| ⚠️ Update |

| The transaction was eventually resolved in my favour and a full refund received. |

I’m on the record as being a big fan of Instarem’s Amaze Card, with its magical ability to convert offline transactions into online ones (read: 4 mpd everywhere), zero FCY transaction fees and 1% cashback.

Disputing a fraudulent transaction though? Completely different story.

Given how heavily I’ve been using my Amaze Card, I suppose it was only a matter of time before I got hit by a fraudulent charge. These are usually minor annoyances- so long as you report the fraud promptly and don’t act with “gross negligence” (e.g. leaving your card lying around or entering your OTP on a dodgy website), you’re fine. The ABS caps your maximum liability for unauthorised charges at S$100, and most of the times the card issuer waives this anyway.

But you’ll still need to navigate an administrative process to raise a dispute, reverse the transaction, block the old card, and receive a new card. With banks, all this is handled through one phone call. With Amaze, it’s significantly slower, and much more complicated.

| ❓ Who you gonna call? |

| As a general pointer: if you see a fraudulent transaction on your Amaze Card, you should raise it with Instarem, not your bank. |

My Amazing fraud transaction

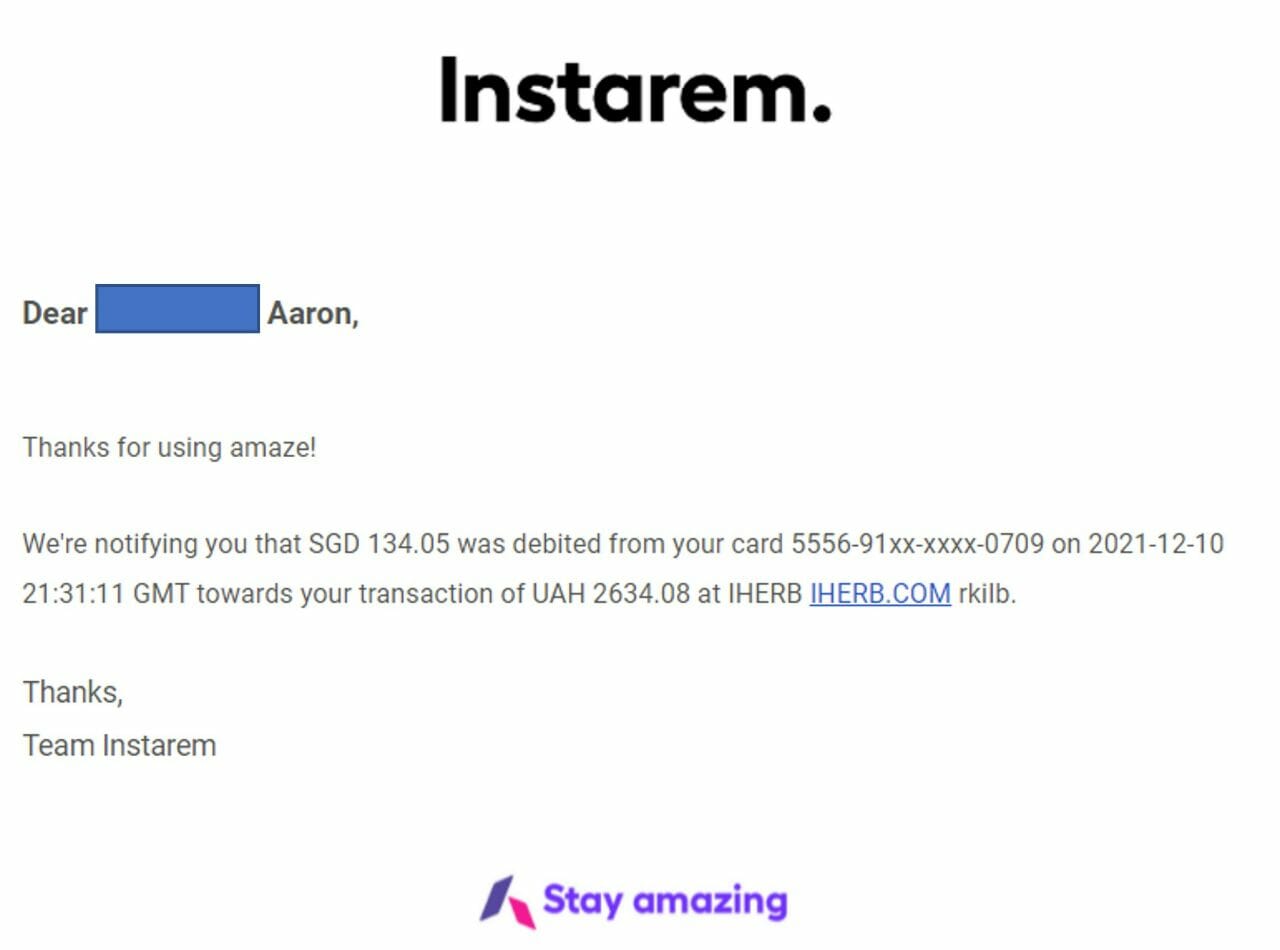

On 11 December, I awoke to an Instarem confirmation email for a UAH 2,634.08 (S$134.05) transaction at iHerb. Now, I’m pretty sure I’m not buying anti-baldness treatments from Kiev, so you can imagine I leapt out of bed rather quickly.

