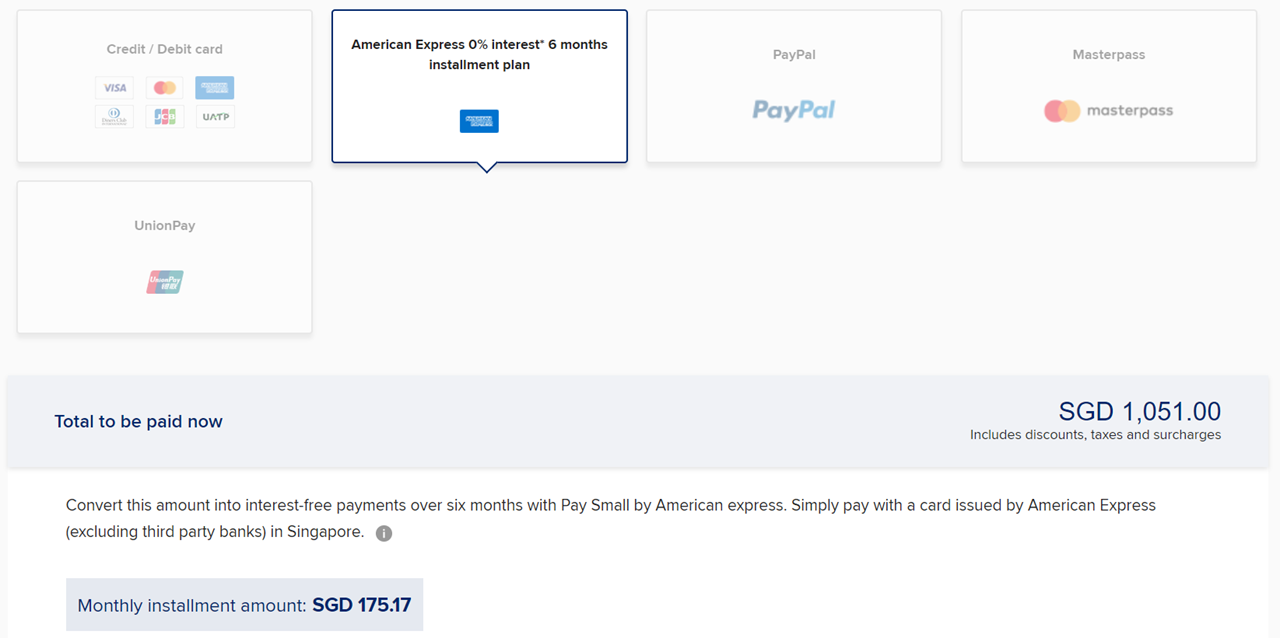

If you hold an American Express card, you may have noticed a new option when paying for Singapore Airlines or SilkAir tickets on singaporeair.com- a six month, 0% interest installment plan.

This scheme is called “Pay Small”, and is now available for flights originating from Singapore, billed in SGD and with a minimum total cost of S$250. This option does not apply to partial miles and cash payments.

All American Express cards issued in Singapore are eligible for this scheme, with the exception of corporate cards, and AMEX cards issued by DBS and UOB.

| Citibank is not explicitly excluded, but that’s probably because they’ve stopped issuing any new AMEX cards. It’s safe to assume that existing Citi AMEX cards won’t be eligible either. |

If you cancel your card during the payment period, any unpaid amounts become due immediately, together with a S$100 admin fee.

Reduced rewards rates

Although 0% interest for six months sounds great, do note that this comes at the expense of rewards. Instead of the regular rates, you’ll earn a reduced rate as shown below:

| Regular Rate for singaporeair.com purchases | Rate for Pay Small installments | |

AMEX KrisFlyer Ascend  AMEX KrisFlyer Credit Card |

2 miles per S$1 | 0.5 miles per S$1 |

AMEX PPS Credit Card  AMEX Solitaire PPS Card |

2 miles per S$1 | 1 mile per S$2 |

AMEX SIA Business Card |

8.5 HighFlyer points per S$1 | 2.5 HighFlyer points per S$1 |

Other AMEX cards will not earn any Membership Rewards points, cashback or STAR$. At least some cards do; it’s still better than other banks (e.g UOB and DBS), which exclude installment payment plans from earning rewards altogether.

In any case, I think the Pay Small scheme will be more of interest to SMEs where the boss may be paying for tickets on his personal card and needs to preserve cashflow. Rewards are relatively less important in this context, at least compared to having a six month interest-free cashline.

Conclusion

If you’re looking to buy tickets on Singapore Airlines and don’t care about installments, do remember that the following cards will earn you a greater rate of return

| Earn Rate | Remarks | |

OCBC 90N Card OCBC 90N CardApply here |

4 mpd | Until 29 Feb 2020 |

DBS Woman’s World Card DBS Woman’s World CardApply here |

4 mpd | Capped at S$2,000/month |

UOB Lady’s Solitaire Card Apply here |

4 mpd | Capped at S$3,000/month, travel must be selected as one of two quarterly 10X categories |

UOB Lady’s Card Apply here |

4 mpd | Capped at S$1,000/month; travel must be selected as quarterly 10X categories |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply here |

3 mpd | |

DBS Altitude Visa/ AMEX DBS Altitude Visa/ AMEXApply here |

3 mpd | Capped at S$5,000/month |

If someone really needs installment, an alternative installment will be DBS MP3, 0% fee, 0% interest for 12 months. You can put almost all retail transactions under MP3 (minimum spend $100 per transaction). But you earn no miles for retail transactions converted to MP3.

I tried this. It’s much more convenient than having to apply for MP3 after making my transaction. Great!