| Update: CardUp has extended this offer till 31 December 2020. Refer to the latest post here |

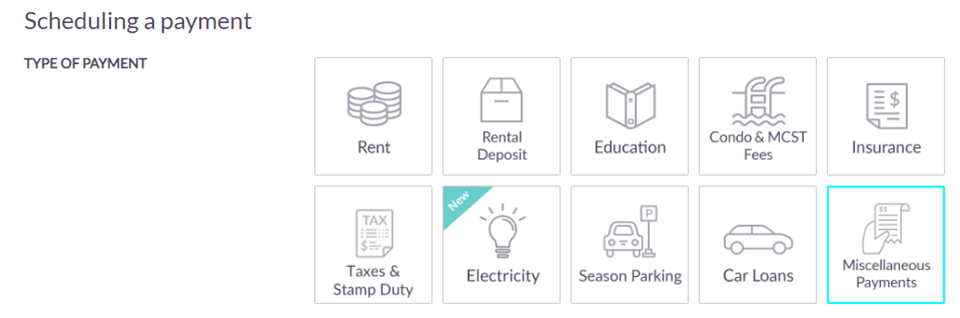

CardUp is service that lets you pay rental, income tax, condo fees, insurance, car loans and more with your credit card, earning rewards points in the process.

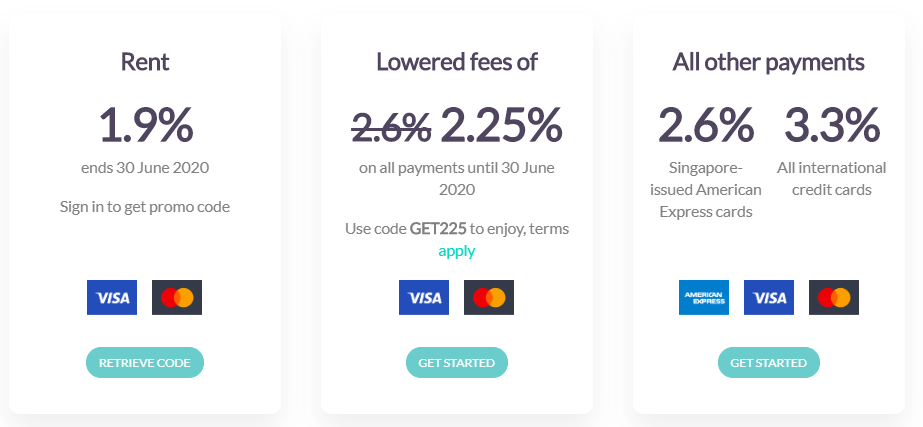

The regular processing fee is 2.6%, but from now till 30 June 2020, CardUp is cutting the fee to 2.25%.

A minimum payment of S$130 is required, and the payment must be set up on or before 30 June 2020 with a due date on or before 3 July 2020. This applies to Singapore-issued Visa and Mastercard transactions on any of the payments supported by CardUp. Here are the links to the T&Cs and the FAQ.

| As a reminder, CardUp is offering a discounted fee of 1.9% on rental payments made by 30 June 2020. Have a read of that promotion here. You can also pay rent at a slightly lower rate of 1.85% via RentHero |

To take advantage of this lower fee, you’ll need to use the code GET225 when setting up your payments. If you have existing payments scheduled, there’s no need to cancel them- you can edit them in the dashboard to add this promo code instead.

If this is your first payment with CardUp, you can use the code MILELION to get S$20 off your first payment of S$1,000 or more. You can’t stack the two promo codes, so set up your first payment with MILELION and subsequently switch to GET225 for maximum savings.

What does this mean for the cost per mile?

Here’s what a 2.25% fee means for your cost per mile with various credit cards.

| MPD | CPM @ 2.25% | |

DBS Altitude Visa DBS Altitude Visa OCBC VOYAGE OCBC VOYAGE Citi PremierMiles Visa Citi PremierMiles Visa SCB X Card SCB X Card OCBC 90N Card OCBC 90N Card |

1.2 | 1.83 |

|

|

1.25 | 1.76 |

| 1.3 | 1.69 | |

UOB PRVI Miles Visa/Mastercard UOB PRVI Miles Visa/Mastercard SCB Visa Infinite (Spend ≥$2K per month) SCB Visa Infinite (Spend ≥$2K per month) UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 | 1.57 |

BOC Elite Miles Card BOC Elite Miles Card |

1.5 | 1.47 |

UOB Reserve UOB Reserve DBS Insignia DBS Insignia OCBC VOYAGE (BOS/Premier Banking) OCBC VOYAGE (BOS/Premier Banking) |

1.6 | 1.38 |

As far as the cost of buying miles in Singapore goes, these are fairly competitive prices. The catch is that you need to have a bona fide payment to make- as part of the payment setup process, you’ll be asked to submit an NOA, tenancy agreement, MCST invoice or insurance bill as supporting documentation.

CardUp FAQ

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

|

CardUp FAQ

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

CardUp’s fee cut continues the trend of cheaper ways to buy miles in Singapore. That can only be a good thing, although it does make you wonder when we’ll see the next KrisFlyer devaluation.

HSBC Visa Infinite (≥$50K spending in past year)

HSBC Visa Infinite (≥$50K spending in past year)

Hi Aaron, can grabpay mastercard be used?

Hi DK, if I may just jump in here – yes, the GrabPay Mastercard can be used for CardUp payments. Feel free to reach out to us at hello@cardup.co should you have any more queries!