The Krisflyer UOB account needs no further introduction for frequent readers of the site (but for those of you who are new here, take a walk down memory lane…).

The account hasn’t changed since it launched- it still offers 0 interest, it still requires you to park a ridiculous amount of money to earn anything more than 1.4 mpd (which you could just as easily earn with a regular miles card), it still caps the bonus miles you earn at a ridiculously low threshold and it’s still shelling out for influencer Instagram ads (which at least are properly tagged with #ad now, with the exception of a certain ferrous female…)

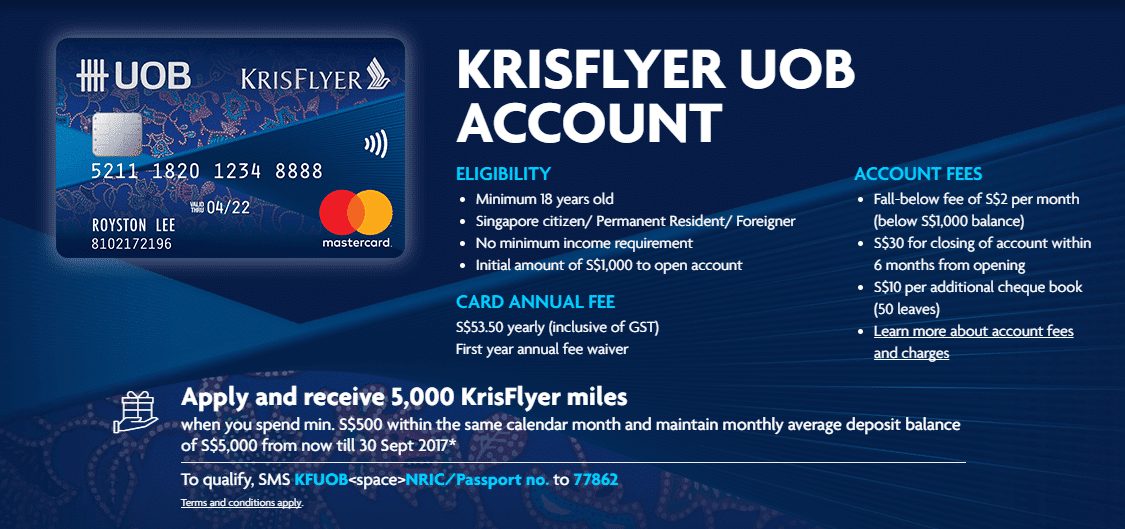

What’s new is that UOB is currently running a sign up offer of 5,000 miles with $500 of spend on the Krisflyer UOB debit card. You need to open an account and maintain a minimum monthly average balance of $5,000.

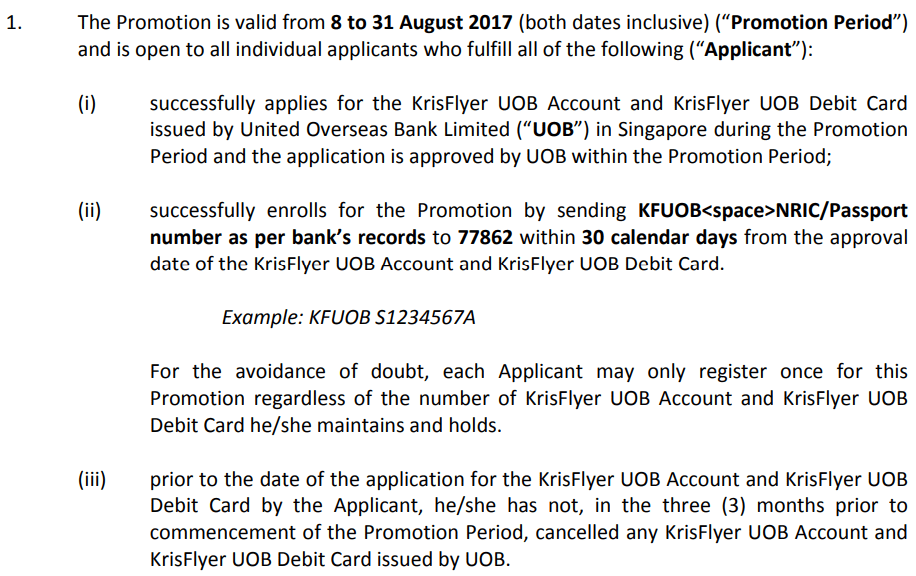

Now, don’t get too excited- this is a UOB-style sign up promotion so as you might expect there’s all sorts of caveats. Here are the main conditions (T&C here):

