Well, you can’t say it hasn’t been a long time coming.

Back in February, I posed the question “What happens when there’s no more credit card rewards for GrabPay top-ups?“

It appears we’re about to find out, because Visa has changed GrabPay’s MCC to a quasi-cash merchant. This effectively closes the door for credit card rewards, and could be the death knell for the GrabPay Mastercard (at least among miles chasers).

What’s happened to GrabPay top-ups?

Up until last week, it was still possible to earn points for GrabPay top-ups with Visa cards. That’s because Visa processed these transactions under MCC 7399- Business Services Not Elsewhere Classified, unlike Mastercard which switched to MCC 6540- Stored Value Card Purchase/Load in December 2019.

Towards the end of the week (17 July is the best guess), people started reporting that GrabPay top-ups with the Citi Rewards Visa were no longer earning points. This isn’t the first time we’ve heard such reports, of course. GrabPay chat veterans will wearily recount numerous false positives, usually from overenthusiastic individuals who didn’t wait long enough for the points to show up.

But there was something different this time round. Not only were GrabPay top-ups not earning points with the Citi Rewards Visa, some transactions were being blocked outright. Upon contacting the bank, cardholders were told that the system was seeing these as quasi-cash transactions, and Citi’s risk assessment algorithm was blocking their card for such MCCs.

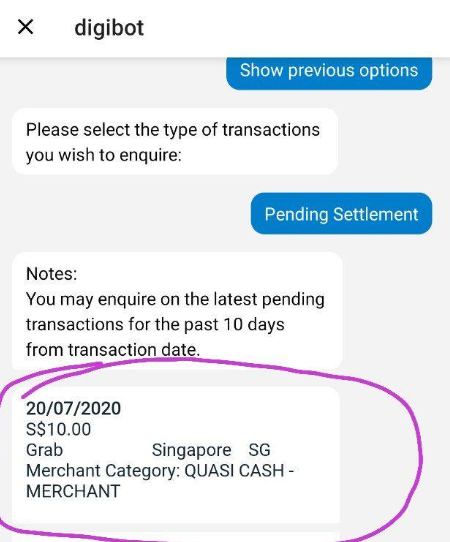

Wait…quasi-cash transaction? This was a first. A quick check with the DBS digibot confirmed that GrabPay top-ups on the DBS Altitude Visa were now coming through as quasi-cash transactions as well.

And there you have it- the MCC for GrabPay top-ups with Visa cards is now MCC 6051- Quasi Cash Merchant. This MCC is excluded from earning rewards on virtually every credit card out there, so it basically spells the end of rewards for GrabPay top-ups.

| 🏳️ Lone Survivors (?) |

|

The AMEX True Cashback card is still confirmed to earn 1.5% cashback on GrabPay top-ups (unlike other AMEX cards, GrabPay top-ups aren’t on the exclusion list) It remains to be seen whether individuals who saved their DBS Woman’s World Card in the Grab app will get bonus points come August (don’t bother with ad-hoc top-ups, these are already confirmed not to receive points). There’s also an outside chance the Maybank Horizon Visa Signature may survive too, given that the T&Cs do not explicitly exclude quasi-cash transactions. I’m not holding my breath on either, but we’ll get some data points next month. |

What now for the GrabPay Mastercard?

The axing of credit card points for GrabPay top-ups spells trouble for the GrabPay Mastercard, because it’s now in direct competition with credit cards.

When credit card points were awarded for GrabPay top-ups, the GrabPay Mastercard was able to ride on the coattails of the banks. People would earn 1.2-4 mpd for topping up their GrabPay balance with a credit card, then spend on the GrabPay Mastercard to earn further GrabRewards points. The two solutions complemented each other, not competed.

Now that no points are awarded for top-ups, you have to choose between using GrabPay or your credit card. Unfortunately, the math just doesn’t favor GrabPay…

| GrabPay | Credit Card | |

| Rewards per S$1 | 2-4 points | 1-4 miles |

| Effective MPD | 0.2-0.4 mpd | 1-4 mpd |

| Effective Rebate @ 1.8 cpm | 0.36-0.72% | 1.8-7.2% |

Thanks to the GrabRewards and KrisFlyer transfer nerfs we saw earlier this year, there’s virtually no reason why you’d use GrabPay over a credit card, where both are accepted.

This means that GrabPay is relegated to fringe cases, for instance at hawker stalls which have a GrabPay QR code but no other cashless payments. Or perhaps you need to make an education or government payment which won’t earn any rewards on your credit card. In this case, it’s better to take the paltry GrabRewards points than to leave empty handed.

| If you hold an AMEX True Cashback card, you may find it useful to top-up your GrabPay Card to make insurance payments, earning 1.5% cashback in the process. No GrabRewards points are issued for insurance. |

Beyond that, however, it’s pretty much game over. I wonder if this is why we’re seeing some promotions for the GrabPay Mastercard right now, like an easy 15,000 GrabRewards points for making S$1,000 in online transactions.

