In my opinion, the PAssion POSB Debit Card might actually be the best miles earning debit card on the market right now that can potentially allow those without an income to start earning KrisFlyer miles on everyday spend, with a slight catch.

What do I get with the PAssion POSB debit card?

Now before I continue, there are two variants of this card which you can apply for with POSB. They are:

- PAssion POSB Debit Card

- HomeTeamNS-PAssion- POSB Debit Card

Of the two, the one which you should be looking at is the PAssion POSB Debit Card and not the HomeTeam NS affiliated version as the latter does not have a good points accrual rate.

The POSB PAssion debit card comes with the following benefits:

- 6X TapForMore points for every S$1 spent at participating Dairy Farm Group (DFG) stores – Cold Storage, Market Place, Jasons, Giant and Guardian Health & Beauty Stores. Subject to a minimum spend of S$400 monthly.

- PAssion card membership

- 1-for-1 offers every 10th of the month

- 1% cashback at Takashimaya Departmental Store and Takashimaya B2

- 3% cashback on on-site medical spend at local hospitals, medical and dental clinics if you are a POSB Smiley Child Development account holder

Of all the benefits, what you should be paying attention to is the 6X TapForMore points for purchases made at DFG stores.

What are TapForMore points and what does it have to do with KrisFlyer miles?

TapForMore points are the loyalty currency for the Dairy Farm Group stores which are accrued using a PAssion card. For a normal PAssion card, you will earn 1 TapForMore point per S$1 spent at all participating DFG stores. For every 150 TapForMore points collected, you will be able to offset S$1 from your purchases at DFG stores, which translates to a cash rebate of 0.66%. However, I’m not particularly interested about this particular use of TapForMore points. What I am actually looking at is the ability to convert your TapForMore points to KrisFlyer miles. Aaron has covered this previously a long while back and you can check out his article here.

TapForMore and KrisFlyer announced a partnership back in 2015 allowing each point currency to be converted to the other. In other words, you can convert TapForMore points to KrisFlyer miles and vice versa. KrisFlyer miles can also be converted to TapForMore points at a rate of 1 KrisFlyer miles to 1.1 TapForMore point which is terrible value since we value KrisFlyer miles at 2 cents a piece.

On the other hand, 2.3 TapForMore points can be converted to 1 KrisFlyer mile. Thus, every TapForMore point you earn is equivalent to earning 0.43 KrisFlyer miles.

As mentioned earlier, all purchases made at DFG stores with the PAssion POSB debit card will earn you 6X TapForMore points, which is equivalent to 2.60 KrisFlyer miles per dollar if you spend a minimum of S$400 monthly on the card. This increased earn rate of 6X earn rate is capped at 7,500 points per month which you will hit with an expenditure of S$1,250 worth of groceries and pharmaceutical items. Upon hitting the cap, you will continue to earn TapForMore points at the normal rate of 1 TapForMore point per dollar spent. If you are able to earn 7,500 TapForMore points each month, you will effectively earn 3,260 KrisFlyer miles a month from the PAssion POSB debit card which is a decent amount of miles to earn if you don’t hold a proper miles credit card.

Of course the caveat is that I’m assuming your grocery shopping and healthcare purchases are made exclusively at DFG stores and you are able to hit the minimum spend amount of S$400 monthly, otherwise you will only earn 1 TapForMore point per dollar. Also, by converting your TapForMore points to KrisFlyer miles you will be giving up the option to offset your purchases at the rate of 150 TapForMore points to S$1 which is essentially a 4% rebate if you are obtaining them at the 6X earn rate.

There is an annual transfer cap of 80,000 TapForMore points to your KrisFlyer account per calendar year so even if you accrue the full 7,500 TapForMore points a month at DFG stores in a calendar year which will give you 90,000 TapForMore points, you will only be able to redeem 80,000 of those. This means you can earn up to 34,782 KrisFlyer miles yearly which is almost sufficient for a round trip Saver award Business Class ticket to Bali(35,000 KrisFlyer miles) from Singapore or a round trip Business Class ticket to Bangkok/Jakarta under Spontaneous Escapes rates.

Note that the minimum spend of S$400 can be made anywhere as long as it does not fall under any excluded categories set out by POSB. You can read the full terms and conditions here. (Edit: Thanks Mattheus for pointing that out)

How do you get the PAssion POSB Debit Card?

In order to qualify for the PAssion POSB Debit Card, you must first have a savings account with POSB or DBS. Next, simply apply for the card and voila, you will receive the PAssion POSB Debit Card in your mailbox in a few days.