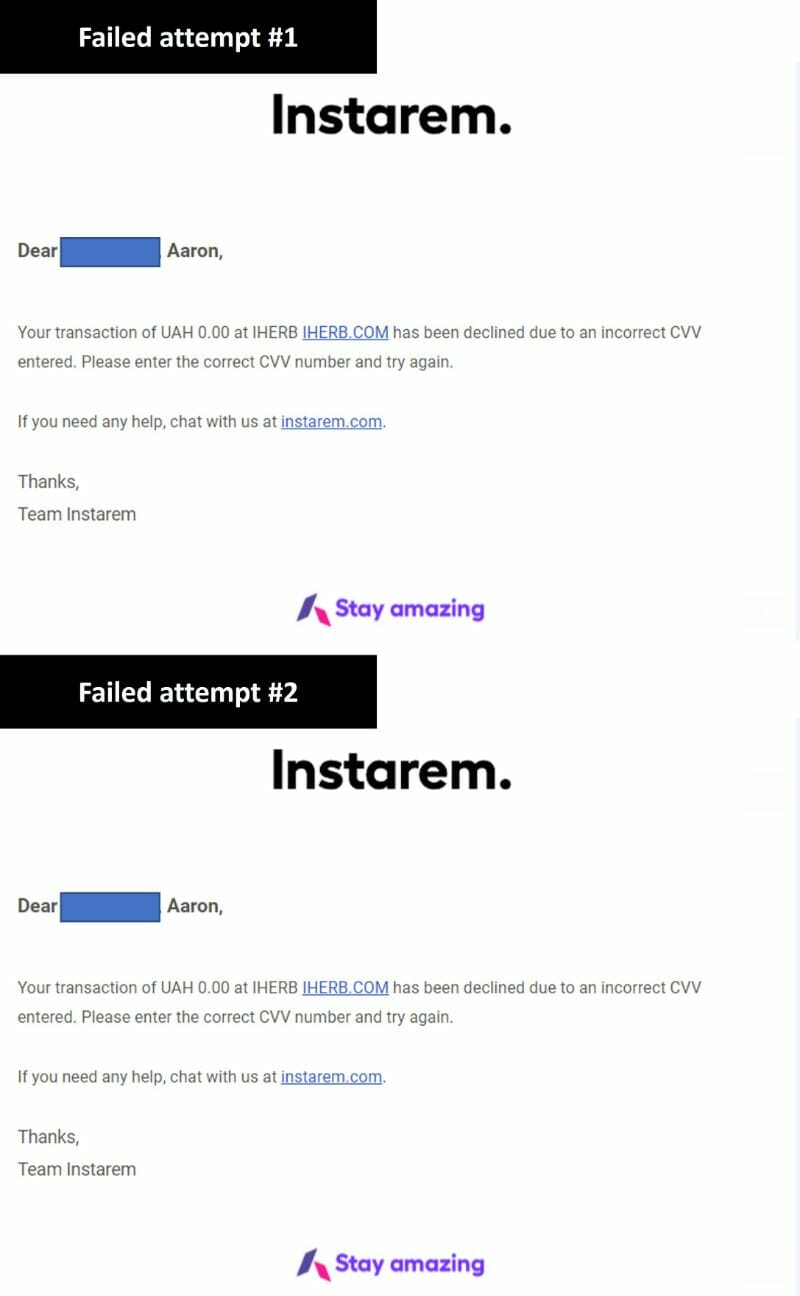

What’s interesting is that just prior to this transaction, I received two emails about attempted iHerb transactions which were rejected due to the wrong CVV. This makes me wonder- if the first two failed, how did the third go through? Did they simply guess the right CVV, and why wasn’t there an OTP challenge?

