Late last week, the IUCN updated its list of critically endangered species. At the top of the list:

- Hawksbill turtle

- Amur leopard

- Sumatran rhinoceros

- Recording devices at SCCCI events

- Points for GrabPay top-ups

What’s the difference between the hawksbill turtle and points for GrabPay top-ups? The turtle has a greater chance of surviving 2020.

The current state of affairs

Back in December 2019, AMEX and Mastercard changed the MCC for GrabPay top-ups to 6540. 6540 designates a stored value facility, which meant a whole swathe of cards ceased awarding points or cashback for top-ups overnight.

In a way, this just continues the general trend we’ve seen over the past couple of years. One by one, banks have either explicitly or implicitly excluded GrabPay top-ups from earning rewards.

Off the top of my head, the DBS Woman’s World Card did away with this at the start of 2019. The BOC Elite Miles World Mastercard followed a couple months later. UOB killed it on the PRVI Miles Mastercard and AMEX on 30 November 2019 (jumping the gun really, because of the MCC changes in December). Come March 2020, we’ll lose rewards on the UOB One and American Express credit cards.

As it stands, the only cards that earn points for top-ups will be:

- General spending, Visa cards (e.g DBS Altitude, Citi PremierMiles Visa, OCBC VOYAGE)

- Very limited specialized spending cards like the Citi Rewards Visa, HSBC Revolution, and Maybank Horizon, all with caps

| Visa still uses MCC 7399 (Business Services Not Elsewhere Classified) for GrabPay top-ups, but don’t count on this staying the same for long |

Now, it clearly makes sense to use a specialized spending card to top-up your GrabPay account. After all, that’s how you turn a general spending situation into a specialized spending one. You normally can’t earn 4 mpd at the dentist, but you could by topping up your GrabPay account with the Citi Rewards Visa and paying with your GrabPay Mastercard .

But it can also make sense to use a general spending card to top-up your GrabPay account, in certain cases. Perhaps you’re at a hawker stall which has a GrabPay QR code but no other cashless payments. Perhaps you’re making an insurance or government payment which will not earn any points on your credit card. Topping up your GrabPay balance with a credit card and then spending it allows you to at least earn some rewards on these transactions.

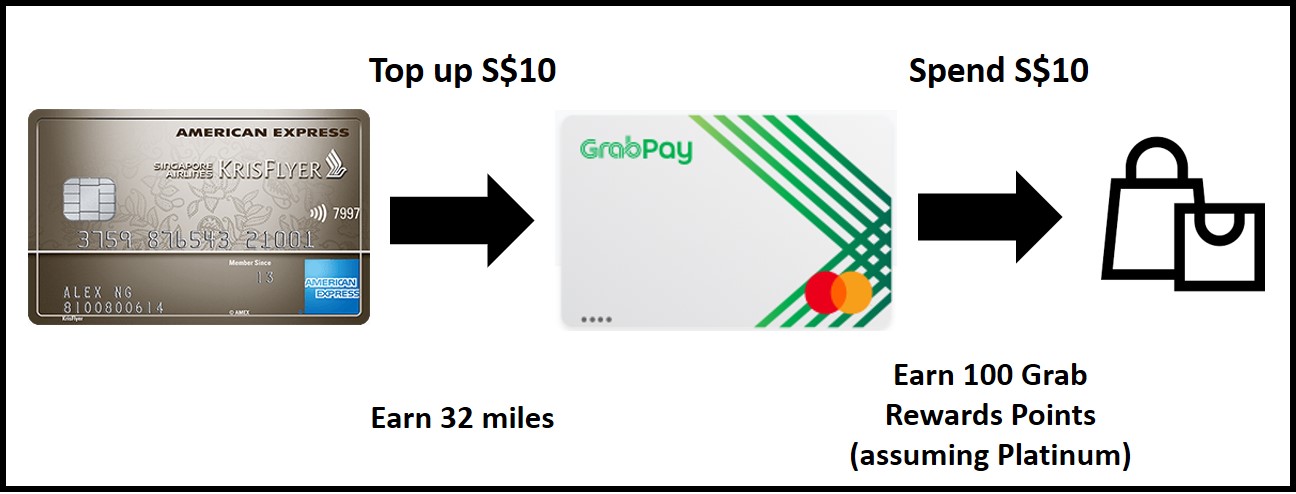

In any case, GrabPay and credit cards are not either/or propositions, for now. That’s to say, I could earn both credit card points for topping up my account, and GrabRewards points when I spend my balance.

What happens when the music stops?

GrabPay and credit cards are not either/or propositions for now, but it’d take a brave man to predict the status quo continuing.

At first glance, it may seem confusing why banks are cutting off points for GrabPay top-ups. After all, unlike charity or government entities, Grab doesn’t enjoy a discounted MDR (merchant discount rate) on its transactions. The bank still earns whenever customers use their cards for GrabPay top-ups, so what’s not to like?

