ShopBack GO has launched a new promotion called Spend, Scratch & Win, where users can win up to S$100 bonus cashback when paying with their ShopBack GO-linked credit cards.

This presents an opportunity to triple dip on rewards at certain merchants, with credit card points, ShopBack GO and Google Pay scratch cards.

| What is ShopBack GO? |

|

|

Register for ShopBack GO and get S$5 |

ShopBack GO Spend, Scratch & Win

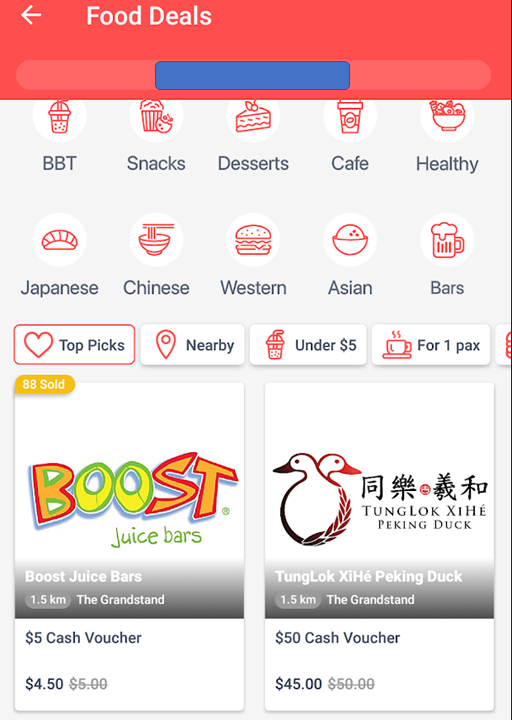

From 17-30 November 2020, ShopBack GO users will receive a scratch card when they spend a minimum of S$3 in-store at any ShopBack GO merchant, or on ShopBack GO in-app deals.

A maximum of five scratch cards can be won during this period, and each one awards up to S$100 bonus cashback (you’ll still earn the regular ShopBack GO cashback as per normal).

Scratch cards can be found in the ShopBack app under the “Challenges & Rewards” section, and must be scratched within 48 hours of issuance. Be sure to activate your notifications for the ShopBack app so you don’t miss yours.

Any bonus cashback won will be credited to your ShopBack account by 31 December 2020.

How do I stack this?

Get $5 when you sign up for Google Pay

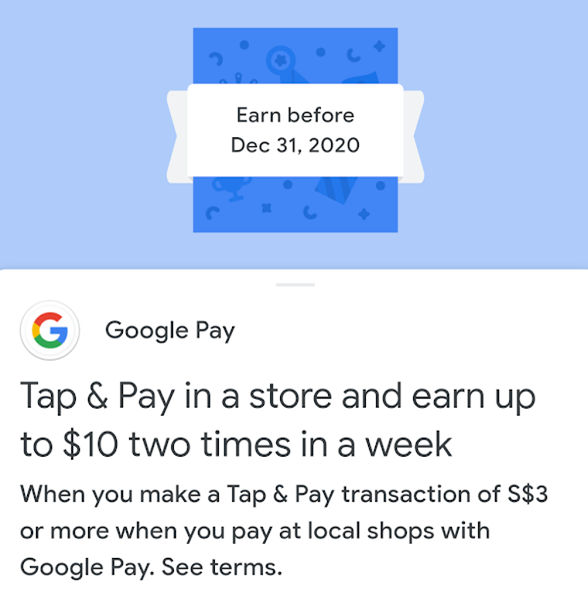

From 16 Nov-31 Dec 2020, Google Pay is awarding a scratch card for every payment of S$3 or more made in-store via Tap & Pay or QR code, capped at two cards per week (a week runs from Monday 8.30 a.m to the following Monday 8.29 a.m). Each card is worth up to S$10.

So what you can do is:

- Link your credit card to ShopBack GO

- Add your credit card to Google Pay

- Use Google Pay in-store to spend at least S$3

- Earn credit card rewards, Google Pay and ShopBack GO scratch cards

Remember- once your credit card is registered on ShopBack GO, it doesn’t matter if you use the physical card or the digitized version on your mobile wallet.

| Note: ShopBack go is not able to track payments made with a UOB-issued Mastercard using a mobile wallet (e.g UOB PRVI Miles Mastercard, KrisFlyer UOB Credit Card, UOB Lady’s Card). For these, you’ll need to use the physical card to earn cashback. |

What card should I use for ShopBack GO?

With ShopBack GO in-store payments, you’re paying the merchant directly, not ShopBack. Therefore, the right card to use depends on the type of merchant.

Assuming you’re dining, the following cards would be the best options:

| Earn Rate | Remarks | |

UOB Lady’s Card UOB Lady’s Card |

4 mpd | Cap S$1K per month* |

UOB Lady’s Solitaire UOB Lady’s Solitaire |

4 mpd | Cap S$3K per month* |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

4 mpd | Cap S$1.1K per month, must use mobile payments |

HSBC Revolution HSBC Revolution |

4 mpd | Cap S$1K per month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd | Min S$500 spend on SIA-group per membership year |

| *Must choose dining as quarterly 10X category | ||

However, it’s also possible to buy dining deals directly from the ShopBack GO app. In this case, it’s safest to default to a general purpose online spending card, such as the DBS Woman’s World Card or the Citi Rewards Card.

Conclusion

Registering your cards with ShopBack GO is a one-time event, and there’s no reason why you shouldn’t be doing it.

The opportunity to triple dip on rewards is quite enticing indeed, and doesn’t cost you anything extra. Remember that you’re capped at 2 scratch cards per week for Google Pay, and 5 scratch cards for the whole promotional period for ShopBack GO.

any idea if HSBC revolution gives 4mpd on google pay? because

https://cdn.hsbc.com.sg/content/dam/hsbc/sg/documents/credit-cards/revolution/offers/10x-reward-points-terms-and-conditions.pdf

only mentions paywave and apple pay:

“6. Selected Contactless Payments” refers to Qualifying Transactions made via Visa contactless through a contactless terminal mode which includes Visa payWave and Apple Pay”

the short answer is that google pay does not support hsbc cards.

i am able to add hsbc card onto google pay and make a transaction fyi

Do you even know HSBC is not on Gpay?

HSBC cards are not supported on Google Pay Singapore.

See https://support.google.com/pay/answer/7351836?hl=en for the full list of cards that is supported.

Will there be an issue when you use Google Pay and the tokenized card is captured but ShopBack Go does not capture the tokenized card data?