Citibank has finally updated its sign-up offer for the Citi PremierMiles Card, changing it for the first time since October 2019. The good news is the revised bonuses are more generous than the previous ones, making this a pure enhancement in every sense of the word.

From now till 31 January 2021, new-to-bank Citi PremierMiles Card members can get up to 45,000 miles (previously: 37,300 miles) when they spend S$9,000 (same as before) within the first 3 months of approval and pay the S$192.60 annual fee.

There’s also a version of this offer for existing customers, as well as for those who prefer to get an annual fee waiver, so keep reading.

| ⚠️ For the purpose of this offer, Citibank defines a new-to-bank customer as someone who does not currently hold a principal Citi credit card, and has not done so in the 12 months prior to 1 November 2020. |

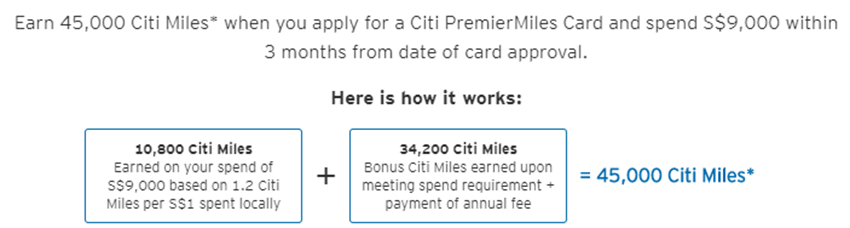

New-to-bank: Spend S$9K, Get 45,000 miles

New-to-bank customers who pay the S$192.60 annual fee and spend S$9,000 within 3 months of approval will receive a total of 45,000 miles.

| 📅 Citi has a generous definition of “3 months.” The qualifying period starts from the date of your card’s approval to three months after the end of the month you were approved. So if you were approved on 2 November 2020, for example, you’d have until 28 February 2021 to hit the qualifying spend. |

This is broken down into:

- 10,800 base miles from spending S$9,000 @ 1.2 mpd

- 10,000 miles for paying the S$192.60 annual fee

- 24,200 bonus miles for meeting the spending requirement

(3) used to be 16,500 miles, so Citibank has effectively bumped it up by 47%, while keeping the spending requirement the same.

The T&C for this sign up offer can be found here.

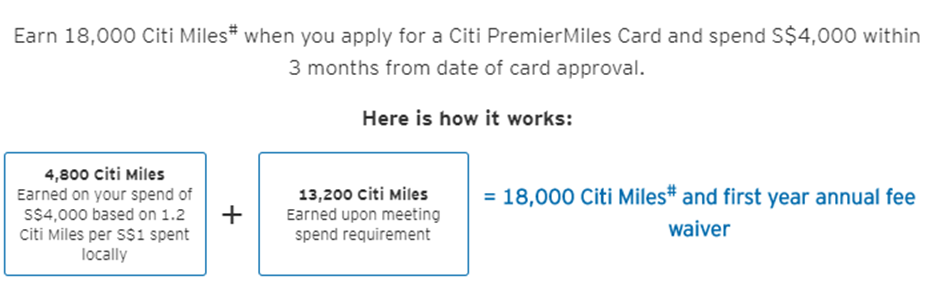

New-to-bank: Spend S$4K, Get 18,000 miles plus fee waiver

New-to-bank customers who prefer not to pay the annual fee get a smaller sign-up bonus.

By spending S$4,000 within 3 months of approval, they’ll earn a total of 18,000 miles. This is broken down into:

- 4,800 base miles from spending S$4,000 @ 1.2 mpd

- 13,200 bonus miles for meeting the spending requirement

This offer previously required cardholders to spend S$3,000 within 3 months of approval for a bonus of 6,400 miles, so Citibank has increased the spending requirement by 33%, while increasing the bonus component by a more-than-proportionate 106%!

The T&C for this sign-up offer can be found here.

