Back in 2020, CardUp started running a year-long promo that cut its headline processing fee from 2.6% to 2.25%. This was extended for 2021, and has been extended yet again all the way till 31 December 2022.

A 2.25% fee allows cardholders to buy miles from as little as 1.38 cents each when making any kind of bill payment through CardUp.

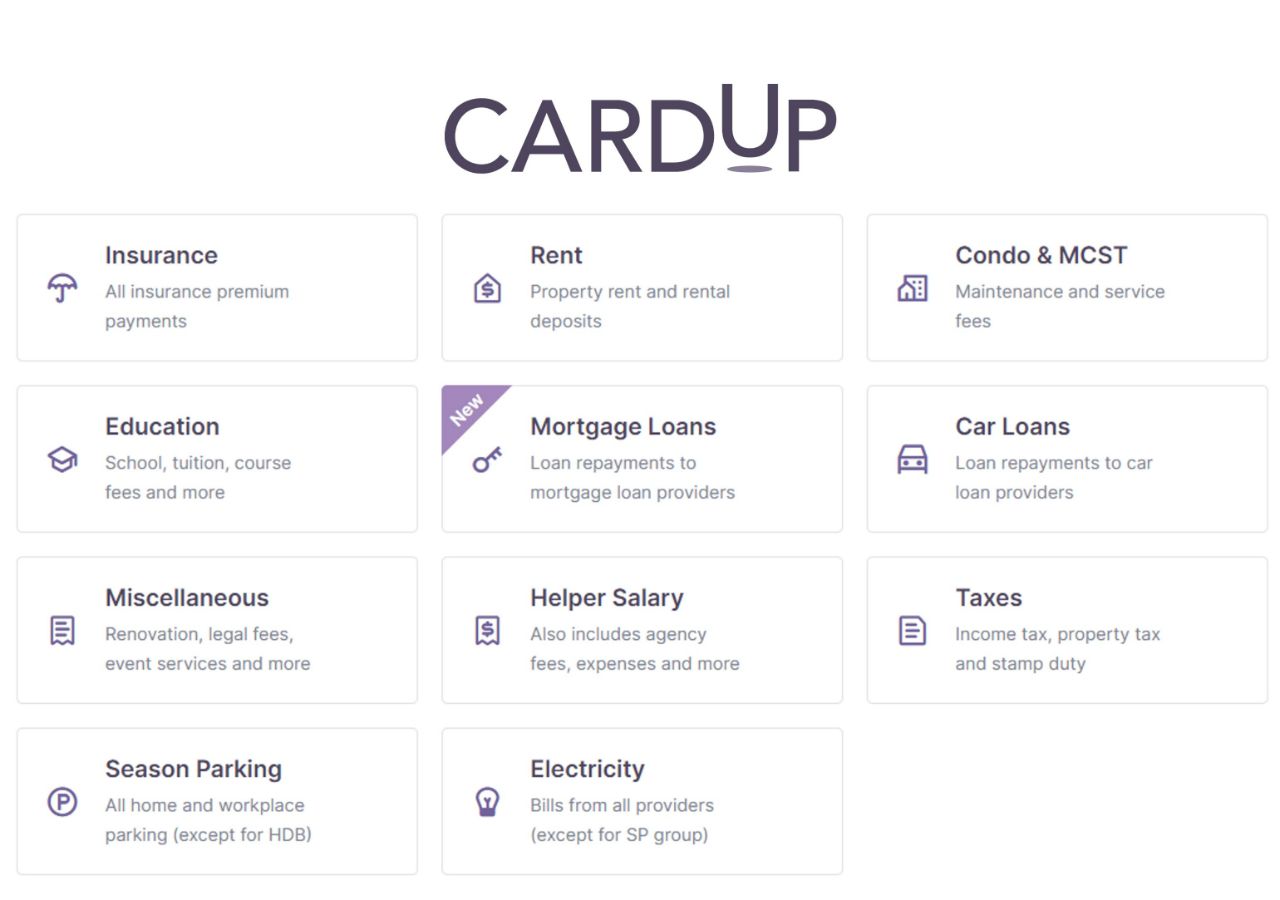

| ❓ What is CardUp? |

CardUp is a bill payment platform that allows users to pay rent, income tax, insurance premiums, MCST fees, season parking, mortgage installments and more with their credit card, earning miles in the process. CardUp is a bill payment platform that allows users to pay rent, income tax, insurance premiums, MCST fees, season parking, mortgage installments and more with their credit card, earning miles in the process. |

CardUp is also offering a special concessionary rate of 1.79% for rent, and 1.85% for a recurring series of at least six payments.

New CardUp customers can use the promo code MILELION to save S$30 off their first payment, with no minimum payment required. This works out to free miles on a payment of up to S$1,154- none too shabby indeed.

How does CardUp’s discounted fee work?

To enjoy the 2.25% fee, enter the code GET225 when setting up your payment. If you have existing payments scheduled, there’s no need to cancel them- you can edit them in the dashboard to add this promo code instead.

A minimum payment of S$130 is required, and the payment must be set up on or before 31 December 2022 with a due date on or before 5 January 2023. This code is valid for any CardUp payment made with a Singapore-issued Visa or Mastercard.

The full T&C of this promotion can be found here.

How much do miles cost with this promotion?

Here’s what a 2.25% fee means for your cost per mile with various credit cards. For more information on whether this is “worth it”, have a read of my guide to valuing miles.

| Card | MPD | CPM @ 2.25% |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.38 |

DBS Insignia DBS Insignia |

1.6 | 1.38 |

UOB Reserve UOB Reserve |

1.6 | 1.38 |

OCBC Premier, PPC, BOS VOYAGE OCBC Premier, PPC, BOS VOYAGE |

1.6 | 1.38 |

SCB Visa Infinite SCB Visa Infinite |

1.4* | 1.57 |