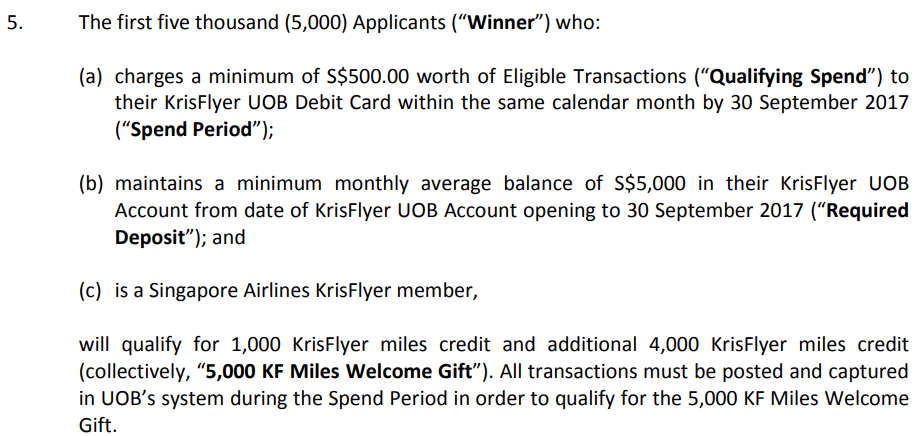

Note that although you have until 31 August to sign up for an account, you need to be among the first 5,000 people to register for the promotion via SMS. The T&C suggest this promotion has been live since 8 August. How many people have registered so far? How many have hit the $500 requirement already? Who knows!

The terms state that if you’re among the first 5,000 to register, keep $5,000 MAB in your account and spend $500 on the debit card by 30 Sept, you get

- 1,000 miles within 3 months of spending the $500

- 4,000 miles within 3 months of 30 Sept

But there’s more. Reading the fine print reveals this additional term-

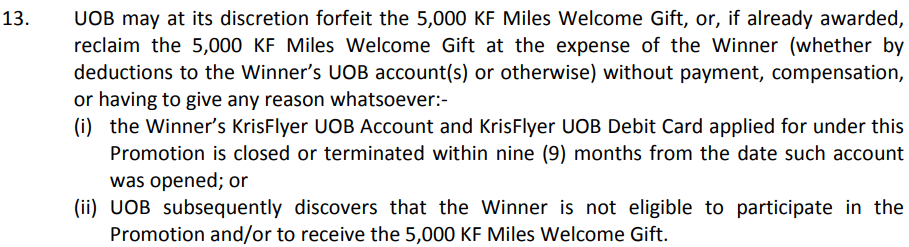

If you close your account within 9 months from the time of opening, UOB reserves the right to claw back the 5,000 miles. There’s nothing stopping you from withdrawing your $5,000 after 30 Sept, but remember that you’ll incur a $2 fall below fee if your MAB is below $1,000 and a $30 fee if you close the account within 6 months.

I value miles at 2 cents each so 5,000 miles is about $100 of value. Is that a decent return for tying up $5,000 for a month and a half (and $1,000 for 7.5 more months, assuming you don’t want to incur $18 worth of fall below fees)? Depends what your alternative is. If that money would have sat in a savings account then you’re not losing much, but that money could obviously be put to much more fruitful purposes. For the record, I’m not a fan of the 3 month timeline given in the T&C either- it seems like a long time for your miles to credit given that one of the professed perks of the account is “faster miles crediting through direct deposit”.

The main problem I have with the promotions that UOB runs is uncertainty. The way they’ve structured this (and other sign up promotions like those for the UOB PRVI Miles card) is that you have no way of knowing ex-ante whether or not the promotion has been exhausted. You have to apply for the account, spend the $500 and pray that you’re still within the first 5,000. If not, the only way you’ll know is when nothing happens. The information asymmetry is not customer-friendly. I understand UOB’s want to cap the liability incurred with each promotion, but surely there’s got to be a better way of doing it than making customers guess in the dark.

Personally I can think of much better and faster ways of earning 5,000 miles, so this one is a pass for me. But if you really need the miles and are willing to bear both the risk (of missing out on the first 5,000 registrations) and the wait (3 months for miles crediting, 9 months for account closure), well…

UOB, how about no.

Hey UOB: 10,000 miles and I’ll bite.

that was really quick hahaha

i aim to please.

Look, the notoriety of UOB for this sort of dangling the carrot (seemingly great promos) while simultaneously whacking you with the stick (pitfalls hidden in the T&C) is well known amongst frequent readers here. But what truly baffles me is why so many of us put up with this terribly business practice of nickel and diming when rewarding their customers. Yes, the UOB Privimiles purportedly gives better mpd comapared to Altitude or PM, but am I the only one pissed off by this business practice? From where I come from, if you want to reward your customers, you reward them.… Read more »

+1, what I’ve been saying a few times here about UOB

I am wondering what can be done though, like a small class action on missing miles?

If at all you have a claim against UOB, that’s only for advertising with details hidden in fine print. And am not convinced we even have a case there as most advertisements carry a * right next to their claims.

One way to tackle it (apart from being smart about spending on their cards) would be to mock it, especially if a competitor does it – by mocking the hidden limits and charges.

Nah it’s technically not missing. Just buried in the fine print.

i can’t trust UOB, too much tricks.

I don’t even bother looking at their promotions even.

Crap deal UOB. Reminds me of their Visa Infinite card, high annual fees with limited benefits.

Hi! Just wondering, assuming i have: 1) 100k lying around in a savings account (with measly interest rates of 0.05%, works out to about $50 a year), which i’m choosing not to invest bcos i want the flexibility of using them at any moment. 2) This makes me eligible for the 3.2mpd earn rate if i deposit in this UOB KF account 3) Assuming i use this UOB KF card for general spend that don’t meet the 4mpd (i.e dining and online) requirement on my specialized cards 4) And i spend approx $500 – $1000 a month, hence i won’t… Read more »