If you’re a UOB PRVI Miles cardholder, you may have received a PRVI Pay offer in the mail.

On the surface, it offers the chance to buy miles at 1.95 cents each. That’s decent, but not life-changing. Before you throw it in the trash, however, what if I told you that it’s possible to cut the price to 1.35 cents each?

How does UOB PRVI Pay work?

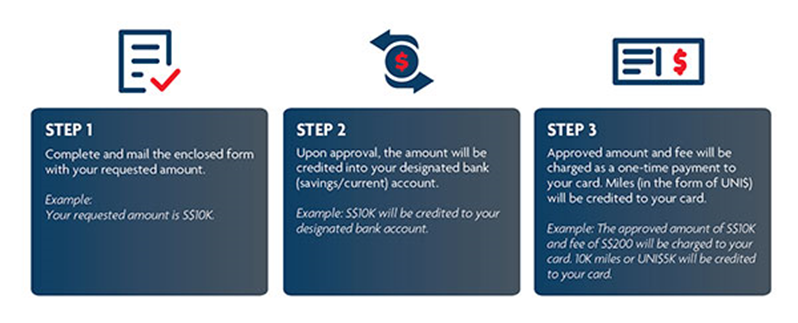

First, a quick refresher.

PRVI Pay is UOB’s “no-questions-asked” miles purchase facility. Unlike similar facilities offered by Citibank and SCB, you don’t need a tenancy agreement, tax bill, MCST invoice or any sort of documentation to use it.

A cardholder may opt to charge, say, S$10,000 to the PRVI Pay facility. That amount is deposited in cash into his designated bank account, after which S$10,195.50 (assuming a 1.95% fee) is charged to his UOB PRVI Miles Card. He is awarded UNI$2.5 for every S$5 (i.e 1 mpd) charged to the facility (excluding the admin fee).

The cardholder takes the S$10,000 to pay off his card bill. He’s then out of pocket S$195.50, for which he received 5,000 UNI$ (10,000 miles)= an effective cost per mile of 1.95 cents each.

UOB PRVI Pay’s targeted offer

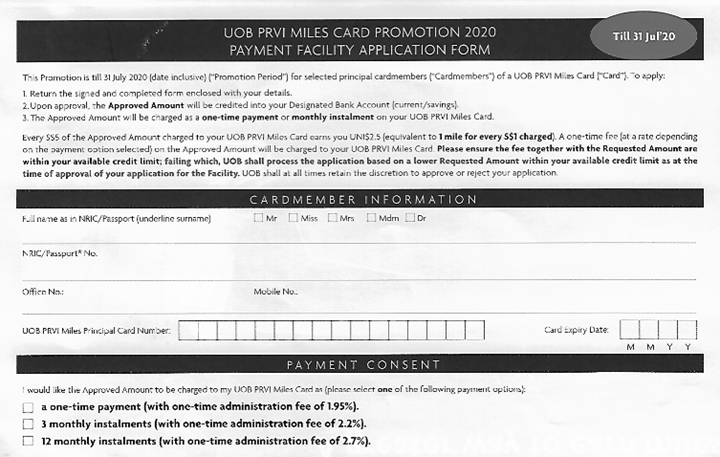

From now till 31 July 2020, targeted UOB PRVI Miles cardholders can choose from three different PRVI Pay payment plans:

- One-time payment: 1.95%

- 3-month payment: 2.2%

- 12-month payment: 2.7%

Now, you could take the one-time payment option and walk away with paying 1.95 cents per mile, as I illustrated above. But the return of the 12-month plan creates an opportunity to offset the cost of your miles, lowering the effective cost to ~1.35 cents each

How does it work?

- Apply for S$10,000 using the UOB PRVI Pay facility and pick the 12-month option. With a 2.7% fee, you’ll pay a total of S$10,270 over 12 months, and receive S$10,000 in your designated bank account.

- Take the S$10,000 and put it in a SingLife account, which earns you 2.5% p. a on the first S$10,000. The 2.5% p.a rate is subject to change in the future, but you can withdraw your funds immediately without penalty should that happen

| SingLife is a capital-guaranteed insurance savings plan that offers 2.5% p.a on the first S$10,000, and life insurance coverage. I don’t earn anything from them (except interest). |

Each month you’ll repay S$833 to UOB (S$10,000÷12, with an extra S$270 in the first month to cover the admin fee), but you’ll also earn interest on the cash parked with SingLife.

