Although hotel points are almost impossible to earn in Singapore without actually staying, there are a couple of banks which offer hotel points transfers.

| Citibank | American Express |

|

|

Unfortunately, the regular transfer ratios are so bad as to make them not worthwhile. In almost every case, you’d be much better off transferring your points into frequent flyer programs instead.

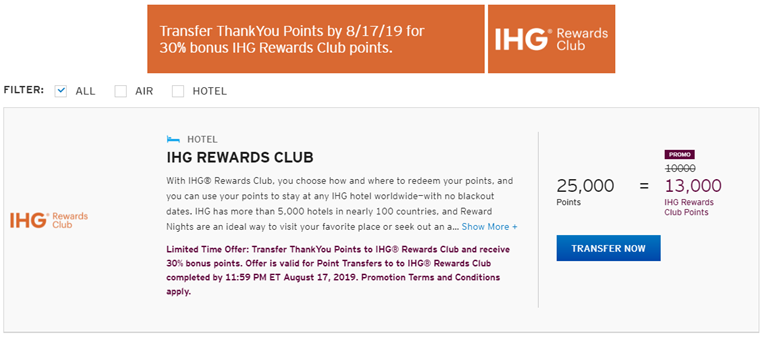

However Citi is now offering a limited-time transfer bonus to IHG Rewards Club. Is it worth biting?

Get 30% more IHG Rewards Club points

From now until 18 August 2019 11.59 am SGT, Citi Rewards Visa, Citi Rewards Mastercard, Citi Prestige, and Citi Ultima cardholders can transfer Citi ThankYou points to IHG Rewards Club points with a 30% bonus. The minimum transfer amount is 25,000 Thank You points, which will yield 13,000 IHG points post-bonus.

You should see this offer automatically when you visit the Citi Rewards portal.

If you hold a Citi PremierMiles Visa or Citi PremierMiles AMEX card, your transfer ratio to IHG is 10,000 Citi Miles= 13,000 IHG Rewards Club points, post-bonus.

Is it worth transferring Citi points to IHG?

25,000 ThankYou points can normally be converted into 10,000 miles with the following frequent flyer programs:

|

|

Let’s take KrisFlyer as our benchmark. I now value KrisFlyer miles at about 1.8 cents each (keep in mind that valuation is highly subjective), which means that 25,000 ThankYou points could be worth roughly S$180.

On the other hand, I’d value an IHG point at about 0.5 US cents, or 0.68 SG cents, because that’s the price you can buy them at when they go on sale (in fact, they’re currently on sale right now). Based on this valuation, 25,000 ThankYou points are worth S$88.40 (1.3 * 0.68 * 10,000).

Therefore, even with the 30% bonus, you’re still taking a substantial haircut by opting for IHG Rewards Club points over airline miles. The 30% makes it a “less bad” deal, but certainly not a good one.

Or perhaps we could think about this in terms of opportunity cost

- A Citi Rewards Visa cardholder has the choice between a 7.2 cents (KF Miles) or 3.5 cents (IHG points with 30% bonus) rebate per $1, assuming he spends on a 10X category

- A Citi PremierMiles Visa cardholder has the choice between a 2.2 cents (KF Miles) or 1.1 cents (IHG points with 30% bonus) rebate per $1, assuming he spends on regular local spend

It’s just very hard to make the case for earning IHG points on Citi cards, unless you desperately need them.

How much do IHG award nights cost?

Technically speaking, IHG pricing still follows a traditional award chart, but good luck trying to find it on their website. That’s because the program is moving towards the dreaded “variable redemption pricing”, and in fact has quietly launched a new 100,000 point price level at selected properties.

At least for now, the majority of the program still follows the table below:

| Category | Points Per Night |

| Category 1 | 10,000 |

| Category 2 | 15,000 |

| Category 3 | 20,000 |

| Category 4 | 25,000 |

| Category 5 | 30,000 |

| Category 6 | 35,000 |

| Category 7 | 40,000 |

| Category 8 | 45,000 |

| Category 9 | 50,000 |

| Category 10 | 55,000 |

| Category 11 | 60,000 |

| Category 12 | 65,000 |

| Category 13 | 70,000 |

To give you some idea of how some sample properties price:

- Intercontinental London Park Lane: 70,000 points

- Intercontinental Sydney: 65,000 points

- Intercontinental Tokyo: 55,000 points

- Holiday Inn Resort Kandooma Maldives: 45,000 points

- Crowne Plaza Changi Airport: 40,000 points

- Holiday Inn Bangkok: 25,000 points

You can see a full listing of IHG properties and their prices here.

Conclusion

Although I love to see hotel points transfer bonuses, the problem is that the base transfer rate is so poor that even these can’t make them good deals. The best ever hotel points deal in Singapore still remains that amazing AMEX Membership Rewards x Hilton one, where 1 MR point got 3 Hilton points, instead of the regular 1.25, but I doubt we’ll ever see that again.

Although it’s fairly easy to earn miles in Singapore, hotel points remain elusive. Let’s hope one of the banks tries to shake that up in the near future.

Amex MR to HH transfer was a mistake rate. If I am not mistaken MR transfer 1:2 in the US, a 50% bonus is 3HH. Unlikely to ever see such bonus again.

yup, my thoughts too. i assume they honored it out of goodwill to customers, which is great, but we shouldn’t expect to see anything like that again.