UOB PRVI Miles UOB PRVI Miles |

1.4 | 1.57 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.57 |

Citi Prestige Citi Prestige |

1.3 | 1.69 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.69 |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

1.28 | 1.72 |

Citi PremierMiles Citi PremierMiles |

1.2 | 1.83 |

SCB X Card SCB X Card |

1.2 | 1.83 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.83 |

OCBC 90N OCBC 90N |

1.2 | 1.83 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.83 |

| *With minimum S$2K spend per statement month, otherwise 1.0 mpd |

||

New to CardUp?

If you haven’t made a CardUp transaction before, you can use the promo code MILELION to save S$30 off your first transaction-no minimum spend required. This allows you to earn free miles on a payment of up to S$1,154 (based on CardUp’s regular admin fee of 2.6%).

You can subsequently use the GET225 promo code for the rest of your payments.

Paying rent?

If you’re looking to pay rent, CardUp recently extended its rent payment promotion until 30 June 2022.

Customers can use the code SAVERENT179 to enjoy an admin fee of just 1.79% on rental payments. This allows them to buy miles from as little as 1.1 cents each, depending on their credit card.

Recurring payments?

CardUp is also offering a concessionary 1.85% fee on the first six payments of a recurring schedule made with a Visa card and the code RECURRING185.

This code is available till 30 June 2022, and miles will cost upwards of 1.14 cents each depending on card.

CardUp FAQ

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

| ❓ CardUp FAQ |

|

Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

CardUp has extended its promotional 2.25% admin fee till the end of 2022, and could be your only option for earning rewards on things like insurance and education payments. You’ll need to make a judgement call as to whether miles earned justify the admin fee, but I personally would be a buyer at any cpm at or around 1.5 cents.

If you’ve got bills to pay, be on the lookout also for any upcoming Citi PayAll promotions as well. Citibank went crazy with the offers last year, but it remains to be seen if they’ll be taking the same approach in 2022.