From now till 31 January 2021, DBS Altitude cardholders can earn up to 2.8 mpd on all local shopping and dining spend, up from the usual 1.2 mpd.

This sounds like an attractive promotion, but unless you’re a “one card only” kind of person, you’ll find it’s probably not worth the effort.

DBS Altitude shopping and dining promotion

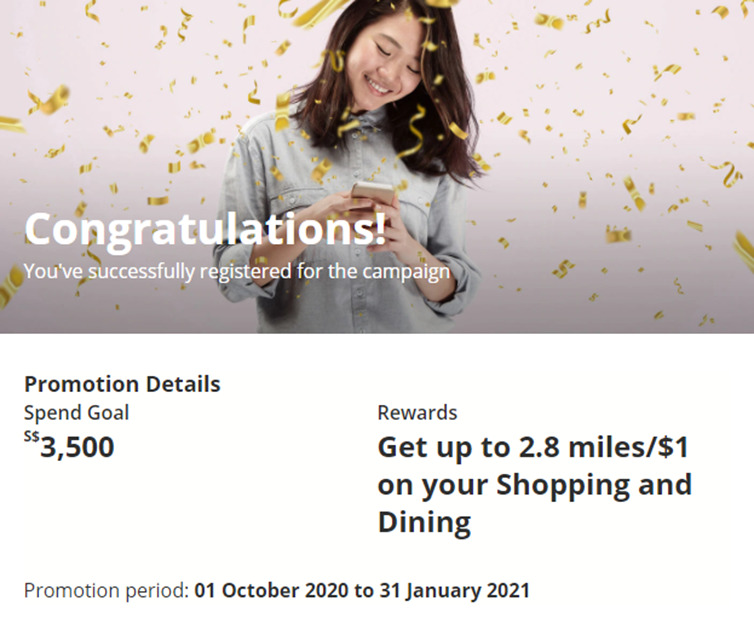

This offer is open to both DBS Altitude AMEX and DBS Altitude Visa cardholders. Cardholders will first need to register via this link, which is capped at 12,000 registrations. You should see the following screen upon successfully registering:

After registration, cardholders will be eligible to earn up to 2.8 mpd on all local shopping and dining spend (“eligible spend”) between the date of registration and 31 January 2021. This is broken down into:

| Spend ⩾S$3,500 per month | Spend ⩾S$7,000 per month | |

| Base Earn Rate | 1.2 mpd | 1.2 mpd |

| Bonus Earn Rate | 1.2 mpd | 1.6 mpd |

| Total | 2.4 mpd | 2.8 mpd |

| Bonus Miles Cap per month | 660 | 1,920 |

To earn a total of 2.4 mpd, you must spend at least S$3,500 per month (on anything). Upon meeting this threshold, you’ll earn a bonus 1.2 mpd on the first S$550 of eligible spend per month.

To earn a total of 2.8 mpd, you must spend at least S$7,000 per month (on anything). Upon meeting this threshold, you’ll earn a bonus 1.6 mpd on the first S$1,200 of eligible spend per month.

What is eligible spending?

Eligible spending refers to online and offline transactions made in Singapore Dollars at merchants with the following MCCs.

| Category | MCC |

| Apparel | 5611, 5621, 5631, 5641, 5651, 5655, 5661, 5681, 5691, 5697, 5699 |

| Department Stores | 5309, 5311, 5399 |

| Electronics and Computers | 5045, 5065, 5732, 5734 |

| Home/Office Furnishing & Appliances | 5021, 5200, 5251, 5712, 5713, 5714, 5719, 5722 |

| Bar & Restaurants, Eating places | 5811, 5812, 5813, 5814 |

You’ll notice straight away that it’s possible to earn 4 mpd on a lot of these categories, with no registration of minimum spend required.

For example, the Citi Rewards Card would cover apparel and department stores, the OCBC Titanium Rewards would cover electronics and computers, while the HSBC Revolution would cover all your dining needs. All these cards will earn 4 mpd from the first S$1 spent (technically S$5 for the OCBC Titanium Rewards), making them comprehensively better options to use.

If you’re in doubt about what card to use for a given transaction, check out this guide.

What else do I need to know?

All bonus miles will be credited (in the form of DBS Points) within 60 days from the end of each calendar month. DBS Points can be converted to the following frequent flyer programs for a fee of S$26.75 per transfer:

| Frequent Flyer Program | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

Supplementary cardholders cannot register for this promotion, but their spending will be combined with that of the principal cardholder in calculating minimum spend and eligible spend.

The full T&C of this offer can be found here.

Conclusion

A big fat “meh” for this promotion, which will interest only the staunchest of “one card for everything” users.

You can do so much better on local shopping and dining with other cards, and not have to hit that hefty minimum spend either.

If one was to have already spent the $1000 limit on DBS Woman’s, CITI Rewards, OCBC Titanium UOB Preferred Platinum Visa and HSBC Revolution. Would this be the next best deal?