Kris+ (formerly known as KrisPay) has added support for Apple Pay and Google Pay, which significantly simplifies the payment and miles accrual process. This functionality is available with the latest version of the app, so be sure to update it when you get a minute.

From 14 June 2021, Kris+ users can make in-store purchases at 151 participating Kris+ merchants with Mastercard and Visa cards linked to Apple Pay and Google Pay. Support for American Express cards will be added from October 2021.

In one sense, this is a great development: you’ll be able to pay and earn miles in a single step, compared to the convoluted multi-step process before. However, you may still have to go about things the old-fashioned way depending on the credit card you use, as I’ll explain below.

Earn KrisFlyer miles automatically with Kris+

While it’s been possible to earn miles at Kris+ merchants since March 2019, the earning process has been less than ideal.

Here’s the current steps:

- Pay as per normal with your credit/debit card or cash

- Open the Kris+ app, tap on “Earn”, and enter the amount paid to generate a QR code

- Let the cashier scan your QR code with the Kris+ merchant device

In my experience, (3) is where the most things go wrong. I have a very poor track record of actually earning miles at Kris+ merchants, with excuses ranging from “can’t find the machine”, to “don’t have the login”, to “what’s KrisPay?”

The new process removes the need for (3), allowing you to automatically earn your miles.

- Scan the merchant’s Kris+ QR code

- Enter the amount to be paid, and press “Pay” to pay via Apple/Google Pay

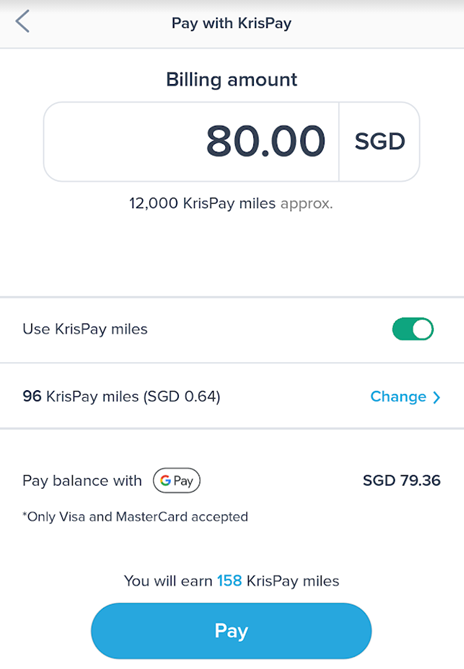

For example, let’s say I have a S$80 bill to pay. I’ll scan the merchant’s Kris+ QR code, and enter S$80 in the “billing amount” field.

Notice how I have a small balance of 96 KrisPay miles (I forgot to transfer these out in time; yes, I know). These will be selected as part of the payment by default, making the nett amount S$79.36.

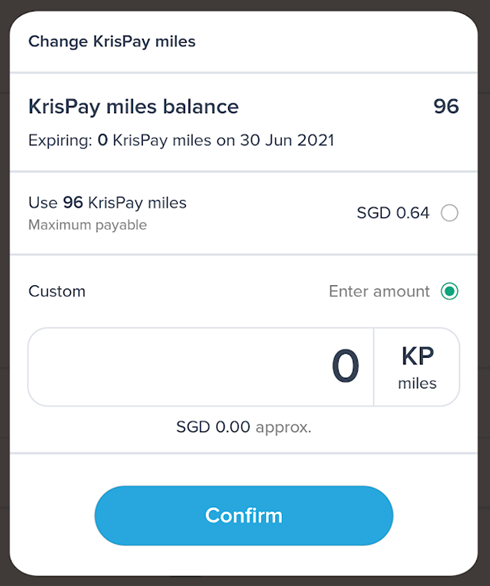

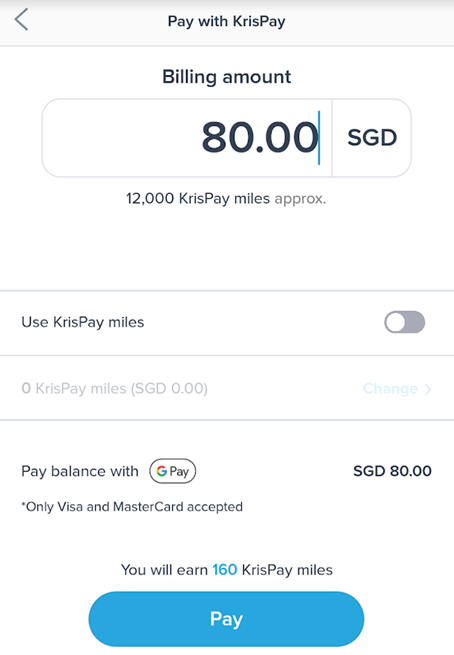

If you don’t want to use your KrisPay miles, you’ll need to tap on the toggle, select “custom” and enter “0” in the field. Once you’re satisfied, tap “Pay”, and your KrisPay miles will be instantly credited.

| This assumes that Apple or Google Pay is already set up on your phone, with a Mastercard or Visa card selected as the default payment method. |

Don’t forget to transfer any miles you earn to KrisFlyer; you only have seven days to do so!