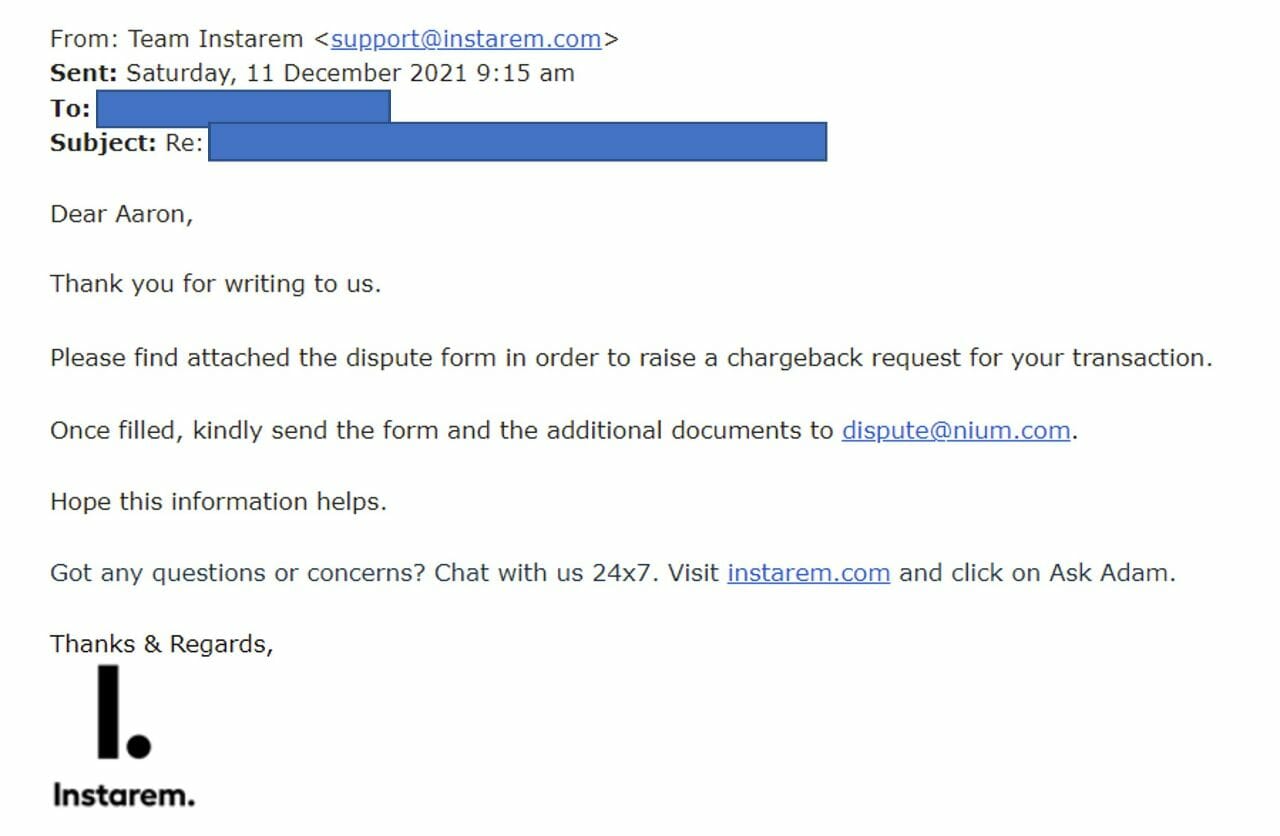

In any case, I reached out immediately to Instarem customer service. They don’t have a call centre, so I opened a support ticket via email at 5.02 a.m and got a reply at 9.15 a.m asking me to fill out a dispute form.

I sent the form back at 10.44 a.m, only to be told at 2.40 p.m that I was supposed to send it to dispute@nium.com. This was done at 4.34 p.m, after which I heard absolutely nothing- no automated response, no acknowledgement of receipt.

It was only after I chased up the matter two days later on 13 December that I received the following email from the disputes department.

Please be informed that the disputed transaction is yet to be settled by the merchant. Waiting for merchant settlement.

As per Mastercard rule, card should be permanently blocked or replace new card for unauthorized/ unrecognized transaction dispute to avoid further unauthorized transaction in card .

Please reach out customer service for replacement card.

Leaving aside the glacial pace of their response (two days is an eternity when you’re dealing with fraud) and the fact I had to email them twice before getting a reply, what’s concerning is this was the first time during the process that Instarem told me to block the card.

Now, blocking the card via the Instarem app was obviously the first thing I did on 11 December, and you could argue that it’s just common sense- but that’s because you and I are already familiar with the procedure for things like this.

