Tax season is here again, and it’s time to look at this year’s options for paying with a credit card.

Individuals with income tax obligations will need to file their taxes by 18 April 2021. They’ll subsequently receive their tax bill (NOA) between the end of April and September 2021. IRAS sends NOAs in batches, so don’t feel left out if everyone else gets theirs before you do.

| 💰The Milelion’s Income Tax Guide 2021 |

How do I pay my income tax bill with a credit card?

IRAS doesn’t accept credit card payments. In their own words:

Credit card payments are not offered by IRAS directly because of the high transaction costs charged by the credit card service providers. This is to keep the cost of collection low to preserve public funds.

Fair enough. However, this doesn’t mean you can’t use your credit card to pay taxes. There are two types of tax payment facilities, which allow cardholders to earn rewards in exchange for a small fee.

| Indirect Payment Facilities | Direct Payment Facilities |

|

|

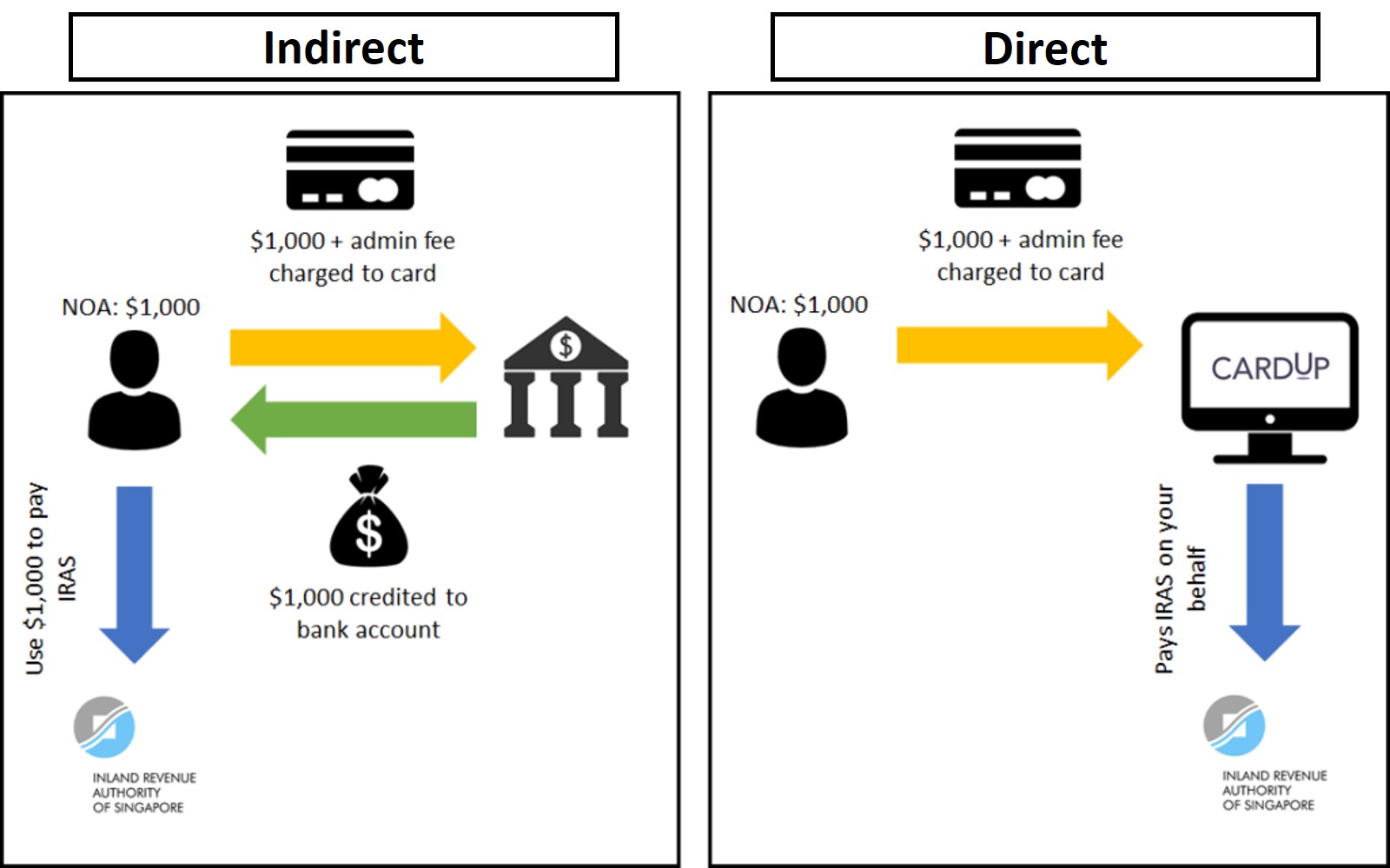

Both work the same in the sense that you submit your NOA, and your credit card is charged for the amount due plus an admin fee.

| 💡 Technically speaking, not all facilities require you to submit an NOA…but we’ll get to that later |

Where they differ is that an indirect payment facility deposits the amount due into your designated bank account, in cash. You’re still responsible for paying IRAS.

With a direct payment facility, the facility provider pays IRAS on your behalf.

Whether it’s better to use an indirect or direct facility all comes down to the cost per mile- the admin fee, divided by the miles you receive on your card.

Regardless of which one you pick, some common rules apply:

- You can’t pay someone else’s tax bill, only your own

- You can’t overpay your tax bill

What are the fees involved?

As mentioned, it’s not free to use your credit card to pay income tax. There’s an admin fee involved, which varies depending on provider.

| 🏦 List of Payment Facilities |

||

| Bank | Applicable Cards | Admin Fee |

| HSBC Premier, Visa Platinum, Revolution, Advance, Visa Infinite | 0.5-1.5% | |

| SCB Visa Infinite | 1.6% | |