Let’s assume you take out S$833 from the SingLife account each month to offset the repayment to UOB.

If my maths is correct, your equation should look something like this:

| Month | Charged to Card | UNI$ from UOB |

SingLife Balance |

Interest from SingLife @ 2.5% p.a |

| 0 | S$10,000 | |||

| 1 | S$1,103* | 415 | S$9,167 | S$20.83 |

| 2 | S$833 | 415 | S$8,333 | S$19.10 |

| 3 | S$833 | 415 | S$7,500 | S$17.36 |

| 4 | S$833 | 415 | S$6,667 | S$15.63 |

| 5 | S$833 | 415 | S$5,833 | S$13.89 |

| 6 | S$833 | 415 | S$5,000 | S$12.16 |

| 7 | S$833 | 415 | S$4,167 | S$10.42 |

| 8 | S$833 | 415 | S$3,333 | S$8.69 |

| 9 | S$833 | 415 | S$2,500 | S$6.95 |

| 10 | S$833 | 415 | S$1,667 | S$5.21 |

| 11 | S$833 | 415 | S$833 | S$3.48 |

| 12 | S$833 | 415 | S$0 | S$1.74 |

| S$10,270 | 4,980 (9,960 miles^) |

S$135.47 | ||

| *The S$270 admin fee is charged in full with the first installment ^ You don’t actually earn 10,000 miles because of UOB’s rounding policy- your monthly installment is S$833, but it’s rounded down to S$830 when calculating UNI$ |

||||

All in all, you’ll earn S$135.47 in interest, which offsets the S$270 fee to give a net cost of S$134.53.

You’ll also receive a total of 4,980 UNI$ (9,960 miles), which means you’ve basically paid 1.35 cents per mile.

Other alternative strategies

If you’re able to earn more than 2.5% p.a on the funds from UOB, your cost per mile naturally decreases.

Assuming you’re still on the BOC SmartSaver account and you’re willing to meet all the conditions for bonus interest, you could earn up to 3.55% p.a, or S$192 of interest. This reduces your cost per mile even further to 0.78 cents each.

Of course, this requires that you spend at least S$1,500 a month on the now-nerfed BOC Elite Miles World Mastercard (or any other BOC card), and given its dismal 1/2 mpd earn rates for local/overseas spend, you’ll have to factor in the opportunity cost of lost miles too.

Conclusion

The catch of this method, if you want to call it that, is that you’re limited to buying 10,000 miles if you take the SingLife route (because only the first S$10,000 earns 2.5% interest).

However, if you’re able to make the BOC SmartSaver work for you, you’re looking at 3.55% interest on the first S$60,000 (not to mention a lower cost per mile), which means the opportunity to buy up to 60,000 miles. It’s a relatively low-cost way of buying miles, and well worth considering if you’re in the market.

Don’t get too hung up on these two methods specifically. You’re perfectly welcome to find other uses for the UOB PRVI Pay funds that yield a higher return and help lower the cost of miles.

Interest rates aren’t guaranteed, so you’re taking on a huge risk here. Unless you manage to find something that would give guaranteed interest, like a short-term endowment plan, I’d pass.

Short term endowment plans would not let you extract the money until maturity. Singlife lets you take it out anytime. If the interest rates are cut later on, take out the money and you’ve still reduced the net cost of the miles by the interest you earned until the point it was cut. It’s hardly a huge risk, in my opinion

Too much hassle for too little miles… a no-brainer pass

I guess we’ll have to agree to disagree on this. Interest rate risk is too large at this point in time for me to take. I have no idea how Singlife and BOC are sustaining their interest rates…

Also, there are short-term endowment plans that allow you to take your money out. Case in point: ELASTIQ by Etiqa. Only a 3 month lock-in period and you get 1.8% guaranteed for 3 years.

The SingLife account is a fairly new product to the market. As with many new products, it would not be surprising if the company is taking a loss on the initial promotional terms in the hope of getting longer-term customers after the initial publicity.

