Amidst all the chaos and uncertainty of Covid-19, there’s something strangely comforting in knowing that no matter what happens, your taxes will still need to be paid.

Tax season is here again, and it’s time to look at this year’s options for earning miles on what could very well be a substantial outlay.

Individuals with income tax obligations will need to file their taxes between 1 March and 31 May 2020. They’ll subsequently receive their tax bill (NOA) between the end of April and September 2020. IRAS sends NOAs in batches, so don’t feel left out if everyone else gets theirs before you do.

| Certain individuals may be able to opt for early assessment, in which case their NOA could arrive as early as March/April |

How do I pay my income tax bill with a credit card?

IRAS doesn’t accept credit card payments. In their own words:

Credit card payments are not offered by IRAS directly because of the high transaction costs charged by the credit card service providers. This is to keep the cost of collection low to preserve public funds.

Fair enough. However, this doesn’t mean you can’t use your credit card to pay taxes. Thanks to demand, tax payment facilities have been created, allowing cardholders to earn rewards in exchange for a small fee.

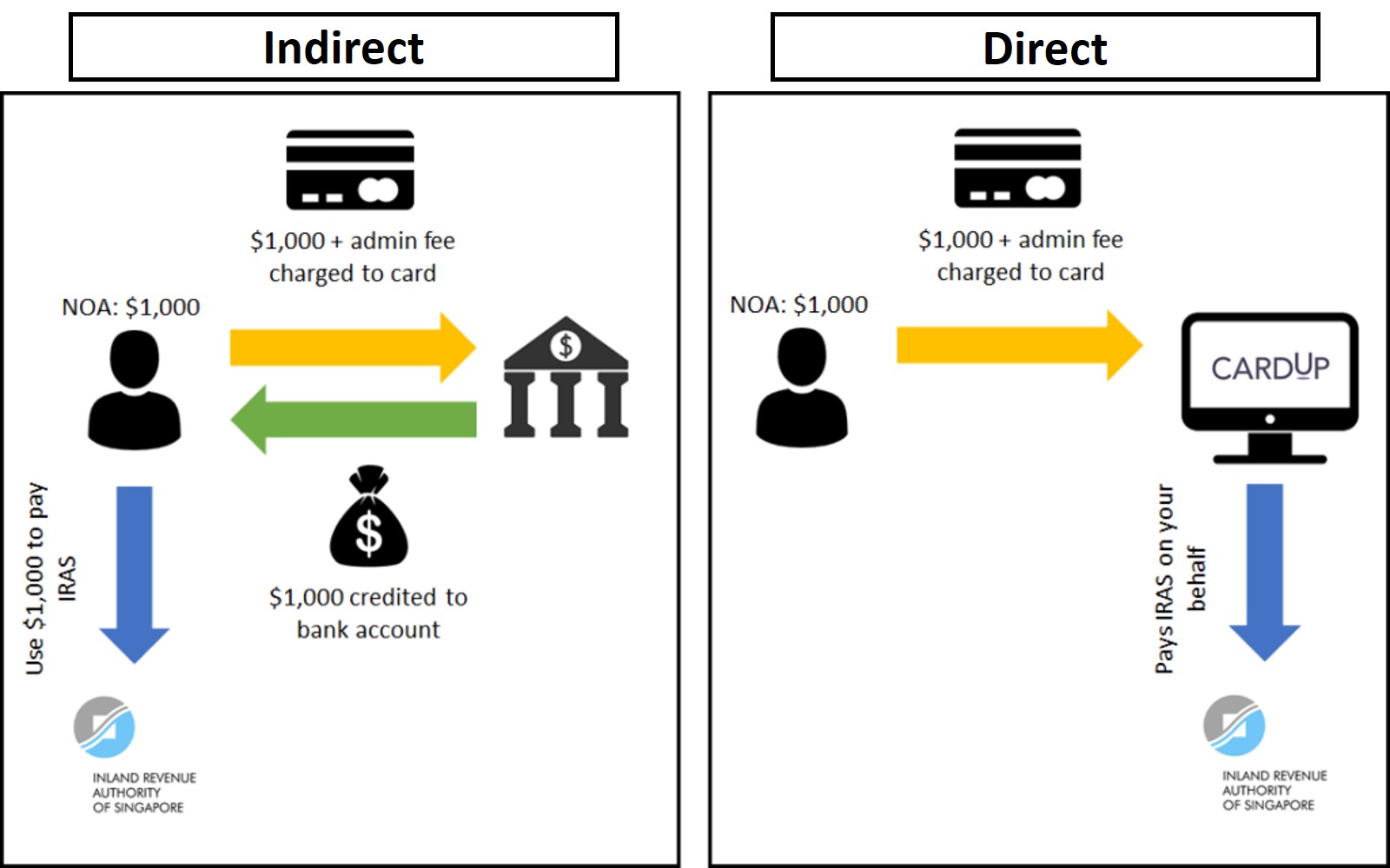

There are two types of tax payment facilities:

| Indirect Payment Facilities | Direct Payment Facilities |

|

|

Both work the same in the sense that you submit your NOA*, and your credit card is charged for the amount due plus an admin fee.

| *Technically speaking, not all facilities require you to submit an NOA…we’ll get to that later |

Where they differ is that an indirect payment facility deposits the amount due into your designated bank account, in cash. You’re still responsible for paying IRAS.

With a direct payment facility, the facility provider pays IRAS on your behalf.

Whether it’s better to use an indirect or direct facility all comes down to the cost per mile- the admin fee, divided by the miles you receive on your card.

Regardless of which one you pick, some common rules apply:

- You can’t pay someone else’s tax bill, only your own

- You can’t pay more than the amount shown on your NOA

In this post, we’ll look at which option gives the lowest cost per mile.

What are the fees involved?

As mentioned, it’s not free to use your credit card to pay income tax. There’s an admin fee involved, which varies depending on provider.

| List of Payment Facilities |

||

| Bank | Applicable Cards | Admin Fee |

