Here’s The MileLion’s review of the OCBC 90°N Card, the card that makes you wish that the standard QWERTY keyboard had a dedicated ° key.

OCBC was a relatively late entrant into the miles game, and when the bank finally unveiled a miles card of its own in 2015, it decided to take the premium route with the OCBC VOYAGE Card. It took a further four years before the mass-market OCBC 90°N Mastercard launched in August 2019, followed by the OCBC 90°N Visa in October 2021.

At launch the 90°N Cards had some sensational welcome offers (like an uncapped 4 mpd on overseas spending), and for a time, were wallet essentials. Sadly, however, they weren’t able to maintain that sort of momentum, and today they’re middling at best.

This is a card that could badly use a spark, and I don’t just mean the built-in LED.

OCBC 90°N Card OCBC 90°N Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The OCBC 90°N Card gets some things right, but poor transfer ratios and a lack of bonus categories make it hard to recommend. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: OCBC 90°N Card

Let’s start this review by looking at the key features of the OCBC 90°N Card.

|

|||

| Apply (Mastercard) | |||

| Apply (Visa) | |||

| Income Req. | S$30,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$196.20 (FYF) |

Min. Transfer |

1,000 90°N Miles (1,000 miles) |

| Miles with Annual Fee |

10,000 | Transfer Partners |

9 |

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 1.3 mpd | Points Pool? | Yes |

| FCY Earn | 2.1 mpd |

Lounge Access? | No |

| Special Earn | 7 mpd on Agoda | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The OCBC 90°N Card is offered on both the Mastercard and Visa network. Historically, there were big differences between the two versions:

- the Visa had lower general spend rates, but enjoyed a bonus (insofar as 1.5 mpd can be called a bonus) on groceries, online food delivery and shopping

- the Mastercard had higher general spend rates, but lacked a bonus category

Both cards were harmonised in early 2023 and are now a single product, issued across two networks. Core benefits are identical, though OCBC is trying to nudge cardholders towards the Visa by running acquisition offers that aren’t available on the Mastercard (more on that below).

While initially issued on traditional horizontal cardstock, the 90°N Cards have now transitioned to the new portrait-style design that’s becoming increasingly common (portrait-style design supposedly allows for a smoother user experience, as it mimics how customers typically handle their cards when they tap to pay or dip the card into a chip reader).

And while we’re talking design, it would be amiss not to mention the so-unnecessary-yet-sort-of-cool LED light embedded in the °, that lights up upon making a contactless transaction.

I mean, come on. You have to applaud that on some level.

How much must I earn to qualify for an OCBC 90°N Card?

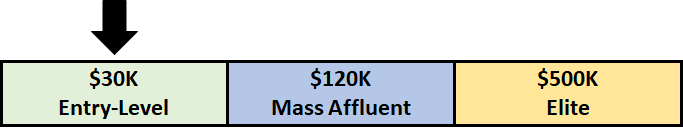

The OCBC 90°N Card has an annual income requirement of S$30,000 p.a., the MAS-mandated minimum to hold a credit card in Singapore.

If you earn below this threshold, it may be possible to get a secured version of the card with a S$10,000 fixed deposit. Contact OCBC customer service for further details.

How much is the OCBC 90°N Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$196.20 | S$98.10 |

The OCBC 90°N Card has an annual fee of S$196.20 for the principal cardholder, and a S$98.10 fee per supplementary card.

The first year’s fee is waived. Subsequent years’ fees are automatically waived if you spend at least S$10,000 in a membership year, though based on personal experience, you can get a fee waiver even if you spend less than this.

Cardholders will receive 10,000 miles every time they pay the principal card’s annual fee, which means buying miles at ~1.96 cents per mile.

They also have the option to upgrade their annual fee by paying an extra S$545, for which they’ll receive 22,000 miles (awarded as 90°N Miles). This represents a price of 2.48 cents per mile, which frankly speaking is way too expensive. You can buy miles for less through bill payment services like CardUp and Citi PayAll, so don’t waste your time here!

What welcome offers are available?