Imagine a noob user who’s relying on the card issuer to tell them exactly what to do, or who believes that the card issuer will handle the blocking automatically once they report the fraudulent transaction (which isn’t unreasonable, as that’s the SOP for banks), or who isn’t aware they’re able to block the card themselves via the app.

A lot of things could have gone wrong in the time it took for the disputes team to reply (or rather, to be chased to reply), and the communication from Instarem sort of assumes you know how to go about blocking your card. That’s fine with me, but it won’t be for some people.

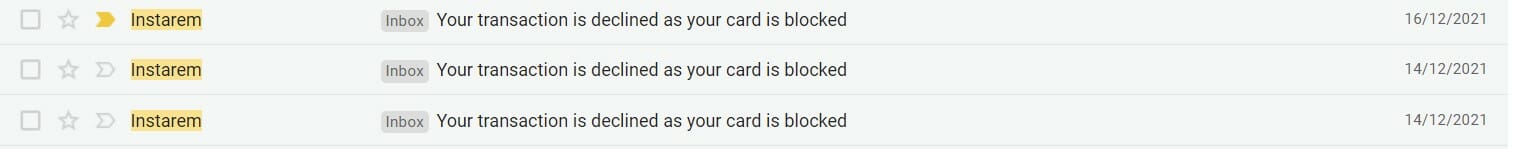

In fact, the fraudsters attempted to make a few more transactions on my card during this period, which only failed because I’d proactively blocked it.

That aside, it was somewhat frustrating to be bounced back and forth while trying to arrange a card replacement (the disputes team told me to ask customer service, customer service told me to do it via the app), but a relatively minor concern compared to the fact there’s no temporary credit issued.

Based on my experience disputing fraudulent claims on credit cards, the SOP for banks is to issue a temporary credit for the fraudulent transaction so you don’t have to bear the “carrying costs” while the matter is investigated. That’s not the case for Amaze, however. Fortunately, we’re not talking about a big amount in my case, but what if it were larger?

The last communication I received from Instarem was on 16 December, when the disputes team informed me that a dispute had been raised with the merchant through Mastercard, and I’d hear back within 45 days. But we’ve crossed the 45-day mark today and I’m still out of pocket, with radio silence from the Instarem side.

