Marriott Rewards historically hardly ever ran points sales, while SPG ran them several times a year. The final SPG points sale was in June 2018, after which the program was folded into Marriott Rewards to form Marriott Bonvoy. Since then, Marriott Bonvoy has only run one points sale- a 25% off offer back in April 2019.

At the time, I said that Marriott was probably going to test several different sales prices to see what sticks with customers. 25% was their opening gambit, and it looks like this time round they’ve decided to increase it slightly to 30%.

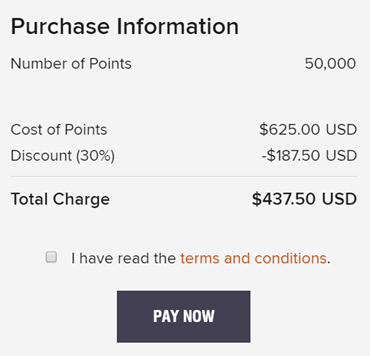

From now till 11.59 a.m 19 October 2019 SGT, Marriott Bonvoy is offering 30% off points when at least 2,000 or more are purchased in a single transaction. You can only buy points if your account has been open for at least 90 days (30 if there’s a qualifying activity like a stay). A maximum of 50,000 points can normally be purchased in a year, but for the duration of the sale Marriott Bonvoy is doubling this to 100,000.

Buy Marriott Bonvoy points at 30% off here

Should you buy Marriott Bonvoy points at 30% off?

The best SPG sales offered 35% off the usual 3.5 US cents per point price, or 2.275 US cents each. 1 SPG point has become 3 Marriott Bonvoy points, so that’s an equivalent price of 0.758 US cents each.

With the 30% off sale, you’re buying Marriott Bonvoy points at 0.875 US cents each. This is still more expensive than the cheapest SPG points sale, but it’s not fair to do a straight comparison because the most expensive properties in the SPG portfolio cost 90,000 SPG points (270,000 Marriott Bonvoy points), while the most expensive properties in the new Marriott Bonvoy portfolio cost 100,000 Marriott Bonvoy points.

Marriott Bonvoy just introduced peak and off-peak pricing, and from what I’m gathering online, this represents more of a move towards dynamic pricing than true “peak/off-peak” rates. People aren’t thrilled about it, but there will be winners and losers, depending on the dates you’re looking at.

| Category | Off-Peak | Standard | Peak |

| 1 | 5,000 (-33%) | 7,500 | 10,000 (+33%) |

| 2 | 10,000 (-20%) | 12,500 | 15,000 (+20%) |

| 3 | 15,000 (-14%) | 17,500 | 20,000 (+14%) |

| 4 | 20,000 (-20%) | 25,000 | 30,000 (+20%) |

| 5 | 30,000 (-14%) | 35,000 | 40,000 (+14%) |

| 6 | 40,000 (-20%) | 50,000 | 60,000 (+20%) |

| 7 | 50,000 (-17%) | 60,000 | 70,000 (+17%) |

| 8 | 70,000 (-18%) | 85,000 | 100,000 (+18%) |

Marriott has given some indication of when off-peak pricing can be found in selected popular markets:

| Off-peak periods for selected markets |

|

That said, it’s important to note that just because a date is off-peak today doesn’t mean the same date will be off-peak next month. Marriott will re-evaluate peak and off-peak dates on a monthly basis, which means that you should check your reservation each month to see if your dates now qualify for lower rates. If so, you can rebook and reclaim the difference in points.

This uncertainty regarding pricing is yet another reason why you should not buy points speculatively. However, if you’re ready to lock in the dates of your stay and just short of a few points, the low purchase threshold of 2,000 points to unlock the 30% discount may work for you.

What cards should I use?

Assuming you’ve decided to take the plunge, Marriott Bonvoy purchases are processed by Points.com in USD, so here’s the cards I’d use:

- OCBC 90N- 4.0 mpd, no minimum spend

- UOB Visa Signature- 4.0 mpd, min S$1K max S$2K of foreign currency spending in a statement period

- Citibank Rewards Visa or Citibank Rewards Mastercard– 4.0 mpd, max S$1K a month

- DBS Woman’s World Card- 4.0 mpd, but requires that you write in to DBS to get the bonus 7X credited (3X, or 1.2 mpd will be awarded as base points)

- BOC Elite Miles World Mastercard- 3.0 mpd, no cap

- Standard Chartered Visa Infinite– 3.0 mpd, minimum S$2K spending a statement period

Conclusion

Is it possible there’ll be bigger sales in the future? For sure. Of course, if you’re just shy of a redemption right now and need to top off your account, this is better than paying the regular price.

Hello Aaron, I used my WWMC and got this response, classifying it as a professional service. Is this something new ?

”

Upon checking your receipt and transaction, I would like to advise that this transaction falls under the category of professional/business services thus, will not be eligible for the bonus points.

they’ve always been saying that, but after appeal they usually give the points. that’s at least what’s happened based on the last few reports on wwmc.