Applicants for the OCBC 90°N Visa have the choice of the following welcome gifts:

| Option 1 | Option 2 | |

| Gift | American Tourister SQUASEM Spinner 20″ | 4x DragonPass Lounge visits |

| Min. Spend (within 30 days of approval) | S$300 | S$500 |

| Cap | No cap | First 700 applicants |

| Application Link | Link | Link |

These gifts are only available for new-to-bank customers, defined as those who do not currently hold a principal OCBC credit card, and have not cancelled one within the past 12 months.

Both offers are valid for applications submitted by 31 August 2024, but it is possible they’ll be further extended, so check the landing pages for more information.

This offer is not available to applicants for the OCBC 90°N Mastercard.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.3 mpd | 2.1 mpd | 7 mpd on Agoda |

SGD/FCY Spend

OCBC 90°N Cardholders earn:

- 6.5 90°N Miles for every S$5 spent in Singapore Dollars

- 10.5 90°N Miles for every S$5 spent in foreign currency (FCY)

1 90°N Mile is worth 1 KrisFlyer mile, so that’s an equivalent earn rate of 1.3 mpd for local spend, and 2.1 mpd for FCY spend.

While this is marginally better than most general spending cards at the S$30,000 income level, OCBC’s nasty rounding policy means you might be earning less than you think on smaller transactions (more on that below).

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles UOB PRVI Miles |

1.4 mpd | 2.4 mpd |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

DBS Altitude DBS Altitude |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles Card |

1.2 mpd | 2 mpd |

StanChart Journey StanChart Journey |

1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 2 mpd* |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 2 mpd* |

BOC Elite Miles BOC Elite Miles |

1 mpd | 2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

| *In June and Dec only | ||

All overseas transactions are subject to a 3.25% FCY fee. This means that using your OCBC 90°N Card overseas represents buying miles at 1.55 cents each.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Bonus Spend

|

| Agoda x OCBC |

OCBC 90°N Cardholders can earn bonus miles for Agoda hotel bookings made by 30 November 2024 and stayed by 31 December 2024:

- 7 mpd for foreign currency

- 6 mpd for Singapore Dollars

Bonus 90°N Miles will be credited to your account within two months of departure from the hotel.

Do note that bookings made through bank x OTA tie-ups like this can sometimes be more expensive than bookings made through the OTA site directly. I would strongly urge you to do comparison shopping to make sure you’re not paying over the odds.

When are 90°N Miles credited?

90°N Miles are credited when your transaction posts, which generally takes 1-3 working days.

How are 90°N Miles calculated?

Here’s how you can work out the 90°N Miles earned on your OCBC 90°N Card.

| Local Spend | Round down trxn. to nearest S$5, divide by 5, multiply by 6.5. Round to the nearest whole number |

| FCY Spend |

Round down trxn. to nearest S$5, divide by 5, multiply by 10.5. Round to the nearest whole number |

Unfortunately, OCBC has joined UOB in adopting a punitive rounding policy that sees all transactions rounded down to the nearest S$5 before points are awarded. That means a S$14.90 transaction earns the same number of miles as a S$10 transaction, and a S$4.99 transaction earns no miles at all!

You basically need to spend at least S$5 to earn any points at all on the OCBC 90°N Card, and because of this policy, the OCBC 90°N Card can be outperformed by a competitor card with a lower headline earn rate. Consider the following:

|

|

|

| OCBC 90°N Card Earn rate: 1.3 mpd |

Citi PremierMiles Earn rate: 1.2 mpd |

|

| S$5 | 7 miles | 6 miles |

| S$9.99 | 7 miles | 11 miles |

| S$15 | 20 miles | 18 miles |

| S$19.99 | 20 miles | 23 miles |

| S$25 | 33 miles | 30 miles |

| S$29.99 | 33 miles | 35 miles |

| S$35 | 46 miles | 42 miles |

| S$39.99 | 46 miles | 47 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND (ROUNDDOWN(X/5,0)*6.5,0) |

| FCY Spend |

=ROUND (ROUNDDOWN(X/5,0)*10.5,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for 90°N Miles?

