I got an interesting question from a reader in Malaysia asking me if I could write something on the miles game across the causeway. My first instinct was to say no, because I don’t think I have anywhere near the level of expertise required. Besides, if you needed advice on where to put your spending, why not ask the nice Malaysian lady who spent US$6M on her credit cards? She might know a thing or two.

But after thinking about it a bit more, I thought it might be fun to do a comparison between miles cards in Singapore and Malaysia. We in Singapore may lament that our cards aren’t anywhere as good as those in the US, but how about compared to regional benchmarks? Should we just be counting our blessings?

Putting the data together

With that goal in mind, I went to compile a list of Malaysian miles and points cards. Fair warning: this was based on what I could find on sites like CompareHero and Ringgit Plus, and I could very well have missed out on other, better cards that exist.

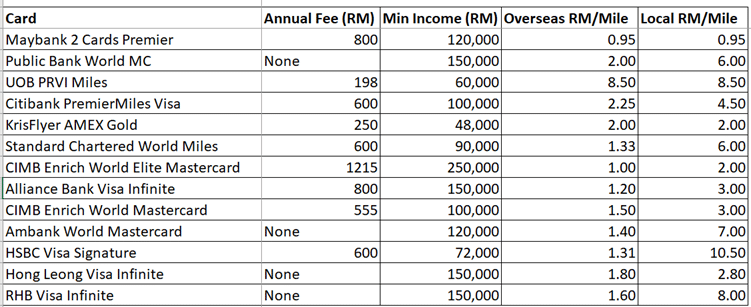

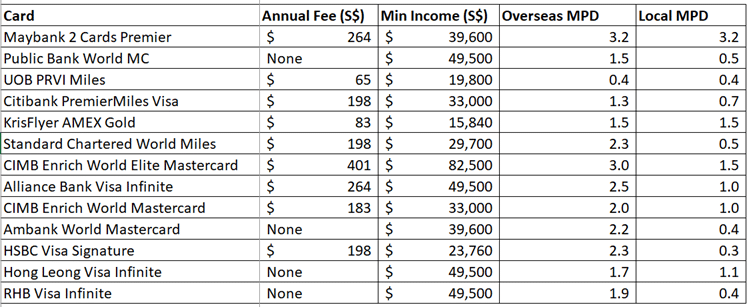

Ulike the Singapore miles game, where marketing materials quote earning rates in terms of miles per dollar, banks in Malaysia advertise RM per mile. In other words, how much do I need to spend to earn one mile?

Now for the benefit of Singapore readers, I’m going to present this information in a form we find more familiar. The table below shows annual fees and minimum income in SGD, and earning rates in mpd equivalent (converted at a rate of 0.33 SGD= 1 RM).

Before the economists jump on me, I’m going to point out that there’s something inherently wrong with doing a comparison based on a simple currency conversion. The cost of living in Malaysia is lower than Singapore, which means that someone earning S$X in Malaysia would be leading a better life than someone earning S$X in Singapore.

Therefore, a card with an equivalent annual income requirement of, say, S$80,000, may not sound like a big deal in the Singapore context where our premium cards start at S$120,000. However, that card would be a premium one in the context of Malaysia. So the differences in purchasing power mean it’s probably not fair to do direct comparisons of income requirements or card annual fees.

What about earning rates? Is it fair to compare those? Yes and no. It’s fair in the sense that airlines don’t discriminate when it comes to paying redemption prices, so a KrisFlyer member based in Malaysia would pay the same redemption prices as a KrisFlyer member based in Singapore. But it’s not fair in the sense that the average Malaysian cardholder won’t be spending as much as his Singaporean counterpart, so higher earn rates may be offset by lower overall spending.

Don’t overanalyze this, is what I’m saying.

He said as he proceeded to totally overanalyze it.

How do Singapore and Malaysia miles cards stack up?

I spent quite a few hours pulling together the data for this post, so I thought I’d share what jumped out at me as I explored the Malaysian miles game.

