I’ve written a couple of times about Singlife, which is a useful place to park short-term funds assuming you’re not waiting for dogecoin to go to the moon or some other celestial body.

Singlife is now offering a new ILP called Singlife Grow, a combination of investment and insurance. For a limited time, they’re offering an easy S$35 cash for new sign-ups, with no lock-in period and no withdrawal fees.

Plus, you can pay for your premium with an American Express credit card, earning up to 1.5% cashback or 1.8 mpd.

How to get your S$35

| Activity | Reward |

| Sign up for a Singlife Account with code 5dCFCARw and activate Singlife Visa Debit Card | S$5 |

| Apply for Singlife Grow Policy with code 5dCFCARw and fund with S$1,000 | S$30 |

Both new and existing Singlife Account customers who open and fund a Singlife Grow policy will receive S$30 cash, simple as that. They will receive an extra S$5 cash if they apply for and activate the free Singlife Visa Debit Card.

|

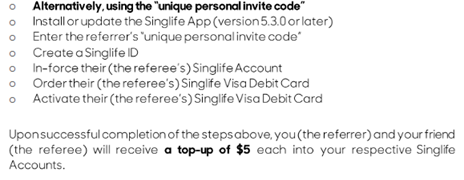

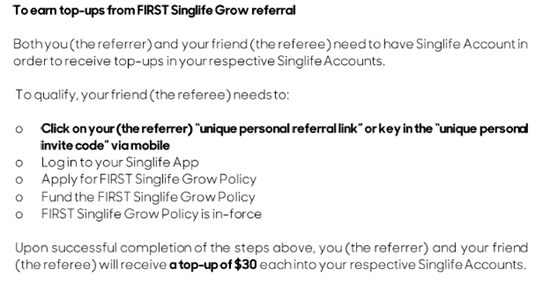

Note: If you do not have an existing Singlife Account, you will need to create one in order to receive the S$30 cash. The full instructions from the T&Cs are copied below, please take a moment to read them: For the S$5 cash:

For the S$30 cash:

|

A minimum of S$1,000 needs to be placed in the Singlife Grow policy, which can subsequently be withdrawn anytime, without fees. The S$30 will be credited immediately to your Singlife account once the Grow policy is in force. It’s basically a free dinner for a few minutes of work.

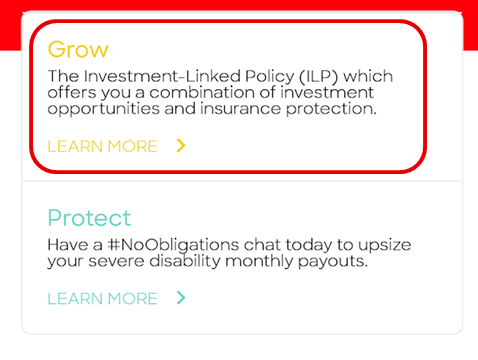

The steps are pretty self-explanatory, but I’ll list them out here anyway. Set up a Singlife Account if you don’t already have one, using the code 5dCFCARw and applying for a Singlife Visa Debit card for S$5. After that, tap “Grow” on the homepage.

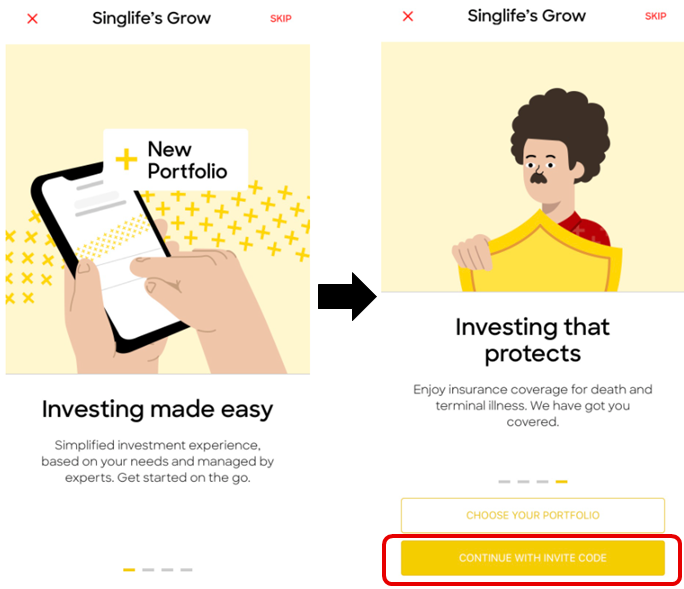

Resist the temptation to tap “skip” at the top right, and instead scroll to the final screen that prompts you for a promo code.

| ⚠️ If you don’t see the invite code appearing, you can try applying via this link instead |

Enter 5dCFCARw and then select a portfolio. Finish the KYC process, review the documents and wait. Within 20 minutes or so you should receive an email from Singlife telling you the account is ready for funding.