A full list of transactions that do not earn 90°N Miles can be found in the T&Cs.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- Hospitals

- Insurance Premiums

- Prepaid Account Top-ups (e.g. GrabPay, YouTrip)

- Real Estate Agents & Managers

- SimplyGo (Bus/MRT transactions)

- Utilities

For avoidance of doubt, 90°N Miles will be awarded for CardUp transactions at a rate of 1.3 mpd.

What do I need to know about 90°N Miles?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| No expiry | Yes | S$25 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 1,000 90°N Miles (1,000 miles) |

9 | <24 hours (for KF) |

Expiry

90°N Miles earned on the OCBC 90°N Card do not expire, so long as the card remains valid.

Pooling

90°N Miles earned on the Mastercard and Visa versions of the OCBC 90°N Card pool together. However, 90°N Miles cannot be pooled with OCBC$ and VOYAGE Miles.

Truth be told, I really don’t understand why OCBC needs three different rewards currencies; life would be so much easier if they just stuck to one!

Partners and Transfer Fee

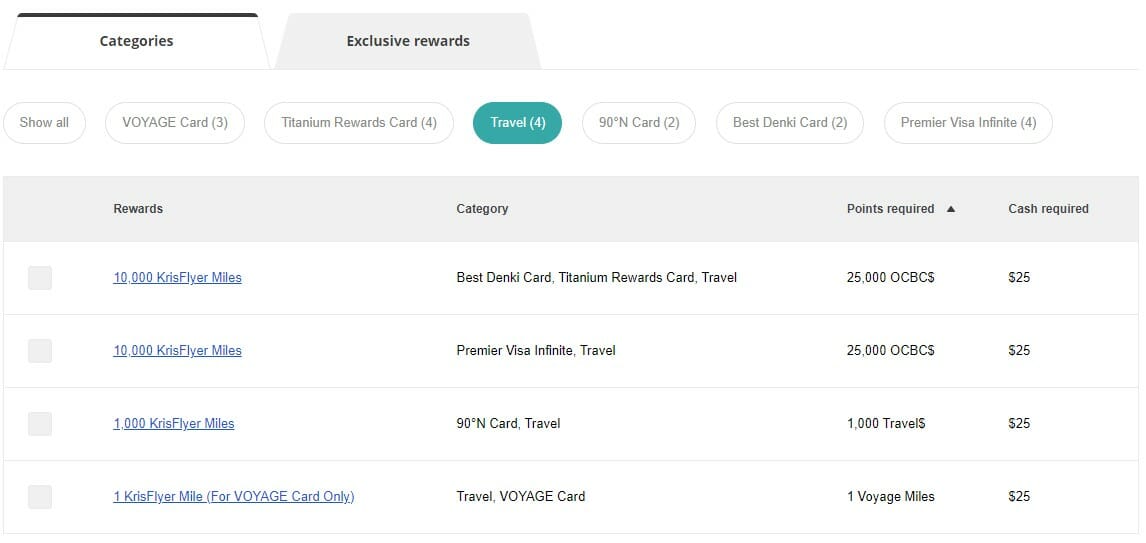

For the longest time, OCBC cardholders could only transfer points to KrisFlyer. However, after numerous delays, OCBC finally added eight new airline and hotel partners to its repertoire in mid-2023.