But there’s much more to a transaction than just the MDR. Data is equally valuable, if not more so. When you spend on your credit card, the bank collects information about your spending habits and preferences, which can be used for targeted promotions. You like to spend on dining? Great, we’ll push you additional dining deals. You frequently use your card overseas? OK, here’s an offer for travel insurance.

When you use your credit card to top-up a GrabPay account, all the bank knows is that you really like GrabPay. It’s a black box, and the bank loses out on data it would otherwise be collecting.

Moreover, the general principle for banks has all along been to award points for retail transactions. Topping up a prepaid account (even if it’s subsequently used for retail spending) doesn’t count, so a better question might be “why have banks awarded points on GrabPay top-ups for so long?” (not that anyone minds, I’m sure)

Therefore, points for GrabPay top-ups are living on borrowed time, and when the music stops, I don’t think it’ll bode well for Grab.

Here’s a thought experiment: Imagine that one day, all the banks stop issuing any sort of rewards for GrabPay top-ups. No miles, no points, no cashback, whether you’re using a generalized or specialized spending card.

Suppose you’re at a merchant which accepts credit cards or GrabPay. What would you do?

Well, you’d ask yourself: What do I get when I spent S$1 on my credit card, versus through GrabPay?

| Credit Card | GrabPay |

||

| Until 2 Mar 20 | From 2 Mar 20 | ||

| Rewards per S$1 | 1.1-4.0 mpd | 5-10 points | 2-4 points |

| Effective MPD | 1.1-4.0 mpd | 0.53-1.14 mpd | 0.21-0.46 mpd |

| Effective Rebate | ~2-7% | ~1-2% | ~0.4-0.8% |

As you can see, the math does not favor GrabPay. With a credit card, you could earn anywhere from 1.1 to 4.0 mpd, depending on the merchant and card. With GrabPay, you’d earn 0.53 to 1.14 mpd until 2 March 2020, then a paltry 0.21-0.46 mpd after thanks to the upcoming GrabRewards devaluation.

All this while, GrabPay has been a beneficiary of the banks’ willingness to extend rewards to top-ups. If I can double dip on credit card and GrabRewards points, why not?

But take away the double dip, and it’s not even a contest- from a rebates point of view, there’s no compelling reason to use GrabPay when credit cards are also accepted.

The only exception is a scenario where GrabPay earns points, but credit cards don’t. GrabRewards has its own list of exclusion categories, but for the moment it still rewards certain transactions that most cards don’t, like government and education payments. I imagine the GrabRewards exclusion list will grow wider over time, so we may see this advantage eroded away too.

| Current GrabRewards exclusion categories |

|

What can Grab do?

Where does that leave Grab and GrabPay?

GrabRewards is simply not strong enough to take on the bank rewards programs, and things will only get worse from 2 March 2020 when the GrabRewards devaluation comes into effect. With earn rates getting slashed by up to 60% and award prices hiked by almost 40%, any reasonably-informed consumer would think twice about using GrabPay.

It follows that Grab needs to dramatically enhance the value of GrabPay should all double dipping opportunities be nerfed. I assume they’re not backtracking on the devaluation, so could we see…

- Grab offering bonus credits for top-ups, e.g S$105 of value when you top up S$100?

- Grab offering bonus points for top-ups, e.g 100 bonus GrabRewards points for a $100, top-up, on top of points from spending said balance?

Grab’s actually tried the former before, back in 2017. It has to be said that GrabPay usage has grown exponentially since then, so this would presumably be a lot more expensive to implement now. The latter model was a favourite of the now-defunct Mileslife, which saw it as a way of building up working capital and locking in future patronage.

Word on the street is that GrabPay recently increased its merchant fee from 0.8% to 1%- could this be a precursor to more incentives for GrabPay usage?

Conclusion

It’s a bit telling that 1 out of every 5 questions I get is “Does Card X earn points on GrabPay top-ups?” Such is the attractiveness of double dipping opportunities, and the uncertainty that they’ll continue.

For now, there’s absolutely no reason not to use GrabPay. The GrabRewards nerf will destroy a lot of value, but it’s still something incremental on top of credit card points, the icing on the cake if you will.

The bigger question is what happens when (and it is when, not if) banks decide to close shop on GrabPay top-ups. What’s the use case for GrabPay then?

Make hay.

Another possible use case, with forex fees getting higher and higher, is to use Grabpay Mastercard abroad. I wonder how that would work on a cpm basis. Unfortunately the GPMC to multi currency card hack has been nerfed, so no more earning 4mpd plus mid market exchange rates on foreign currency transactions.

I thought about that, but given the cpm for gpmc is the same local and overseas (I.e to say abject), wouldn’t you be better off using revolut or youtrip and avoiding the 2% gpmc fcy fee altogether?

Does top up of You Trip with a credit card earn points? What is You Trip MCC?