If you’re currently holding on to a PAssion card membership courtesy of the NS50 celebrations, you can perform the switch over to the POSB PAssion Debit Card at no extra cost if you currently hold another debit/ATM Card from POSB/DBS. Your TapForMore(TFM) points stored in your current PAssion card will also be transferred over to your new POSB PAssion Debit Card.

How do I transfer TFM points to KrisFlyer miles?

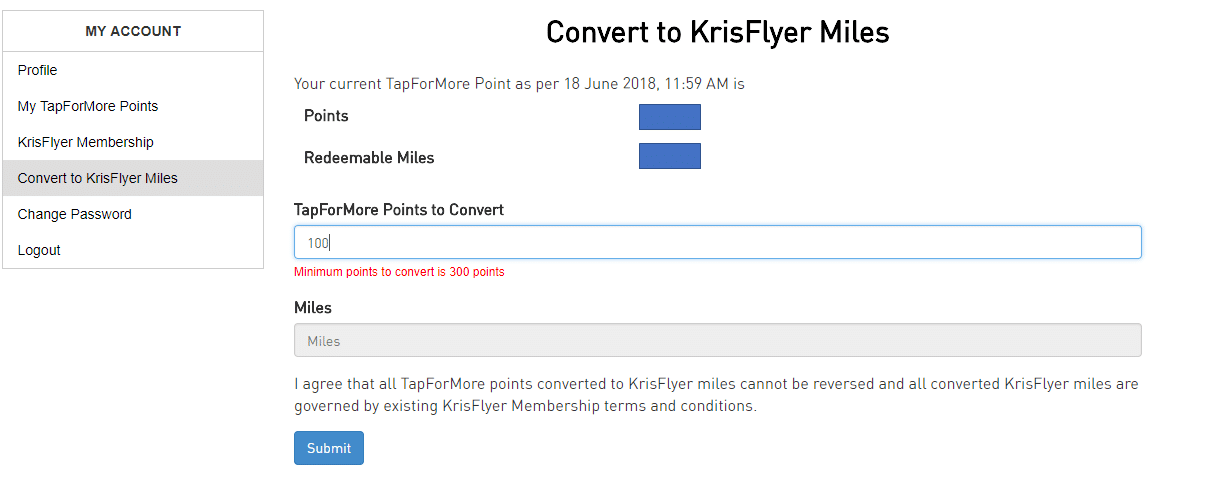

You have to first sign up for a TapForMore account and link it to your KrisFlyer account, which can be done instantaneously. After which, simply click on “Convert to KrisFlyer miles” and you will see the amount of TapForMore points available for redemption as well as the equivalent amount you have in KrisFlyer miles. For every conversion, a minimum of 300 TapForMore points is required.

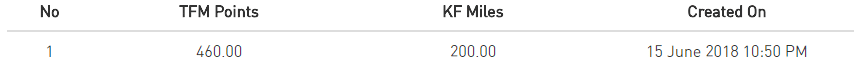

The points conversion is instant and your converted miles will reflect in your KrisFlyer account within a minute. I performed a transfer on 15 June 2018 and the miles appeared in my account instantly.

Stack this with Beep Beep Ka-ching to earn both cashback and miles

DBS/POSB is running the Beep Beep Ka-ching promotion from now until 30 September where you will get up to 10% cashback on all retail purchases if you do not withdraw any physical cash from your bank account via an ATM. This is of course subjected to a minimum spend of S$400 each month via contactless payments on an eligible debit card and the cashback is capped at S$50 a month. The PAssion POSB debit card is one of the eligible cards for this promotion.

What’s great about this promotion is that it ties in nicely with the minimum spend amount required to unlock the 6X TapForMore points at DFG stores. So if you’re able to hit S$400 a month from now until September 2018 on your POSB PAssion debit card, you are able to earn both cashback and miles which is an excellent deal in my opinion.

If you are disciplined enough to not withdraw any cash, you’re looking at a maximum return of S$50 cashback and 3,000 TapForMore points which is equivalent to 1,304 KrisFlyer miles when you spend exactly S$500 at DFG stores a month.

Concluding Thoughts

Of course, if you are in the market to earn miles your best bet to redeeming a coveted Business Class ticket would still be a proper miles and points earning credit card. If you’re unable to apply for a credit card and shop frequently at DFG stores, consider using the PAssion POSB debit card to kickstart your miles earning journey. With the current Beep Beep Ka-ching promotion, this is definitely a good time to be spending with your PAssion POSB debit card and to start accruing your first KrisFlyer mile if you haven’t already started chasing miles.

If I use the passion card to collect Tap For More Point but pay using Citi rewards via Apple Pay, do you think we will still get 6x TPM point plus 8mpd? Assuming spending S$400 per month.