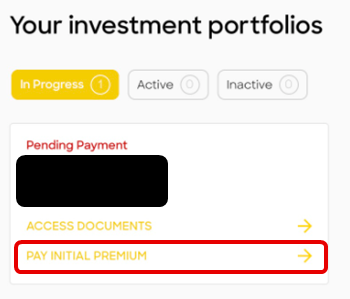

Return to the Singlife app, tap on “Grow” and then “Pay Initial Premium”.

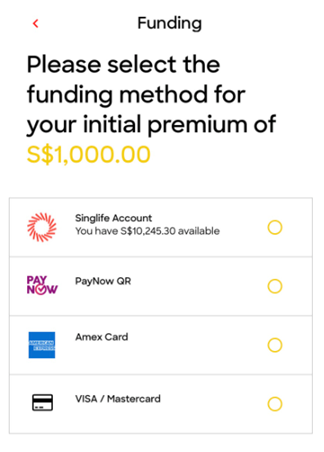

You can transfer money directly from your Singlife Account, or pay via AMEX, Visa or Mastercard. This transaction codes as insurance so you won’t earn any rewards with most cards, but insurance isn’t an excluded category for the AMEX True Cashback Card or AMEX SIA Business Card.

I paid with my AMEX Singapore Airlines Business Card and can confirm I received the equivalent of 1.8 mpd on my transaction- do note the maximum premium you can pay with AMEX is S$1,000; any more than that and the system will prompt you to use PayNow. You can only pay with a credit card for the initial premium; subsequent top-ups are via PayNow only.

That’s it. Once your policy status changes to “in force” (<1 hour), you’ll see the S$30 credited to your Singlife Account. This can be withdrawn immediately, with no fees.

On top of the sign-up gift, you also earn an additional 0.5% p.a. returns on the balance in your Singlife Account, which boosts the rate to 1.5% p.a. on the first S$10,000.

The T&C of this offer can be found here.

What is Singlife’s Grow Policy?

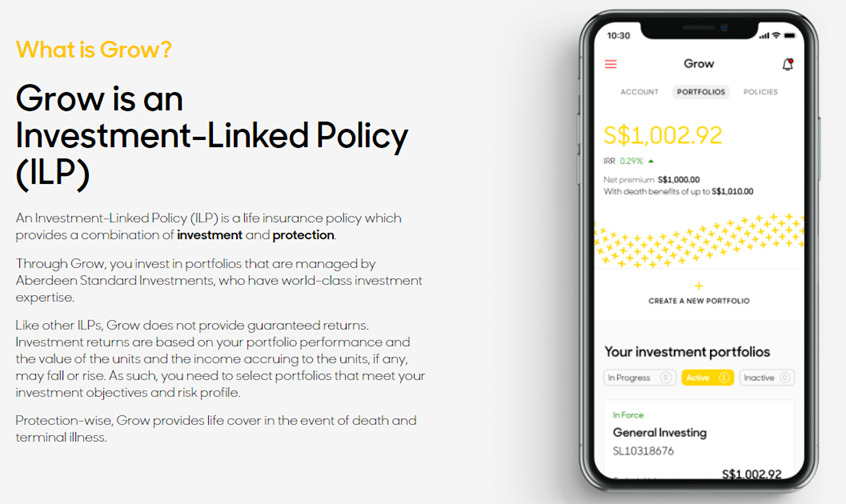

Singlife’s Grow Policy is an ILP that offers a combination of investment and protection. Customers can choose from three different portfolios:

- Conservative: 20% equities, 80% fixed income

- Balanced: 50% equities, 50% fixed income

- Dynamic: 80% equities, 20% fixed income

Returns are not guaranteed, and will depend on your portfolio performance, the value of the units and the income accruing to the units. In other words, it’s not capital guaranteed like the Singlife Account- if this is a concern, there’s nothing stopping you from selecting the conservative portfolio and withdrawing your funds once the S$30 is credited (see below).