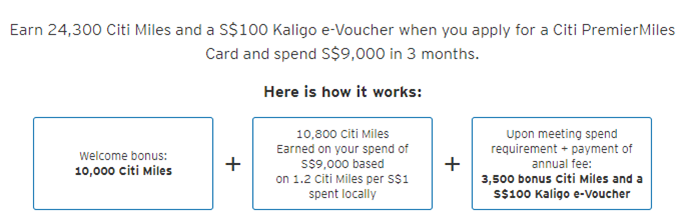

Existing Customer: Spend S$9K, Get 24,300 miles + S$100 Kaligo e-voucher

Existing customers who pay the annual fee and spend S$9,000 within 3 months of approval get a S$100 Kaligo.com e-voucher and 24,300 miles. This is broken down into:

- 10,800 base miles from spending S$9,000 @ 1.2 mpd

- 10,000 miles for paying the S$192.60 annual fee

- 3,500 miles for meeting the spending requirement

The Kaligo.com e-voucher comes with a few strings attached so do take note. You’ll need to go to www.kaligo.com/100gift to spend the voucher, and your stay must be at least two nights. The voucher is valid till 31 December 2020.

This offer is exactly the same as before, and I’m kind of worried they haven’t seen fit to extend the validity of the Kaligo voucher for new sign ups. 2020 is almost over, after all.

The T&C for this sign-up bonus can be found here.

Existing customer: Fee waiver

Existing customers can also opt for a waiver of the first year’s annual fee. If you do, that’s all you get- no bonus miles, no nothing.

What counts as qualifying spend for the sign-up bonus?

Qualifying spend refers to retail transactions charged to the card, and excludes the following:

|

Other payments like insurance, education or government services will count towards the qualifying spend, but will not earn any base points. CardUp payments count towards the sign-up bonus, and will also earn base points as per normal.

Citibank has confirmed that spending on Citi PayAll will count towards the qualifying spend, which is good news for those with rent, education expenses, taxes or condo fees to pay.

| Cost per mile @ 1.2 mpd | |

Citi PremierMiles Card Citi PremierMiles Card |

1.67 |

Do remember that Citibank is running some targeted offers for Citi PayAll now, which can bring the cost per mile down even further.

Citi Miles are one of the most valuable transfer currencies in Singapore

Citi PremierMiles cardholders get access to 11 different frequent flyer programs and one hotel partner, the widest selection of any bank in Singapore.

| Transfer Ratio | |

|

1:1 |

| 1:1 | |

| 1:1 | |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

| 1:1 |

A S$26.75 conversion fee applies for every transfer, and do note that Thank You points earned on the Citi Prestige/Citi Rewards cards do not pool with Citi Miles, so you’ll have to redeem them separately.

The flexibility of Citi Miles means they’re a great way to enjoy sweet spots in programs like Etihad Guest, British Airways Avios and Turkish Miles&Smiles.

For example, you could redeem a Singapore to Europe round-trip Business Class flight for just 90,000 miles with Miles&Smiles. That’s half the price that Singapore Airlines charges (albeit with fuel surcharges), which means you could fly two people with Miles&Smiles for the cost of flying one with KrisFlyer.

Recap: Citi PremierMiles Card Basics

Apply Here Apply Here |

|||

| Income Req. | S$30,000 p.a | Points Validity | No Expiry |

| Annual Fee | S$192.60 (First Year Free) |

Min. Transfer |

10,000 Citi Miles (10,000 miles) |

| Miles with Annual Fee |

10,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$26.75 |

| Local Earn | 1.2 mpd | Points Pool? | No |

| FCY Earn | 2.0 mpd | Lounge Access? | Yes- 2 x Priority Pass |

| Special Earn | 7 mpd on Agoda, 10 mpd on Kaligo | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The Citi PremierMiles Card earns 1.2 mpd on local spend and 2.0 mpd on overseas spend. Citibank awards points on every dollar of spending, and the minimum spend to earn points is S$1.

The Citi PremierMiles Card comes with a Priority Pass membership that provides two complimentary visits per calendar year. Note that this is slightly different from most other credit cards on the market, which award their free visits per membership year.

Read a full review of the Citi PremierMiles Card here.

Conclusion

The Citi PremierMiles Card is a solid general spending card to have in your wallet, and the improved sign-up bonus only sweetens the deal. Assuming you’re able to spend S$9,000 in the first 3 months, it’s definitely one of the first sign-up bonuses I’d consider.

I’ve updated the post on current credit card sign-up bonuses in Singapore to reflect this latest offer.

I suppose if 1 year anniversary comes halfway through the promotion period (I cancelled on Jan 2020), we won’t be eligible for this deal?