For what it’s worth, GrabPay did hike its merchant fees some time back, so perhaps it’s trying to generate the margins needed to support a more generous rewards ecosystem. They’ll certainly need it, now that the days of double dipping are over.

Conclusion

We all knew it was only a matter of time before credit card rewards disappeared for GrabPay top-ups. I hope everyone made as much hay as they could, and so we’ll pause for a moment, press “F” and move on with life.

The GrabPay wallet is basically a zero-interest credit line for Grab, and the challenge now is to convince users to continue loading funds, as opposed to just charging their card at the time of transaction. The MCC change means the banks won’t indirectly subsidize GrabRewards anymore, and as I said in February:

All this while, GrabPay has been a beneficiary of the banks’ willingness to extend rewards to top-ups. If I can double dip on credit card and GrabRewards points, why not?

But take away the double dip, and it’s not even a contest- from a rebates point of view, there’s no compelling reason to use GrabPay when credit cards are also accepted.

How interesting that in the end, it wasn’t the banks which nerfed GrabPay top-ups; it was Visa (technically the acquiring bank assigns the MCC, but they’re bound to follow Visa guidelines anyway). And just like that, another chapter has closed in the Singapore miles game.

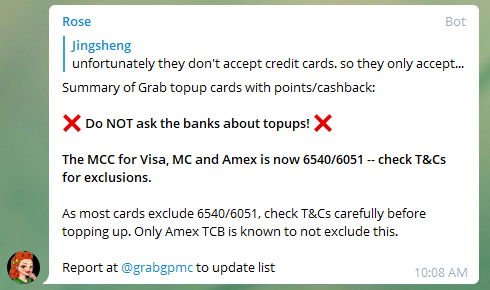

I think it’s only apt I give the closing word to Rose:

Indeed. Press “F” for respect.

It’s all over red rover!

Great article! Thank you. :). Notice there is no mention of what happens for those who top up GrabPay using their UOB Lady’s Solitaire Card (for those who have selected Transport as their rewards category).

uob lady’s cards are mastercards, and have not given points for a while.

Ok, thank you for the heads-up

“It remains to be seen whether individuals who saved their DBS Woman’s World Card in the Grab app will get bonus points come August (don’t bother with ad-hoc top-ups, these are already confirmed not to receive points). “

i don’t understand this line. If ad-hoc top-ups dont earn bonus points on the WWMC, what are we waiting to see? Whether taking a grabride still earns online bonus points?

The behaviour of saved cards is different compared to ad-hoc top ups. For the past few months people were reporting successful 10x with wwmc, provided they saved the card on the app before a certain date. It’s almost as if the mcc was “cached” under the old transport code, thereby earning 10x not withstanding the mcc change

I used my wwmc for the very first time last month – and got the 9x bonus points. So not sure if that “before a certain date” theory is actually true. Might just be a generic ymmv case after all.

Ah, good to know! I personally don’t have exeprience- it’s what I gathered from the chat group

Thanks! Now I get it.

Since rides are ok, do ad-hoc payments (i.e. see Grab QR, scan and pay by credit card) also still earn 10x on WWMC?

1) I don’t think that even exists (but may be wrong), QR codes will deduct from your balance, not ask you for a credit card number. Hence put the money onto your account before scanning a QR-Code.

2) Either way: Make sure your card is saved as payment option prior to making any top-up in order to stand a chance. Be prepared for a potential disappointment on August 16th, the day online bonuses are credited for the month of July.

This has always been a loop hole that was going to be plugged sooner or later. I don’t think Grab or the banks intended for us to double/triple-dip, or to earn 4mpd (or even 1.2mpd) making payments that do not normally earn points.

Now that the party is over, we should all say “thanks for the free booze” and try to find another party to gate crash. I expect some will linger hoping to find an unfinished bottle. For the rest of us, “so long, and thanks for all the fish!”

end game

The card still has some marginal use cases, especially for the MCCs that don’t normally earn credit card points (insurance, education, etc). Pair it with the Amex True Cashback Card and you earn some marginal rewards for something that you don’t get anything for.

Other than that, the GPMC is well and truly dead. 1 Aug can’t come soon enough with the HSBC Revolution upgrade.

Does that mean from 1st August, you can use HSBC revolution to top up grab pay and get the 10x points or 4mpd?

I’m skeptical if Grab themselves are enthusiastic about promoting this card in the first place. My wife has been waiting for the card to be available since last year and still no updates in the app.

Unfortunate that the music stopped, but it was good while it lasted.

I topped up my GrabPay credits with Maybank Horizon Visa on 23 July. My August points balance reflects I’m still awarded 3.2mpd.

yes, seeing a couple of reports on that. interesting…

Thanks for the article Aaron. I’m late to the party as I was still topping up my grabpay wallet with a CC last week, which in turn was funding my favepay txns. Do you know if making favepay txns (through a linked CC) allows for double-dipping, or if I am forfeiting my CC rewards when I used favepay?

Earning points via favepay depends on what the underlying mcc is. In other words, different merchants may code differently