From 17 Feb to 30 Apr 2020, DBS is running a “Go Online” promotion that awards qualifying customers with a sure-win gift worth 8% of their spending.

Registration is required and is open to the first 50,000 principal cardholders.

I tried registering through iBanking and received an error message, but upon checking in the DBS Lifestyle App I could see my registration had gone through.

Here are the links to the T&Cs and FAQs of this promotion.

How does it work?

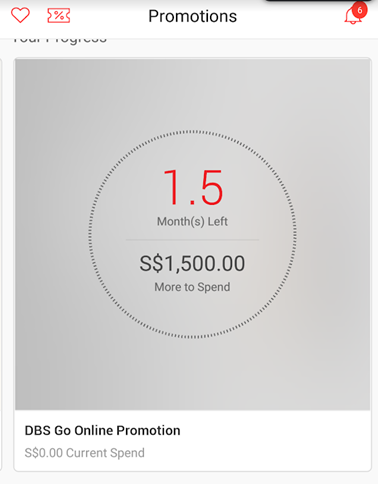

Upon registration, you’ll receive a personalized spend goal. This can be met by online or in-app spending on any of your DBS/POSB credit cards during the qualifying period. Spending can be combined across cards; there’s no need to stick to just one.

The promotion is split into two periods, so you can potentially win two different gifts.

| Qualifying Period 1 (17 Feb-31 Mar 20) | ||

| Tier | Spending Goal | Reward (Cash or e-voucher) |

| 1 | S$200 | S$16 |

| 2 | S$350 | S$28 |

| 3 | S$750 | S$60 |

| 4 | S$1,500 | S$120 |

| Qualifying Period 2 (1 Apr- 30 Apr 20) | ||

| Tier | Spending Goal | Reward (Cash or e-voucher) |

| 1 | S$150 | S$12 |

| 2 | S$250 | S$20 |

| 3 | S$500 | S$40 |

| 4 | S$1,200 | S$96 |

Once you’ve registered, that registration is valid for both qualifying periods (so there’s no need to register twice).

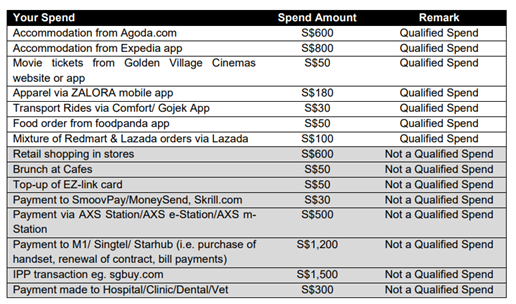

Qualifying spending refers to online or in-app spending, and excludes the following transactions. Note in particular that CardUp and ipaymy are excluded.

| a) refund(s) into the Card account; b) pre-authorisation transactions on the Card account (e.g. hotel bookings) c) payments to government institutions (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); d) payments to financial institutions (including banks and brokerages); insurance companies (sales, underwriting, and premiums); telecommunications providers; schools, hospitals, professional service providers; e) payment of funds to prepaid accounts and merchants who are categorized as “payment service providers” and/or “online payment gateway”. For example, MoneySend, Skrill.com, Matchmove.com, SmoovPay, CardUp, iPaymy; f) payment for parking lots; g) payments made via AXS and SAM; h) all other bill payments; i) donations; j) EZLink transactions; k) NETS transactions; l) balance transfers, cash advance, My Preferred Payment Plan, and any fees and charges (including annual fees, interest charges, cheque processing fees, administrative fees, cash advance fees, finance charges and/or late payment charges and other miscellaneous fees and charges); m) Installment Payment Plan (“IPP”) transaction(s) n) betting (including lottery tickets, casino gaming chips, off-track betting, and wagers at race tracks) through any channel; o) any other transactions determined by DBS from time to time |

Based on past promotions, GrabPay top-ups should count, but as always you’ll run the risk of falling afoul of e) payment of funds to prepaid accounts or o) any other transactions determined by DBS from time to time. Roll the dice if you want, but don’t blame me if it doesn’t count.