| Frequent Flyer Programme | Conversion Ratio (90°N Miles : Miles) |

| 1,000 : 1,000 |

|

| 1,000 : 1,000 | |

| 1,000 : 1,000 | |

| 1,000 : 1,000 | |

| 1,000 : 900 | |

| 1,000 : 900 | |

| 1,000 : 750 | |

| 1,000 : 700 | |

| 1,000 : 500 |

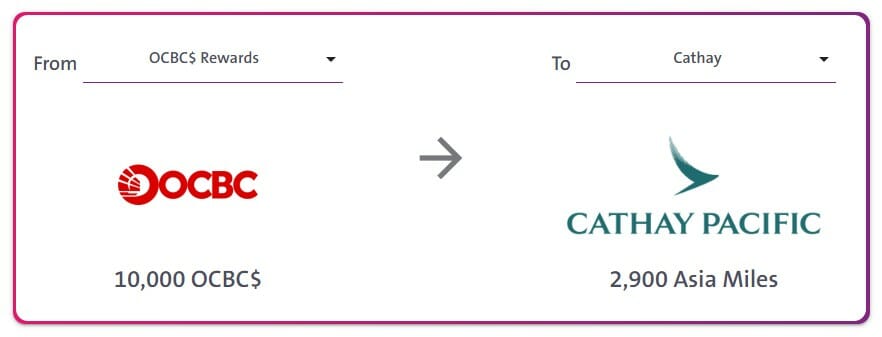

Unfortunately, the transfer ratios for the eight new partners leave a lot to be desired.

I would at the very least have expected Asia Miles to enjoy the same conversion ratio as KrisFlyer. That’s the way it is for every other bank on the market, and it effectively eliminates Asia Miles as a viable transfer partner. After all, why on earth would you take a 25% haircut on the value of your OCBC points (and therefore your card spending rebate) when no other bank forces you to do that?

Likewise, it’s disappointing to see that there’s a 10% haircut for British Airways Executive Club and Etihad Guest, when Citibank and the HSBC TravelOne Card offer transfers to both at the same ratio as KrisFlyer.

As for hotel partners, the ratios for IHG and Marriott Bonvoy aren’t that appealing when you factor in the opportunity cost- you’re basically forgoing 1 KrisFlyer mile (~1.5 SG cents) for every IHG (~0.5 US cents/0.67 SG cents) or Bonvoy (~0.7 US cents/0.94 SG cents)

What about Accor? This is an easier comparison since Accor works like a cashback programme where 2,000 points = €40. This implies an opportunity cost of 1.5 SG cents per KrisFlyer mile, which is marginal, really. I would only consider it if Accor brings back one of its conversion bonuses.

As for conversion blocks:

- Transfers to KrisFlyer must be in blocks of 1,000 90°N Miles

- Transfers for all other programmes must be a minimum of 1,000 90°N Miles, but subsequent conversions can be in blocks of 100 90°N Miles (e.g. you could transfer 1,200 or 5,900 miles)

The OCBC 90°N Card used to offer free points conversions, but this was nerfed in February 2023 and a S$25 fee now applies across the board.

Transfer Times

OCBC splits its partners across two different platforms:

- Transfers for KrisFlyer miles are done via the OCBC Rewards portal, and are usually processed within 24 hours

- Transfers for the other programmes are done via the STACK Rewards portal, under the Points Exchange tab. Transfers should be more or less instantaneous, because they’re powered by Ascenda Loyalty which has a direct API linkage with the airlines.