| All cards except HSBC | 1.75% (code: MLTAX2021) |

|

| OCBC VOYAGE | 1.9% |

|

| UOB PRVI Miles, Visa Infinite Metal, Reserve | 1.7-1.9%* | |

Link Link |

All SCB cards | 1.9%^ |

Link Link |

All Citi cards except Citi Rewards/ Cash Back | 2% |

| All DBS cards | 2.5% | |

| Key | Indirect | Direct |

| ^This is the rate I see on my account; SC is known to target different people with different rates *Promo rate till 30 June 2021 |

||

| There is an additional option called ipaymy, but for reasons outlined in this post, I have made a decision not to endorse or comment on their services. You’re welcome to check out their rates, in any case- their tax payment promotion last year was on par with CardUp. |

It may be tempting to compare them on the basis of admin fees, but that’s only half the story. You need to also consider the earn rate.

For example, the HSBC Premier Mastercard has an admin fee of 0.5% and an earn rate of 0.4 mpd, so your cost per mile is 1.25 cents. On the other hand, the SCB Visa Infinite has a higher admin fee of 1.6%, but also a much higher earn rate of up to 1.4 mpd, resulting in a lower cost per mile of 1.14 cents.

You also need to keep in mind that banks may apply different earn rates for income tax payments. For example:

- the UOB PRVI Miles Card normally earns 1.4 mpd, but awards 1 mpd for UOB payment facility transactions (you’ll earn 1.4 mpd for CardUp, though)

- all DBS cards earn a flat 1.5 mpd for income tax payment plans, instead of their usual rates.

If this is too complicated for you, the next section should make it very simple.

What are my options for paying tax with a credit card?

| CardUp offer for Milelion Readers |

|

Milelion readers can use the code MLTAX2021 to pay income tax with a fee of 1.75%. Payments must be set up by 26 December 2021, with a due date by 7 January 2022. |

Here’s a sample of the rates you can expect to pay with each card, pending additional promotions and targeted offers (check your mail). I’ve not shown any options that cost more than 2 cents per mile, because I believe it simply doesn’t make sense beyond that. Your actual ceiling will of course depend on how you value a mile.

