Citibank has launched a flash deal for its Citi PayAll bill payment service, which runs from now till 19 March 2021, 11.59 p.m. Users who set up a minimum of S$2,000 worth of payments during this period will receive S$100 of GrabFood vouchers.

I’ve confirmed with Citibank that this offer runs concurrently with the excellent deal that Citibank is currently offering for PayAll, where customers receive either a 1% service fee (for existing users) or two fee-free payments (for new users).

Get S$100 GrabFood vouchers with Citi PayAll

To qualify for the GrabFood vouchers, Citi PayAll customers will need to set up at least S$2,000 worth of PayAll payments between 18 March 2021, 12.00 a.m to 19 March 2021, 11.59 p.m. The payment due date must fall before 31 May 2021.

Eligible customers will receive S$100 of GrabFood promo codes, capped at one gift per customer for the promotion period. It’s not completely clear what denominations these will come in; one part of the T&Cs states that they come in S$10/20 denominations, another part says 5 x S$20.

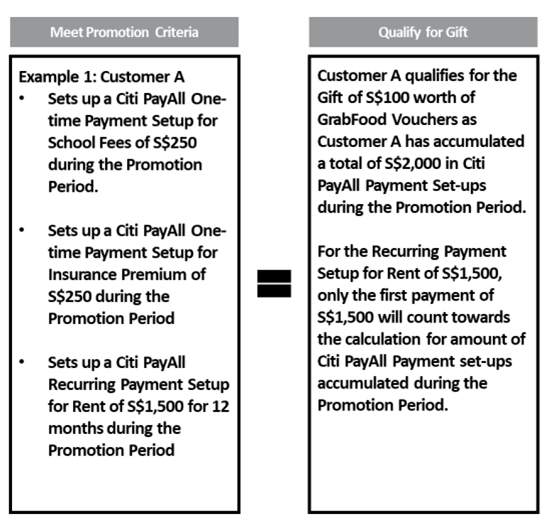

Customers may make more than one Citi PayAll payment to fulfill the promotion criteria. For recurring payment setups, only the 1st payment of the setup would count towards the S$2,000 calculation.

Here’s the example scenarios provided by Citibank:

Eligible customers will receive their gift via SMS/email within 10 weeks from the end of 19 March 2021, i.e by 28 May 2021.

This promotion is only valid for the following Citibank cards:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Cash Back+ Card

The omission of the Citi Rewards and Citi Lazada Card is no big loss, since there’s absolutely no point using them for PayAll in the first place.

The full T&C of this offer can be found here.

Stack this with Citi PayAll’s ongoing promotion

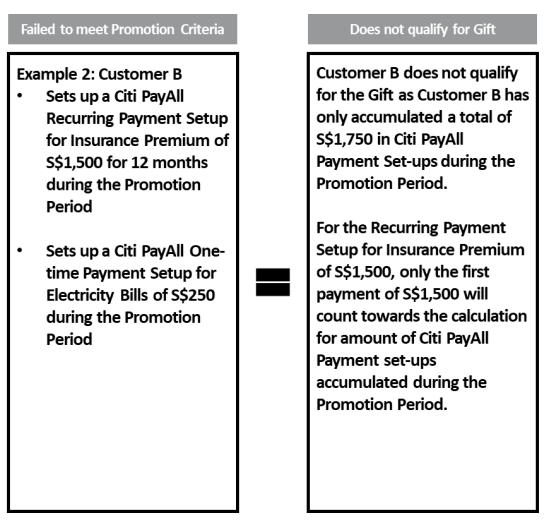

As mentioned earlier, the S$100 GrabFood vouchers can be stacked with the ongoing 1% service fee (for existing users) or two fee-free payments (for new users) that Citi PayAll is offering.

However, you will need to cancel and set up your payments again by 19 March 2021, 11.59 p.m, in order to meet the eligibility criteria.

Here’s a recap of the offers.

New Customers: 0% Citi PayAll fee for two payments

New customers can enjoy two fee-free Citi PayAll payments, provided they schedule at least three payments between 4 January to 30 April 2021.

The fee waiver will be applied to the two smallest payments scheduled, and rebated in the form of cashback. A maximum cap of S$400 applies.

