| Update: Citibank has updated the T&Cs of this promotion to remove the “targeted” requirement, and confirmed with me that it is open to all customers |

Citibank is kicking off 2021 with a honking good deal for Citi PayAll, and something you really need to consider if.

From 4 January to 30 April 2021, Citi PayAll customers will either receive 1% cashback (for existing users), or two free-free payments (for new users). This lowers the cost per mile to as little as 0.42 cents depending on your card, and at that price you can’t possibly lose.

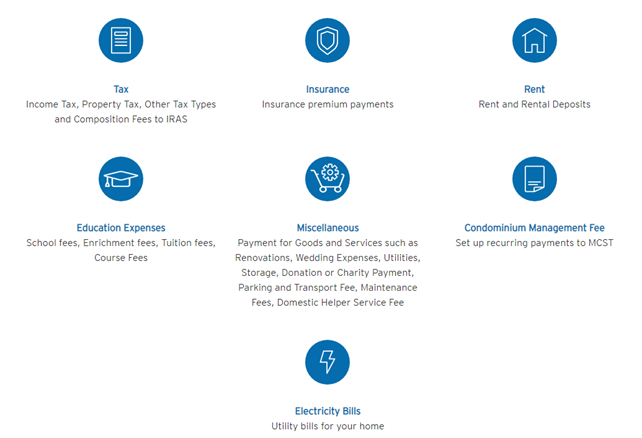

Citi PayAll recently expanded its range of supported payments, and now covers insurance, utilities, charitable donations, rent, tax payments and more. You can also pay miscellaneous invoices, but if you’re planning to pay a friend or family member, keep in mind there may be tax implications.

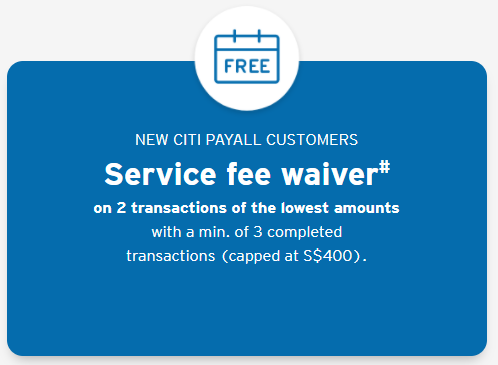

New Customers: 0% Citi PayAll fee for two payments

New customers can enjoy two fee-free Citi PayAll payments, provided they schedule at least three payments between 4 January to 30 April 2021.

The fee waiver will be applied to the two smallest payments scheduled, and rebated in the form of cashback. A maximum cap of S$400 applies.

To illustrate:

| Payment Setup: 4 Jan 21 | |||

| Date | Amount | Fee @ 2% | |

| Payment 1 | 7 Jan 21 | S$10,000 | S$200 |

| Payment 2 | 7 Feb 21 | S$10,000 | S$200 |

| Payment 3 | 7 Mar 21 | S$10,000 | S$200 |

| Total | S$30,000 | S$600 | |

| Cashback | S$400 (smallest two payments) |

||

| Net Fee | S$200 | ||

Your actual cost per mile will depend on the amount you’re paying. I’m assuming you’re maxing out the S$400 rebate on the dot, which means you can buy miles from just 0.42 cents each- a complete no-brainer.

| Earn Rate (Miles) |

Fee | Cost Per Mile | |

Citi ULTIMA |

1.6 mpd (48,000 miles) |

S$200 | 0.42 cents |

Citi Prestige Citi Prestige |

1.3 mpd (39,000 miles) |

S$200 | 0.51 cents |

Citi PremierMiles Citi PremierMiles |

1.2 mpd (36,000 miles) |

S$200 | 0.56 cents |

| I’m not showing the Citi Rewards or Citi Lazada Card because the earn rate is a paltry 0.4 mpd and you’d have to be mental to use them | |||

Cashback will be credited within 8 weeks of the end of the promotion, i.e by 30 June 2021. The T&C for the new customer offer can be found here.

