| ⚠️ Update |

|

A Grab customer service manager reached out to clarify that going forward, Grab will not be requiring the submission of merchant correspondence in the case of fraudulent transactions. The help form will also be updated to better distinguish between disputes (fraudulent transaction) and chargebacks (not fraudulent but contested), with a different process for each. |

If you’ve been using your GrabPay Card on a fairly regular basis, it’s probably only a matter of time before you get hit by a fraudulent transaction.

This is likely to be a mild annoyance more than anything else, particularly since the GrabPay Card is a debit card, and unless you’re keeping a sizeable balance in your GrabPay wallet (why?), the quantum of damage can’t be very high.

But even so, money is money, and you’ll want to file a chargeback to get reimbursed. And here’s where things start to go awry…

My experience disputing a fraudulent GrabPay transaction

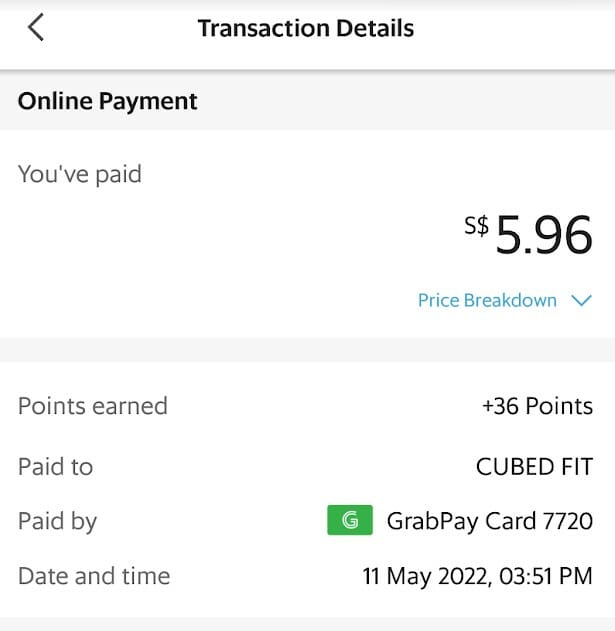

On 11 May, I received a transaction alert that a charge of S$5.96 had been made on my GrabPay Card (I had a small balance in my GrabPay wallet because of a refunded transaction).

This was made to a merchant called CUBED FIT, which I’ve never heard of (do you even lift bro). So naturally I blocked my card immediately and initiated the chargeback process.

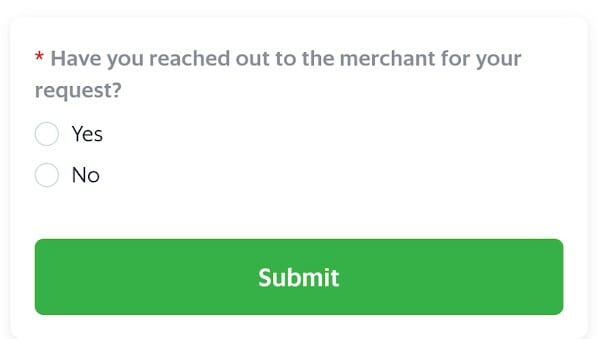

Now, the very first question asked when filing a chargeback is whether you’ve reached out to the merchant to resolve the issue.

That obviously makes no sense in the case of a fraudulent transaction, but it’s impossible to continue unless you tap “yes”.

So I just put “yes” and carried on. I filled out the usual details like the merchant name, transaction date and amount (you’d think the app would be smart enough to auto-populate these fields), and hit submit.