The T&Cs have included some examples of qualifying and non-qualifying transactions.

What can I win?

Once you’ve hit your spending target, you’ll receive a push notification on the DBS Lifestyle App to redeem your reward. Rewards for Qualifying Period 1 and 2 must be redeemed by 30 Apr 20 and 31 May 20 respectively.

You’ll play a mini-game (basically selecting a gift box) with the chance to win one of the following prizes:

| Qualifying Period 1 (17 Feb-31 Mar 20) | |

| Gift | Quantity |

| S$16 e-voucher | 17,592 |

| S$16 cash credit | 6,103 |

| S$28 e-voucher | 6,705 |

| S$28 cash credit | 1,209 |

| S$60 e-voucher | 8,572 |

| S$60 cash credit | 3,626 |

| S$120 e-voucher | 5,106 |

| S$120 cash credit | 1,087 |

| Qualifying Period 2 (1 Apr- 30 Apr 20) | |

| Gift | Quantity |

| S$12 e-voucher | 17,592 |

| S$12 cash credit | 6,103 |

| S$20 e-voucher | 6,705 |

| S$20 cash credit | 1,209 |

| S$40 e-voucher | 8,572 |

| S$40 cash credit | 3,626 |

| S$96 e-voucher | 5,106 |

| S$96 cash credit | 1,087 |

Obviously a cash credit is much more preferable to an e-voucher, but based on the gift quantities I think an e-voucher is the more likely outcome.

All e-vouchers are from foodpanda, Lazada, or Redmart. These must be redeemed by 31 July 2020, and do not have a minimum spend (however, the amount payable must be at least equal to the voucher amount).

What DBS cards should I be using for online spending?

If you’re collecting miles, these are the two DBS cards you’ll want to use for the online/in-app spending promotion.

| Card | Online Spending | Remarks |

DBS Woman’s World Card DBS Woman’s World Card |

4 mpd | Capped at S$2K per calendar month |

DBS Altitude AMEX/Visa DBS Altitude AMEX/Visa |

3 mpd on flights and hotels | Capped at S$5K per calendar month |

The DBS Woman’s World Card is the more flexible option, offering 4 mpd on the first S$2,000 of online spending per calendar month. If you’re spending on flights and hotels specifically, you can also use the DBS Altitude AMEX/Visa card for 3 mpd, on the first S$5,000 per calendar month. Do note that in the case of hotels, your reservation must be fully prepaid online; using your card to guarantee your reservation does not count.

Conclusion

With more people staying home and shopping online on account of the Covid-19 outbreak, it’s not surprising to see banks trying to get a share of their online wallet. I suspect we may see similar promotions from other banks, so be on the lookout for those. A quick calculation shows that the total prizes on offer are worth S$3.6 million (of course DBS won’t pay full face value for those vouchers, so this is probably an overestimate), a pretty hefty “stimulus package” by DBS.

If you’re holding a DBS card, do register ASAP because registrations are limited, and your spending doesn’t count until you’ve registered.

Tried to register but “Sorry, this promotion is not applicable to you. Please download/log in to DBS Lifestyle to check out other awesome deals that are available for you”

Same here 🙁

hmmm. the t&C don’t say anything about it being targeted (in fact, it says it’s applicable to all personal DBS/posb principal cardholders), so could the 50k cap be hit already?

Just registered thru Lifestyle app. 40k+ left.

Just registered at 10.30pm, goes through and accepted.

I couldn’t register through both iBanking and the lifestyle app, but I finally managed to register through iBanking on my laptop.

Just registered through DBS lifestyle app, so the 50k cap not hit yet

registered via online banking and within the 50K

I managed to sign up using desktop version of browser on my mobile

You mean one get 8% back and still earn miles?

Yes. This is like a promotional event.

Does youtrip count? Don’t think so but just asking in case

I did a $10 top up with Altitude visa card to test out, not counted for online spend in this promotion.

Base miles were awarded.