Citibank has just launched a new miles purchase promotion for Citi Prestige cardholders that runs from 1 April to 30 June 2020. This allows them to buy miles at just 1.15 cents each.

Here’s how it works.

How to register

First, you’ll need to register. This can be done by sending the following SMS to 72484

PRESTIGESPEND<space>Last 4 digits of Citi Prestige card (principal card) number

By registering, you give consent to Citibank to deduct the relevant admin fee for the purchase of miles, as explained below.

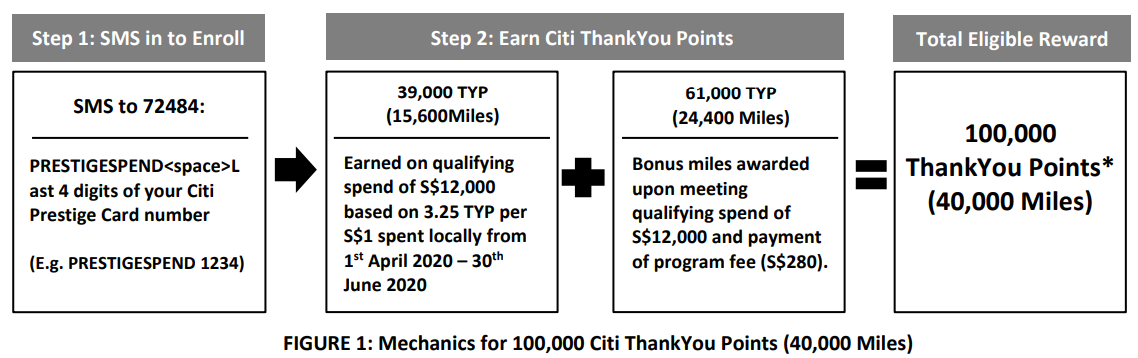

Tier A: Spend S$12,000, buy 24,400 miles for S$280

Under Tier A, cardholders need to spend at least S$12,000 by 30 June 2020. This earns them 39,000 base ThankYou points, or 15,600 miles.

By paying a one-time fee of S$280, they’ll be able to purchase a further 61,000 ThankYou points, or 24,400 miles. This works out to 1.15 cents per mile.

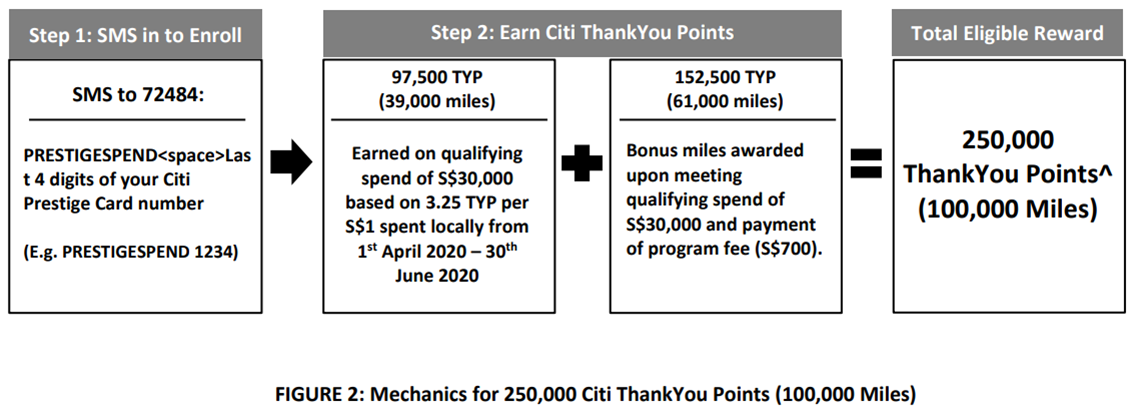

Tier B: Spend S$30,000, buy 61,000 miles for S$700

Under Tier B, cardholders need to spend at least S$30,000 by 30 June 2020. This earns them 97,500 base ThankYou points, or 39,000 miles.

By paying a one-time fee of S$700, they’ll be able to purchase a further 152,500 ThankYou points, or 61,000 miles. This works out to 1.15 cents per mile, the same as Tier A.

You are eligible for either Tier A or B. If you spend enough to qualify for Tier B, you can’t opt for Tier A instead.

The admin fee of either S$280 or S$700 will be automatically charged to your account within two months from 30 June 2020, if you meet the spending criteria. Obviously, if you fail to meet either Tier A or B’s spending criteria, you won’t be charged any fee.

What kind of spending qualifies?