To illustrate:

| Payment Setup: 4 Jan 21 | |||

| Date | Amount | Fee @ 2% | |

| Payment 1 | 7 Jan 21 | S$10,000 | S$200 |

| Payment 2 | 7 Feb 21 | S$10,000 | S$200 |

| Payment 3 | 7 Mar 21 | S$10,000 | S$200 |

| Total | S$30,000 | S$600 | |

| Cashback | S$400 (smallest two payments) |

||

| Net Fee | S$200 | ||

Your actual cost per mile will depend on the amount you’re paying. I’m assuming you’re maxing out the S$400 rebate on the dot, which means you can buy miles from just 0.42 cents each- a complete no-brainer.

| Earn Rate (Miles) |

Fee | Cost Per Mile | |

Citi ULTIMA |

1.6 mpd (48,000 miles) |

S$200 | 0.42 cents |

Citi Prestige Citi Prestige |

1.3 mpd (39,000 miles) |

S$200 | 0.51 cents |

Citi PremierMiles Citi PremierMiles |

1.2 mpd (36,000 miles) |

S$200 | 0.56 cents |

| I’m not showing the Citi Rewards or Citi Lazada Card because the earn rate is a paltry 0.4 mpd and you’d have to be mental to use them | |||

Cashback will be credited within 8 weeks of the end of the promotion, i.e by 30 June 2021. The T&C for the new customer offer can be found here.

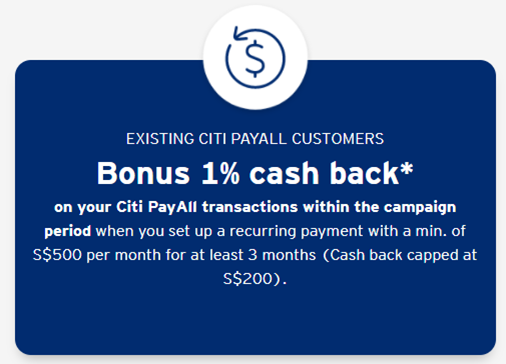

Existing Customers: 1% Citi PayAll fee

Existing customers can enjoy 1% cashback on Citi PayAll payments between 4 January to 30 April 2021. At least three payments must be scheduled in total.

| 💡 Citi defines existing customers as those who have made at least 1 Citi PayAll transaction prior to 4 January 2021. |

You might recall a similar 1% cashback offer for PayAll back in September 2020. This one’s arguably better, because the minimum payment is just S$500 per month (versus S$3,000 previously).

| Current Offer | September 2020 Offer | |

| Admin Fee | 1% | 1% |

| Min. Spend | S$500 per month | S$3,000 per month |

| Duration | 3 consecutive months | 4 months (need not be consecutive) |

| Cap | S$200 | S$1,800 |

That said, there is an overall cap of S$200 (down from S$1,800 previously), which means you’ll exhaust the offer with a total payment of S$20,000.

The set up date and charge date for your first Citi PayAll payment must fall within the promotion period (4 January to 30 April 2021) to qualify, and a minimum payment of S$500 must be made for three consecutive months.

To illustrate:

| Payment Setup: 4 Jan 21 | |||

| Date | Amount | Fee @ 2% | |

| Payment 1 | 7 Jan 21 | S$5,000 | S$100 |

| Payment 2 | 7 Feb 21 | S$5,000 | S$100 |

| Payment 3 | 7 Mar 21 | S$5,000 | S$100 |

| Total | S$15,000 | S$300 | |

| Cashback | S$150 (1% of S$15,000) |

||

| Net Fee | S$150 | ||

| 📅 You could set up a series of payments with some falling inside the promotional period and others outside, but you’ll only earn the cashback for the payments within the promotional period. For example: 30 Apr 21, 30 May 21, 30 Jun 21- only the 30 Apr 21 payment will receive 1% cashback |

Based on a 1% admin fee, you could potentially be buying miles from as little as 0.63 cents each, depending on the Citi card you use.

| Earn Rate | Cost Per Mile @ 1% | |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.63 cents |

Citi Prestige Citi Prestige |

1.3 mpd | 0.77 cents |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 0.83 cents |

| I’m not showing the Citi Rewards or Citi Lazada Card because the earn rate is a paltry 0.4 mpd and you’d have to be mental to use them | ||

Cashback will be credited within 8 weeks of the end of the promotion, i.e by 30 June 2021. The T&C for the existing customer offer can be found here.

Are the offers worth it?

Yes, yes, yes.

