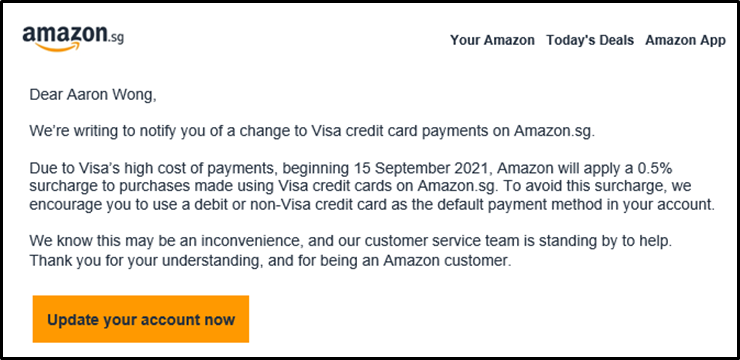

Amazon Singapore has announced that effective 15 September 2021, it will start applying a 0.5% surcharge to all purchases made using a Visa credit card on Amazon.sg. The fee does not apply to Visa debit cards, or any other credit cards.

If you ask me, this feels like a power play by Amazon, throwing down the gauntlet to Visa publicly and hoping they’ll blink first.

|

An Amazon spokesperson has reached out with the following statement. “The cost of accepting card payments continues to be an obstacle to providing the best prices for customers. These costs should be going down over time with innovation and technological advancements, which allows merchants to reinvest savings into low prices and shopping enhancements for customers. Yet, despite these advancements, some cards’ cost of payments continue to stay high or even rise. As a result of Visa’s continued high cost of payments, a surcharge is being added to Visa credit card payments in Singapore. We understand this is inconvenient for customers, and encourage them to switch to other payment methods moving forward in order to avoid a surcharge. With the rapidly changing payments landscape around the world, we anticipate a future that is less card-centric in the coming years, and we will continue innovating on behalf of customers to add and promote faster, cheaper, and more inclusive payment options to our stores across the globe.” -Amazon Spokesperson Yeah, I think they’re definitely trying to put public pressure on Visa… |

But it’s not exactly unprecedented…

What’s going on?

This isn’t the first surcharge-related drama that Visa’s been involved in this year. Back in March, Grab announced that it would be adding a S$1 admin fee to all GrabPay top-ups made with Visa credit cards, a move that was later postponed indefinitely. YouTrip has also added a S$1 top-up fee for Visa credit cards.

To understand what’s going on, you need to know that back in February 2020, Visa announced plans to adjust its interchange fees. While categories like rent and vending machines would see lower fees, e-commerce merchants and ride-hailing apps would pay more.

| 💳 Incidentally, this might explain why some of CardUp’s recent promotions have been for Visa cards only. |

These changes were initially delayed until April 2021 due to the COVID-19 outbreak, and then again until April 2022, but for whatever reason some merchants are looking to get customers to switch their card habits ahead of time (all these adjustments were mentioned in the context of the US, but I assume there’s some knock-on effect globally; Singapore merchants tell me if you know more).

Visa’s policy regarding surcharges is kind of fuzzy. Merchants in the USA have been permitted to add a credit card surcharge ever since January 2013, but merchants elsewhere are “prohibited” from doing so.

Surcharging remains prohibited outside the U.S. unless there is a local law or variance that requires merchants be permitted to engage in the practice

-Visa

The fuzziness arises because of how inconsistently the policy is enforced. We all know of a merchant or two that levies a credit card surcharge, and while they’re mostly small mom-and-pop operations, sometimes the big boys get involved.

Everyone remembers the infamous Comfort-Visa surcharge war back in 2013, when Visa severed ties with ComfortDelGro (and TransCab) over the latter’s imposition of a 10% credit card surcharge, a practice that had been ongoing since the mid-1990s.

Visa quietly backed down a few years later, providing the face-saving reason that surcharges had become less of an issue thanks to booking apps that allowed fee-free payments. They made it known how unhappy they were though:

“We are very disappointed that we’ve not been able to remove or reduce the 10 per cent surcharge, after a longstanding discussion with ComfortDelGro,” said (Visa country manager) Ms Ooi. “We continue to oppose the practice of surcharging.”

So, yeah. Take that, merchants.

What card should I use for Amazon Singapore?

In my experience, Amazon Singapore transactions code as MCC 5399: Misc. General Merchandise (although the MCC may vary depending on what you buy). Since they’re processed online, there’s a wide range of cards offering 4 mpd.

The good news is that Mastercards are unaffected by this change, so if you’re using any of the following, carry on as normal:

| Card | Earn Rate | Remarks |

Citi Rewards Citi RewardsApply |

4.0 mpd | Max. S$1K per s. month |

DBS Woman’s World Card DBS Woman’s World CardApply |

4.0 mpd | Max. S$2K per c. month |

OCBC Titanium Rewards OCBC Titanium RewardsApply |

4.0 mpd | Max. S$12K per m. year |

| S. Month= Statement Month, C. Month= Calendar Month, M. Year= Membership Year | ||

| ⚠️ Surprisingly, the UOB Lady’s Cards don’t include 5399 under their fashion category, so they won’t be an option here. |

The bad news is that the following Visa cards become poorer options with the 0.5% surcharge.

| Card | Earn Rate | Remarks |

Citi Rewards Visa Citi Rewards Visa(no longer issued) |

4.0 mpd | Max. S$1K per s. month |

HSBC Revolution HSBC RevolutionApply |

4.0 mpd | Max. S$1K per c. month |

UOB Pref. Plat Visa UOB Pref. Plat VisaApply |

4.0 mpd | Max. S$1,110 per c. month |

| S. Month= Statement Month, C. Month= Calendar Month, M. Year= Membership Year | ||

Every self-respecting miles collector should have a 4 mpd Mastercard though, so it’s not that big a deal.

Conclusion

Merchants and credit card companies are natural enemies (like brothers and sisters, or Englishmen and Scots, or Welshmen and Scots, or Japanese and Scots…), so I don’t expect this will be the last we hear of such shenanigans. Who remembers Singapore Airlines’ ill-advised attempt to add a 1.3% credit card surcharge on its cheapest Economy Class tickets (a decision reversed the very next day)?

Fortunately there’s still a whole lot of ways to earn 4 mpd on Amazon transactions, so all you need to do is switch out your default payment method before 15 September 2021.

Just buy store credit on shopback. Not only do they accept visa, it’s also 1.5% off.

modern problems. modern solutions.

Goes up to 5%. Best time to buy and hodl.

that’s a lot of business missed by Visa for 0.5%