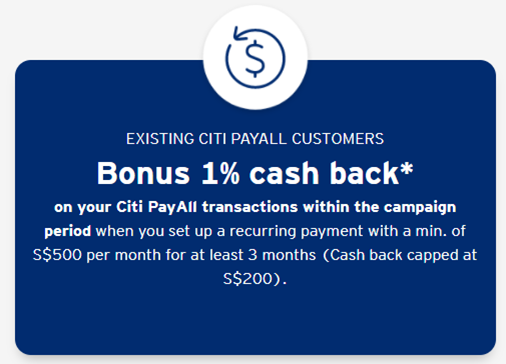

Existing Customers: 1% Citi PayAll fee

Existing customers can enjoy 1% cashback on Citi PayAll payments between 4 January to 30 April 2021. At least three payments must be scheduled in total.

| 💡 Citi defines existing customers as those who have made at least 1 Citi PayAll transaction prior to 4 January 2021. |

You might recall a similar 1% cashback offer for PayAll back in September 2020. This one’s arguably better, because the minimum payment is just S$500 per month (versus S$3,000 previously).

| Current Offer | September 2020 Offer | |

| Admin Fee | 1% | 1% |

| Min. Spend | S$500 per month | S$3,000 per month |

| Duration | 3 consecutive months | 4 months (need not be consecutive) |

| Cap | S$200 | S$1,800 |

That said, there is an overall cap of S$200 (down from S$1,800 previously), which means you’ll exhaust the offer with a total payment of S$20,000.

The set up date and charge date for your first Citi PayAll payment must fall within the promotion period (4 January to 30 April 2021) to qualify, and a minimum payment of S$500 must be made for three consecutive months.

To illustrate:

| Payment Setup: 4 Jan 21 | |||

| Date | Amount | Fee @ 2% | |

| Payment 1 | 7 Jan 21 | S$5,000 | S$100 |

| Payment 2 | 7 Feb 21 | S$5,000 | S$100 |

| Payment 3 | 7 Mar 21 | S$5,000 | S$100 |

| Total | S$15,000 | S$300 | |

| Cashback | S$150 (1% of S$15,000) |

||

| Net Fee | S$150 | ||

| 📅 You could set up a series of payments with some falling inside the promotional period and others outside, but you’ll only earn the cashback for the payments within the promotional period. For example: 30 Apr 21, 30 May 21, 30 Jun 21- only the 30 Apr 21 payment will receive 1% cashback |

Based on a 1% admin fee, you could potentially be buying miles from as little as 0.63 cents each, depending on the Citi card you use.

| Earn Rate | Cost Per Mile @ 1% | |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.63 cents |

Citi Prestige Citi Prestige |

1.3 mpd | 0.77 cents |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 0.83 cents |

| I’m not showing the Citi Rewards or Citi Lazada Card because the earn rate is a paltry 0.4 mpd and you’d have to be mental to use them | ||

Cashback will be credited within 8 weeks of the end of the promotion, i.e by 30 June 2021. The T&C for the existing customer offer can be found here.

Is it worth it?

Yes, yes, yes.

Simply put, this is the cheapest price I’ve ever seen miles sold for, and remember: it’s not just KrisFlyer. Citibank points can be transferred to 11 different frequent flyer programs, including some with great sweet spots like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles.

| Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

I realise that flying isn’t on anyone’s agenda right now, but just imagine what you could do with miles bought at 0.42-0.83 cents each:

- Singapore to Koh Samui on Bangkok Airways in Business Class for S$84-S$166 round-trip

- Singapore to Europe on Qatar Airways Business Class for S$630-1,245 round-trip

- Singapore to Bangkok on Cathay Pacific Business Class for S$134-266 round-trip

Even better- neither the Qatar Airways nor Cathay Pacific awards above will have fuel surcharges, meaning you’ll just pay for airport taxes.

But even if you opt for plain vanilla KrisFlyer, buying miles at less than 1 cent each is flat out arbitrage. For example, you could use KrisFlyer miles to pay for air tickets at a rate of 1.02 cents each, so buying miles at 0.42-0.83 cents is like locking in a travel discount of 19-59%.