What should Instarem be doing?

As you can tell, I’m far from impressed by Instarem’s fraud handling process.

When I see a fraudulent transaction on my credit card, I call the bank, they block the card, issue a temporary credit, and arrange for a new card to be mailed out- all on one phone call.

With Instarem, I was bounced between departments, didn’t get a reply until I chased them, didn’t receive clear instructions for card blocking and replacement (not that I needed them, but they should have idiot-proof templates prepared for scenarios like this), didn’t get a temporary credit, and am still waiting for a resolution 45 days later.

So if you ask me, Instarem should:

- Have the entire fraud reporting process handled by a single team- flagging, filing a dispute, getting a replacement card

- Automatically lock the card once a cardholder reports a fraudulent transaction, or at the very least reply quickly with detailed instructions on how to do so

- Issue a temporary credit while the case is investigated

- Proactively communicate with the cardholder at the end of the 45-day period if more time is required

I just felt a general lack of urgency from the Instarem side in dealing with this, and in fact, Amazes’s FAQs don’t say anything about how to dispute a transaction. The disputes form and email address are only obtainable through customer service, and if customer service isn’t the team that processes the form, you’re just adding an unnecessary layer of administration.

Conclusion

Amaze is a great card to have- when everything goes smoothly. But as much as I appreciate the miles and cashback with zero FCY transaction fees, their procedure for handling fraudulent transactions leaves a lot to be desired.

One would hope that after the recent OCBC fiasco, card issuers would be stepping up their processes to provide prompt assistance to customers hit by unauthorised transactions. Instarem has a long way to go here, and it makes the Amaze somewhat less Amazing.

Anyone else dealt with fraudulent transactions on their Amaze before?

I got bounced back and forth as well when I mentioned my card was suddenly un-usable for physical transactions – took them a good 6-7 working days to get it resolved. At the initial stage, I reached out for assistance using the live chat but the CSO mentioned she wasn’t trained to manage such an issue and I was like -___-

I have also experienced a lot of fradulent transactions when i linked my credit card to amaze. Although those transactions were subsequently denied, it scares me to know that there are people who have access to my card.

Probably instarem has quite a problem with their card issuance and processing team, never had such prevalent problems with youtrip and wise.

Looks like the trouble not worth the 4mpd

Well, I’m not going to stop using Amaze, but this has definitely taken the gloss off somewhat.

I normally will by-default link the card to the wallet which is the bucket collecting cashback with not much money inside. Only when I am about to use the card, I will go into the app and switch on the fly. This real-time switching probably one of the good feature of the Instarem app. I can anticipate some inconvenience of switching the app in/out when overseas frequent biz trip/leisure travel back on the card as it’s undeniably a card that provide the best foreign currency rate and 4mpd. Not sure if my way is better in avoiding the fraud reporting… Read more »

If instarem were to never respond, would there be any recourse via the bank whose card is linked? Or is that a lost cause because you technically authorised amaze to bill to that card?

Had similar issues – multiple charging for same transactions and Amaze did not take responsibility for it. I ended up chasing the merchants myself for refunds.

merchants will always be the first to resolve the issues. Even if you report it to the banks or card associations, the first thing they will ask you to do is to contact the merchants for refund.

I’m sorry to hear about this. This is, unfortunately, not surprising. Nium is licensed as a Major Payment Institution under the Payment Services Act (PSA), which itself is a new law which took effect only in 2020. I have worked in a fintech start-up licensed under the PSA before, and I can tell you it is typical for such start-ups to still have a lot of the processes not in place. This is simply because the CEO and leadership are pressed for other measures like growth, while compliance and disputes are cost centres and a “distraction”. They also probably have… Read more »

I don’t earn anything from amaze, except referral credits I have no means of using (since I don’t send $ overseas)

Got it. I hope you get your resolution. Otherwise it will be a big hit on your effective mpd from all your Amaze transactions.