Other card perks

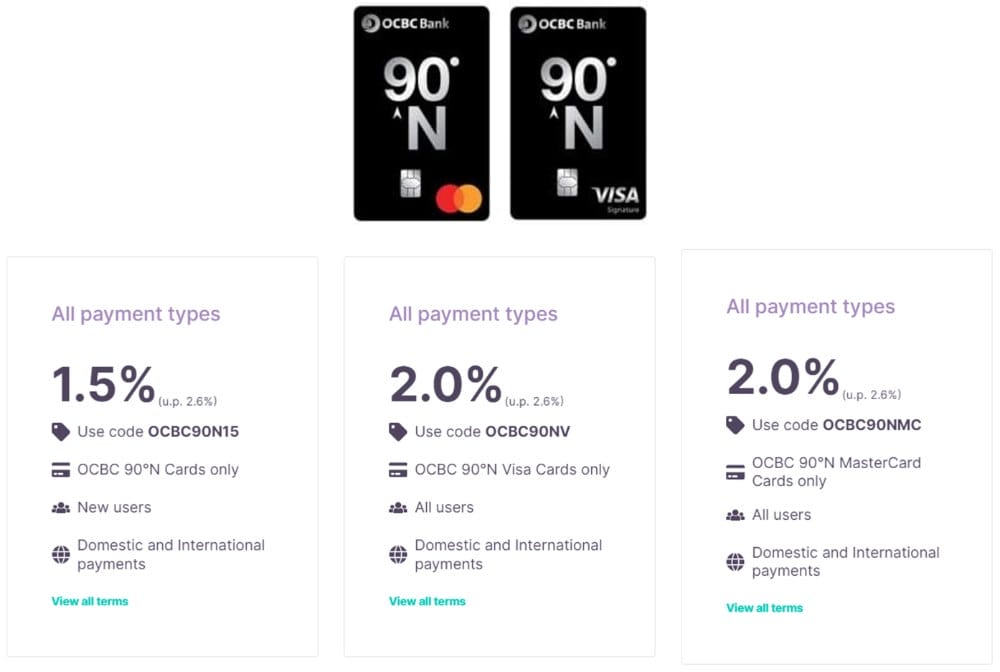

1.5-2% fee with CardUp

OCBC 90°N Cardholders can enjoy a discounted admin fee of 1.5% (new) or 2% (existing) with CardUp, which reduces the cost per mile to as low as 1.14 cents apiece.

| Card | Earn Rate | Cost Per Mile (1.5% fee) |

Cost Per Mile (2% fee) |

OCBC 90°N Visa/MC OCBC 90°N Visa/MC |

1.3 | 1.14¢ | 1.51¢ |

New CardUp users (defined as those who have yet to make a first payment on the platform) can use the code OCBC90N15 to enjoy a 1.5% admin fee on their first payment of any kind.

| 💳 New-to-CardUp | |

| Code | OCBC90N15 |

| Card Type | OCBC 90°N Visa or Mastercard |

| Limit | No cap on total redemptions, but max 1x per user |

| Admin Fee | 1.5% |

| Min. Spend | None |

| Cap | S$10,000 |

| Schedule By | 31 December 2024, 6 p.m SGT |

| Due Date By | 6 January 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

The payment must be scheduled on CardUp by 31 December 2024, 6 p.m (SGT), with a due date on or before 6 January 2025. No minimum payment is required, but the maximum payment you can make is S$10,000. Any amount in excess of S$10,000 will be charged at the prevailing fee of 2.6%.

The code can be used either on a one-off payment, or the first payment of a recurring series.

Existing CardUp users can use the code OCBC90NV (for 90°N Visa) or OCBC90NMC (for 90°N Mastercard) to enjoy a 2% admin fee on any CardUp payment.

| 💳 Existing CardUp customers | |

| Code | OCBC90NV OCBC90NMC |

| Card Type | OCBC 90°N Visa or Mastercard |

| Limit | No limit on redemptions |

| Admin Fee | 2% |

| Min. Spend | None |

| Cap | S$10,000 |

| Schedule By | 31 December 2024, 6 p.m SGT |

| Due Date By | 6 January 2025 |

| Payment Type | One-off payment, or first payment of a recurring series |

The payment must be scheduled on CardUp by 31 December 2024, 6 p.m (SGT), with a due date on or before 6 January 2025. No minimum payment is required, but the maximum payment you can make per month is S$10,000. Any amount in excess of S$10,000 will be charged at the prevailing fee of 2.6%.

The code can be used either on a one-off payment, or the first payment of a recurring series. There is no limit on the number of times each account can use this code (though remember, you’re capped at S$10,000 per month).

Bonus interest with OCBC 360 account

| 🏦 OCBC 360 Interest Structure | ||

| First S$75K | Next S$25K | |

| Salary | 2.0% | 4.0% |

| Save | 1.2% | 2.4% |

| Spend | 0.6% | 0.6% |

| Wealth (Insure) | 1.2% | 2.4% |

| Wealth (Invest) | 1.2% | 2.4% |

| Base Interest | 0.05% | |

| Max EIR | 7.65% | |

| Additional Grow bonus of 2.4% p.a. available if minimum ADB at least S$200,000 | ||

OCBC 90°N Cardholders who spend at least S$500 per month on their card will be eligible for a bonus 0.6% p.a. on the first S$100,000 in an OCBC 360 Account.

Assuming you keep the full S$100,000 inside, that works out to an extra S$600 interest per year- though you will need to consider the opportunity cost of the miles foregone by spending on the 90°N instead of on higher earning cards.

