DBS is currently running a sign up bonus on the DBS Altitude where new-to-bank customers who spend S$6,000 earn 10,000 bonus miles. When base miles and miles from paying the annual fee (optional) are factored in, the total haul is 27,200 miles.

However, there’s a much better targeted offer that’s going out now, where customers can spend the same S$6,000 and earn 36,000 miles. In addition to this, they’ll enjoy a local/FCY (foreign currency) earn rate of 1.5/2.2 mpd for the first 180 days, subject to a cap.

The T&C of the offer can be found here.

Spend S$6,000, get up to 36,000 miles

Customers who receive the invitation to apply (via eDM, SMS or push notification on the DBS app) can earn 36,000 miles by spending S$6,000 within 90 days of approval. This is broken into:

- 17,000 bonus miles (8,500 DBS Points) for hitting the S$6,000 threshold

- 9,000 base miles (4,500 DBS Points) for spending S$6,000 @ 1.5 mpd [the regular earn rate is 1.2 mpd, but is upsized to 1.5 mpd for first 180 days subject to a cap, see below]

- 10,000 miles (5,000 DBS Points) for paying the first year annual fee of S$192.60 (optional)

The 17,000 bonus miles will be credited to your account by the end of 150 days from the card approval date, assuming you meet the qualifying criteria.

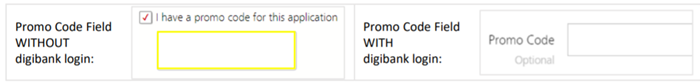

To take advantage of this offer, you’ll need to enter the following promo code during the online application process:

- ALTFORYOU – if you prefer not to pay the S$192.60 annual fee

- JUSTFORYOU – if you prefer to pay the S$192.60 annual fee for 10,000 miles

Your application must be submitted by 31 March 2020, and approval received by 14 April 2020.

Both the DBS Altitude Visa and American Express are eligible for this bonus, and there’s no need for you to be a new-to-bank customer (the fact that this is a targeted offer means it’s only being sent to DBS customers anyway).

Do note that DBS publishes a list of transactions excluded from qualifying spending. It’s pretty much the usual suspects, such as:

|

|

1.5/2.2 mpd on local/FCY spending for the first 180 days

In addition to the sign up bonus, customers will receive an upsized earn rate of 1.5/2.2 mpd on local/FCY spending for the first 180 days after approval.

The earn rate is broken down as follows:

| Local | FCY | |

| Base Miles | 1.2 | 2.0 |

| Bonus Miles | 0.3 | 0.2 |

The maximum bonus miles are capped at the first S$5,000 of eligible spending per calendar month. This means your monthly bonus is capped at 1,000-1,500 miles, depending on your mix of local/FCY spending.

| Because of the monthly cap, you’ll want to spread out your S$6,000 sign up bonus spending. If you spend S$5,000 and S$1,000 in months 1 and 2, for example, you’ll get the full 36,000 miles. If you spend S$6,000 in month 1, you’ll get 35,700 miles because the cap kicks in for the last S$1,000 |

One interesting thing about this mechanic is that the upsized rate is available for the first 180 days, but the cap is by calendar month. Depending on when your approval comes in, you may enjoy the upsized rate for either 6 or 7 months.

For example, if you’re approved on 15 Feb 2020, 180 days takes you to 13 August 2020, so you have 7 months’ worth of cap. If you’re approved on 1 March 2020, 180 days takes you to 28 August 2020, so you have 6 months’ worth of cap. Time your application carefully!

What can you do with DBS Points?

DBS Points earned on the DBS Altitude card can be transferred to the following frequent flyer programs.

| Transfer Ratio (Points: Miles) | |

Singapore Airlines KrisFlyer Singapore Airlines KrisFlyer |

1:2 |

| 1:2 | |

Qantas Frequent Flyer Qantas Frequent Flyer |

1:2 |

| 1:3 |

DBS Points earned on the Altitude do not expire so long as the card is active. A S$26.75 admin fee applies per transfer; however, customers can also opt to pay S$42.80 to enroll in the KrisFlyer Auto Conversion program, where points are automatically converted at the start of each quarter.

Conclusion

This is a solid offer by DBS, and well worth thinking about if you were targeted. You’ll have the same spending requirement as someone who applied publicly, yet get an additional 7,000 bonus miles.

Remember that you can see a full list of credit card sign up bonuses here.

(HT: Yun)

They also have promotion for DBS WWMC as well!

saw it- will cover that in a separate article

7,200 base miles (3,600 DBS Points) for spending S$6,000 @ 1.2 mpd

Given the upsize earn rate shouldn’t it be 1.5 mpd instead?

sharp! you’re absolutely right. will update the post.