| Premier Mastercard, Visa Platinum, Revolution, Advance, Visa Infinite | 0.5-1.5% | |

Link Link |

All BOC cards | 1% (No rewards points) |

| Visa Infinite | 1.6% | |

| All Cards | 1.75% for Milelion readers (see below) |

|

| VOYAGE | 1.9% | |

| PRVI Miles, Visa Infinite Metal, Reserve | 1.9-2% | |

Link Link |

All Citibank cards | 2% |

Link Link |

All SCB cards | 2% |

| All DBS cards | 3% | |

| Key | Indirect | Direct |

| *UOB payment facilities are not specifically designed for tax, but can be used for this purpose. However, it’s cheaper to use CardUp (see below) | ||

It may be tempting to compare them on the basis of admin fees, but that’s only half the story. You need to also consider the earn rate.

For example, the HSBC Premier Mastercard has an admin fee of 0.5% and an earn rate of 0.4 mpd, so your cost per mile is 1.25 cents. On the other hand, the SCB Visa Infinite has a higher admin fee of 1.6%, but also a much higher earn rate of up to 1.4 mpd, resulting in a lower cost per mile of 1.14 cents.

In the same way, the UOB PRVI Pay facility has a 2% fee, but the PRVI Miles card only earns 1 mpd through it, resulting in a cost of 2 cents per mile. In contrast, CardUp has a higher fee of 2.25%, but the PRVI Miles card earns 1.4 mpd here, resulting in a lower cost of 1.57 cents per mile.

What’s the cheapest option for paying tax with a credit card?

|

👍 CardUp is running a promotion for Milelion readers, which allows them to pay tax with just a 1.75% fee. Use the promo code ML175TAX20. This applies to all Singapore-issued Visa and Mastercards. Payment must be scheduled by 25 August 2020 If you want to use an AMEX card, the promo code AMEXTAX24 will give you a fee of 2.4%. This only applies to American Express issued AMEX cards (i.e not DBS/UOB). Payment must be scheduled by 23 July 2020 |

If that’s too much math for you, here’s the summary table. In the interest of space, I’ve only listed the cheapest option possible for each card.

| Summary of Tax Payment Options |

||||

| Card | Pay Via | Fee | MPD | CPM |

DBS Insignia DBS Insignia |

CardUp | 1.75% | 1.6 | 1.07 |

UOB Reserve UOB Reserve |

CardUp | 1.75% | 1.6 | 1.07 |

OCBC VOYAGE OCBC VOYAGE(Premier & PB) |

CardUp | 1.75% | 1.6 | 1.07 |

Citi ULTIMA Citi ULTIMA |

CardUp | 1.75% | 1.6 | 1.07 |

SCB Visa Infinite SCB Visa Infinite |

Bank | 1.6% | 1.41/ 1.0 |

1.14/ 1.6 |

AMEX Centurion AMEX Centurion |

CardUp | 2.4% | 1.952 | 1.2 |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