Travel with OCBC portal

|

| Travel with OCBC |

OCBC 90°N Cardholders can use their 90°N Miles to pay for airfare and hotel bookings on the Travel with OCBC portal at the following rates:

| 💰 Value per 90°N Mile on Travel with OCBC |

||

| Airfares | Hotels | |

| Economy | 0.87 | 0.87 |

| Premium Economy | 1.09 | |

| Business | 1.45 | |

| First | 1.45 | |

| Valuations are accurate as of date of publishing and may be subject to change in the future |

||

This used to be much better in the past, where you could get up to 2.88 cents per 90°N Mile on First Class fares. Unfortunately, that valuation was nerfed, and while 1.45 cents per 90°N Mile might make sense in certain circumstances, it’s not something I’d heartily endorse.

Flexiroam package

OCBC 90N Mastercard Cardholders will enjoy a complimentary 3x 1 GB 5-day Flexiroam Data Plan once per calendar year. This provides mobile data in more than 200 countries, with both regular SIM and eSIM options available.

For redemption steps, refer to this guide.

Summary Review: OCBC 90°N Card

|

|||

| Apply (Mastercard) | |||

| Apply (Visa) | |||

| 🦁 MileLion Verdict | |||

| ☐ Take It ☑Take It Or Leave It ☐ Leave It |

The OCBC 90°N Card launched with some really fantastic offers: an uncapped 4 mpd on foreign currency spending, 4 mpd on Singapore Airlines, Scoot, Air Asia and Jetstar bookings, 8 mpd on Airbnb, and there was even a time where you could buy Business Class tickets to Europe from just S$1,000 before Travel with OCBC got nerfed!

But it’s not reached the same heights ever since. Even though the 1.3/2.1 mpd earn rates are slightly above average, the annoying S$5 earning blocks offset the advantage on smaller transactions. Likewise, non-expiring points are great, but free transfers to KrisFlyer are no longer offered, and while there’s transfer partner variety, the conversion ratios come pre-nerfed for most programmes.

If you’re in the market for a general spending card, I’d reckon the Citi PremierMiles Card or HSBC TravelOne Card have a lot more to give, with better welcome offers, lounge access, and more transfer partners. So it’s just very hard to make the case for the 90°N Card, unless you really like the light-up feature.

What a stingy sign up bonus…

Don’t sign up then

Good for use until 29 Feb 2020. After that, switch back to the BOC Elite Miles card.

The best looking card at entry level from OCBC ever, basically the OCBC card design is so lame, their designer deserve to be fired..

Not a compelling proposition overall. Better miles earning rates during the promo period, and then back to average-ness after that. The promos are key to this card – give them a longer lifespan and OCBC may have a winner on its hands. Otherwise meh as a gen spend card.

Edit for clarity.

The way I see it, this card is on par with dbs altitude and Citi PM visa. Very similar mpd rates (after promo ends), but each has tis own usp. Dbs altitude- 3mpd on flights + hotels. Citi pm- 12 xfer partners. Ocbc 90n- no xfer fees. Which one you prefer depends on what you value- if you’re a krisflyer or bust person, you won’t value the additional xfer partners on Citi. If you hardly ever book revenue tickets or hotels, you won’t value the 3 mph on altitude. If you want something other than krisflyer, Ocbc 90n won’t appeal.

Some ppl are funny right? Some brands go on sale, do ppl say “don’t buy, not worth to buy on sale. I will only buy if this brand have sale whole year long. If it’s promo for a certain period, I won’t buy. “

LOL!!!

Promo is meant to be used there and then. Don’t complain when got lobang!

this has come just in time for my overseas trip. 4 mpd with no cap ftw

Since OCBC last year said I don’t qualify for Titanium in writing, I won’t get this card unless I go apply at their branch. Wonder why I am banned by OCBC from getting even their low level cards when after that letter, I can get AMEX charge and X-Card. Must have done something wrong decades ago and blacklisted.

can use this card to buy lifemiles/alaskan miles?

Sure, 4 mpd

isn’t prvi fx rate at 3.25%?

thanks! updated it.