Thanks for sharing, this was illuminating and a great caveat for us to keep in mind

I’ve had multiple transactions appeared on my card when ordering Uber Eats in the States. My first email to Instarem was replied to quite promptly in 30mins on New Year’s Day that the transactions will be looked into. I continued using my card during this period and on the 5th received a few more transactions again. All the transactions still appeared as pending. I then emailed them again and received an explanation shortly 2 hrs later. Basically the transactions with Uber Eats were caused by the biller consolidating the transactions I made into a single transactions and I’ll have to… Read more »

If you prefer, you can ask Amaze to block any pending transactions from you. It is not any safer just because you don’t know. It happens to every card, some card will show pending transactions and some will not.

I would suggest you don’t use Amaze at some petro kiosks. You will be surprised that the charges will be posted to your underlying card, then reversed long after.

This has already happened to me by putting my Amaze card in the local parking.sg app. So many transactions and reversals appearing in my underlying card.

Aaron, probably worth another article how/why Amaze treats pending transactions, versus normal credit cards

not fraud, but have also experienced poor customer service around a reversed transaction not registering on my underlying card. Tried making a transaction using Amaze 3 times, all of them showed as ‘reversed’ in the app. Except that one of those transactions was charged on the underlying card. Waited 7 business days before emailing them, only for them to reply that it “normally takes 3-5 business days” for the reversal to show on the underlying card – helpful 🙄 Waited 4 more business days, reversal still didn’t show, so I replied to them again and only then did they say… Read more »

Wow. Maybe I should stop using them. Scary.

I had almost the same dispute with them. I tried to reload the Amaze card using credit card with a small amount (100 SGD), first tried was rejected, I have experience this before with Grab Card and the situation was handled perfectly and the amount is reversed within a few days, so I gave it a second tried again with the same amount, it went thru. At the same time I raised a dispute with them immediately for the first transaction. After more than 2 weeks, there’s no answer by them, but the amount has been marked “Completed” by my… Read more »

I locked my card after reading the article and all the comments here. I guess I could unlock and relock each time I make a transaction but it’s going to be a pain in the a$$.

Same. While I haven’t had any weird transactions with Amaze thus far, I’m just going to play safe lock it when not in use given all the shared datapoints.

I am having the same issue but with a prominent merchant – Apple USA. This is terrible. Instarem needs to work on this.

I had similar issues of being bounced between departments when I disputed a transaction. Not the best customer service if one encounters any issues with their card/transactions.

One method I use to avoid or minimise chance of fraud is to switch the card used to the Amaze balance whenever the card is not in use, so that the transaction would fail owing to the Amaze balance card (which houses the 1% cashback credited every quarter) having insufficient balance. It would not work for those with recurring card transactions, however.

This exactly what I am doing all along as I don’t 100% trust them from the start lol

Nah.. I linked it to my wallet which has zero credit. Yet, they still charged it! Now the wallet is negative! So, it’s not preventing the fraud charge or whatsoever. Really not amaze after all.

how about deactivation online and cross border transaction?

I’ve had similar experiences with Citi, completely unhelpful. The last one they kept telling me was OTP authorised which was impossible! In the end I spoke to the merchant in the US myself, they cancelled the order and I just ate the FX difference and I replaced the card

Hi Aaron. I got hit in the middle of the night till this morning. Got a rude awakening having to experience it on my birthday! 6 transactions went through to Amazon for Kindles and an Amazon Prime subscription. Have raised with DBS immediately to put a stop to the card and reached out to Amazon too. Also put a lock to the Amaze card for now.

You’re spot on on the way Amaze handles such fraudulent transactions. Live chats were hopelessly handled and emails were sent to and fro. I’m tired having to deal with this especially today…

Hmm …this is quite discouraging to hear the bad customer experience from Amaze esp during card fraud.

makes me reconsider now if its worth still to continue using this card for the extra rewards given that you will be left without much support in cases of fraud.

just realised also have been exploring the app and there is totally no info there how to submit a txn dispute and no mention of the email dispute@nium.com.

