Pre-registration for DBS’s Go Online, Go Contactless promotion is now open. This promotion runs from 1 July to 31 August 2020, and registrants can enjoy up to S$160 of cash credits or e-vouchers.

If you don’t have a DBS credit card, remember that you can get S$220 cash when approved as a new-to-bank customer, from now till 10 July 2020.

Get S$220 cash upon approval for a DBS card

DBS Go Online, Go Contactless promotion

DBS cardholders need to register either via ibanking or the DBS Lifestyle app.

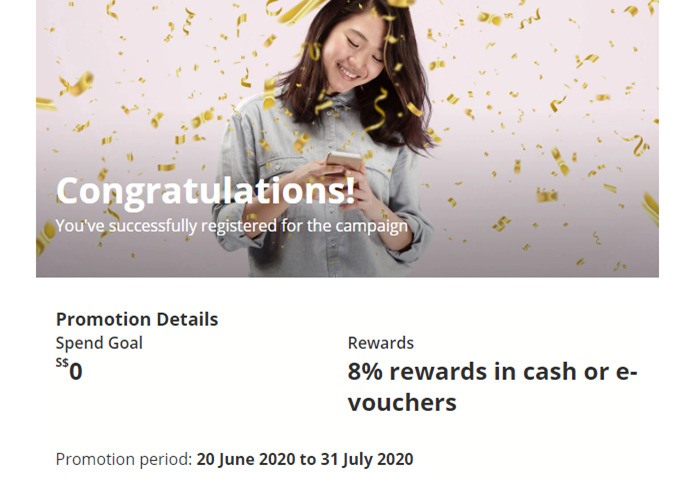

The first 30,000 registrants to register will receive a personalised spend goal. This is based on how much you spent online on average from Feb to May 2020.

| Tier | Spend Goal | Reward |

| 1 | S$200 | S$16 cash or e-voucher |

| 2 | S$400 | S$32 cash or e-voucher |

| 3 | S$900 | S$72 cash or e-voucher |

| 4 | S$2,000 | S$160 cash or e-voucher |

| ⚠️ Your spend goal isn’t S$0 |

|

Do note that if you register in June, you’ll initially see your spend goal reflected as S$0. Don’t get too excited- you’ll need to come back on 1 July to see your actual spend goal.

|

Cardholders then need to hit their spending goal either in Qualifying Period 1, Qualifying Period 2, or both. Upon meeting the target, they’ll get 8% of their spend goal back in the form of cash credits or e-vouchers. They can receive one reward for each qualifying period, and only need to register once.

| Spend Period | Redemption Period | |

| Qualifying Period 1 | 1 -31 Jul 2020 | 1 Jul-31 Aug 2020 |

| Qualifying Period 2 | 1-31 Aug 2020 | 1 Aug-30 Sep 2020 |

The spending target can be hit with online/in-app purchases or contactless spending at any merchant except the following:

|

a) bill payments and all transactions made via AXS (except Pay+Earn), SAM and eNETS; |

Contactless spending includes transactions made with Apple/Samsung/Google Pay. Your spending will be combined across all your DBS/POSB credit cards. Supplementary cardholder spending will accrue to that of the principal cardholder.

What gifts are available?

Here’s the full list of gifts and the quantity available for each Qualifying Period.

| Qualifying Period 1 | Quantity |

| S$16 cash or e-voucher (KFC/ Comfort Taxi/ iShopChangi) | 8,214 |

| S$32 cash or e-voucher (Shopee/Comfort Taxi/ iShopChangi) | 6,367 |

| S$72 cash or e-voucher (Lazada/ Shopee/ iShopChangi) | 6,017 |

| S$160 cash or e-voucher (Lazada/ Shopee/ Zalora/ iShopChangi) | 9,402 |

| Qualifying Period 2 | Quantity |

| S$16 cash or e-voucher (foodpanda/ Lazada/ Shopee/ KFC/ Comfort Taxi/ Zalora | 8,214 |

| S$32 cash or e-voucher (foodpanda/ Lazada/ Shopee/ Comfort Taxi/ Zalora | 6,367 |

| S$72 cash or e-voucher (Lazada/ Shopee/ Zalora/ iShopChangi) | 6,017 |

| S$160 cash or e-voucher (Lazada/ Shopee/ Zalora/ iShopChangi) | 9,402 |

Cash gifts will be credited to the qualifying cardholders account by 60 days after the end of each Qualifying Period. e-Vouchers need to be redeemed through the DBS Lifestyle app. You’ll play a mini-game and receive one of the vouchers at random.

Each of the vouchers have their own conditions, which you can view in the full promotion T&Cs. The FAQs can be found here.

What card should I be using to hit my spending goal?

For online spending, you’ll definitely want to use your DBS Woman’s World Card for 4 mpd, capped at the first S$2,000 each month.

For contactless spending, the DBS Altitude would earn the usual 1.2 mpd for local currency spending.

Conclusion

Most miles chasers will anyways be using their DBS Woman’s World Card for all online spending, so this adds an extra 8% rebate on top of the usual 4 mpd.

Spending does not count until you have registered, so take two minutes to do it now.

Hi Aaron after reading the FAQ and T&Cs it’s a bit unclear to met (or I’m being dense): am I allowed to pick the cash option (which is the most desirable) or does DBS decide for me via the “game” whether I receive cash or one of the vouchers?

Am I also right in understanding that anyone who hits his target will receive an award matching that target tier? The fact that there are quantities attached to each gift suggests otherwise and is rather worrying.

Nope, Dbs decides what you get. Otherwise everyone would go for cash!

I didn’t do the maths, but when you add up there should be 30k or so gifts- enough for everyone who registers

That makes a lot of sense. Thanks for the sanity check.

For folks who don’t spend on DBS cards like me, after I signed up, my personal spent goal is $0 )<:

And I thought “Why would Aaron state the obvious in his article”…

The spending goal will be updated on July 1, isn’t it

I think if you don’t spend, u will most likely get the lowest spending goal instead of “0”

It says in the tnc that contactless spend are transactions which are $200 and below. Sigh

Promotion is extend for September.

Btw, something unrelated but I would just like to confirm, for the following promotion.

https://www.dbs.com.sg/personal/cards/promotions/sg-30firstsep20la.page?cid=sg:en:cbg:dbs:mob:own:eng:pn:rewards:cards:na:sg-30firstsep20la

Say I redeem $10 with 1000 DBS points and I will receive $7 cashback on first redemption.

Meaning the value I get is 1.7cents per point, is that correct.. so still not so worth it, did I calculate correctly?