Does buying air tickets from Expedia qualify for 8mpd too?

Yes only with participating airlines

And you must go through their dedicated landing page link http://www.expedia.com.sg/ocbc90n – guessing OCBC gets a referral fee which offsets cost of miles?

Remember … airlines exclusion, AND hotel exclusions!! Be careful. Hotel are heavily restricted! Basically non chain / branded are ok. Chain and branded hotels are excluded.

so grab top ups will be counted in as gen spend right? not excluded right?

Did you test it out?

Hi,

Can we get points if we use services such as renthero to pay the rent with this card ?

Could such services be used to reach the $5000 expense threshold in 3 months ?

I can’t find the information online; appreciate if you can circulate the information 🙂

Just to be clear: even all online foreign currency spend qualify for 4mpd? It appears so to me in the T&C

yes

Anyone applied and already received the card? I used MyInfo to apply when this article came out but til now no word 😐

I only tried to apply for one online just now using MyInfo, and as soon as I enter the first page worth of information on the OCBC website and click “next”, I get a “system error” message, even after using different browsers. After calling OCBC to check on this, all they say is “Can you try again later, pls?”. Doesn’t inspire much confidence in their IT set-up…

Update: After unsuccessfully trying for three consecutive days to apply for this card using MyInfo across multiple browsers and devices, today I decided to use the traditional method of filling in my information myself instead. And voila, the system accepted my application – though I do not know yet whether I have been successful or not. So it appears that at least for some people, OCBC cannot use MyInfo as a method to apply for cards yet.

My application was approved in the same day.

I applied through MyInfo yesterday and no word as well – no email notification, nothing. (I had my expectations set high from the “same day approvals” remarks I guess)

I clicked to OCBC via the referal link in this article

Does this count as one of the OCBC Credit Cards for OCBC 360 account bonus?

Yes

Applied for the card through “my info” and received the electronic card within a few hours for online usage. By evening there was a courier at my door delivering the physical card-absolutely amazed with the service. I have been using the BOC elite Card for all my general foreign spends since Nov 2018 but this one definitely is a fantastic promo. The only critique I have is that they award 4mpd for Shilla & DFS@ Changi but not for online changi portal: ishop changi! Also while other OCBC credit cards offer fuel discount, there is no promo for fuel on… Read more »

What does FCY 4.0 mean?

Ocbc is now saying that SQ website ticket purchases will only get the 4mpd if cardholders go to ocbc website first and click through to SQ. Otherwise, if purchases are made directly, only 1.2mpd. This doesn’t seem to be stated anywhere on the T&Cs.

Where are they saying that? Checked with ocbc- only expedia and agoda need to go via special link. Singapore Airlines can just book as per normal

I just got my statement and didn’t get the bonus points for SQ bookings. Called up and the call centre lady said it’s because I didn’t click through from ocbc’s website and cited Agoda as an example of the requirement. Will call again tonight and try.

I thought as long as you pay using OCBC 90N Card to pay SQ bookings on line, one is eligible for the mpd. Can you share the link from OCBC website. I could not find the link from ocbc website.

as long as you pay via the SQ website, you will get 4 mpd. there is no special link for SIA. fyi, there was a coding error that resulted in people not getting the proper bonus for SIA purchases. it has since been fixed and missing miles have been credited.

Curios if only the Airbnb bonus only applies to accommodations? Or experiences/tours bought on Airbnb counts toward this too?

as long as merchant of record is airbnb, it will earn 4 mpd

Does Grab top up qualify for miles?

any current welcome bonus / link to apply

@aaron trouble you to update article to say free conversion is no longer in existence

HSBC TravelOne is so much better

Just received this message a few days back –

OCBC 90N Card: On 1 January 2024, the Annual Service Fee for the OCBC 90N Card will be revised from S$54.00 to S$196.20 for principal cards and S$54.00 to S$98.10 for supplementary cards (all fees include GST). Principal cardholders who pay the Annual Service Fee in 2024 will earn 10,000 bonus 90N Miles. For details or to contact us, go to the OCBC website > Personal Banking > Cards > OCBC 90N Card.