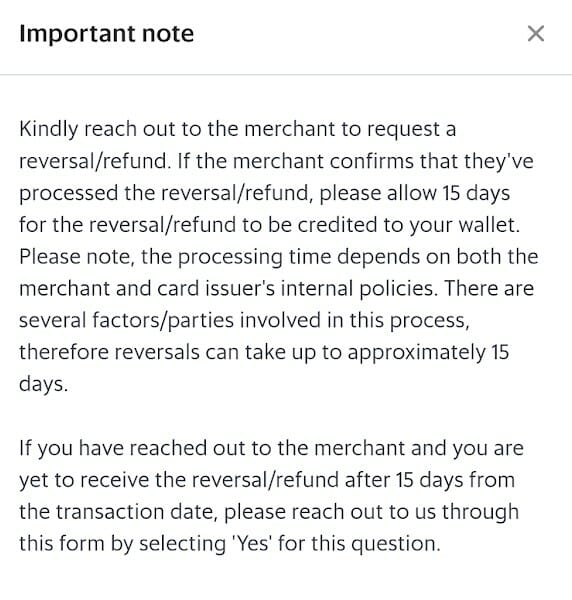

On 15 May I received a call from a Grab CSO, who cancelled my existing GrabPay Card and waived the application fee for a new one. I asked about the chargeback status, and was told that they were unable to open a chargeback claim until I showed them proof that I had already contacted the merchant to try and resolve the matter first.

She pointed me to this term on Grab’s chargeback page.

Please note that you’ll need to provide supporting documents (i.e. screenshots) indicating you’ve reached out to the merchant regarding the refund. This will allow us to proceed with the chargeback process.

Let’s just pause to think about this.

Asking the customer to contact the merchant makes sense in certain chargeback situations. For example:

- The goods you received were different from the ones advertised

- The goods you received were defective

- The merchant charged your card for the wrong amount

- The merchant charged your card twice for a given transaction

- The merchant said they’d issue a refund but have yet to do so

In those cases, sure. There is a pre-existing relationship between the customer and the merchant, and the customer should at least make an attempt to resolve the matter with the merchant before bringing in the card issuer.

But in the case of a fraudulent transaction? I have no idea who the merchant is in the first place (a cursory Google search shows no hits for a company called Cubed Fit), so how am I supposed to even contact them?

And supposing I could, what am I expected to say? “Hi, I don’t know who you are, but someone used my card for a fraudulent transaction with you.” To which they’ll reply….what exactly?

It sounds silly spelling it out, but that’s exactly what Grab is asking customers to do. If you have a fraudulent transaction on your GrabPay Card, you’re expected to somehow contact the merchant and ask them to reverse it (good luck when you don’t even know what you supposedly bought!) before Grab will consider helping you out.

I’ve had to dispute fraudulent charges on my bank-issued credit cards before, and not once was I asked to contact the merchant. I’m wondering why it’s different with Grab.

So back to my call: I told the Grab CSO that what they were asking for didn’t make any sense since this was a fraudulent transaction not made by me in the first place. She kept insisting it was “policy”, but eventually agreed to “escalate” the matter to the disputes team again.

Now, there’s always the possibility the CSO was misinformed, and this isn’t Grab’s actual policy. But given the way the chargeback filing process is set up in the app, how there’s no separate flow for fraudulent vs non-fraudulent-but-disputed transactions, and how you can’t actually submit a claim unless you state that you’ve reached out to the merchant already, I wouldn’t be surprised if it is.

| ⚠️ Chargeback vs Dispute |

|

Someone’s pointed out that a chargeback (legitimate transaction where something’s gone wrong) is different from a dispute (illegitimate transaction), and technically what we’re dealing with here is a dispute. That’s true, but Grab doesn’t distinguish between the two in its Help Centre page, and includes fraudulent transactions under the chargeback category. |

Conclusion

Mark this as unresolved for now, but if Grab continues to insist on this requirement, I’m just going to have to eat the S$5.96. There’s simply no way to do what they’re asking for.

It’s hard not to be cynical about the reasons behind Grab’s blanket application of the “contact merchant first before raising chargeback” rule. Yes, it makes sense in certain scenarios, but certainly not when dealing with a fraudulent transaction. If anything, it feels like a case of trying to tai chi the responsibility to the customer.

Long story short: keep as small a balance as possible in your GrabPay wallet, and lock your card whenever it’s not in use. And if you do get hit by a fraudulent transaction, be prepared for some surreal correspondence with customer service.

Have you had a fraudulent transaction on your GrabPay Card? How was it resolved?

grab team is basically unrealiable, took two days to reply with an email. i had the same encouter.