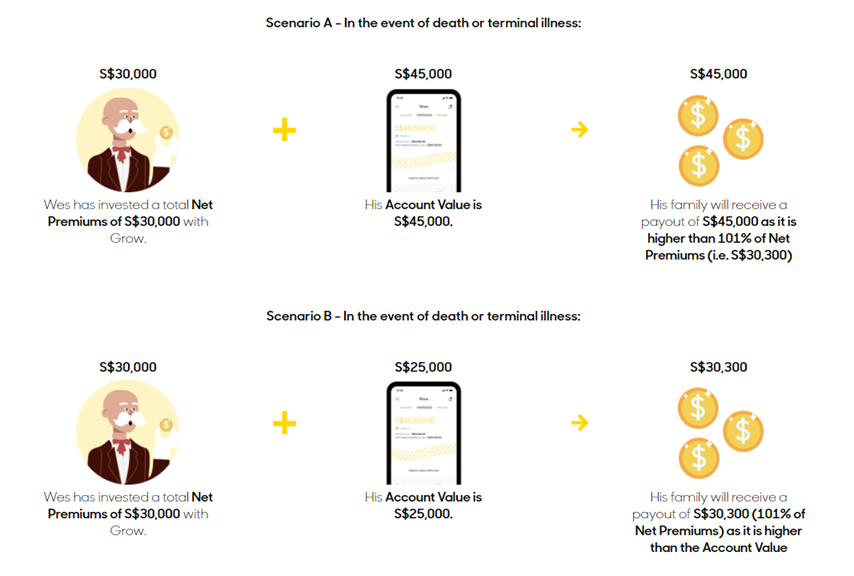

In terms of protection, Grow provides life coverage in the event of death or terminal illness. Your loved ones will receive the higher of 101% of your net premiums or your account value.

Once again, there is no lock-in period and no fees for withdrawal. You have the flexibility to terminate your policy and take out your funds any time you wish.

| How do I withdraw? |

|

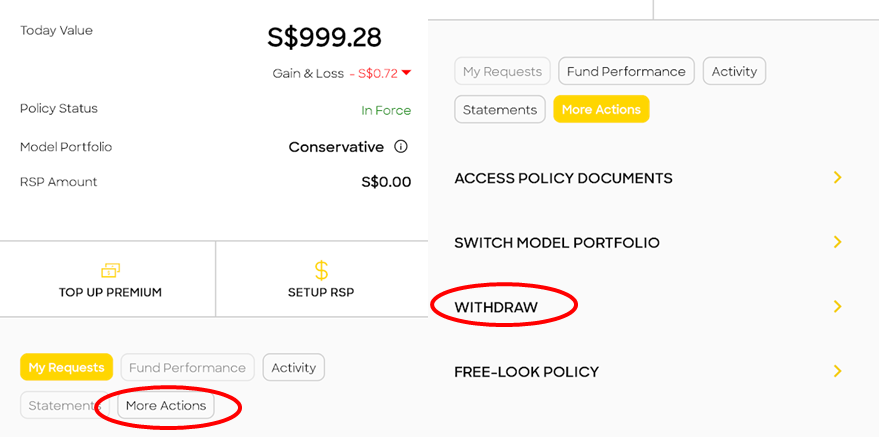

Funds can be withdrawn from the Singlife Grow Policy at any time. Simply tap on your policy ➜ more actions ➜ withdraw

Do note that there is a S$1,000 minimum withdrawal amount. My balance had become S$999.28 at the time of withdrawal, so I topped up an additional S$100 (reflected within 2 hours) and submitted a withdraw request for the entire balance of S$1,099.28. Funds will be transferred within seven business days of the request, but I’ll update this with the actual timeframe once I see it. You can read about the full details of withdrawals at point 6 of the T&Cs. |

Conclusion

Not a whole lot more to add here, except that it’s S$30/35 with minimal effort, valid even for existing Singlife members. If you like the Singlife Grow policy, go ahead and keep it; if not there’s no penalty for withdrawing your money.

so i can pay using uob amex cashback card and get 1.7% cashback. following which i withdraw the cash 🙂

only the first premium is payable with card, and capped at $1,000, but yes.

cap at $1000? can we put more than $1k pay using amex for initial payment?

Do you not know what the words “capped at $1,000″ mean?

no he doesnt know

Doesn’t seem like there’s any promo code box available in Singlife Grow for existing users though!

Weird, I saw it even though I’m already a customer. I suppose you followed the steps in the article and have the latest version of the app?

Have same problem. Applied referral code, did KYC, the app hanged and now cannot apply promo code. box is missing on the last page.

I’ve got the same issue here. The app crashed and when I try to create a portfolio again, the promo code box is gone.

Same problem. We tried Aaron! Wanted to support you here given your regular and great content but unfortunately the SingLife app is terrible. Couldn’t even login properly a few hours ago and now facing the same issue the above mentioned when trying again…

yes i just saw it on someone else’s device. no idea why that’s happening, sorry! thanks for the thought anyway 🙂

Same issue, the referral code button is missing even though I just signed up for a new singlife account.