| Summary of Tax Payment Options |

||||

| Card | Pay Via | Fee | MPD | CPM |

Citi ULTIMA Citi ULTIMA |

PayAll | 2% | 2.51 | 0.8 |

Citi Prestige Citi Prestige |

PayAll | 2% | 2.51 | 0.8 |

Citi PremierMiles Citi PremierMiles |

PayAll | 2% | 2.51 | 0.8 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

CardUp5 | 1.7% | 1.6 | 1.04 |

DBS Insignia DBS Insignia |

CardUp4 |

1.75% | 1.6 | 1.07 |

UOB Reserve UOB Reserve |

CardUp4 | 1.75% | 1.6 | 1.07 |

SCB Visa Infinite SCB Visa Infinite |

SCB | 1.6% | 1.42/ 1.0 |

1.14/ 1.6 |

HSBC Visa Infinite HSBC Visa Infinite |

HSBC | 1.5% | 1.253/ 1.0 |

1.20/ 1.5 |

HSBC Premier Mastercard HSBC Premier Mastercard |

HSBC | 0.5% | 0.4 | 1.25 |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

CardUp4 | 1.75% | 1.4 | 1.23 |

UOB PRVI Miles Mastercard UOB PRVI Miles Mastercard |

CardUp4 | 1.75% | 1.4 | 1.23 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

CardUp4 | 1.75% | 1.4 | 1.23 |

OCBC VOYAGE OCBC VOYAGE |

CardUp5 | 1.7% | 1.3 | 1.29 |

OCBC Premier VI OCBC Premier VI |

CardUp5 | 1.7% | 1.28 | 1.31 |

OCBC 90N OCBC 90N |

CardUp5 | 1.7% | 1.2 | 1.39 |

SCB X Card SCB X Card |

CardUp4 | 1.75% | 1.2 | 1.43 |

KrisFlyer UOB KrisFlyer UOB |

CardUp4 | 1.75% | 1.2 | 1.43 |

DBS Altitude Visa DBS Altitude Visa |

CardUp4 | 1.75% | 1.2 | 1.43 |

BOC Elite Miles BOC Elite Miles |

CardUp4 | 1.75% | 1.0 | 1.72 |

HSBC Revolution HSBC Revolution |

HSBC | 0.7% | 0.4 | 1.75 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

CardUp6 | 2.2% | 1.2 | 1.79 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

CardUp6 | 2.2% | 1.1 | 1.96 |

| 1. Earn rate of 2.5 mpd during promo period from 1 May to 31 Aug 2021 2. 1.4 mpd if ≥S$2K spent in a statement period, 1.0 otherwise. This includes tax payments made via the tax payment facility 3. 1.25 if ≥S$50K spent in previous membership year; 1.0 otherwise 4. Use code MLTAX2021, valid till 26 December 2021. If tax payment is at least S$30K, write in to hello@cardup.co for concessionary rate 5. Use code OCBCAFFCARD for VOYAGE and Premier VI cards (no cap), OCBCCARDS for 90N (capped at S$10K). Valid till 24 August 2021. 6. Use code AMEXNEWTAX, valid till 27 August 2021 (for new users only). If existing user, use code AMEXTAX for 2.4% fee |

||||

| 🧮How is this calculated? |

|

For CardUp, both the admin fee and the tax payment earn miles, so a S$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,221 miles (ignoring rounding). This works out to 1.43 cents per mile. For bank facilities, only the tax payment earns miles, so a S$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,200 miles. This works out to 1.46 cents per mile. |

A few points to note.

Apply for as many facilities as you want

If you hold more than one of the cards above, there’s nothing stopping you from applying for multiple tax payment facilities in order to buy more miles (otherwise known as churning).

For example, someone with a S$10,000 tax bill who holds both the SCB Visa Infinite and HSBC Visa Infinite could send the same NOA to both SCB and HSBC. Upon approval, he/she could buy up to 26,500 miles (14,000 from SCB, 12,500 from HSBC) for S$310 (S$160 from SCB, S$150 from HSBC).

