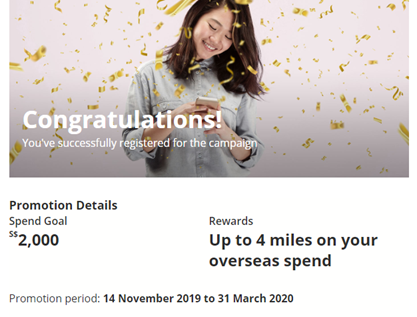

From 14 November 2019 to 31 March 2020, DBS Altitude Visa and AMEX cardholders can earn 4 mpd on overseas spending with a minimum overseas spend of S$2,000.

This offer is available to the first 5,000 registered cardholders, so be sure to go to this page and register quickly. No one likes caps, but at least with this mechanism you should know upfront whether you’re inside or outside the first 5,000, so it’s still better than how UOB does things from my point of view.

The T&C can be found here.

How does the bonus work?

If you spend at least S$2,000 overseas in foreign currency from 14 November 2019 to 31 March 2020, you’ll earn the equivalent of 4 miles per S$1, broken down as follows:

- The regular base rate of 5 DBS Points per S$5 (equivalent to 2 mpd)

- A bonus rate of 5 DBS Points per S$5 (equivalent to 2 mpd)

Bonus miles are capped at the first S$7,000 of eligible spending during the promotion period, so the maximum bonus you can earn is 14,000 miles.

Once registered, supplementary cardholders will also be eligible to earn 4 mpd too. However, the cap of S$7,000 is shared with the main cardholder.

What kind of spending qualifies?

Although the landing page talks about “shopping and dining” overseas, as per the T&C almost any foreign currency transaction will qualify apart from the usual exceptions like education, insurance, non-profit, hospitals, government institutions and prepaid accounts.

Do note however that online flight and hotel transactions are not eligible for this promotion. I’m guessing it’s because of the overlap with the DBS Altitude’s existing evergreen 3 mpd on flights and hotels.

When are bonus miles credited?

The bonus miles will be awarded 90 days after 31 March 2020 in the form of DBS Points. You’ll have the option of converting these to the following frequent flyer programs at at a 1 point: 2 miles ratio

- Singapore Airlines KrisFlyer

- Asia Miles

- Qantas Frequent Flyer

How does this compare to other ongoing FCY promotions?

As the year draws to a close we’re seeing a handful of banks running overseas spending promotions. Here’s how they measure up:

The FCY promo on the UOB PRVI Miles offers the lowest cost per mile, but you’ll have to contend with a S$3K cap and a restricted definition of overseas spending (dining, shopping and accommodation only).

Otherwise, the OCBC 90N still offers the most fuss free experience for FCY spending. So long as your transaction is denoted in FCY, you’ll earn 4 mpd with no cap and no minimum spend until 29 Feb 2020.

After 29 Feb 2020, I’d switch to the DBS Altitude to enjoy 4 mpd on FCY for a further month. This assumes you’ll be able to hit S$2K spending in just one month though.

Conclusion

In the light of ever-increasing FCY transaction fees, it’s good to see banks offering bonus promotions on FCY transactions. That said, these promos are temporary, and the fee hikes are permanent.

So we’ll need to take another call when all these promos lapse at the end of Q1 2020 to see what’s the best card to use overseas. In the meantime, make hay.

(HT: Yun)

Isn’t the Altitude Amex FCY still only at 3%? I thought the 3.25% only applied to the Visa variety? Or did they stealthily raise it in some recent T&Cs?

nope, you’re right. i’ve added that nuance in the table. it’s still 3% for dbs amex cards

Also, if you have both Altitude cards, does that mean a total of $14000 spending bonus cap? Or is it $7000 total for both cards?

cap should be per card, so i would assume double.

I just tried – Amex one was confirmed to be successful but on Visa attempt I was prompted that I have already been registered so more likely one cap per account holder

A little confusing now that whether the promo now only applies to the Amex that I tried or a combined spend across both variants

Will call to clarify if I have time but if anyone else has spoken to cso pls share results

you’re right- the registration process seems to just be entering your ibanking credentials. so unless that one registration covers all your altitude cards…

How did you confirm a specific card? As Aaron pointed out below, you are only prompted to enter your ibanking details…

I happened to sign up for the altitude AMEX a few days ago but dbs says I’m not eligible for this promotion. Anyone having the same problem, or could it be because it’s already fully subscribed?

I just got it like half hour ago – quota still not full as of then

Signed up meaning approved and card issued? If card has already appeared in your Ibanking then I don’t see why not

If not u might have to wait till it does and try again

So many 4mpd cards for overseas spend this festive year end, even if u don’t get this one there are still options elsewhere

Card issued and activated. Literally just came in the mail today haha.

Yes strange, I wondered whether it was cos it hadn’t had any charges on it, but still not eligible after making a transaction..

Does topping up a Suica card count as foreign currency spend?

I am also wondering 🙂