Spoke to the cs and he suggested to use the referral link instead. Perhaps Aaron you can share your link with us here?

https://app.singlife.com/3mbNSRkMKjb

see if this works, thanks!

Anyone tried of this works?

Just tried. Didnt work for me

sorry all- no idea why this is happening for some and not others. all i can suggest is to try it on another phone in case the issue is software related rather than account (but i’m grasping at straws).

The CSO on Whatsapp explained today that the code and link are mutually exclusive. It was suggested to me that once the referral link is used, it tags the account, so you won’t see the option to add the code.

Quote

Good afternoon to you, sir. After further checking, the referral code is currently linked, therefore, the referral code option is not available once linked.

You may proceed with the application accordingly.

Unquote

didnt work for me too, topped up no $30

Can I get this right – i top up the growth account with UOB AMEX Absolute for $1000. I can withdraw immediately and get $1030 in my Singlife account with another $17 cashback at the end of the month?

that appears to be the case, but you can only do it once.

No mention of you receiving $30/$35 as well Aaron?

evidently you don’t know to read the disclaimer that appears at the bottom of every article.

Thank you for pointing it out Michelle

Why do you care? Or are you from HWZ and want the referrer to give you $20 out of the $30 they get? lolol.

Hi, for new signup Singlife account, do you know where to key in the invitation code?

Hi Aaron, i did all the step and my policy in force already, but I don’t see $30 in my account. How long need to wait from funding $1k?

it took about 1 hour for me.

Created and funded yest. I dont see $30 in my account yet

I didn’t get as well :(. Didn’t know I needed a normal singlife account to receive the $30. Now I’ve created one but don’t see the $30

Yea prob this is the issue, need to create account first. The cso I talked to via WhatsApp even mentioned need to top up $500 for the account to be active

Do all PRs and citizens qualify? Are US citizens exempt?

USA is not on the nationality list

Is there a 0.25% management fee for the plan? Will they deduct it from the plan upon termination

Also you dont seem to have mention that the funds will take 3-5 working days to be invested and upon termination your 1k will only come back after 7-10 business days. Your article has the impression that we can just do a couple of transfers risk free to get $35 and our principal back which is not the case. Not to mention you will also get $35 from each of our sign up. I thought you advocated transparency?

free $35 still want to complain.

some people…

This post is themed as $35 with minimal effort, but people may not understand that this is an investment linked policy, returns are not guaranteed, not sure if principle is. There is no free lunch in this world, it is all about being transparent and letting people know what are the tradeoffs.

step 1: put in money

step 2: get $30/35

step 3: take out money

if this is too complicated for you, i have nothing to say.

can I also point out the $35 is credited literally with an hour. you could set up, get your free $35 and clear out your funds on the same day. Unless you think the world will end the very day you apply…

This is not entirely true. Yes, you can for the $30 (considering you’re not experiencing techincal glitch from the app which happened to a few readers here). The $5 is only credited once your card is delivered to you and activated. That takes at least a few working days, so i’m not sure with what you’re saying ‘clear out your funds on the same day’. The most important part here is the $1000 that need to be invested in to be eligible for the bonus. It will take 3-5 working days to be reflected in your account otherwise there’s no… Read more »

The article is quite clear that this is an insurance + investment policy (see “Singlife is now offering a new ILP called Singlife Grow, a combination of investment and insurance”) and that returns are not guaranteed. It says right there in the article “Returns are not guaranteed”. The mechanics of the policy are also very clearly explained in the section titled “What is Singlife’s Grow Policy?” How more transparent can Aaron get when everything is literally spelled out, and the formal black and white is provided in link to the official website? He’s advertised a sign-up bonus, you make your own… Read more »

thanks for the feedback edmund! The article mentions that returns are not guaranteed, but to avoid any misunderstanding, I’ve added an additional line restating the fact that unlike the singlife account, this isn’t capital guaranteed. If your goal in this is to get the $30 and jump out straight away though, I think the odds are quite in your favour.

Have also added a section explaining the withdrawals process.

regarding the point on transparency- all articles have a disclaimer at the bottom (look for the grey box) saying that the links generate a referral fee for the website.