Take particular care if you’re applying for two direct payment facilities, however, because there’s a chance you might end up overpaying your tax bill. “What’s wrong with funding the government’s working capital?” you may ask. Well, IRAS has to arrange for a refund, and tells off the sender in the process. Hence this line in the Citi PayAll T&Cs:

| “Where we have determined in our discretion exercised reasonably that your Payment(s) to IRAS exceed the amount of taxes which you are required to pay to IRAS, we shall be entitled to claw back any rewards credited to your card account in connection with any amount so overpaid to IRAS using the Service. In such an event, we will refund the relevant portion of Fee in respect of such overpaid amount.” |

There’s no chance of this happening with indirect payment facilities, because the onus is on you to pay IRAS. What you do with the cash after it’s deposited into your account is your own business.

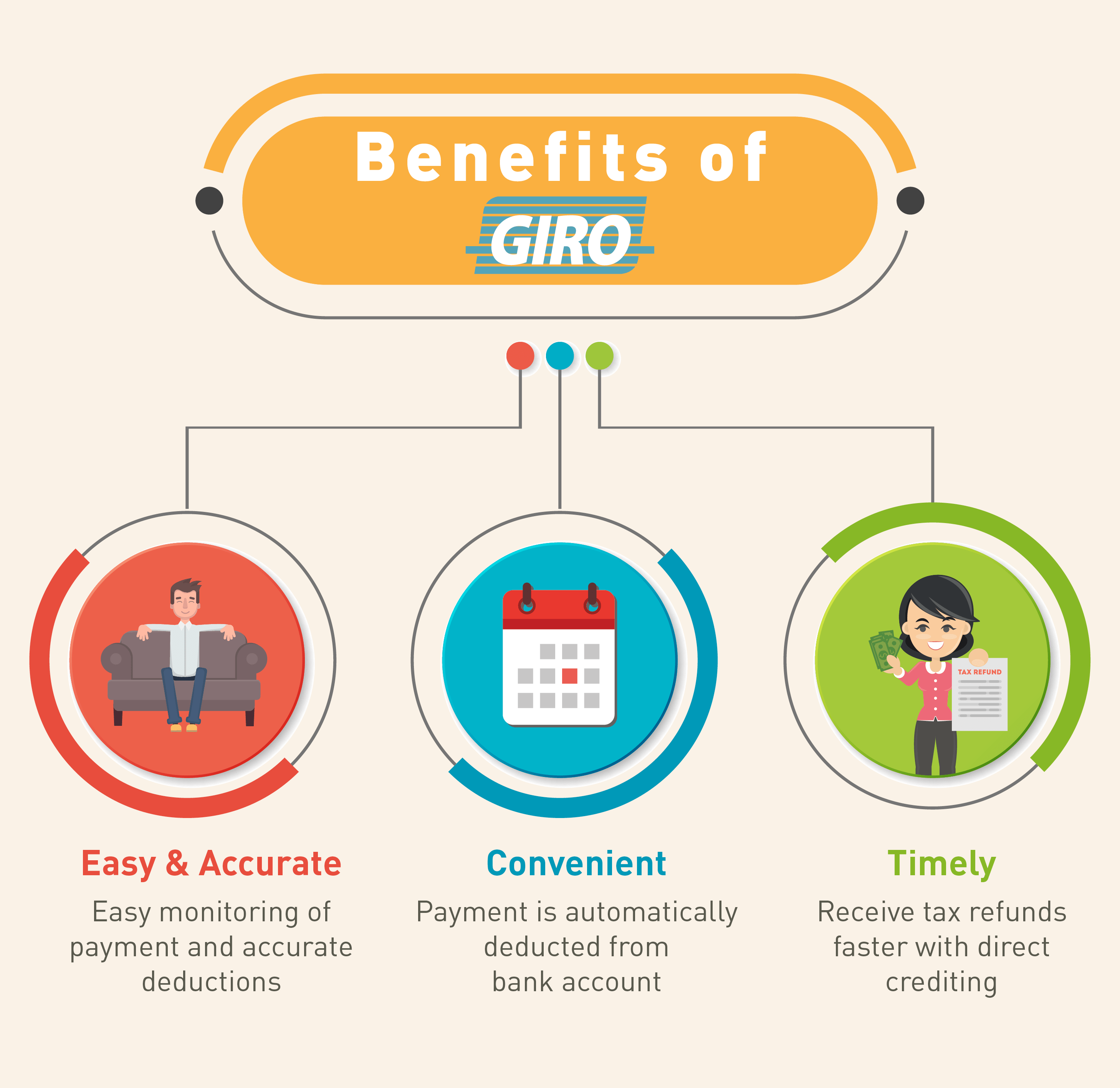

You can still use GIRO (in most cases)

IRAS allows taxpayers to split their payment into 12 interest-free installments via GIRO. This is great for maximizing your cashflow, and something I opt for each year.