Going to temp block my card first for now

Pay peanut get monkey. These fintech garbage are only able to outcompete the banks by cutting costs in the most important departments. Hope you learnt your lesson.

I agree with you. But sometime people only see the carrots and can’t see past the wolf dangling the carrot. I don’t think Amaze is bad but I do think they are not good enough in todays digital security we need customer support which should be paramount before carrots

Fintechs may or may not be garbage but banks are fat cats making margins unrelated to the service they provide. A fintech going through growing pains is no reason to support traditional banks. It is better to support disruption than have no choice, get charged high fees and live with ho-hum service.

It’s one thing to support competition and another to pay out of your pocket to subsidise some inferior product while they fool around. Fintechs already have much lower costs by sidestepping regulatory oversight through loopholes and now they’re giving customers a bigger finger by cutting even more costs on security. I for one won’t allow my own personal finances to be screwed around by some fly by night especially with VC money drying up over the coming months with ongoing monetary tightening.

True, in my case i find these ideas are great when they work. But when you do need customer service, there is none or extremely difficult to get to. I had problems with my Revolut and after trying very hard to finally reach a human operator, I was just bounced around departments until I gave up.

This is an excellent idea! Thanks for the tip

Perhaps, instead of locking the card, just disable the cross-border transactions option by default?

Another thing that worries me out about Amaze is that you need to have at least 1 credit card linked at all times. I wanted to remove a linked card because I only use Amaze for travel and found that this wasn’t possible unless I linked a different credit card. Given that Instarem does not even require 2FA for log-ins, locking the card isn’t good enough. If your account is compromised for whatever reason, the person could easily unlock the card and just wreak havoc. And from what’s been shared here, it’s going to be difficult to get any sort… Read more »

Link it to a e-wallet and limit the amount in the wallet.

That’s the problem when we are obsessed with reaping maximum rewards without taking into the risks involved.

Risk can be managed. There is no such thing very profitable yet risk-free.

It’s all about risk management.

Better stick with banks for credit cards and to avoid all these gimmick cards for extra miles and points.

Is anyone else missing the 11.11 extra 1% cashback?

What’s the alternative in the meanwhile while waiting for dispute to be resolved & replacement card to arrive ? Use back the original cards ?

Can confirm that their customer service is atrocious. I’m filing a chargeback against a merchant and they asked me to provide supporting documents. Supporting documents were provided as requested but they keep asking questions that have already been answered in the documents. Wanted to call them to explain the complicated situation but that seems impossible.

I had a rather satisfactory experience with their CS team though! A refund was due to be processed on my old Amaze card, which I had already blocked and cancelled. Reached out to the team and they were able to route the refund to my DBS card directly!

Just received their card today….now I’m thinking to cancel my account with Instarem or not.

Did you manage to get your transaction resolved?

yes, it was eventually resolved in my favour.

Thanks for the reply Aaron! Great to know that, but you had to bear the transactions out of your pocket. What was the duration to get your money back?

about 1-2 months. it is an inherent risk involved in using the card.

Received 2 fraudulent transactions on my amaze card yesterday. Meanwhile, do you pay your cc bills with the bank while this is being resolved?

Yup. So you bear the carrying costs unless you can get them to issue a temp credit

Yesterday night, I had 10 fraudulent transactions being charged, SGD 6k+ in total. The bank did say that they will issue a chargeback when the transactions are posted.

hi did you file the chargeback via the bank or you did it via amaze? and everything’s returned?

Perhaps you can add that the transaction was resolved in your favour in a post-script/addendum in the post, so people don’t have to scroll through comments to find out what happened. Could you also share more about how much more you had to bounce back and forth with Amaze?

Hi Aaron. I was reading the T&Cs of the UOB cards and thought to bring to your attention that UOB has now excluded the earning of points/miles for transactions with description *AMAZE with effect from 1 March 2022

that only affects transit transactions.

What does transit transactions entail?