@edmund also a further point of clarification. the $5 for the debit card is credited to your singlife account, not your singlife grow policy. so it’s true that you can indeed clear out your funds from the singlife grow policy quite quickly if you’re so inclined- you don’t need to sit around for a few working days. remember there’s two things at play here- your capital guaranteed singlife account, and the non capital guaranteed singlife grow policy. The $30/$5 rewards are credited to the singlife account. the T&C may say 3-5 working days for the funds to be reflected, but… Read more »

Speaking as someone who has gone through with this, the other problem not mentioned in the article is that Singlife won’t allow withdrawal less than $1000. I put in exactly $1000 to get the bonus and the fund value drops below $1000 immediately on the first day. Now I can’t withdraw without either topping up more funds or wait for market to move back. This could be avoided by depositing a bit more than $1000 initially, but too late for me now…

hey allen!

have added a section on withdrawals which addresses exactly that. That said, i still think it’s better to top up $1,000 initially, for the simple reason that this is the maximum for which AMEX cards can be used (remember- we want to earn card rewards on top of the $30). Once you exceed $1,000, only PayNow QR option is available.

just like you, my balance is now $999.28, so if I want to withdraw, i top up a further $100 (subsequently only paynow QR is available) and then take out the whole thing.

Thanks for this i bet most people did not know about this. Its not about that ‘free $30’ but what is at stake is the $1k that you have to put in and not immediately being able to withdraw. Hence, to say its a few minutes of work for $35 is not wrong by itself but you can see where more discerning readers are coming from. I also have no qualms with using Aaron’s link and have used that myself but my take is that Aaron could be more transparent by stating that using this link will also get the… Read more »

Hi Kelp! Well, I’d hardly say that’s a double standard. All sponsored posts on this site are disclosed upfront, at the very start of the article- exactly what I’d expect others to do. A generic disclaimer exists because the site is supported by reader referrals/affiliate sales, and therefore it’s simply more efficient to state it plainly in every article. keep in mind- posts on card deals/hotel sales also generate revenue for the site too, so if you wanted to be consistent you’d also be complaining that those posts “only” have a generic disclaimer at the bottom. in any case, thanks… Read more »

Yes he did not state that you cannot immediately withdraw 1030 after depositing 1000, this is not a money multiplication scheme and if anyone seriously thought such a thing existed for real in this world they would lose their money anyway, one way or another.

signed up, got my $30 within the hour. going to close my account tomorrow and go home.

to all those complaining- seriously dudes. it’s free money, what more do you want. this isn’t some high risk crypto venture. it’s an ILP backed by reputable companies. don’t like the risk? cash out ASAP. you’re still better off.

i think the CB is making people extra tetchy.

Sorry it doesnt work this way to open and take out your 1k tomorrow to get your $35. It is not so simple as 3 steps as some people has made up to be. I wonder if they have tried it for themselves before making such comments.

Existing singife customer here so I don’t qualify for the $5 since I already have the visa card.

I opened my grow policy a couple days back, got $30 posted into singlife account and then submitted a request to close the grow policy. Now just waiting for the money to be transferred back via paynow. Seems pretty straightforward to me…

I wonder if you’ve tried it for yourself while making these complaints on free money, seems like there are plenty of people who have and are sharing that it is indeed straightfoward.

Success in 45mins

this is not the case for everyone, for me my policy is not even active even after funding $1k a couple days back, still indicates in progress. I cannot withdraw yet and I did not receive the $30 also.

if you did not receive the $30, it probably means you did not set up a singlife account as well. this is required to receive the $30, as it’s where the $30 gets deposited. the steps are outlined in the article and T&Cs.

Bloody ridiculous. Not only did I not get A SINGLE CENT I lost $8 when I terminated the account. Wrote in and awaiting singlife’s response.

If the initial $1,000 premium was paid with the AMEX cards mentioned in this article, there would have been cashback of 1.5% or 1.7%, which would have covered your loss, despite the failed referral situation. $15 or $17 cashback would have covered the $8 loss and more.

My transfer of $1000 (and a bit) arrived in my account 8 business days later, and with a deduction – Only $977 arrived and without explanation. So looks like there was some admin fee deducted? I am trying to get some answers from Singlife. But it doesn’t seem like you gain much at the end

Hey Aaron, so how much did you get back after withdrawing from the grow policy? Seems like there were some additional fees.

At the time of withdrawal, my policy balance was S$1099.28. I received $992.42, and was told that a further $100 is on the way. There are no termination fees, but the value is subject to change because it depends on the price at time of liquidation.

Hey Aaron, seems like I could not find the referral link button as described

is this a targeted promo?

if you mean you can’t find a referral code field in your application, it likely means you applied for singlife account previously with someone else’s referral code, and won’t be able to enter a new one for singlife grow (your original referrer will get the credit)

For those with policy value <$1000, why not just terminate the policy and get back everything below $1000? Am I missing something, appreciate clarification Aaron.

if you go via the app the min. amount to cashout is $1,000 (however, someone found that it’s possible to cash out online with a balance under $1k)