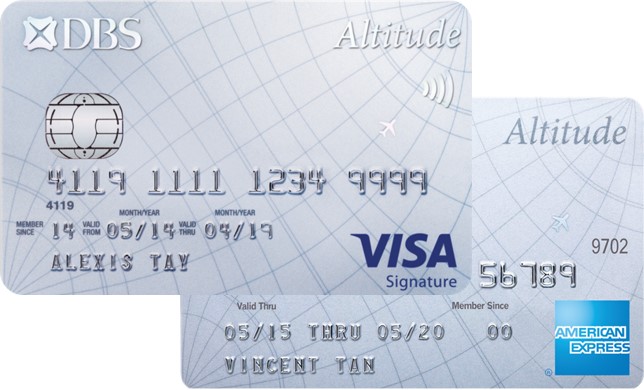

DBS has launched an enhanced earn rate for the DBS Altitude Visa and DBS Altitude AMEX cards, which runs from now till 31 July 2021.

Cardholders will earn up to 3 mpd when they shop online, subject to a minimum spend of S$2,500 and a cap of S$5,000. While those who insist on using one card for everything might welcome the offer, everyone else would find better value by using 4 mpd cards instead.

Earn up to 3 mpd with DBS Altitude cards

From 1 June to 31 July 2021, DBS Altitude Visa and DBS Altitude AMEX cardholders can earn up to 3 mpd on selected online transactions as follows:

|

|||

| Regular | Bonus | Total | |

| Local Spend | 1.2 mpd | 1.0 mpd | 2.2 mpd |

| Foreign Currency Spend | 2.0 mpd | 1.0 mpd | 3.0 mpd |

No registration is required for this offer. Cardholders who spend at least S$2,500 on qualifying transactions in a given calendar month will qualify. If you want to enjoy this rate in both June and July, you’ll need to spend at least S$2,500 in each month.

Qualifying transactions refer to any retail transactions posted to the card, excluding:

|

|

My reading of the T&Cs is that transactions like insurance premiums or government payments would not earn any points, but would count towards the S$2,500 minimum spend.

Assuming the minimum spend threshold is met, you’ll earn a bonus 1 mpd for eligible spend, defined as online transactions made at the following merchants:

| Category | MCCs | Examples |

| 👚 Apparel |

5137, 5139, 5611, 5621, 5631, 5641, 5651, 5655, 5661, 5681, 5691, 5697, 5698, 5699 | bYSI, Forever21, Chomel, La Senza, Coach, Lacoste |

| 🏬 Department Stores |

5309, 5310, 5311, 5331, 5399 |

KrisShop, M&S, Muji, Iuiga, Japan Home, Isetan |

| 🖥️ Electronics & Computers | 5045, 5065, 5732, 5734 | Apple, Audio House, Best Denki, |

| 🪑Home/Office Furnishing & Appliances | 5021, 5200, 5712, 5713, 5714, 5718, 5719, 5722, 5997 | Castlery, Thermomix, Selffix |

| 🛍️ Specialty Retail | 4225, 5111, 5193, 5531, 5931, 5932, 5933, 5937, 5943, 5947, 5948, 5950, 5973, 5978, 5992, 5993, 5996, 5999, 9751 | Amazon, Rimowa, Far East Flora, Noel Gifts |

| 💍 Watches & Jewelry | 5094, 5944 | Cartier, Citigems, Gold Heart |

Don’t confuse qualifying spend and eligible spend:

- All eligible spend will be qualifying spend

- However, not all qualifying spend is eligible spend, e.g groceries, taxi rides, entertainment subscriptions

The maximum bonus you can earn is capped at S$5,000 of spending per calendar month, i.e 5,000 bonus miles. Bonus miles will be posted by the end of the following month, i.e. bonus miles for June will post by 31 July, and bonus miles for July will post by 31 August.

The full T&C for this offer can be found here.

Is it worth it?

Unless you’re dead set on using one card for everything, it’d be much more straightforward to use a specialized spending card instead for online shopping.

The following cards earn you 4 mpd on all online transactions (except travel in the case of the Citi Rewards) regardless of currency, with no minimum spend required.

| 🖥️ Best Cards for Online Shopping | ||

| Card | Earn Rate | Remarks |

| 4.0 mpd | Max S$1K per s. month, excludes travel Review |

|

|

|

4.0 mpd | Max S$2K per c. month Review |

| C. Month= Calendar Month, S. Month= Statement Month | ||

Alternatively, the following cards can also earn 4 mpd for online transactions, depending on the MCC (e-commerce platforms like Amazon and Lazada are safe bets, but refer to the T&C for specific inclusions):

| 🖥️ Alternative Cards for Online Shopping | ||

| Card | Earn Rate | Remarks |

| 4.0 mpd |

Max S$1K per c. month. See T&C for eligible trxns Review |

|

|

|

4.0 mpd | Max S$12K per m. year. See T&C for eligible trxns Review |

|

|

4.0 mpd |

Max S$1,110 per c. month. See T&C for eligible trxns Review |

| C. Month= Calendar Month, S. Month= Statement Month, M. Year= Membership Year | ||

It’s worth noting that OCBC is also running a tier-up offer on groceries, online shopping and FCY transactions on its OCBC 90N Card, which has no minimum spend requirement. However, the incremental offer is a measly 0.2 mpd and capped at S$1,000- really nothing to get excited about.

What can I do with DBS points?

The bonus miles are awarded in the form of DBS points, which can be transferred to the following frequent flyer programs at a ratio of 1 point= 2 miles (except AirAsia, where the ratio is 1:3). Transfers cost a flat S$26.75, regardless of the number of points converted.

| 💳 DBS Transfer Partners | |

| For a full list of transfer partners, refer to this article | |

In my opinion, it’s only worth transferring miles to KrisFlyer or Asia Miles. AirAsia BIG is more of a rebates program than a traditional frequent flyer scheme, and Qantas Frequent Flyer has no sweet spots worth talking about.

Conclusion

Given how you can easily earn 4 mpd on online transactions in local and foreign currency (with no minimum spend to boot), I doubt this DBS Altitude offer will interest many miles collectors.

The only situation I could see this making sense is if you already maxed out your 4 mpd caps, but given how many options there are, you’d have to be spending quite a lot.

OCBC Titanium Rewards

OCBC Titanium Rewards