One of the benefits that OCBC VOYAGE cardholders enjoy is a complimentary airport limo transfer when they spend a minimum of $3K in a month. Cardholders can earn up to two free limo transfers a month, which they must utilize within three months.

OCBC is now offering VOYAGE cardholders an alternative way of unlocking an airport transfer by spending a minimum of $1.5K in FCY in a month. Cardholders can opt to qualify for a limo by whichever option is more beneficial to them.

The T&C of the new limo offering can be found here.

Here’s how this measures up to other cards on the market:

[table id=1 /]

The OCBC VOYAGE card is currently offering 2.4 mpd on foreign currency spending until 31 Dec 2019, which makes it one of the best cards to use in this category.

Conclusion

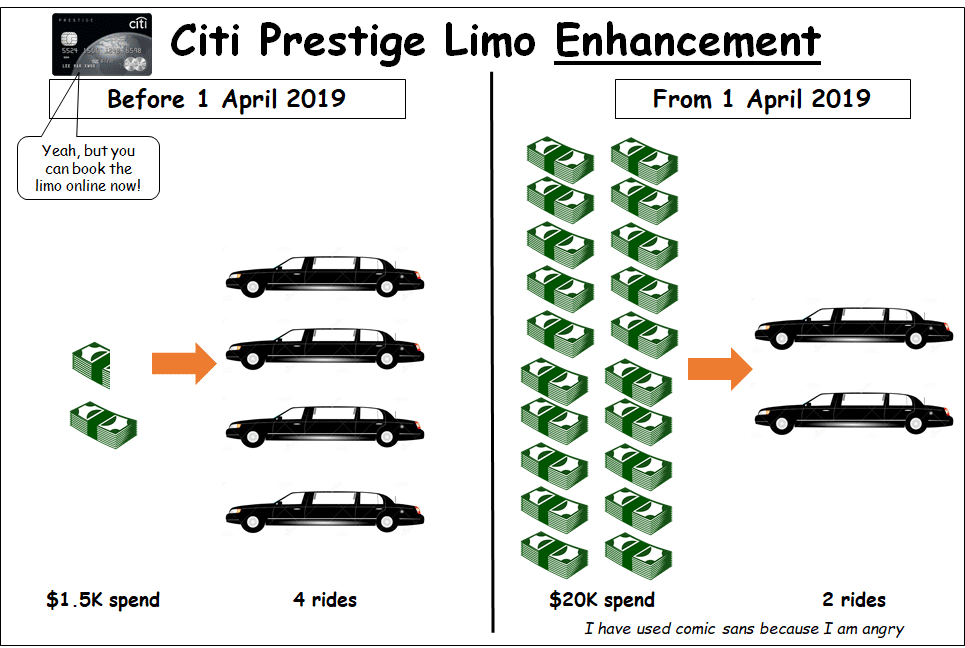

In a few day’s time, Citibank plans to increase the airport limo spending requirement on the Citi Prestige card by more than 13X. I’m still struggling to get over how ridiculous an increase that is.

This ludicrous change means that in my opinion, the Citi Prestige for all intents and purposes no longer offers an airport limo benefit.

In light of that, it’s good to know that not every bank is moving in the same direction.

If only the Voyage still offers 2.3 MPD on dining and I’ll love it big big and ditch my other general spend cards.

An enhancement indeed, but I see it as just being halfhearted. Most of our travel spending would be in SGD before the trip starts. It is also more likely that FCY is spent DURING travel. But it would then be too late to accrue and book the airport transfer. If they were big hearted they would just reduce the SGD spending requirement or allow booking before spending (like Citi used to). [Yes, I recognize it is possible sometimes to charge in FCY prior to travel]

usually incurred FCY tx booking hotel room prior to travel to satisfy min spend

On my recent mileymoon trip I actually incurred most of my fcy spend in SG, not overseas. Bought attraction tickets, paid for turo car rental, paid for Airbnb, booked tours etc. In contrast I spent v little on my cards once in the usa

If it helps, the limo ride is valid for 3 months. Starting the following month. Eg. FCY in March, limo valid April-June

Yes, I’m borderline looking a gift horse in the mouth. But in my circumstances, the largest value transactions that would qualify are hotels and rental cars, both of which are more likely than not paid only at point of check-in or collection. The rest are either not large value enough to accrue or the prepayments are in SGD (eg Expedia). Just saying it’d be better if they allowed the spending to be per quarter basis or ex-post.

Must be learning from their pals at UOB

Hi Aaron

Is it confirmed that 3k can be mixed with local and overseas spending? The CSO gave me negative answer when I called in on the first day they changed the spending requirements. Thanks

Yes