Oh Transit like Transportation – Bus, MRT, etc…

Was charged with around 750 usd last night and the customer service cant do much really. But only told me to submit dispute form in case the transaction is settled. And have to wait 45-90 days for the charge back. Urghh. Hopefully everything goes well

Hi, can I find out if you managed to get your money back?

I don’t have the Amaze card but I use Youtrip and the moment I saw 5 transactions in Steam when I don’t play games, I immediately locked the card. Then began the nightmare. I contacted their customer service via the app and emails and their contact us form. They didn’t reverse the charges but I googled and found similar cases and Steam had a wonderful customer service team who said it was likely fraud and reversed the charges. Then Youtrip sent a new card. But, and this was the clincher, did not allow me to activate the new card in… Read more »

The blog is giving us good awareness. I always practice linking the amaze card to the wallet as the default payment unless i want to use it and i will switch it to a mastercard. 10 mins ago i have just received multiple email notifications, there was charge USD $1110 at ROMAN, USD $240 at RO, and USD $294.57 at CAR AND TRUCK REMOTES. Only 1 success transaction of USD $0.01 at C&J LAMDSCAPING. All transactions were performed in US. I start feeling this card is not so secure, Imagine if I link to a MasterCard, it will give big… Read more »

Warning for those using this card for hotel stays. I stayed in a hotel in the US and as is the usual practice, the hotel put in a hold of a particular amount on my Amaze card in addition to charging me for the stay. With a normal card, you would not notice the hold. With “amaze” however, you will be charged twice by the bank that you used the credit card on. When you want to raise a dispute, you have no one to call so you’re forced to send messages back and forth on the app. This is… Read more »

Hi John, my wife is facing the same issue with her hotel charge in US. She was double charged and now facing exactly the same issue of getting responses from Amaze that do not make sense. Can I check if you had eventually got the charge reversed by the hotel?

Hopefully this gets sorted out. One way to avoid this problem is to use some other card for booking and during check-in for the “hold”. But during check out, use the Amaze card to settle the bill. Most hotels are fine with using a different card to settle the bill compared to the one used for booking/security. I did this a few times on my recent trip to Europe. The only problem I had was my bank blocked my Mastercard as it triggered some security alert, but that was sorted out via a quick online chat. I use Amaze only… Read more »

Hi Aaron and other people, before Christmas, Instarem charged me $44,912.35 worth of fradulent transaction. My Citibank card linked to the Instarem Amaze is saying that I have to pay these charges because they are marked as secured transaction with OTP received.

I am still battling with them about this case and it is not resolved yet. Anyone able to advise?

Similarly, another friend of recently also encountered a fraudulent transaction that failed.

I think we need to warn people about this more.

In a similar situation – got hit with multiple transactions totaling over $20k via Amaza linked to Citi. OTP received as well. Any resolution on this?

What was the outcome of this fraud case?

I just encountered my own fraud case, and I could not lock nor block/replace my card on the app, approached the customer service, and was informed that they cannot do it on their end. So as I was trying to figure out what is causing my lock to fail, more fraud charges came in.

Another time, if you can’t lock your Amaze card, immediately then go and lock the linked master card. This will be just as effective and any attempt to use the amaze card will then fail.

Comparing Amaze with a normal bank credit card: Instarem will not guarantee (fraud) recovery. All risk is with the customer. Instarem will not provide temporary credit. Instarem will not provide support to customers outside Singapore, who may be in need of a replacement card due fraud. Instarem will allow the card to be used with unsafe sites that don’t even require an OTP. (My fraud was this case – a charge without even an OTP request) Instarem will not follow-up with transactions that may be still pending. The worst part about the above list, is that these issues are not CLEARLY advised… Read more »

The Instarem App has the ability to lock and unlock your Amaze card on demand (a feature i have used since i first got the card in 2023). Those who leave it unlocked all the time “for convenience”, are simply asking for trouble. I leave mine locked all the time until the very moment i want to use it to pay, then unlock and make payment and lock it again – fraudsters will have to time their attacks at exactly the right window of a few seconds in order to use my card. So far, never had a fraudulent charge… Read more »