Local earning rates are mediocre, but overseas earning bonuses are decent

Malaysian miles cards seem to really want to encourage overseas spending. Local mpd equivalents are bad, compared to Singapore, with just a handful of cards above the 1.0 mark. Overseas mpds are relatively more generous, with most banks applying an average of a 3X multiplier over local mpd rates (in Singapore the ratio is about 1.9X).

In terms of out and out miles earning power, special mention should go to the Maybank 2 Cards Premier account, which sounds like a mouthful but packs a punch. Cardholders who use the AMEX earn the equivalent of 3.2 mpd on both local and overseas spending, without any cap.

That’s head and shoulders above what we can get in Singapore (well, BOC Elite Miles card notwithstanding).

The Malaysia miles game isn’t really accessible at the entry level

The minimum annual income you need to get a credit card in Malaysia is RM24,000. But none of the miles cards I found in my searching were anywhere near that level. It’s true that my data set is probably biased towards high end cards (see the abundance of Visa Infinites and World Mastercards), but that’s because I didn’t find the earning rates for the lower end cards worth writing about.

The card in my dataset with the lowest income requirement is the cobrand KrisFlyer AMEX Gold, and even that requires an income of RM48,000 a year, twice the minimum.

In a way, this reminds me of the situation in Singapore a few years ago. When I first started writing The Milelion back in 2015, the big three general spending cards (UOB PRVI Miles, Citi PremierMiles and DBS Altitude) all required annual incomes of S$50-80K to qualify. This led to many fresh grads, who earned maybe S$36K a year, having to start with cashback cards and sticking to them out of sheer habit even when their incomes rose.

Over time, however, the income requirements dropped and now all three are available at the $30K mark, the minimum required by MAS to issue a credit card. This has made the miles game a lot more accessible, and one wonders if Malaysia will head in that direction soon.

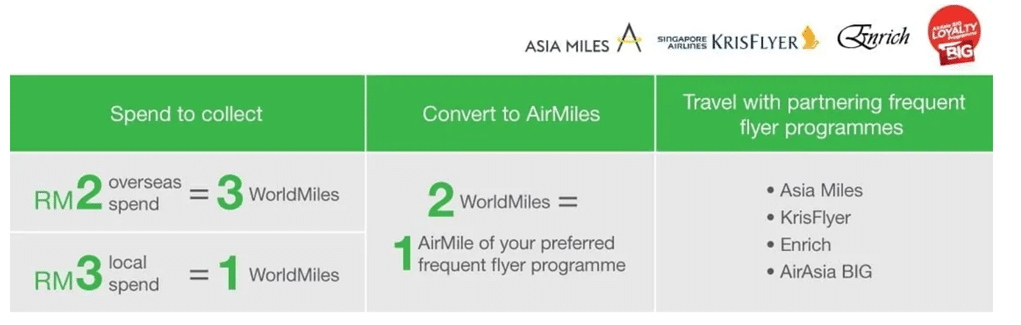

Like Singapore, airline transfer options are limited

I’ve said it before and I’ll say it again- people in Singapore don’t nearly explore Alternative Frequent Flyer programs enough. And who can blame them? Unless you bank with Citibank or American Express, you’re limited to just Asia Miles and KrisFlyer for point transfers. That doesn’t encourage exploration.

It’s much the same story in Malaysia, where the standard approach is to partner with Enrich, KrisFlyer and Air Asia, with selected banks having Asia Miles too. Citibank has a much wider selection, as they do in most countries, but apart from that you’re constrained to these programs.

Given Enrich’s awful 2017 devaluation, which made the FFP virtually a cashback program, I’d be surprised if many Malaysian miles hackers are still transferring to Enrich. In general, Asia Miles and KrisFlyer offer way superior redemption value over Enrich. Heck, you could redeem Asia Miles for MAS flights and still use far fewer miles.