Alternatively, you could convert those miles into Shangri-La Golden Circle points at a ratio of 12:1. Golden Circle points can be used for F&B credit at a rate of 10 points= US$1 or US$1.25 (for Jade/Diamond members), so you’d be enjoying quite the discount on dining too.

This does not stack with other Citi PayAll promotions

The T&Cs for new and existing customers mention the following:

|

“This Promotion is not valid in conjunction with other promotions (including the Citi PayAll – -T&C for existing customers “This Promotion is not valid in conjunction with other promotions (including the Citi PayAll – -T&C for new customers |

I believe the “bonus ThankYou points/bonus miles promotion” is referring to the one launched back in August 2020, which covers payments up till February 2021. If you’re participating in this promotion, you won’t be able to double dip with the current one. Likewise, the other 1% cashback promotion launched in September 2020 can’t be stacked here either.

Conclusion

This is an offer that’s almost too good to pass up, and it’s very hard to lose when you buy miles at a price this low.

You have no shortage of options for converting Citi points, and even if flying’s not on the immediate agenda, you could just as well spend it as F&B credit at the Shangri-La through the Infinite Journeys partnership.

Did you get this offer? Are you taking it?

Hi Aaron, I am currently paying $4k a month income tax via giro – wondering how to max out the free transactions? I thought income tax can only be paid in full? please advise.

with citi payall, by right you need to pay off the full remaining balance and not pay bit by bit. but then again, citi doesn’t ask for a copy of the NOA…

it’s a by right by left thing, and you will need to try your luck

in short, just do the payment. log into mytax on iras, go to your account and for your income tax account it will list payment plan. click the plan details to see the monthly instalments you have to pay – iras updates this as you make payments so it is a “live” counter (insofar as it takes iras a bit of time to process your payment, depending on your payment method). lets say you have instalments from now (next giro is feb 2021) until june 2021, thats 5mths of $4k instalments. the way iras does its giro is that if… Read more »

Hi Aaron, is this a targeted offer? Must receive mailer or sms to qualify for this?

same question~ did not receive any sms or email, still eligible?

Same qns here

citibank reached out and told me they’ve updated the T&C. no longer need to be targeted, it’s open to all

Thanks Aaron

I’m already using the 1% cashback offer which ends 28/2/21. If I schedule 3 payments for Feb/Mar/Apr will it count for this offer? Or will the Feb payment be included in the existing campaign and then the other two payments won’t meet the terms for this offer? So I’d need to schedule Mar/Apr/May and the May payment won’t earn 1% cashback.

If you already have existing scheduled Citi payall payments that would meet the criteria do you automatically receive the rebate? Or do you need to cancel the existing arrangement and set it up again to trigger the rebate?

thanks!

Can rent be paid to another individual? For e.g. I am renting a room in a private residence.

why not? just that the person receiving it is subject to tax.

they would be subject to tax anyway, rental income is taxable income

i suppose if the receiving party had 0 income, then you could pay him/her $20k with no tax implications…

Do I need to send SMS to register? Neither the article nor the Citi website/ T&C is mentioning this. Thanks

nope. no registration mechanism

The Citi payall app does not let me set up a recurring tax payment. Any others facing the same issue? iOS here.

same issue. got their reply like this “We wish to inform you that recurring transactions are only applicable for Rent, Education and MCST payments.”

i am gonna pass it liao.

Is it possible to pay into my own account and then pay to the other overseas entity?

I want to use it buy furniture overseas, so can’t use other party account directly.

will Citi allow that, or disqualify my transactions to get rewards?

This qualify for the NTB bonus miles spending limit?

Can I make 2 x $10K within April itself to maximise the rebate and then the balance be paid as per the usual GIRO schedule?

The date for the crediting of cashback earned from this promo (30 Jun 2021) has come and gone. Nothing is showing in my account. Anyone else in the same predicament?

Citi is usually late with the crediting. As a data point the previous promo came in about 7 days late