There are no issues using GIRO if you opt for an indirect payment facility, as the bank simply credits the cash to your account and how you go about paying IRAS after that is up to you.

GIRO used to be an issue for direct payment facilities, but the good news is that’s no longer the case. CardUp, Citi PayAll and SC EasyBill now allow you to pay off any amount up to and including the total balance on your NOA.

In other words, you could:

- Elect to pay your income tax via GIRO

- Make partial payments each month, a few days before the scheduled deduction (6th of each month; where this is a weekend/public holiday, on the next working day). Do note that neither service allows you to set up recurring payments for IRAS

As long as you don’t overpay your total tax bill (which triggers a refund from IRAS and a chiding from the bank), I don’t see any issues here. It’s OK to get the installment slightly wrong and pay more than what’s needed (but not less, obviously), so long as your final payment clears off the remaining balance exactly.

Don’t forget about transfer partner variety

| KrisFlyer |  |

|

|

|

|

|

|

|

|

| Star Alliance | |||||||||

| ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

|

✅ | ✅ | ✅ | ||||||

|

✅ | ✅ | |||||||

|

✅ | ||||||||

| ✅ | |||||||||

|

✅ | ||||||||

| Oneworld | |||||||||

| ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |||

|

✅ | ✅ | |||||||

| ✅ | ✅ | ✅ | |||||||

| ✅ | ✅ | ✅ | ✅ | ||||||

| ✅ | ✅ | ||||||||

| SkyTeam | |||||||||

| ✅ | ✅ | ||||||||

|

✅ | ||||||||

| Non-aligned | |||||||||

| ✅ | ✅ | ||||||||

| ✅ | ✅ | ||||||||

| Hotels | |||||||||

|

✅ | ||||||||

|

✅ | ||||||||

| ✅ | ✅ | ||||||||

| ✅ | |||||||||

When evaluating two cards with similar cost per mile figures, it’s helpful to think of qualitative factors as well.

One important consideration is transfer partner variety. All things equal, the card that offers more transfer partners will be more useful. If you need a refresher on who partners with who, check out this article.

Another consideration is points expiry. While most frequent flyer programs are extending the validity of their miles during COVID-19, it doesn’t hurt to have a bit of additional wriggle room on the bank side. For a guide on points expiry policies by bank, refer to this post.

Conclusion

No one enjoys paying taxes, but if you’re a glass half-full kind of person, they’re an opportunity to buy miles on the cheap. It all boils down to what your expectations are regarding travel opening up in the second half of this year, and how your miles balance looks right now.

I will be updating this article as new tax payment promotions are announced, so bookmark it for future reference.

As someone working in aviation, my advice is not to expect any significant travel opportunities in 2021. So, do think carefully about buying miles which you may then find hard to use. When some travel does resume, the demand for seats will be high (especially by corporates in premium cabins) and one should expect that airlines will give priority to revenue seats.

to offer a contrasting view: there’s no reason to expect corporate travel to pick up anytime soon. IATA has said as much- companies have moved to remote working and meeting, and if anything it’s leisure travel that will recover first. IATA also says load factors won’t recover until 2024…surely that means opportunities for awards?

Doesnt it work both ways??

You can bet money on it those living in USA/Europe (definitely hear this with my and other friends colleagues) will travel for business….they’ve been so messed up in their so called “loss of freedoms” they’ll do anything just to fly out and there’s nothing stopping them other than a bit of testing etc. They really keen to fly and have the budgets ready. Our restrictions are on the way back here….they don’t understand why we don’t just fly given no lockdowns!

With 40k iras tax bill upcoming. Nice to see some options which helps to generate some return for future travel.

