In March this year, DBS launched an online spending promotion for DBS Altitude cardholders, which allowed them to earn up to 4 mpd on online spending from 3 March to 30 June 2020, subject to meeting a “personalised spend goal”.

DBS has extended now this offer till 31 August 2020, and added offline shopping as an eligible bonus category. The cap on registrations has also been increased from 10,000 to 12,000.

Earn 4 mpd on online and offline shopping with the DBS Altitude Card

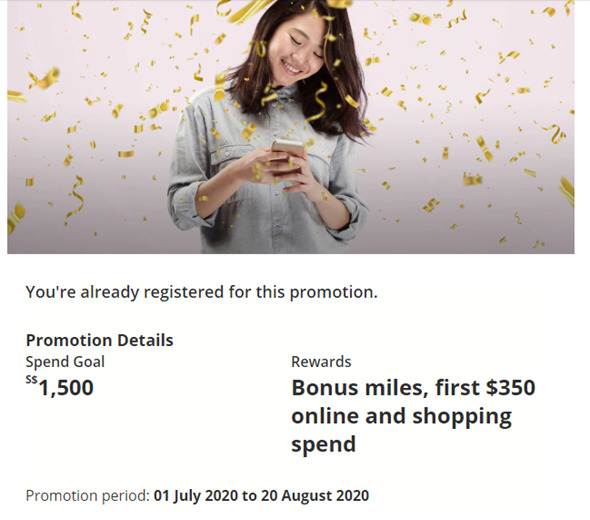

DBS Altitude cardholders will first need to register via DBS iBanking or the DBS Lifestyle App. They’ll then receive a personalised spend goal and reward for meeting it. Only transactions made from the date of registration will count, so be sure to register, even if preemptively.

My spend goal was S$1,500 per month, for which I’d earn up to 4 mpd on the first S$350 of online and shopping spend each month.

There will be variants of this offer floating around, but I find it hard to get excited about earning up to 4 mpd only on S$350 out of S$1,500 of spending.

You’ll notice I’ve been saying “up to 4 mpd”. That’s because of how the promotion is structured. Cardholders actually earn double miles, and they’ll only earn 4 mpd if they spend in foreign currency. If you spend in local currency, you’re looking at a very anemic 2.4 mpd.

| Local Currency Online or Shopping | FCY Online or Shopping | |

| Base | 1.2 mpd | 2.0 mpd |

| Bonus | 1.2 mpd | 2.0 mpd |

| Total | 2.4 mpd | 4.0 mpd |

Bonus miles will be credited within 90 days from 31 August 2020. The full T&C can be found here, and FAQs can be found here.

| 💳 Separate offer for new cardholders |

|

If you don’t already hold a principal DBS Altitude card, and haven’t cancelled one in the past 12 months, you’re eligible for a separate offer. Your spending goal will be S$3,000, for which you’ll receive up to 4 mpd on the first S$600 of online and offline shopping spending. All the other details such as spending periods and exclusions are the same as for existing customers. Until 10 July, DBS is offering S$220 cash upon approval for the DBS Altitude card. Apply through these links (Altitude AMEX | Altitude Visa) and use the code SHOP220 |

What kind of spending qualifies?

To avoid confusion, it’s helpful to think about two different spending amounts:

- the spending goal (qualifying spend)

- the reward spending (online spend and offline shopping spend).

For example, my spend goal is S$1,500, for which I’ll a reward of up to 4 mpd on S$350 of online spend and offline shopping spend.

Spending Goal

Your spending goal can be met by any kind of retail spending, either online or offline, in local or foreign currency. The usual exclusions for cash advances, balance transfers, AXS payments, SAM bill payments and fees apply.

Reward

If you hit the spending goal, you’ll be entitled to earn a reward up to 4 mpd on online spending or offline shopping spending.

Online spending excludes the following categories:

|

The particular exclusions to take note of are online flight and hotel transactions, as well as payments to CardUp, ipaymy and GrabPay.

Offline shopping is limited to transactions made at merchants with the following MCCs:

| MCC | Description |

| 5311 | Department Stores |

| 5611 | Men’s and Boy’s Clothing and Accessories |

| 5621 | Women’s Ready to Wear |

| 5631 | Women’s Accessory and Specialty |

| 5641 | Children’s and Infant’s Wear |

| 5651 | Family Clothing |

| 5655 | Sports and Riding Apparel |

| 5661 | Shoes |

| 5691 | Men’s and Women’s Clothing |

| 5699 | Misc. Apparel and Accessory |

| 5948 | Luggage and Leather Goods Stores |

Is this promotion worth it?

Nope.

I don’t think you should have to jump through so many hoops to earn 4 mpd on online spending and shopping, when there’s an abundance of alternatives out there:

| Online Spending | Remarks | |

DBS Woman’s World Card DBS Woman’s World Card |

4 mpd | Capped at S$2K per month |

Citi Rewards Visa Citi Rewards Visa |

4 mpd | Excludes travel. Capped at S$1K per statement period |

OCBC Titanium Rewards OCBC Titanium Rewards |

4 mpd | For online shopping. Capped at S$12K per membership year |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

4 mpd | For online shopping and entertainment. Capped at S$1,110 per month |

Any of the cards above would give you 4 mpd from the first S$1, with more generous caps and fewer exclusions.

You also need to take into account the opportunity cost of using the DBS Altitude to hit the spending goal. If you hold the UOB PRVI Miles Card, for example, you’re losing out on 0.2/0.4 mpd for every S$1 spent on local/FCY transactions.

Conclusion

By all means register if you’re curious to see what your targeted spending goal is, but I just can’t see any scenario in which this would be worth switching away from your existing online spending card.

The biggest problem here is that you’ll have to spend in foreign currency to trigger the 4 mpd, and even then you’ll only earn it on a very limited portion of your spending. It’s simply too much complication for too little payoff.