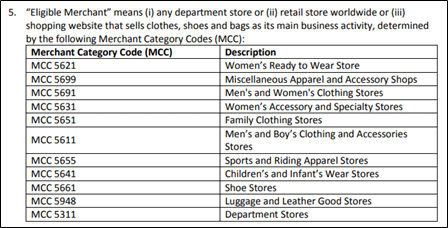

The Citi Rewards card has always been a bit of a strange one for me. On paper (and in the T&Cs), it purports to offer 10X points (4 mpd) online and offline at “department stores, or stores which sell bags, shoes and clothes as their main business activity”.

And yet, it’s probably the worst kept secret that the Citi Rewards card also gives 10X points on all sorts of things that aren’t bags, shoes and clothes. People have long reported earning 10X on Grab rides and top ups, Points.com transactions and the Comfort Taxi app for example. Is this accident or design? Who knows.

So in that sense, Citi’s enhancement (and it really is an enhancement) of the Citi Rewards card is welcome, but not that surprising.

Earn 10X rewards for all online spending, except travel and mobile wallet transactions

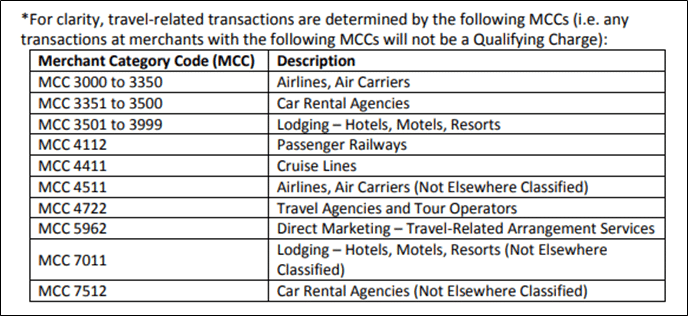

From today onwards, the Citi Rewards card will offer 10X points on all online spending, with the exception of mobile wallet transactions and the following travel related expenditures:

This change puts it more in line with the DBS Woman’s World MasterCard (WWMC), with two key exceptions:

- The DBS WWMC has a 10X cap of $2,000 spending per month, versus $1,000 for the Citi Rewards

- The DBS WWMC offers 10X on travel transactions, so long as they are processed online

In that sense, the DBS WWMC remains a superior card for online spending. However, it also has an income requirement of $80K per annum, so if you don’t meet that threshold than the Citi Rewards card ($30K per annum) is a good substitute.

The other implication of this change is that you’ll no longer be able to use the Citi Rewards card to earn 10X points on GrabPay top ups. It seems that banks are really starting to crack down on GrabPay (case in point: BOC), although the silver lining is that Grab Rides and GrabFood transactions have a different MCC from GrabPay, so you should continue to earn 10X via the Citi Rewards card going forward.

The same change will apply to the Citi Rewards Mastercard, so if you hold both cards you’ll be able to enjoy 10X on online spending for up to $2,000 in total each month.

The revised T&C can be viewed here.

Conclusion

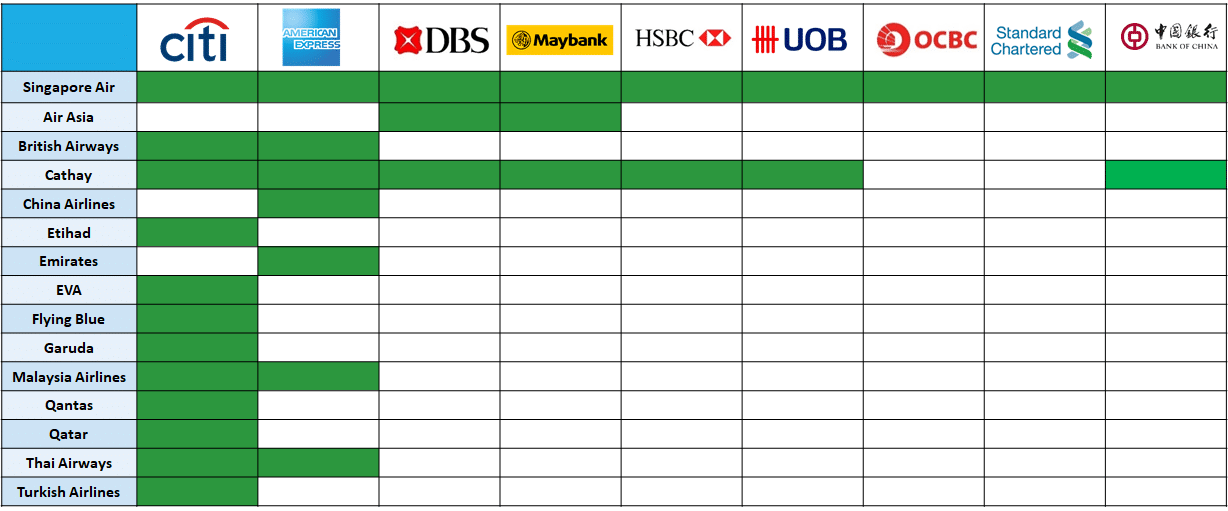

This is a welcome move by Citibank, not least because Citi ThankYou points are one of the most valuable points currencies to have in Singapore. With the most transfer partners of any bank in Singapore, you can access both the usual Asia Miles/KrisFlyer as well as more “exotic” programs like Turkish and British Airways.