Mine is 80k … sienzzz

Do you know what happen if I really paid my wife’s taxes?

The Ipaymy promo 1.85% fee till 30 Apr would come in much cheaper than cardup for tax payment right?

but you need to make 2 payments for that rate. income tax through cardup/ipm can only be made in a single payment of full amount due

It’s for up to 2 payments (I already used the code once this month for something else).

Anyway ipaymy does let you pay only part of your IRAS NOA it doesn’t have to be the full amount.

re: ipm, added a note in the post on my decision not to endorse them. I’ll check with cardup whether partial payments will be possible this year, but from my understanding the restriction is imposed by iras (but since citi payall etc allow partial payments, i think there’s a by right by left thing going on here)

Why has ipaymy been left off? They’re much more flexible (and in my view sensible) on tax matters than cardup, not to mention being cheaper to boot

added a note on this in the post! i’ll be discussing with cardup whether it’s possible to do partial payments this year; from what I understand, the restriction is on IRAS side not theirs.

I’ve also had the (mis)fortune to work with Ethan Dobson and can confirm that Ethan is – for lack of better terms – a kid.

How pay IRAS income tax with your credit card (and earn miles)

->

How TO pay IRAS income tax with your credit card (and earn miles)

See what happens when I don’t drink in the morning?

If you have the discipline to track and manage properly, pay with UOB One card via ipaymy (or Cardup when they allow partial payment), and apply for as many indirect payments as you wish. UOB One gives you 3.33% or 5%, profiting 1-3% after the fees, depending on promo of the month. Overall, the cpm can be lower.

Question for Aaron: The “choose GIRO then monthly partial pay with PayAll/Easybill” method. Have you done this yourself? As I understand it, even if you pay with credit card a few days before the GIRO deduction date, the bank will still send the GIRO payment over on the stipulated day. Would it make a difference if it the GIRO and credit card bank are one and the same or different banks? If the GIRO deduction goes through after the credit card payment, wouldn’t the double payments eventually stack up earning the notice of IRAS?

yes, i just did it with citi payall. my giro is usually deducted between 6-8th of each month. i made an ad-hoc payment via payall on 20 march, and i didn’t get any deduction for april because the ad-hoc payment was more than the monthly giro instalment. i guess that giro is not triggered on the IRAS side in that case.

Thanks for the super quick reply! Maybe something for me to consider then for the Citi PayAll offer. But then again I might pass on the whole buying miles with taxes thing for this year. Comments from ithh above seem to align with what I’m hearing from my own friends too. The problem might be worse than what is obvious: once travel is ‘open’, SQ will stop extending miles but the difficulty would be securing travel in J/F to a few ‘safe’ places that everyone would want to go to (Taiwan/Vietnam/New Zealand if they will have us) when there are… Read more »

Just spend your points in kris shop as no point hoarding.

To you question about the Payall/Giro method, yes I confirm Giro won’t deduct if your payall has gone in prior to the monthly deduction date. HTHs.

Thanks for the suggestion. I’ve looked in Kris shop. Converting at Krishop dollar prices, it’s 0.8 cpm if we pay with miles. But Cristal 2012 at $378? I get it at $295 nett in Singapore shops. I also looked at Krishop prices for Apple Samsung Garmin SK2 etc If I used prices elsewhere in Singapore it’s 0.6 to 0.7 cpm. If I used Amazon…… ok never mind. Even earning at 4mpd for everything (impossible for everything), that’s about 2.4% ‘discount’ per dollar spent with credit cards in Singapore. Forex-involved transactions would be outright losses assuming 0.7 cpm redemptions. I also… Read more »

Sure….on the assumption air travel and redemptions are on the cards in the very near future without devaluations then i’d hoards and spend the points elsewhere if I could. It’s sitting currency that’ll go poof if it’s not utilised eventually.

You say

“the UOB PRVI Miles Card normally earns 1.4 mpd, but awards 1 mpd for payment facility transactions”

but then in the table you show PRVI MC @ 1.4 in the MPD column.