What card should I use to pay?

If paying via Kris+

Even if you use Apple/Google Pay with Kris+, the transaction should still code under the merchant’s usual MCC. In other words, if it’s a dining merchant, use your dining card. If it’s a shopping merchant, use your shopping card.

|

Update: KrisPay has now confirmed this in an email to me. “We wish to share that Merchant Category Code (MCC) is applied according to the merchant category e.g. dining under 5812, 5814, retail under 5621 and electronics 5723.” |

But there’s one important thing to note: even though you’d normally use your UOB Preferred Platinum Visa or UOB Visa Signature with Apple/Google Pay to earn 4 mpd, this does not apply to in-app payments. The T&Cs state very clearly you need to tap the mobile device against the contactless reader to qualify, which doesn’t happen with in-app payments.

Therefore, if you’re using either of these cards, your best bet is to go via the old route, i.e. making payment outside the Kris+ app first, then asking the merchant to scan your Kris+ QR code to accrue miles.

If you’re using another card like the HSBC Revolution (4 mpd on shopping and dining), I don’t see any issues at all. Set it as your default card, and use it for payment at Kris+ merchants; so long as the transaction codes as one of the eligible MCCs, it makes no difference whether you pay via Apple/Google Pay.

It gets slightly trickier if we come to cards that reward online transactions only, like the DBS Woman’s World Card. Does Kris+ turn an offline transaction into an online one? For instance, could I use the DBS Woman’s World Card to pay my dining bill at a restaurant through Kris+ and earn 4 mpd?

I’m not sure about this. It’ll require some field testing, but i don’t think it’s worth the risk. Really, any self-respecting miles collector should have at least a UOB Preferred Platinum Visa.

If paying direct to merchant

If you’re paying directly to the merchant, things are more straightforward. You could use the following cards for dining…

| 🍴 Best Cards for Dining | ||

| Card | Earn Rate | Remarks |

HSBC Revolution HSBC RevolutionApply |

4.0 mpd | Max. S$1K per c. month. Must use contactless |

UOB Pref. Plat Visa UOB Pref. Plat VisaApply |

4.0 mpd | Max. S$1.1K per c. month. Must use mobile payments |

UOB Lady’s Card UOB Lady’s CardApply |

4.0 mpd | Max. S$1K per c. month. Must choose dining as 10X category |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4.0 mpd | Max. S$3K per c. month. Must choose dining as 10X category |

Maybank Horizon Maybank HorizonApply |

3.2 mpd | Min. S$300 spend per c. month on any category. Capped at ~S$4.2K per month |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

3.0 mpd | Min. S$300 spend on SIA Group in a m. year |

| C. Month= Calendar Month | M. Year= Membership Year | ||

…and the following cards for shopping.

| 🛍️ Best Cards for Shopping | ||

| Card | Earn Rate | Remarks |

Citi Rewards Citi RewardsApply |

4.0 mpd | Max. S$1K per s. month |

HSBC Revolution HSBC RevolutionApply |

4.0 mpd | Max. S$1K per c. month. Must use contactless |

OCBC Titanium Rewards OCBC Titanium RewardsApply |

4.0 mpd | Max. S$12K per m. year |

UOB Lady’s Card UOB Lady’s CardApply |

4.0 mpd | Max. S$1K per c. month. Must choose shopping as 10X category |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4.0 mpd | Max. S$3K per c. month. Must choose shopping as 10X category |

UOB Pref. Plat Visa UOB Pref. Plat VisaApply |

4.0 mpd | Max. S$1.1K per c. month. Must use mobile payments |

| C. Month= Calendar Month | S. Month= Statement Month | M. Year= Membership Year | ||

Conclusion

The integration of Apple/Google Pay will make it a lot simpler to earn miles with Kris+, although the overall merchant list continues to be rather small three years after launch.

However, you may still need to go about things the old fashioned way depending on what card you use. UOB Preferred Platinum Visa/Visa Signature cardholders in particular should take note: pay through your mobile wallet as usual, then generate the QR code for the merchant to scan and award miles.

You can refer to this guide for more information on using the Kris+ app.

wait for amex integration