CardUp | 1.75% | 1.4 | 1.23 |

UOB PRVI Miles Mastercard UOB PRVI Miles Mastercard |

CardUp | 1.75% | 1.4 | 1.23 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

CardUp | 1.75% | 1.4 | 1.23 |

HSBC Premier Mastercard HSBC Premier Mastercard |

Bank | 0.5% | 0.4 | 1.25 |

HSBC Visa Infinite HSBC Visa Infinite |

Bank | 1.5% | 1.253/ 1.0 |

1.28/ 1.61 |

OCBC VOYAGE OCBC VOYAGE |

CardUp | 1.75% | 1.3 |

1.32 |

Citi Prestige Citi Prestige |

Cardup | 1.75% | 1.3 | 1.32 |

Citi PremierMiles Citi PremierMiles |

PayAll | 2% | 1.5 | 1.33 |

SCB X Card SCB X Card |

CardUp | 1.75% | 1.2 | 1.43 |

DBS Altitude Visa DBS Altitude Visa |

CardUp | 1.75% | 1.2 | 1.43 |

OCBC 90N OCBC 90N |

CardUp | 1.75% | 1.2 | 1.43 |

KrisFlyer UOB KrisFlyer UOB |

CardUp | 1.75% | 1.2 | 1.43 |

AMEX Platinum Charge AMEX Platinum Charge |

CardUp | 2.4% | 1.562 | 1.50 |

BOC Elite Miles BOC Elite Miles |

CardUp | 1.75% | 1.0 | 1.72 |

HSBC Revolution HSBC Revolution |

Bank | 0.7% | 0.4 | 1.75 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

CardUp | 2.4% | 1.2 | 1.95 |

| 1. 1.4 mpd if ≥S$2K spent in a statement period, 1.0 otherwise 2. Promotional rate until 20 July 2020 3. 1.25 if ≥S$50K spent in previous membership year; 1.0 otherwise |

||||

I’ve not shown any options that cost more than 2 cents per mile (so no Citi Rewards Visa for example), because that’s the limit which most people are willing to buy miles. Your ceiling will of course depend on how you value a mile.

A few points to note.

Apply for as many facilities as you want

If you hold more than one of the cards above, there’s nothing stopping you from applying for multiple tax payment facilities in order to buy more miles (otherwise known as churning).

For example, someone with a S$10,000 tax bill who holds both the SCB Visa Infinite and HSBC Visa Infinite could send the same NOA to both SCB and HSBC. Upon approval, he/she would buy up to 26,500 miles (14,000 from SCB, 12,500 from HSBC) for S$310 (S$160 from SCB, S$150 from HSBC).

Take particular care if you’re applying for two direct payment facilities, however, because there’s a chance you might end up overpaying your tax bill. “What’s wrong with funding the government’s working capital?” you may ask. Well, IRAS has to arrange for a refund, and it apparently scolds the sender in the process. Hence this line in the Citi PayAll T&Cs:

| Where we have determined in our discretion exercised reasonably that your Payment(s) to IRAS exceed the amount of taxes which you are required to pay to IRAS, we shall be entitled to claw back any rewards credited to your card account in connection with any amount so overpaid to IRAS using the Service. In such an event, we will refund the relevant portion of Fee in respect of such overpaid amount. |

There’s no chance of this happening with indirect payment facilities, because the onus is on you to pay IRAS. What you do with the cash after it’s deposited into your account is your own business.

You can still use GIRO (in most cases)

IRAS allows taxpayers to split their payment into 12 interest-free installments via GIRO. This is great for maximizing your cashflow, and something I opt for each year.

There are no issues using GIRO if you opt for an indirect payment facility, as the bank simply credits the cash to your account and how you go about paying IRAS after that is up to you.

With direct payment facilities, it’s slightly trickier. You can’t use GIRO if you opt for CardUp, because they’ll charge your card for the full amount as shown on your NOA, and transfer that to IRAS. Your tax bill is paid off in one shot, and there’s no installments to speak of.