It’s really hard to compare miles cards in Malaysia

One of the most confusing things about the Malaysia miles game is that the same bank tends to have different earning and burning rates for points, depending on the card type.

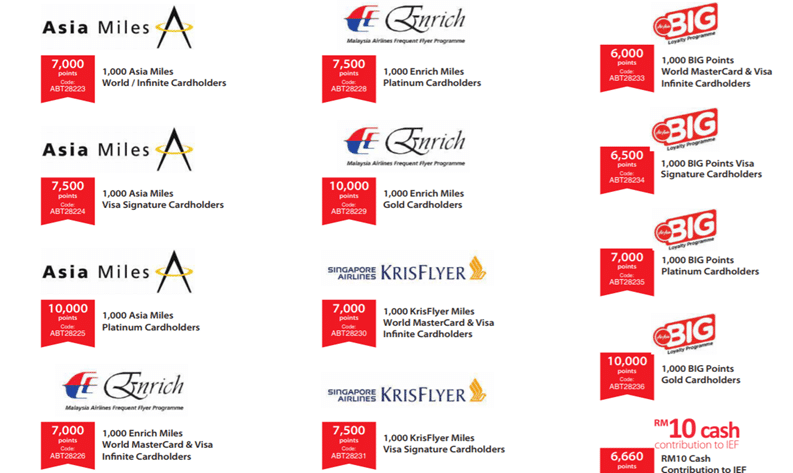

This leads to really head-scratching redemption catalogs, like this one from AmBank:

As you can see, the number of AmBank rewards points you need to redeem 1,000 Enrich miles differs depending on what type of card you hold. It’s 7,000 points if you hold the World MasterCard or Visa Infinite, 75,00 for Platinum and 10,000 for Gold.

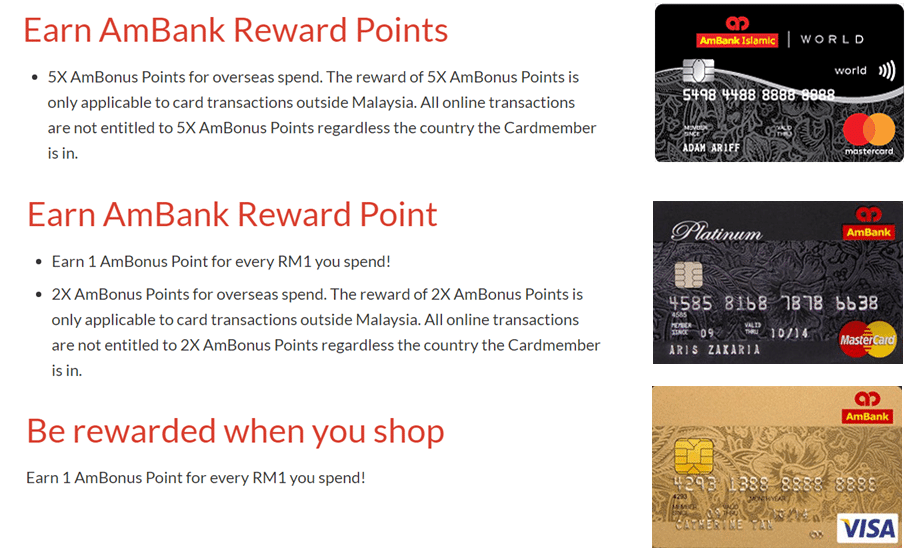

But remember, AmBank cards also earn points at different rates, depending on which one you have:

So that’s an additional layer of complexity to consider- not only do better cards earn points faster, those points transfer to miles at better rates.

This makes me thankful that the equation in Singapore is fairly straightforward- higher tier cards may earn miles at a quicker rate, but the conversion is standard*. For example, DBS Altitude cardholders earn 3 DBS Points per S$5, while DBS Insignia cardholders earn 4 DBS points per S$5, but both cards transfer to KrisFlyer at the same rate of 1 DBS Point = 2 miles.

