Last month, Kris+ introduced in-app payments through Apple and Google Pay, combining the payment and miles earning process into a single step. To celebrate the launch they even ran a very generous 3X miles campaign, with up to 15 mpd at 150+ merchants.

|

| Get S$5 when you sign up for Kris+ |

Well, it looks like Kris+ is ready to move to Phase 2 of the plan, because from 1 September 2021, in-app payments will be the only way to earn miles from Kris+ merchants; the offline option will be removed.

Kris+ terminating offline earn from 1 Sept 2021

For context, there are currently two ways of earning miles through Kris+:

| 💳 Offline Earning (Ends 1 September 2021) |

📱 In-App Earning |

| Make payment with cash or credit/debit card | Scan merchant QR code |

| ⇓ | ⇓ |

| Tap “earn” button in Kris+ app, enter spend amount and generate QR code | Enter amount to pay via Apple/Google Pay |

| ⇓ | ⇓ |

| Merchant scans QR code | Miles credited |

| ⇓ | |

| Miles credited |

The traditional, offline earning way is to make payment as usual with cash or a credit/debit card, then generate a QR code in the Kris+ app for the merchant to scan and award you miles. As you might have guessed, a lot could go wrong with the last step; over the years I’ve heard excuses ranging from “can’t find the machine”, to “don’t have the login”, to “what’s KrisPay?”

The new in-app earning method does away with the last step. Kris+ users simply scan the merchant’s QR code, make an in-app payment via Apple/Google Pay, and earn miles automatically.

From 1 September 2021, in-app payments will become the only way to earn miles on Kris+.

What are the implications?

In one sense, this doesn’t change much. You’ll still be able to double dip on miles earning through Kris+ and your credit card, stacking an additional 4 mpd on top of whatever Kris+ gives you.

However, there are some important things worth highlighting.

UOB Pref. Plat. Visa & UOB Visa Signature

While you’d normally use the UOB Preferred Platinum Visa or UOB Visa Signature with Apple/Google Pay to earn 4 mpd, this does not apply to in-app payments. The T&Cs state very clearly you need to tap the mobile device against the contactless reader to qualify, which doesn’t happen with in-app payments.

It was easy enough to circumvent the issue with the offline method by tapping your mobile device to pay and then generating a QR code to earn Kris+ miles, that option won’t be available come 1 September.

American Express cards

Kris+ currently only supports Mastercard and Visa card for in-app payment, with American Express support to come in October 2021.

The shift to pure in-app payments means that those who rely primarily on an AMEX card will have to use something else in the interim.

What card should you use for Kris+ in-app payments?

Kris+ has confirmed that in-app payments will still code according to the underlying merchant’s regular MCC. In other words, simply use whatever credit card you’d normally use at that particular merchant.

| ❓ Want to know the MCC of a particular merchant? The Visa Supplier Locator is your friend. |

Here’s some recommendations for dining…

| 🍴 Best Cards for Dining | ||

| Card | Earn Rate | Remarks |

HSBC Revolution HSBC RevolutionApply |

4.0 mpd |

Max. S$1K per c. month |

UOB Lady’s Card UOB Lady’s CardApply |

4.0 mpd* | Max. S$1K per c. month. Must choose dining as 10X category |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4.0 mpd* |

Max. S$3K per c. month. Must choose dining as 10X category |

Maybank Horizon Maybank HorizonApply |

3.2 mpd | Min. S$300 spend per c. month on any category. Capped at ~S$4.2K per month |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

3.0 mpd | Min. S$300 spend on SIA Group in a m. year |

| C. Month= Calendar Month | M. Year= Membership Year *6 mpd till 31 October, registration required |

||

…and for shopping.

| 🛍️ Best Cards for Shopping | ||

| Card | Earn Rate | Remarks |

Citi Rewards Citi RewardsApply |

4.0 mpd | Max. S$1K per s. month |

HSBC Revolution HSBC RevolutionApply |

4.0 mpd | Max. S$1K per c. month |

OCBC Titanium Rewards OCBC Titanium RewardsApply |

4.0 mpd | Max. S$12K per m. year |

UOB Lady’s Card UOB Lady’s CardApply |

4.0 mpd* |

Max. S$1K per c. month. Must choose shopping as 10X category |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4.0 mpd* |

Max. S$3K per c. month. Must choose shopping as 10X category |

| C. Month= Calendar Month | S. Month= Statement Month | M. Year= Membership Year *6 mpd till 31 October, registration required |

||

I don’t think there should be any issue with using the DBS Woman’s World Card (since all transactions should be processed online), but I’d prefer to hear a few data points before recommending it.