You’re going to want to note that Citi points do not pool, however. If you have a Citi Prestige and Citi Rewards card, for example, you’ll need to pay two separate transfer fees when converting points to miles.

A reminder that if you’re looking to sign up for a Citi Rewards card, you can do so via the SingSaver #whatsnext campaign, and get up to $200 in Grab/Taka/NTUC vouchers (existing customers get $60).

(HT: The Shutterwhale)

So insurance, utilities, telecom will now earn 10x?

Looked at T/C. Did not find any notion of ‘dramatically expanding’ categories. On second page, section 6 lists the same number of exclusions as it was before.

Am I missing anything?

I have 2 transactions for online insurance payment which did not get 10x points. Anyone with the same experience?

It’s under the exclusion [from tnc no. 6 (vi)]

where they say in tnc grab top up excluded ? from MCC grab top up ?

“The Citi Rewards card will offer 10X points on all online spending, with the exception of mobile wallet transactions and the following travel related expenditures:”

The table does not show any exclusion to mobile wallet

Cardup, will it earn 10x with citi rewards now?

Oh noo… What card to use to top up grabpay now? One by one removed 4mpd on grabpay.

Also does it mean offline cloth is not eligible anymore?

a Qualifying Charge made at any department store, or retail store worldwide

UOB PRVI 3mpd

Do you reckon points.com transactions no longer earn 10x, Aaron?

is mileslife and favepay considered online? 10x possible?

The answer to this qn, as it is to all the other “does x get 10x” , is I don’t know. We’ll have to see what people report

Hi all, I’ve made 2 grab topup on 29 March using Citi Rewards and I am still receiving 10x points. Not sure if Citibank will claw it back. Will continue to monitor and update here.

Thanks for letting us know!

Just tested my grab top up, unfortunately there is no 10x. CSO also confirms topup is normal transaction and that will be one point.

Hi CJ.. Citi Rewards MC or VS?

Thanks!

Hi, I’m using Citi Rewards Visa.

Thanks!

Similarly top up on 3th apr.

“The Citi Rewards card will offer 10X points on all online spending, with the exception of mobile wallet transactions and the following travel related expenditures:”

The table does not show any exclusion to mobile wallet

The table is just a list of examples

But cant seem to find where indicate the exclusion oof mobile wallet top up, still received 10x 8th apr top up

Seems like my GrabPay top-ups on 18, 19, 28 and 30 Apr no longer earned any bonuses. Will probably switch to AMEX KrisFlyer for now.

my CR Visa top up to GrabPay on 28 Apr still give me bonus points….

[…] in the realm of cards, including the introduction of BOC’s Elite World Mastercard and much-needed upgrades to Citibank Rewards as well as (finally!) the UOB Lady’s Card. My spending patterns have also changed drastically […]

Right now, both WW and CR are vying to be the top

“online” card in the market.

Certain transactions excluded by DBS which I can get 10x from CR.

UI functionality and bonus pts update made CR winning over WW.

Expiry of points. 5Y vs 1Y

AND the occasional 19X. Clear winner for me.

Non travel related win for CR.

Does AXS payment included for the 10x?

Thank you

Just received my Citi Rewards e-statement for Apr/May and I realized I’m still earning 10X for all Grab top ups. Anyone else got it too?

same here. citi rewards visa.

Yeah mine is Citi rewards visa too

Just got off with a Citibank “Customer Service” rep via the Citibank livechat function in their credit card portal. She said and i quote : “https://www.citibank.com.sg/global_docs/pdf/Citi_Rewards_Card_10X_Rewards_Promotion_Terms_and_Conditions.pdf” “Please note that the bonus points will be granted for transactions under the MCC in the Terms and Conditions” “Qualifying Charge made at any department store, or retail store worldwide, or shopping website that sells clothes, shoes and bags as its main business activity, determined by the following Merchant Category Codes (MCC)” “for 5(ii), any online retail merchants that is still under the MCC in the list provided for 5(i).” To me that is… Read more »

i did get 10X for my lazada/redmart purchases on 26 and 28 april. possible the CSO just has no idea what he/she is talking about? grab rides and top ups still getting 10X for me too.

edit: FWIW, in telegram people report 10X for Circles Life, Points.com, Caroupay, chope deals, shaw movie tickets. certainly sounds like an expansion beyond bags shoes and clothes to me, despite whatever misinformation CSOs might be spreading.

Isn’t telco bills excluded from earning 10x rewards?