*it’s true that Standard Chartered has differential earn and burn rates for the Visa Infinite (2,500 pts= 1,000 miles) versus the Rewards+ card (3,500 pts= 1,015 miles), but that’s the exception rather than the rule

Thought that was confusing? It gets better. Not all Malaysian banks practice airline parity:

Airline parity basically means that 1 point converts into the same number of miles, regardless of frequent flyer program you choose. We take that for granted in Singapore, where 1 DBS Point gets you 2 miles, be it with KrisFlyer or Asia Miles and 1 Citi Mile gets you 1 mile with any of Citibank’s 12 transfer partners*.

*Banks which offer transfers to Air Asia BIG points do use a different rate from KrisFlyer/Asia Miles, but that’s because the Air Asia, a budget carrier, operates a fundamentally different loyalty program from full service airlines

But with some banks in Malaysia, your points redeem a different number of miles, depending on the airline program.

With RHB, it takes anywhere from 3-5.5K rewards points to redeem 500 Enrich Miles, and 6K rewards points to redeem 500 KrisFlyer miles. With HSBC, it’s 10.5K points for 1,000 Enrich miles, 15K points for 1,100 Asia Miles and 15,000 points for 1,000 KrisFlyer miles.

Imagine trying to compare two miles cards in this situation. See how this gets real confusing, real fast?

Malaysia cards are more generous with the lounge access

Perhaps this is a byproduct of miles cards being positioned several levels above the entry tier in Malaysia, but the lounge benefits on Malaysia cards did seem more generous than their Singapore equivalents.

In Singapore, most miles cards give you maybe 2-4 free lounge visits at best. In Malaysia, it seems par the course for most cards to offer either unlimited or at least 5 free lounge visits each year. For example, the Citibank PremierMiles Visa gives cardholders unlimited access to Plaza Premium Lounges in Malaysia.

Ditto the Standard Chartered WorldMiles World Mastercard. The HSBC Visa Signature card offers 6 free lounge visits each year to selected lounges in KUL, SIN and HKG. Keep in mind, these aren’t even super high-end Visa Infinite or World Elite MasterCards. These are cards at the Signature/World level, which is what the DBS Altitude/Citibank PremierMiles are in Singapore.

I like how generous the limo policies are on Malaysia cards too. All you need to do to unlock a free ride back from the airport with the Citibank PremierMiles card, for example, is spend three times on your card overseas.

Annual fees, where charged, are equivalent for both sides…but Malaysia has more free cards

When you look at miles card annual fees as a % of the minimum required income, you get a figure of about 0.6% for both Singapore and Malaysia. The difference? Malaysia has quite a few miles cards that don’t charge any annual fee, and surprise surprise, some of these are high end Visa Infinite cards.

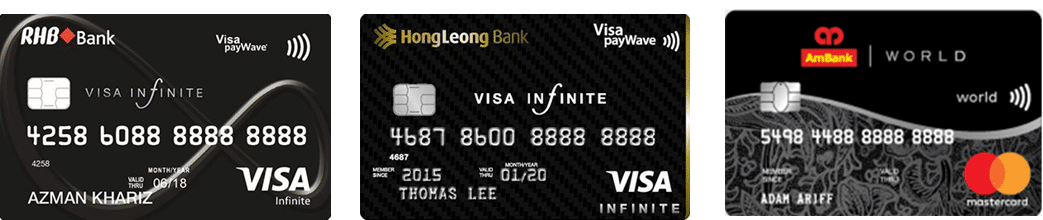

For example, neither the RHB Visa Infinite nor the Hong Leong Visa Infinite charge any annual fee yet come with perks like unlimited lounge access (RHB Visa Infinite), complimentary travel insurance and other standard Visa Infinite benefits.

Come to think of it, I don’t think it’s any coincidence that the only fee-free Visa Infinite card in the Singapore market is offered by CIMB, a Malaysian bank. This is something the Singapore banks could certainly learn from. Although banks here tend to be generous with annual fee waivers for cards at the $30,000 level, it’s relatively unheard of to get annual fee waivers for higher end cards.