Last time when I apply the passion card, I asked the officer and she said that’s workable. But I have yet to verify that cos I don’t know how to check TFM points.

Hello YY, yes you can. But just remember to clock a minimum of S$400 on the PAssion POSB Mastercard else you won’t earn 6X TFM.

And also, you can check your points over on the TapForMore website. Just enter the CAN number of your PAssion card.

Wouldn’t you only get the 6x TFM points if you use the card to pay? If you use Apple Pay & Citi, you’ll only get the usual 1x TFM points

That’s what I am asking… will I get both 6x TFM point and Citi rewards mile.

When I check out at Cold Storage counter, first they will ask if I have passion card, then I tap it. After scanning all the product, I will use Citi rewards to pay by Apple Pay.

In this case, logically I will get 6x TFM points with Min spending of $400 plus the 8mpd by Citibank

Yup that sounds about right. As long as you hit the 400 on the PAssion POSB you will get 6x TFM as per T&C.

Even if your payment at Cold Storage was via Citi Apple Pay. Also, there’s no breakdown on the TFM website afaik.

No that is not right. You MUST charge the spend at DFG Stores to the Debit Card to get the 6x TFM points. It’s stated clearly on the T&Cs if you bother to go read it… https://www.posb.com.sg/iwov-resources/pdf/cards/tapformore_tnc.pdf “3. Programme allows Eligible Cardmembers to earn additional 5X TapForMore points (“5X TFM”) for every S$1 of DFG Spend (defined below) when a minimum of S$400 Mastercard retail purchases is charged to the PAssion POSB Debit Card (“Eligible Card”) in the same calendar month (“Qualifying Spend”). A cardmember who is 65 years and above is not subject to the minimum spend. 4. DFG… Read more »

Ah missed out that portion. Thanks for pointing it out.

I don’t think Anoymous is correct. The S$400 charged to the card is referred to as Qualifying Spend, which is defined in 5: ” Qualifying Spend is calculated based on local and foreign nett Mastercard retail transactions charged to the Eligible Card in a calendar month and posted to the Eligible Card at the point of computation of the 5X TFM. It excludes NETS purchases, EZ-Link transactions, interest, finance charges, AXS and SAM transactions, bill payment, cash withdrawals, balance transfer, smart cash, fund transfer transactions, any top-ups or payments of funds to any payment service providers, prepaid cards and any… Read more »

I read both parts again and I think you’re right Mattheus. The S$400 spend can be spent anywhere just that the additional 5X TFM is awarded for DFG spend.

Will reamend again. Thanks so much!

Hmm, Anonymous and Mattheus aren’t conflicting. Anonymous is explaining what DFG Spend is, and Mattheus is explaining what Qualifying Spend is. Both are correct. What are incorrect are Matthew’s first two replies to YY, which confusingly differ from what he wrote (amended?) in the article. The current version of the article tallies with what Anonymous and Mattheus have said, and also tallies with my understanding. However, Matthew’s first two replies imply that you can earn 6X TFM points regardless of payment method as long as you charge $400 to the card in the relevant period. That is incorrect and that… Read more »

So to summarise (hopefully I understood everything correctly): You can’t earn both 6X TFM and 8 mpd at the same time, because the DFG spend for 6X TFM points has to be charged to the PAssion POSB Debit Card itself, while the 8 mpd has to be charged to the Citibank card through Apple Pay. You can only do one or the other. If you have the 8 mpd Citibank promotion you should be using that everywhere you can instead of the 6X TFM since it is strictly better. If you don’t have the 8 mpd Citibank promotion then the… Read more »

Almost correct. Some clarifications (based on my understanding): – DFG Spend means the amounts spent at DFG merchants AND charged to the PAssion POSB card. Saying “DFG Spend charged to the PAssion POSB Card” is kinda like saying “ORD Day”. LOL! – In other words, a dollar spent at DFG merchants is not always DFG Spend (ie when it is paid for by any means other than the PAssion POSB Card, such as when paying with a Citibank card on Apple Pay). – Only DFG Spend will earn 6X (aka Anomymous’s point; but even then, it’s not always, see below).… Read more »

didn’t check the post few days, then suddenly so many replies… how come i didn’t get any notification? hmm… anyway… thank you for the input, i understand it.

Just 1 point to note, cannot get TFM points when buying voucher at DFG, only retail purchases.

Cheers

I will try to check the TFM website, see if they show me the breakdown.

Just transferred my Tap For More Points to KF, and the miles appeared in KF account almost immediately.. very impressed..