The Singlife account is a short term (ie. 1 year) endownment plan of sort. The principle amount (10k) is available for withdrawal anytime however interest, while accrued daily, can only be withdrawn at the policy anniversary.

Thank you for this clarification. I might have missed it but I don’t recall Aaron mentioning this bit about only being able to withdraw the interest at the end of the policy year.

No, that’s not true. I’ve been withdrawing my interest from there every month.

Anyone managed to get or know where to get this app form?

Ur letter box

FWIW Singlife was founded 2014 and was worth about $150 million in total Dec 2018 (yes someone bought 33% of the whole company for $52 million, only!). SingLife credit rating is BBB. Great Eastern, Prudential and AIA typically have credit ratings of AA- thereabouts. DBS bank is AA- and CIMB Bank is A-. Great Eastern is the smallest of this bunch and market cap is about $9 billion. I like to bank with bigger banks. Just saying. BUT Below 75K SDIC will guarantee deposits with Singlife I think…..someone correct me if I’m wrong. Still I like to bank with bigger… Read more »

The SingLife account is NOT a deposit product. SingLife is licensed as an insurer and not a bank – if it were to offer true standalone deposit products, it would need to obtain a licence under the Banking Act. It is first and foremost an insurance policy, but it allows the policyholder more flexibility and ways of using the cash value from the premium that the policyholder pays SingLife.

think it’s pretty clear was comparing to great eastern, prudential and aia…..anyway singlife’s apparently covered by Singapore DEPOSIT Insurance Corporation, same one as for banks. Not a deposit product but maybe trying to be a bit like one…. that’s their idea of ‘disrupting’ the insurance industry, is it? or was it something else they were trying to disrupt. the peace maybe. anyway silly me I like to insure (bank? deposit? whatever?) with bigger insurers too, instead of 6 year old unlisted co with recent single investor buyouts (33%) and credit ratings several tiers below mainstream insurers. safe money in safe… Read more »

Instead of looking to SDIC’s name, you should look at the actual law behind SDIC to understand why SDIC got its name.

methinks you’re a troll or maybe you work for singlife….. probably even? aaron’s creative riff on the fixed deposit roll using singlife is precisely by using it as a deposit instrument for 2.5% to partially finance the miles. The actual instrument is less relevant than the intention but of course if you can’t see that or if you think he’s using the ‘life insurance coverage’ part of Singlife for this purpose …….er, how? Sigh. It’s a bit irritating. I already said it’s not a deposit product. you aren’t the only one aware of the requirements for finance co, banks, insurers,… Read more »

isn’t it that better that I just park 10k in singlife and opt-in for the 1.9% one time payment, that should give me a 0.6% positive return right?

You need to pay the full amount, plus 1.9% interest after 1 month (one time charged to cc bill)

But you will only get the interest from singlife after 1 year…so u need to keep it inside.

Meaning you suddenly need to find another 10k out of nowhere to pay that cc bill, isn’t it?

Correct me if I’m wrong.

SingLife does credit interest monthly, on the ‘monthsary’ of your account opening date. What is not guaranteed is the 2.5% interest rate

Shall not wade into the debate on the risks of SingLife and falling interest rates. To me the only question is whether I need more miles at this point in time.

But I must say Aaron is getting quite creative here.

the so called “fixed d roll” has been around for a long time already actually. back when interest rates on fixed d were higher people would do exactly this and get cheap miles

an overall thought: it’s probably true that the above is a bit too much to do for 10,000 miles, but this assumes you take the singlife route. the general principle here is that UOB is giving you a 12-month loan for a total cost of 2.7%. what you do with that money can help offset the cost of your miles. put it in fixed dep. put it in singlife. put it in the stock market. whatever suits you- so long as your return >2.7%, you get miles for free. easier said than done, of course, but there’s some low hanging… Read more »

well said. agree 100% some people have made money since march april buying blue chips with personal loans and maxxing out card limits. too aggro for me but hey, they all got rich if they’d stopped by May. tend to agree with adam on no risk, but also with no brainer on the hassle. IF i made the effort for this then i’d probably go all the way for at least 100K (max out the limit) free miles rather than partial payment, esp since i personally (personally!) find singlife +/- and it doesn’t work for > 10K miles. But to… Read more »