How to use Kris+ in-app payment

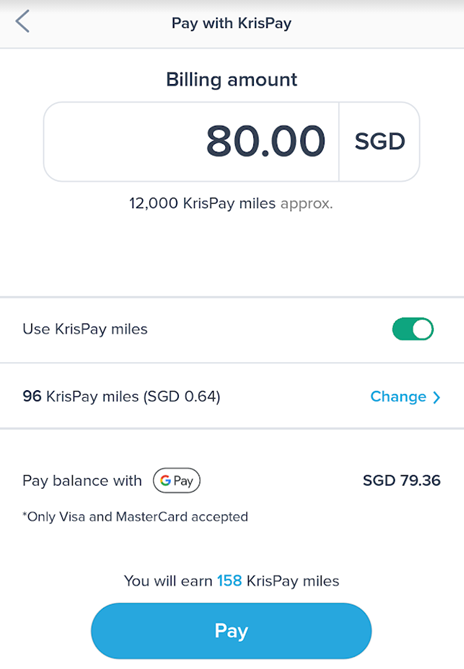

Suppose I have a S$80 bill to pay. I’ll scan the merchant’s Kris+ QR code, and enter S$80 in the “billing amount” field.

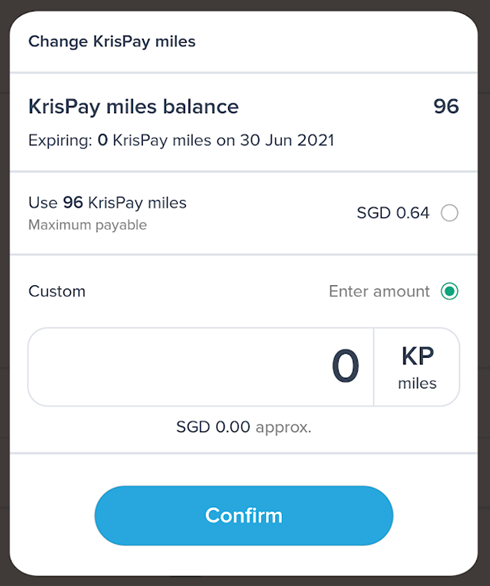

Notice how I have a small balance of 96 KrisPay miles. These will be selected as part of the payment by default, making the nett amount S$79.36.

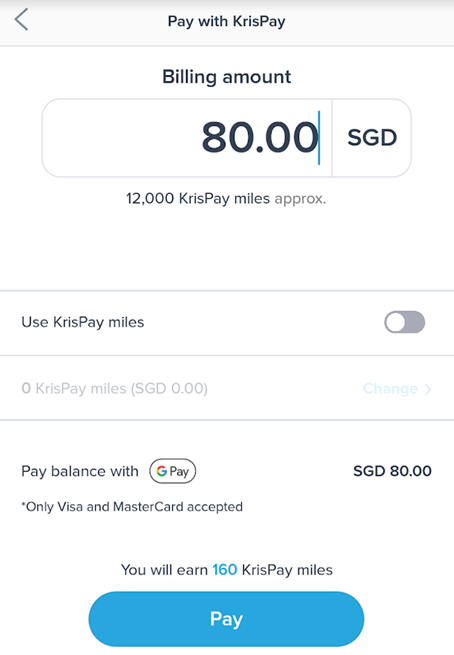

If you don’t want to use your KrisPay miles, tap on the toggle, select “custom” and enter “0” in the field. Once you’re satisfied, tap “Pay”- for Google Pay at least, you’ll be able to choose which card you wish to use before the payment is finalized.

Miles will be instantly credited. Don’t forget to transfer them to KrisFlyer immediately; you only have seven days to do so!

Conclusion

August will be the last month to earn Kris+ miles the old fashioned way, but this shouldn’t be a major inconvenience to anyone with a HSBC Revolution or similar card. In fact, it’s going to make things a heck of a lot more convenient, and minimized missed opportunities to pick up additional miles.

Be sure to load your preferred cards into your Apple or Google Pay wallet before then.

“(Ends 1 September 2021)” is shown under “In-App Earning” instead of “Offline Earning”.

thank you! fixed it.

The 4 mpd for HSBC Revolution looks interesting but then I checked the T&C and realized that need to pay $40 annual fee to maintain link to KF account

Thanks Aaron. So if I were to purchase electronic products at Harvey Norman with Kris+ tagged to OCBC Titanium Rewards card, would I get double dip?

Mcc is passed through, so I don’t see why not

Also means we won’t be able to stack with ShopBack earnings 🥲

doesn’t shopbackgo also track if you use google pay? i guess the question is how the MCC shows up on your credit card statement though.

for big purchase items like electronics product. The earn rate may be lesser now. Previously can use UOB PPV card to pay like for an iPhone and still earn Kris miles. A double dip

Now with a cap like 1K for HSBC Revolution miles earning may be lesser if use KrisPay.

Hopefully the use of DBS women card can be considered as an online purchase. Anyone got data point?

Phew I did manage to redeem the miles via the offline method when I did my health screening just last week.

When I click Pay on the Kris+ app, am i able to select which card i would like to use in my GooglePay wallet? or the default card is auto used?

You can still select card

Hi guys, may I check if DBS woman’s world card should be used with Kris+ app? any updates on that? thank you!