Since May 2019, OCBC has been giving new-to-bank customers S$50 cashback upon approval for an OCBC credit card, with no minimum spend required.

This offer was due to expire on 30 November 2019, but OCBC has extended it once more for applications submitted by 31 December 2019. Successful applicants will receive their cashback by 31 January 2020. The full T&C can be found here.

| Who is considered “new to bank”? |

| OCBC has redefined “new-to-bank” with effect from 1 December 2019. Previously, anyone who didn’t hold a principal OCBC credit card now or in the last 6 months before application was considered “new”. Going forward, the requirement is that you don’t hold a principal OCBC credit card now or in the last 12 months before application. |

Which cards are eligible?

The following cards are eligible for this promotion:

- OCBC 90N Card

- OCBC 365 Credit Card

- FRANK Credit Card

- OCBC Plus! Visa Credit Card

- NTUC Plus! Visa Credit Card

- OCBC Cashflo Credit Card

- OCBC Great Eastern Cashflo Credit Card

- OCBC Robinsons Group Credit Card

- OCBC Titanium Rewards Credit Card (Blue)

- OCBC Titanium Rewards Credit Card (Pink)

- OCBC Arts Credit Card

- OCBC Best Denki Credit Card

- OCBC Platinum Credit Card

The obvious choices for miles chasers are the OCBC 90N Card and the OCBC Titanium Rewards Card.

| Income Req. | Annual Fee | Miles from Annual Fee |

| S$30,000 | S$192.60 (first year free) | 10,000 |

| FCY Fee | Points Validity | Transfer Fees |

| 3.25% | No expiry | None |

| Local Spend | Overseas Spend | Special Spend |

| 1.2 mpd | Until 29 Feb 2020: 4.0 mpd |

Until 29 Feb 2020: 4.0 mpd on SIA group, AirAsia, Jetstar, DFS & Shilla @ Changi, Netflix & Spotify, 8.0 mpd on Airbnb, Millennium Hotels, Agoda, Expedia, Mr & Mrs. Smith |

The OCBC 90N Card normally earns 1.2 mpd on local spending and 2.1 mpd on foreign currency spending. However, the foreign currency earn rate has been boosted to 4 mpd until 29 Feb 2020, with no minimum spend or cap. This makes the 90N my go-to card for all foreign currency spending at the moment.

Cardholders will also earn an uncapped 4 mpd on Singapore Airlines, SilkAir, Scoot, AirAsia and Jetstar tickets, DFS and Shilla spending at Changi Airport, Spotify and Netflix subscriptions. An uncapped 8 mpd can be earned on agoda, airbnb, Expedia, Mr & Mrs. Smith and Millennium Hotels and Resorts. These are some really generous bonuses and time is running out to enjoy them, so if you haven’t already got a 90N card, now’s the time.

Travel$ earned on this card never expire, and there is no transfer fee when converting them to KrisFlyer miles.

| Income Req. | Annual Fee | Miles from Annual Fee |

| S$30,000 | S$192.60 (first 2 years free) | None |

| FCY Fee | Points Validity | Transfer Fees |

| 3.25% | 2 years | S$25 |

| Local Spend | Overseas Spend | Special Spend |

| 0.4 mpd | 0.4 mpd | 4 mpd on online and offline shopping, capped at S$12K per membership year per card |

The OCBC Titainum Rewards card earns 4 mpd on online and offline shopping, capped at S$12K per membership year per card. This means that if you get both the Blue and Pink versions, you can double your 4 mpd cap.

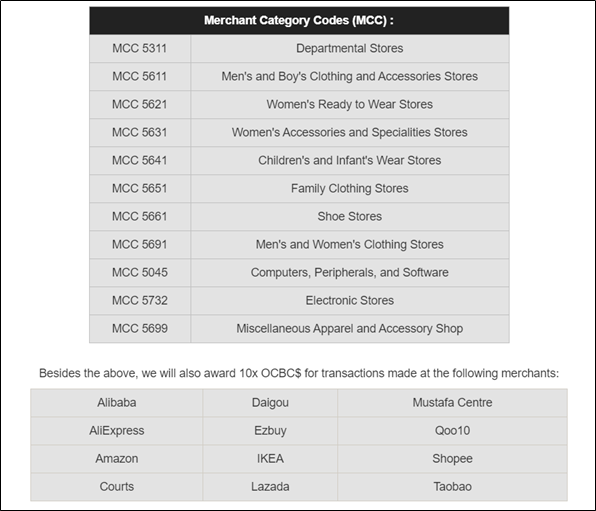

Shopping is defined as purchases at any merchant with the following MCCs, as well as selected online merchants:

The bonus applies whether you’re spending in local or foreign currency.

OCBC$ earned on this card expire in 2 years, and you’ll pay a S$25 fee when converting them to KrisFlyer miles.

Conclusion

If you don’t already have an OCBC credit card, this is a way to get some additional free cash when signing up. Remember that you need to apply online to get the cash; use SingPass MyInfo for faster approval.

The only “trick” with the OCBC TR is that you have to monitor the 10x transactions. The bonus points post a long time after the transaction date and I’ve had a few instances where I had to call OCBC to get the bonus. The 90N is a lot more transparent and the bonus miles post straight away – why can’t all banks be like that?

Does “New to bank” also mean someone who does not have ANY OCBC principal credit card at all? If I already have other ocbc card, then I am not considered as “new to bank”, even if I don’t have the 90N card, hence I do not qualify for the sign up cash ? Is my understanding correct?

if you hold any principal OCBC CC, you’re not new to bank.