No, but neither does topping up grab, in future?

Interesting that GrabPay doesn’t enjoy MDR but they only charge 0.8-1% at the other end. What’s the business model for GrabPay then? Are they losing money on every transaction? They probably earn from having the idle cash but I doubt that covers the spread.

Grabpay didn’t charge the first wave of merchants any mdr. Those who came on board later paid 0.8%, and it’s now supposedly going up to 1%

But they have to pay the banks 2.0% fees for the top ups presumably? Or something north of 1.0%.

ah ok i get what you’re saying now. yes, there is presumably some loss there, but i think it’s part of the “burn money to gain share of payment industry” route. you’ll have noticed grab is nudging people towards lower cost top up options like paynow.

Seems like a very expensive way to gain market share and there’s no customer loyalty there. On paynow, who would do that to fund GPMC when they can use the credit card to pay directly. Only useful for people with no access to credit cards which is a very small market. I don’t see how this biz model is sustainable, which I Guess is your point.

Grabpay just goes back where it should be. A way to enable cashless society for small merchants. GPMC is just noise and another way to spend money inside Grabpay wallet.

Another reason why banks don’t like to reward GP topup:

As with all stored value / prepaid cards, it’s vulnerable to churning / MS

Hence you are right, it’s just a matter of time

Churning doesn’t matter as long as banks get their fee.

As long as they get their 1-2% they’ll be happy. The more you churn the more profit they get.

Churning only becomes a problem when say the merchant in question pay less or doesn’t pay at all.

Surely at least one of the ex-MBB/M&A/Corp Strat guys they hired must have seen the mass exodus coming. Really curious as to their gameplan for making money going forward because I’m sure as hell not getting any insurance from them…

There are less astute people out there who might! Just like how people use Citi Rewards card for their general spend.

I would advise against massive topping up grabpay wallet as they are likely to run promos like Aaron mentioned once the incentive to top up by card is removed.

Haha, love the IUCN reference.

But when the time comes, it’s nice knowing you, GrabPay. It was great while it lasted.

I still get point paying thru pypal

Paying thru PayPal is under condition too, the bank will check what’s the transaction if it’s paying for a merchant like online shopping than they will consider the points

I believe Amex CashBack card will still rebate you 1.5% for topping up GrabPay after March. If I am not wrong Aaron actually mentioned it in his other article on Amex cards.

Hi Aaron can I confirm that we still earn 3.2mpd for Maybank horizon visa?

Ymmv. Some people get, others don’t.

Hi Aaron, regarding using specialised vs general spending cards to top up GrabPay, could you elaborate on why one would choose to use a general spending card if one can use a specialised card? Since payment will be made out of the same GrabPay account anyway, it makes more sense to use a specialised card to maximise the benefits one can get, right? Please correct me if I have misunderstood. Thanks!

Another grey area: what if one does not top up the GrabPay wallet, but spends directly from the credit card via GrabPay? Will this continue to earn rewards even after GrabPay wallet top ups (which can be likened to EZLink top ups) are excluded? Looking at the new terms for UOB One, it seems that GrabPay wallet top ups are excluded but spending directly from credit card via GrabPay isn’t. This could work out, especially since I never really saw much point in storing value in the GrabPay wallet unless the aim is to frontload future purchases and earn rewards/miles… Read more »

How do you pay directly from credit card via GrabPay?

Just link the credit card to GrabPay and set the primary mode of payment as the credit card instead of the GrabPay wallet. By definition, this is still considered using GrabPay as it is a cashless transaction routed through Grab, just not using the GrabPay wallet.

https://www.grab.com/sg/pay/

Scroll down to read the FAQ on the difference between GrabPay and GrabPay wallet.

Thanks! But that only applies to payment for grab offerings like rides and food. If you pay at grabpay merchants by scanning the QR code I don’t think you will be able to select payment via credit card.

Btw, has anyone tried the pay later function? Will points be awarded for that?

Hi Aaron,

I thought that Grabpay top ups were excluded from DBS Altitude cards based on the T&Cs here (no reward points for top-ups to prepaid accounts), or have you seen otherwise? https://www.dbs.com.sg/iwov-resources/pdf/cards/dbs_rewards_programme_tnc.pdf

Also, does Grabpay qualify for 10X points for Citibank Rewards? Again, doesn’t seem so from Citibank T&Cs https://www.citibank.com.sg/global_docs/pdf/Citi_Rewards_Card_10X_Rewards_Promotion_Terms_and_Conditions.pdf

No points Eunice.

Hello, does anyone know whether the SCVI awards 1.4MPD on grap top ups if they hit >2k?

Going by the visa logic and that SCVI doesn’t explicitly exclude Grab in its T&Cs, would assume so.

However, I do recall reading somewhere that for the SC X Card sign up promo’s qualifying spend, Grab Top ups would be excluded.

Thanks in advance!