Citi PayAll and SC EasyBill, on the other hand, don’t request for your NOA. This means you could:

(1) Elect to pay your income tax via GIRO

(2) Make manual payments each month via PayAll/EasyBill, a few days before the scheduled deduction (6th of each month; where this is a weekend/public holiday, on the next working day)

As long as you don’t overpay your total tax bill (which triggers a refund from IRAS and a chiding from the bank), I don’t see any issues here. It’s OK to get the installment slightly wrong and pay more than what’s needed, so long as your total payment matches the total amount due.

Don’t forget about transfer partner variety

| KrisFlyer |  |

|

|

|

|

|

|

|

|

| Star Alliance | |||||||||

| ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

|

✅ | ✅ | ✅ | ||||||

|

✅ | ✅ | |||||||

|

✅ | ||||||||

| ✅ | |||||||||

|

✅ | ||||||||

| Oneworld | |||||||||

| ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |||

|

✅ | ✅ | |||||||

| ✅ | ✅ | ✅ | |||||||

| ✅ | ✅ | ✅ | |||||||

| ✅ | ✅ | ||||||||

| SkyTeam | |||||||||

| ✅ | ✅ | ||||||||

|

✅ | ||||||||

| Non-aligned | |||||||||

| ✅ | ✅ | ||||||||

| ✅ | ✅ | ||||||||

| Hotels | |||||||||

|

✅ | ||||||||

|

✅ | ||||||||

| ✅ | ✅ | ||||||||

| ✅ | |||||||||

When evaluating two cards with similar cost per mile figures, it’s helpful to think of qualitative factors as well.

For example, both the DBS Altitude and KrisFlyer UOB credit card will have a 1.83 cents per mile cost through CardUp. However, points earned on the DBS Altitude can be transferred to KrisFlyer, Asia Miles, Qantas Frequent Flyer and AirAsia BIG, while the KrisFlyer UOB card can only earn KrisFlyer miles. All things equal, the DBS Altitude wins for its greater flexibility.

If you need a refresher on who partners with who, check out this article.

Conclusion

Tax season is a great opportunity to buy miles, as that NOA opens up a lot of possibilities. Be sure to educate yourself on the full range of options available!

Hi Aaron,

Tax payment seems to be excluded from the promotion for SCB VI. You can refer to page 3, clause 6 of the T&Cs: https://av.sc.com/sg/content/docs/sg-vi-tc-full.pdf

thanks. perhaps it’s changed from last year. will update

I have used it with early assessment this month and points have already credited.

But was it credited at 1.4 miles per dollar or 1.0 mpd?

SCB informed me they no longer issue the Visa Infinite card; you can see there is no option to apply on their website though the card is still featured. I’m not sure if the current cardholders can still earn points for tax payment. For a very good alternative, HSBC is offering 35,000 miles on their Visa Infinite card for a limited time, which seems like a reasonable deal for an annual fee of $650 ($488 for Premier customers). The miles earning are unimpressive, but you get 2 limo/expedited immigration, unlimited Loungekey access for principal cardholder and up to 5 supplementary… Read more »

the tax payment form is still live on the site, so i’m assuming it’s available until it disappears.

yes, scb visa infinite has been discontinued: https://milelion.com/2020/01/23/rumour-standard-chartered-to-discontinue-scb-visa-infinite-card-from-1-feb/

Aiyo, just paid yesterday. Should have waited for the article and then the CardUp promo.

A non-monthly payment option such as Card Up means forgoing the IRAS policy of not charging interest for monthly GIRO payments. It’s not much but usually works out to about 54% of the prevailing bank savings or fd interest rate. For 1.1% fd rate and 10k tax bill it’s about $60 savings. At 1.5% and 100k tax bill it’s about $820 savings. At 2.2% with a 100k tax bill its about $1200 savings. Miles are nice but I wouldn’t leave money on the table. Monthly payall and easybill don’t really appeal to me from a convenience point of view (I… Read more »

How to activate the monthly payall? I login to the Citibank apps but there is only one option to pay one lump sum.

As I said it’s not convenient. You may have to get IRAS to allow non-GIRO installment and then do a Payall every month. Better not forget…… Not convenient at all. Makes life more complicated. Never done it before myself. I wouldn’t bother for smaller tax bill and for larger tax bill then tax-payer would probably qualify for the GIRO-friendly options.