Simply put, this is the cheapest price I’ve ever seen miles sold for, and remember: it’s not just KrisFlyer. Citibank points can be transferred to 11 different frequent flyer programs, including some with great sweet spots like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles.

| Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

I realise that flying isn’t on anyone’s agenda right now, but just imagine what you could do with miles bought at 0.42-0.83 cents each:

- Singapore to Koh Samui on Bangkok Airways in Business Class for S$84-S$166 round-trip

- Singapore to Europe on Qatar Airways Business Class for S$630-1,245 round-trip

- Singapore to Bangkok on Cathay Pacific Business Class for S$134-266 round-trip

But even if you opt for plain vanilla KrisFlyer, buying miles at less than 1 cent each is flat out arbitrage. For example, you could use KrisFlyer miles to pay for air tickets at a rate of 1.02 cents each, so buying miles at 0.42-0.83 cents is like locking in a travel discount of 19-59%.

Alternatively, you could convert those miles into Shangri-La Golden Circle points at a ratio of 12:1. Golden Circle points can be used for F&B credit at a rate of 10 points= US$1 or US$1.25 (for Jade/Diamond members), so you’d be enjoying quite the discount on dining too.

Conclusion

The addition of $100 GrabFood vouchers to the ongoing Citi PayAll promotion make an already great deal almost impossible to pass up.

As a reminder, Citi PayAll now supports the following types of payments:

|

|

It’s possible to pay other miscellaneous invoices, but if you’re planning to pay a friend or family member, keep in mind there may be tax implications (at least if the person earns more than S$20,000 per annum).

If I already made 3 transactions earlier using either the waived or 1% fee offer, this means my next transaction will just get a $100 Grabfood voucher?

yup, while the promotions are stackable, each is subject to its own set of T&C. if you exhausted the waived/1% fee offer already, you’ll just get the vouchers.

I cannot find POSB in the bank list (for rent). Shall I select DBS?

Yes, you just select DBS and input your POSB account number will do.

Thanks mate!

This is only for eligible personnel ? I didn’t receive sms

not targeted, open to all.

Question: I was existing user on 1% cashback. Already paid twice $900 rent. This coming 31 March last payment. If I cancel it and change to $2000, the 1% cashback is on $900 per month or total amount paid ?

Is it possible to split a payment into 3 to the same payee e.g. To pay IRAS income tax and still enjoy the benefits?

by right you’re supposed to pay off your entire NOA at one go. by left…

The payall portal does not allow scheduling of recurring payment for tax

How about 3 one-time payments to IRAS? I’ve never used Citi Payall before so I wouldn’t know. Asking for a friend.

I believe the tnc says it needs to be set up as a recurring payment to qualify for the 1%

My friend is more interested in the 2 fee-free payments promo for first time users.

I read and they didn’t. But the T&Cs for new and existing users say “not valid in conjunction with other promotions (including the Citi PayAll – Citi Spend and Get 1% Cash Back Promotion, the Citi PayAll – Citi Spend and Get Bonus ThankYou Points or Bonus Miles Promotion and the Citi PayAll – Spend and Get 1% Cash Back for Existing-to-PayAll Customers Promotion), discounts or vouchers.”.

I have made two payments to IRAS since January, with a third transaction reschedule in April to enjoy both the two free transactions for new customer as well as the $100 grabfood voucher. So, yes – no problem with partially paying NOA for now.

Must the payment be made by any date? If my annual insurance premium is due in Dec, would it work?

you may prepaid the premium in advance as the deal is end by 19 March 2021, 11.59 p.m.

Does that mean I can just transfer $2K to a family member to qualify??!

yes and subject to income tax in YA2022, please read the last sentence… “It’s possible to pay other miscellaneous invoices, but if you’re planning to pay a friend or family member, keep in mind there may be tax implications (at least if the person earns more than S$20,000 per annum).”

Income tax is assessed according to tax law, not just merely the fact you’ve received payment characterised as payment for goods/services. It is entirely legitimate that the cash received pertains to non assessable income, is income that is assessable in a different period, or may be subject to deductions etc that will bring net tax liability to nil. Hence assessing tax merely because cash is received is problematic for tax authorities, but the data does invite them to ask questions.

Schedule 3 separate payments to iras by 30 Apr and viola!

Anyone can confirm whether that works? I pay 10k X 3 between now till 30 Apr as a new payall user and I get 400 cashback on fees and 39000 miles on prestige card?

I have scheduled 4 recurring payment ($5000 each), and had made 3 transactions. If I cancel it now and set up another $5000 payment, will it get 1% cash back?

Anyone got this offer already?

nope- still waiting for mine. should have received by now- will drop citi an email

Hi, isn’t it supposed to be credited on 30 June 2021? I put a reminder on my phone to get the $400 rebate.

you must be part of the second campaign, which due date is 30 june. i did mine as part of the first one, which due date was supposed to be 30 may.