As per the T&C:

| “Qualifying Spend” refers to any retail transactions (including internet purchases) which do not arise from (i) any Equal Payment Plan (EPP) purchases, (ii) refunded/ disputed/ unauthorised/ fraudulent retail purchases, (iii) Quick Cash and other instalment loans, (iv) PayLite/ FlexiBill/cash advance/ quasi-cash transactions/ balance transfers/ annual card membership fees/interest/goods and services taxes, (v) bill payments made using the Eligible Card as a source of funds, (vi) late payment fees and (vii) any other form of service/ miscellaneous fees. |

Based on past promotions, transactions like insurance, government payments, charitable donations and GrabPay top-ups will not earn you base miles, but will count towards the total spending threshold.

Citi PayAll spending will be eligible, which creates some interesting maths. The regular cost of miles through PayAll with a Citi Prestige is 1.54 cents each (2% divided by 1.3 mpd).

If you used PayAll to meet the S$30,000 spending threshold, then exercise the option to buy miles, you’d pay S$1,300 in total to purchase 100,000 miles, or 1.3 cents each.

| Amount Paid | Miles Earned | |

| 2% PayAll Fee (Based on S$30K) |

S$600 | 39,000 |

| Miles Purchase Fee | S$700 | 61,000 |

| Total Spend | S$1,300 | 100,000 |

| Cost Per Mile | 1.3 cents | |

The math is the same if you went for the S$12,000 target instead.

| Amount Paid | Miles Earned | |

| 2% PayAll Fee (Based on S$12K) |

S$240 | 15,600 |

| Miles Purchase Fee | S$280 | 24,400 |

| Total Spend | S$520 | 40,000 |

| Cost Per Mile | 1.3 cents | |

I suppose that if you have an income tax payment coming up and intend to pay it with PayAll anyway, this provides an option to further top up your miles.

Is it worth it?

Here’s a summary of the various ways of buying miles in Singapore:

[table id=4 /]

During regular times, I’d say that buying miles at 1.15 cents each would be a no-brainer. However, these times are anything but regular. With all travel plans on hold indefinitely, it’s hard to say when we’ll get to fly again.

I guess it comes down to what you think will happen after the dust settles. ThankYou points on the Citi Prestige never expire, but the question is whether we’ll see a spate of program devaluations as airlines try to shore up their balance sheets.

The good thing about ThankYou points is they let you hedge your bets. Citibank has 11 different transfer partners, so you’re less vulnerable to a devaluation by any given airline (versus, say, OCBC which only partners with KrisFlyer).

| Transfer Ratio (Points: Miles) |

|

|

5:2 |

| 5:2 | |

| 5:2 | |

|

5:2 |

|

5:2 |

|

5:2 |

|

5:2 |

|

5:2 |

|

5:2 |

|

5:2 |

|

5:2 |

| 5:2 |

Conclusion

If you’ve got upcoming big ticket spending planned and want to give your miles account a shot in the arm, I can think of few cheaper ways to do so.

However, if you’re already well stocked with miles, this may not be the ideal time to load up on more.

I guess this goes without saying, but easy to miss out upon. The promo miles take upto 8 weeks from closure of the campaign to be credited to your account. So if your Prestige CC is coming up for renewal, and you are not sure about renewing.. factor that in, before signing up for this campaign. Last thing you’d want to do is spend up the 30k, earn your 1.3 mpd, and then have your CC expire before the promo miles get credited. Some of you might think it’s a no brainer. But your’s truly did that math AFTER he… Read more »

yeah, that’s a good point. especially if you dont fancy plonking down another $535 in the current environment…

I may be wrong but payment via cardup will give base miles. I think I tried it before.

From Cardup’s FAQ:

“All spend made through CardUp are eligible for the base earn rate* of miles (up to 1.6 miles per dollar), points or cashback (up to 5% cashback) on most credit cards, including for payments such as insurance premiums and taxes.”

In this case for Citi Prestige it would be 1.3 miles/dollar.

With Cardup’s 2.2% you would be buying miles for 1.36c?

Yes, Cardup would earn base miles and count towards spending criteria. But why would you pay 2.25% with Cardup when you can pay 2% with Payall? Unless Payall doesn’t support the payment in qn

Oh, Ya was thinking about insurance payment.

Thanks to your help, I could join the last year-end campaign and hit the lower target. The bonus point has finally issued recently. Combined this and the wealth of know-how on this website, I could earn 300k points since last July.

Hi Aaron, do u think charitable donations will contribute to the min spend even if it doesn’t earn any miles on its part?

Overseas spending: does it qualify? The terms don’t mention it at all. I have some big USD purchases coming up which would help to hit the spending requirement. Thanks