers, in spite of naysayers.

Emphasis mine. Well, I guess I must be an indignant and misinformed detractor, as much this litany of consumer rights advocates, travel hacking experts and many average joes who see red because of DCC.

I wonder how they can write these materials with a straight face, and how many First Data company executives opt for DCC when they go on vacation.

What can I do to protect myself?

DCC is here to stay. That’s a sad but unfortunate fact of life, like malaria or herpes or Nickelback.

But that doesn’t mean you can’t protect yourself. Here are some things you can do to guard yourself against DCC:

(1) Use an AMEX when overseas

This is the most surefire way of protecting yourself from DCC. AMEX does not support DCC on its platform the way Visa and Mastercard do.

Here’s a reminder of the overseas charges each bank levies on foreign currency transactions by card type.

[table id=3 /]

You’ll note that AMEX cards generally have slightly higher foreign transaction fees than Visa/MC, but it’s still much better than getting taken advantage of by the DCC rate.

(2) If you get DCC-ed without consent, deface the charge slip

Assuming the merchant is unwilling (or claims they’re unable) to reverse the transaction and conduct it again in local currency, your best course of option is to deface the merchant’s charge slip by writing “DCC declined and merchant did not provide choice” on it and refusing to sign.

This may seem like a petty thing to do, but it’s important if you’re filing a dispute. During the dispute process, the bank will request for a copy of the original charge slip that you signed from the merchant. If it says very clearly “DCC declined and merchant did not provide choice”, that would play a lot better for you than a meekly signed slip.

As a side point- if the merchant gets angry about this, you always have the right to walk away and not complete the purchase (I guess it’s a bit more complicated if it’s a restaurant and you’ve already consumed the food). A merchant who uses DCC by default is certainly one with questionable ethics, and I certainly wouldn’t want to send my business that way.

(3) If you get DCC-ed without consent in a card-not-present situation, dispute the charge immediately

This also applies to (2)- you should raise a dispute immediately with your bank informing them what happened and saying you’ll be doing a chargeback. You can cite them the relevant chargeback codes from either the Visa or Mastercard chargeback guides

- Visa- Reason Code 76: Incorrect Currency or Transaction Code. Reason Code 76 is used when the transaction was processed with an incorrect transaction code, or an incorrect currency code, or one of the following:

- Cardholder was not advised that Dynamic Currency Conversion (DCC) would occur

- Cardholder was refused the choice of paying in the merchant’s local currency

- Mastercard- Reason Code 4846:

- The cardholder states that he or she was not given the opportunity to choose the desired currency in which the transactions was completed or did not agree to the currency of the transaction

Different banks have different policies about this, and I’m not even sure there’s consistency within banks. When I called UOB to dispute one such transaction, the CSO told me that this was a merchant customer dispute and they would not get involved, I had to go to the merchant myself to get it sorted out. However, I know that DBS will do an immediate reversal of the transaction pending investigation. Your mileage will definitely vary.

Conclusion- fighting the DCC scam

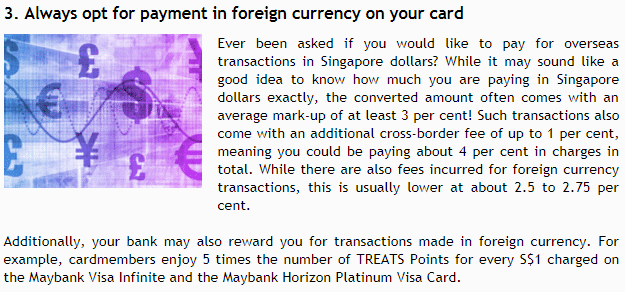

It would be unfair to say that all banks are complicit in this. I must applaud Maybank and OCBC for taking steps to advise customers to avoid DCC like the plague.

This is from a circular published by Maybank

And this from OCBC

But it’s still not enough. We need more consumer education, more empowerment, more transparency.

The Mastercard compliance guide talks a big, noble game (for the record, Mastercard and Visa do not offer DCC, they merely facilitate it on behalf of payment solutions providers) that says all the right things. At the end of the day however, these practices are not being followed. And that’s a problem.

Until DCC is conducted in a manner more befitting the lofty ideals set out in the implementation guide, regulators should step in to monitor the use of this technology and penalize errant merchants.

On a separate note, I do hope that Singapore credit cards move to a chip and pin system soon. Signatures are hardly effective security methods (when was the last time someone verified your signature, and in any case it’s often a subjective call as to whether signatures do match), but more importantly a chip and pin system requires the merchant to turn control over the transaction to you. This includes selecting the transaction currency, and rejecting the transaction if the merchant chooses the currency for you.

Thanks. That was a great article.

Would be great to hear your thoughts on the CCY charges that are imposed by visa or others. 0.8% fee when a SGD transaction is processed outside of Singapore seems like a scam to me as this is not clearly mentioned during the transaction. Expedia.com.sg does this. But who’s to blame? The bank, visa or Expedia?

Thanks Alex. That 0.8% you mention is imposed by the banks on dcc-ed transactions. I would blame Expedia because they are the merchant who is benefitting from the rigged exchange rate they offer. Ultimately it is up to merchants to decide whether they want to earn additional money at the expense of their customers via dcc or not.