Hi Aaron, is my understanding correct that in any case if you charge your tax to your credit card, you will have to pay it in full by the credit card next pay by date. In other words, you better have saved that money before starting this process, as for some people, it might be a significant amount of money. Correct?

yes…in a way. but what you’re really paying is the admin fee? e.g if my tax is $1,000 with 2% fee, i will be charged $1,020 on my card and given $1,000 of cash. i use the cash to pay back my bill. the $20 fee is my cost. i still OTOT pay IRAS.

Makes sense indeed. But that is only true of indirect payment facilities where you receive the cash, correct?In the case of direct payment facility like CardUp and if your tax is substantially more than the amount you quoted, if you get my drift, you need to “hedge” with own savings.

Looks like indirect payment with GIRO instalments is better if one doesn’t intend to pay a lump sum. Otherwise CardUp with credit card instalments but then I don’t think those qualify for miles. The problem is getting instalments instead of lump sum. Otherwise ask IRAS to allow non-GIRO instalments and then to a cardup/payall/easybill payment every month?

Correct- you need to schedule monthly Payall or easybill. Cardup they will only let you pay full amount- they have your noa. Payall /easybill does not ask for noa

Hi Aaron,

I am keen to explore manual installment of my income tax via the Citi PayAll program. However, I cannot find the option for monthly installment on the Citi App. Can you care to elaborate how I can do so to maximize earning miles on my Citi CC with the current 1.5 mpd promotion?

Should I clock miles on credit cards that can redempt more than 1 airline in case the only one is declared bankrupt and restructured happen with miles program, the lowest priority in their mind?

Hi, just wondering why the article doesnt mention ipaymy as an option, but only Cardup?

Perhaps because their CEO does things like this…

https://milelion.com/2018/08/12/responding-to-allegations-made-by-the-ipaymy-ceo/

just wondering … about your citi prestige comment that the promotion ends on 31 March . What happens if I prepay my tax to IRAS ? Does IRAS refund it ?

Probably. Then Citi would claw back the miles

Aaron, the DBS link points to a ‘direct’ one time payment option that can be converted into a 12 month installment plan, not an ‘indirect’ one like SC VI. One would still dither going down that route considering the cost per mile even if it were indirect; nonetheless you may want to fix it for the sake of accuracy?

yes! well spotted. have updated

Hi Aaron,

Like CW mentioned, with reference to the SCVI T&C on https://av.sc.com/sg/content/docs/sg-vi-tc-full.pdf, on Page 3, Clause 6(j):

The following transactions will not be considered as Qualifying Transactions and are not eligible for this

Promotion:

(j) tax payments charged to your eligible credit card

This means that tax payments charged to the SCVI will only earn the base 1mpd, and not the bonus 0.4mpd.

Hence, it will cost 1.6 CPM to use the SCVI Tax facility, is that right?

Thanks for clarifying!

if you spend more than 2k on your card, you earn 1.4 mpd on everything.

Just saw from SCB Singapore website I can apply for SCB VI (brown card) online, even though supposedly discontinued. One way to get some cheaper miles but have SCB VI annual fees……

the links should be gone. where are you looking?

I’m sorry. You are right. The link to apply has been removed from the webpage.

Just a DP, HSBC VI just charged my tax payment yesterday. There was an extra 7% GST on top of 1.5% fee, so its now 1.284mpd instead of 1.2mpd for those on “Tier2” earn rate. I checked to last year’s statement, the 1.5% fee last year included gst but this year its excluded gst.

this is very interesting indeed. able to send me a screenshot via contact us? i’ve never heard of GST being imposed on this (although technically the service itself should be subject to GST, the banks should be quoting gst inclusive pricing)

Is there a reason why for Citi Prestige in the table, you would choose PayAll over CardUp? The latter has a lower admin fee and doesn’t award fewer miles, from what I see.

good spot. previously, cardup’s 1.75% promo did not support citi cards. now it does- i updated citi ultima but missed out prestige. fixed now

Is it worth if my tax amount is less than 2,000? with HSBC Premier?

Hi! Is there gonna be a 2021 version ? Thanks!

there will be, but no one has announced their promos yet so we’ll have to wait.