Can you clarify?

because that’s PRVI MC rate with cardup (2.25%, 1.4 mpd). if you use UOB’s own payment facility, you pay 2% and earn 1 mpd

Ah thanks, good to know. I use cardup now for rent with UOB PMC.

Sorry Aaron, love the blog generally but I cannot take this article seriously when you exclude ipaymy – your choice to do so but they have by far the best rate right now for IRAS payments and the entire article is inaccurate / misleading if you don’t include them.

is it incomplete? perhaps. is it inaccurate/misleading? hardly. there’s a clear note behind the table that addresses ipaymy’s omission. his blog, his decisions. and you’ve obviously not been misled in any way.

hi greg! understand where you’re coming from. if your NOA isn’t in yet, perhaps wait a week or so and see what tax promotions come out- i think you’ll be pleasantly surprised.

He has the discretion to do that and he has openly stated his reasons and that readers can check out their rates if they wish so. Calculations wise, if they have a better rate then go for ipm over CardUp if you were going to use CardUp. Easy?

This is nothing next to all the bias and agenda most fora have, TheMileLion is one of the more neutral ones.

Hi Greg, in case you didnt get it, ipaymy doesn’t want to be mentioned in this blog. Aaron is just respecting their wishes and he has also made a disclosure. What else do you want? I just cannot see how this makes the article factually inaccurate? Are you somehow related to ipaymy? Maybe you should make a disclosure.

This is probably a noob question: I use Citi Payall Premiermiles to pay 5K. Admin fee is 100 dollars. I get about 6000 miles? based on local spend 1.2. Now the question is i need about 180,000 miles for Etihad first class one way to London. I spend 150K to get 180000 miles? But i would have paid 3K in admin fee- is that still a good deal?

Etihad first class flight from Singapore to London is 5.8k. 5.8k is a lot more than 3k so it is a good deal?

Yes it is a noob question because your answer is google.

Ideally you would not be paying 2 cents per mile, though

I have applied for the HSBC premier tax payment facility for the last 2 years – and as usual, no news after the application has been submitted. Any attempts to enquire via the premier banking centre or the usual call centre has been futile. This year, I have submitted my application again but really have no high hopes at all. Does any one has any experience to share? Beginning to feel that may be only HSBC Jade members deserve better.

Is there a spend cap for Uob privi miles?

I went thru Uob t&cs n can’t seem to find any indication

Just got email for ipaymy 1.75% IRAS payment. Worth to hold out for a better CardUp offer or will they match like last year? Hmmm. Got to pay mine by 27 May!

cardup’s offer is the same at 1.75%, you can use the promo code MLTAX2021 to unlock it. will publish something shortly.

Thanks Aaron! I’m using Citi PM Visa so I think the only better option for me is if they run 1.5mpd via PayAll again this year

Hi Aaron, im trying to utilize citi payall facilities and still using Giro, im still rather unclear on how it works, need you to advice

Thanks!

Yes the normal GIRO deductions will continue until it is fully paid. To avoid confusion, it’s best to use these mile buying facilities only when you want to pay the entire bill in full.

it depends when you make your payment. if you do it well in advance of the giro deduction date, no further deduction will be made.

i tried this back in March. my giro deductions normally happen on the 6th to 8th of each month. I used payall to make a manual payment on 20 march that more than covered April’s instalment, and sure enough, nothing was deducted in April from GIRO.

Thanks fr this, will give it a try

zzz my giro still kena deduct.

that’s very weird, I assume you made your payment well in advance of the GIRO deduction date? and we’re talking personal income tax?

Hi, is there any good Cashback option for paying tax?Thanks

step 1: top up grabpay with uob absolute card, earn 1.7% cashback

step 2: use grabpay with AXS to pay off tax

thank you. is there any other options not going through GrabPay as well ?

UOB One with Cardup. Make sure you do your sums right and hit as close to the quarterly spend requirement as possible.

sorry I’m extremely late to the game as I recently had a tax review. For CardUp, the steps are essentially to:

(1) apply for a GIRO plan with IRAS using your existing bank account

(2) make sure your CardUp plan pays IRAS before it triggers a GIRO deduction on the 6th

(3) sit back and earn miles

thanks 🙂

Will there be an updated article for 2022?