Since July 2017, UOB has been offering PRVI Miles cardholders a service called PRVI Pay. This allows cardholders to generate as many points as they want (subject to their credit limit, of course), which can be converted into KrisFlyer or Asia Miles. The effective cost per mile is 2 cents each.

Of course, it’s possible to buy miles at much lower rates than 2 cents in Singapore, but PRVI Pay has two key advantages:

- Unlike buying miles through annual fees or tax payment facilities, PRVI Pay has no annual purchase quantity limit

- There’s no need to submit any sort of documentation to UOB when applying for PRVI Pay. UOB doesn’t care if you’re paying a tax bill, a renovation invoice or a hostage ransom- so long as it’s within your credit limit

UOB increases the cost of PRVI Pay miles to 2.1 cents each

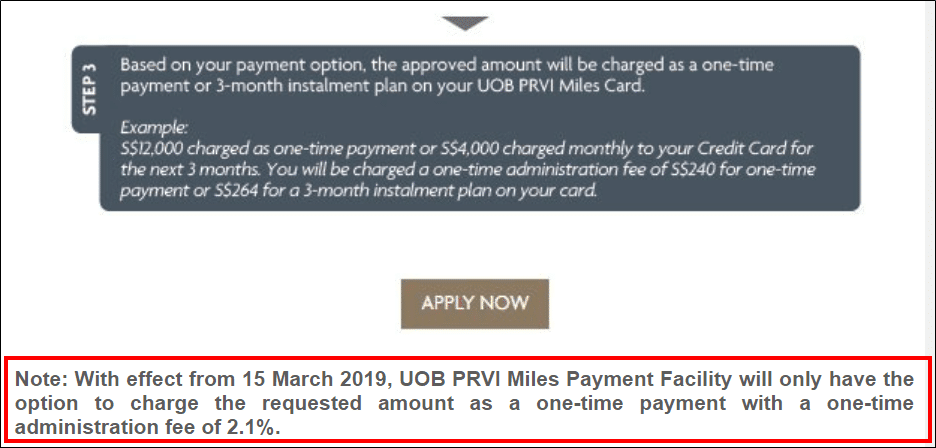

PRVI Pay has been around for about 18 months now, and it seems that UOB is adjusting the price of the facility. The PRVI Pay landing page has been update as follows:

From 15 March 2019, PRVI Pay will charge an admin fee of 2.1% instead of 2.0%. PRVI Pay awards 1 mile per dollar, so this overall increases the cost of buying miles from 2 cents to 2.1 cents each.

Is PRVI Pay still worth using at 2.1 cents each? Well…

[table id=4 /]

I’ll refer you back to what I said previously: if you’ve exhausted your other, cheaper avenues for buying miles, then this is your fallback option. When it comes to paying bona fide rental or other sorts of expenses, however, my first option would still be Citi’s newly-expanded PayAll service. Although Citi PayAll charges a 2% admin fee, you earn miles at the base rate of your card, meaning a cardholder with the Citi PremierMiles Visa would be paying 2/1.2= 1.67 cents per mile.

Other points to note

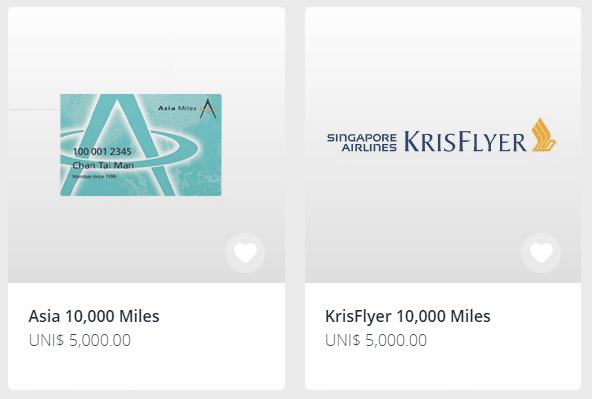

When you use PRVI Pay, you’re buying points in the form of UNI$, not miles per se. Why does that matter, when UNI$ can be converted to miles anyway?

It matters because UNI$ can be converted into miles only in blocks of UNI$5,000 (10,000 miles). Therefore, it’s only feasible to use PRVI Pay as a top-up mechanism if your existing UNI$ balance is approaching a full block. Otherwise, you may need to purchase more than you actually need.

UOB has also removed the installment option for PRVI Pay, but that isn’t a big loss anyway since back in May 2018 UOB increased the fee for installments from 2.0% to 2.2%.

Conclusion

In addition to PRVI Pay, UOB also offers a simliar payment facility for Visa Infinite cardholders. The admin fee for this service is 1.9%, and given the PRVI Pay’s increase I do wonder if this will be similarly affected.

| Update 18/2: UOB has indeed increased the admin fee for the Visa Infinite Payment Facility from 1.9% to 2% and removed the installment option |

PRVI Pay’s relatively high price means it should not be your first port of call when you need miles. Be sure to review your other options carefully before using it.

HI Aaron,

Able to add calculations for IPAYMY on citi rewards?

Thank you.

Cheers!