Conclusion- who has it better?

I think if you look at sheer earning power, I’d give Singapore miles cards the edge. There are noticeable exceptions (e.g. the Maybank 2 Card Premier account), but by and large the general spending rates on Singapore cards are better than their Malaysian counterparts. I’ve not looked at the case of specialized spending, and it is possible that Malaysia has superior alternatives to our 4 mpd cards (do chime in if you know!).

I dislike how complicated it is to compare miles cards in Malaysia, but they have way better travel perks (although you could argue that since they’re positioned more at upper income earners you’d expect them to). There are also more high-end miles cards available with no annual fee, and I have to say I like the idea of a no-fee card with unlimited lounge access.

Does anyone know any other great Malaysia miles cards, or any perks I’ve missed out?

i wonder if a foreigner can apply a local Malaysia Credit Card? I truly attracted to the unlimited lounge access to KL lounge as i travel to KL on monthly basis.

Haha i’m sorry I have no idea about that…the extent of my research was what I could find online. maybe someone from across the causeway can chime in?

I believe in most cases you’ll have to hold a valid Malaysia work pass. Or maybe park some cash in the bank

Hi Aaron, I am Malaysian holding HSBC Malaysia credit card. For the assessment of annual income I am earning in Singapore let’s say $40k annual but when it comes to their assessment they do not recognize my annual income as RM120k. Not sure how other Malaysian banking work but HSBC does this way.

Same for Citibank, no such thing as 3x currency conversion. But AmBank and Maybank did recognise.

+1 for Citibank. I tried applying for Citi PremierMiles (RM100k annual income req.) but the agent informed me that they require monthly salary of S$4000 and above to qualify if working in Singapore. This converts to about RM145k annual income. The CSO told me that monthly salary requirement for Citi PremierMiles and Citi Rewards World MC is S$4000 while Citi Rewards Visa Signature is S$3000.

Did u apply recently? I applied back in April, and they told me Citi PM needs S$100k to qualify and S$60k for Citi Rewards. Meanwhile I can easily get the AmBank Visa Infinite. But then again, Citi gives more perks so..

I applied in June, strange that they gave you an annual income requirement instead of a monthly salary requirement like me, maybe their CSO are not too sure about the SGD requirements either. S$100k for Citi PM is pretty much overkill imo, but I agree that Citi perks are really good for a mile chaser.

UPDATE: I managed to get both Citi PM and HSBC Visa Signature at their roadshow! They didn’t ask for ridiculous annual income, maybe you can try out both. Free 6x lounge in SG,HK,MY and unlimited at KLIA, worth a shot 😀

wont waste time on Malaysian cc. banks change the conversion rates as and when they please without notice. devalautions galore is what I hear.

Maybank 2 cards premier is the only way to go for malaysia. The rest of the cards are utter crap….. Have been comparing earning rates from many banks of the last few years and none of them are really competitive or even try to be.

@Aaron Wong how about comparing the AMEX Platinum Charge Card for Singapore and Malaysia. The annual income requirement for the Malaysia version seems to be much lower than the Singapore equivalent.

haha that’s a nice thought but maybe one for the future. it’s back to SG cards for now…

Just some friendly feedback from a regular reader – the ads within the content itself (rather than along the side) are becoming quite distracting 🙂 but still, absolutely great content

thanks! in-content ads are undoubtedly more disruptive than ads along the side, but they’re what help to keep the site going. hopefully the quality of the content can make up for it. i think (but correct me if I’m wrong) you dont get more than 3 in-content ads for a 700-800 word article. this one is almost 2k so you’re going to see more

Would appreciate an updated post if you can, please and thanks alot!

need an updated post in 2024, as mbb 2 premiere benefit has been nerfed, also many malaysian/singaporean are relocating to msia now haha 😛

Aaron would you mind doing a refresher on this as article please since the last article was in 2018 ?