Edit: I believe the 0.8% has since changed to 1%. Not sure I fully understand. The CCY charges are on SGD transactions processed overseas, even if the vendor is in Singapore and billing in SGD. So my expedia.com.sg bill would be SGD 100, I would be billed SGD 100 on my statement and visa/citibank would add/charge me SGD 1 for CCY fees, because even if in SGD, the transaction is being processed in the Netherlands. Also, I just checked a few FX transactions I had on my Citi Visa Premiermiles and am getting 3.25% charges on top of xe.com rates… Read more »

some banks are 0.8, some are 1%. i put together a list. yes, the table is not full cost, this is what the banks charge. visa/mastercard will charge their own fees on top of this and there will be some exchange rate differences. you can read the full workings here

in the case of of expedia, they bill you through a payment portal located in the netherlands apparently, and that’s what gives rise to the DCC fee.

I’m not sure you’re referring to the same thing here – the cross-border fee is for payments incurred in SGD (not converted from foreign currency) and processed overseas. Other than Expedia, Uber also does this.

In this case, since there’s no currency conversion going on, I don’t think you can blame the merchant. DBS, at least, pins the blame on Visa/Mastercard – though I suppose you can also blame the merchant for not bothering to set up a local payment processor to handle card transactions.

yeah that’s what i meant by blame. it’s dbs charging it, but it’s expedia who didn’t process the payment locally. ultimately “blame” is subjective here, suffice to say that such fees feel very gratuitous. they’re nowhere as bad as the dcc ripoff we’re dicsussing above though

Take uber in Sg pay via hsbc cards, also DCC

Indeed, if you ask me, the 1% CCY fees imposed by banks is as big a scam as DCC. Every single Uber ride costs 1% more if charged to an HSBC card!

Groupon and Airbnb too!

this phenomena has exacerbated with the rise of e-commerce & cross border processing. what used to be the card scheme rule of “no cross border merchant acquiring” no longer applies with the behemoths such as Uber, AirbnB, Grab now operating globally and driving their own bottom lines.

the fact that we are faced with this surcharge is because although we’re using a SG-issued card consuming a service in SG, that transaction is routed and settled to Uber’s account in Netherlands, and in doing so, constitutes a cross border transaction.

Mr Brown tweeted this article. Famous much?

one step closer to singularity.

Aaron, I fell for the DCC scam when I was overseas last year. The hotel swiped my card and when they gave me the charge slip to sign, they said that they have already converted the amount charged at a “very good rate” to SGD for my convenience. I tried to dispute this on the spot, but they said that the transaction has already went through and made it seem as though I had no other choice but to sign on the charge slip.

Do you think I should call DBS to complain? It has been about a year.

Sorry to say but there is no way dbs will take up a case from a year ago. What hotel was this?

It was a small boutique hotel in Zagreb, not a major hotel chain. I have been a long time reader of your blog since 2015 so it makes me really mad to have fallen for the DCC scam!

I’m sorry that happened to you. But yeah, that’s a common lie merchants will tell you. It is completely possible to reverse. that’s what I did in a hotel restaurant in Abu Dhabi. Made noise, manager came, reversed the sgd transaction and billed me in aed

I had the same issue with the London Marriott Hotel County Hall in May this year (2017). It was an online booking… & I was charged in SGD. When I reached the hotel, I was told “transaction done”.

How do I contest it with Citibank, please?

My guess is may is too long ago, but if you want to try pick up the phone right now and cite the reason codes I mentioned in the St article. Explain that you were not given a choice of currency

As someone mentioned above, expedia charges SGD regardless and involves this DCC. I have no way out of this and have to pay usually – any suggestions other than avoiding expedia?

If it was possible to avoid DCC at AirBnB…

I glanced online and some folks seem to have found a way of circumventing it. Not sure if it still works…

It involve.s setting the country/currency to native. I am not sure whether it still works – the last I used was last year and worked.

Could you write up exact instruction?

I have disconnected with airbnb for quite a while, but if you should google it, you could find the instructions fairly easily.

Although smaller in value, I view the 0.8%/1% Cross Border fee as worse because it is a hidden fee.

You don’t know until it shows in the CC stmt.

I am looking at a rather expensive UA ticket in the vicinity of S$2000. I am not sure if this carries a DCC charge (1%, which would be $20), or should I choose US$ and risk incuring even more charges (at 3.25% on UOB PRVI after conversion)? Thanks for advice

I use my HSBC Advance Credit Card, which offers a 2.5% cash back (for Advance customers) with no minimum spend, to put all transactions that have a no choice DCC impact on it (AirBnB, Uber, Uber Eats, Spotify etc.) . This way I can offset the DCC charges (on a monthly basis), but I may be losing out on points – which I am fine with. Assigning blame can be tough here. As a corporate providing a service (such as Uber etc), they are utilizing DCC to minimize the FX fluctuation and local currency exposure. So I don’t necessarily blame… Read more »

Aaron, this is a bit dated. Any ideas if airlines such as ANA, JAL levy DCC charge for Singapore website purchase? I can’t seem to find anything definitive for my trip to Japan

Sorry but I couldn’t tell you how they process. Ask in telegram group, more sources