Long way to go before they can be a digital bank or displace credit cards, and then perhaps they will start an equiv transaction fee or else how to fund fraud management work

surreal (and illogical)

Many merchants use a different name instead of their brand name to process transactions. Asking customers to contact the merchant to resolve fraudulent transactions sounds absurd.

Probably best to limit grab wallet usage to QR code transactions and not anything else locally. No good reason to use their cards overseas as there are multi currency cards like revolut with good rates.

grabpay card can come in useful for making AXS transactions, though. Klook sometimes offers promo codes for paying with grabpay card, so that’s another use case.

maybe better to get MAS involved ?

Grab is a shady company and things have changed since they became unchallenged in the market. They are no longer as customer-centric. Complaints hotline for customers is removed. Even if you did call in to a CSO for complaints they’ll tell you they don’t take complaints and you just gotta e-mail in. Bad ratings from customers are removed. Do you notice almost all drivers are 5 Stars now? It’s because drivers can challenge poor ratings, except for safety issues, most poor ratings are removed. Also in my experience this is the risk of using cards from Fintech, non-traditional FIs. Customer… Read more »

I’ve had the same situation when they issued the grab card first time. I bought a pair of Adidas shorts but I bought the wrong size so went back to then but Adidas couldn’t refund because it was a purely digital card. Grab kept making me go back to Adidas store and Cso for an explanation as they believe their digital card accepts refunds. In the end Grab ate their own nonsense and refunded me their points equivalent to the shorts price after admitting their card had problems.

Escalate this to MAS, they are quite happy to step in when it comes to things like this.

How to do that?

I too had a hard time and it was when I was in Dubai booking a partner transport which in the end I did not end up taking. Their solution was to simply delete the evidence and remove all records in my wallet. Lucky I had screenshots of my grab wallet which is now missing. I’m taking this to MAS. From an accounts and audit point of view it’s most concerning. How can one trust a company who’s solution is to delete records and then says it never happened. While I dislike classic financial institutions for their dinosaur methods modern… Read more »

Suggest you share the screenshots of convos and evidence etc with MAS. You would be doing everyone a public service. Grab is nowhere near a bank and they should not be issuing cards with such poor service. Previously they blocked my account with no sympathy (stupidly logged in to mum’s account on own phone to help with Points redemptions) and there was no way to contact them either, i.e. they stole all my remaining money and points. Had to use family member’s account to send a message to them, still ongoing. MAS needs to at least be aware of the… Read more »

I’ve said it before and I’ll say it again: don’t use these newfangled payment services companies, whether Grab or Amaze or whatever. Everything looks fine until these kinds of problems happen. One single fraudulent transaction means the cost of your miles suddenly becomes a lot more expensive, or you lost your cashback, defeating the point of using these services in the first place. This means you have no choice but to go through these companies’ garbage recovery processes. But is it worth your time and mental load? If you value your time at say, $100 an hour, there is no… Read more »

Most of the people who take advantage of grab card aren’t capable of generating 100sgd an hour i think

For those who could, they wont even pay any attention to grab.

Wonder how reliable would their digital banking be ?

I had a fraud transaction on 8 May too. I went through the ‘report issue’ route and selected unrecognised transaction. Grab needed answers to the following questions: 1)Did you get a chance to speak to contact the merchant – Letting them know about the unauthorised charges on your GrabPay MasterCard? 2)Did you use your card to make this transaction? 3)Did you get notified when the transaction was posted in your account / card e.g 4 digit one time passcode (OTP) from Grab? 4)If yes, did you share the 4 digit one time code with anyone else? 5)Was the card and… Read more »

Same encounter on 14th May with grab card. 100+ sgd at stake

Grab is increasingly unreliable and desperate to milk their users. Any customer service, if there’s any, is impersonal, templated and absolutely frustrating. MAS should know about this, before they they go full fledged digital bank. Would be utter chaos, seeing how they are so rubbish now.

You should make a police report against grabpay and cubefit for making unauthorised transaction.

Grab as a whole has zero customer service. 2 recent issues- I ordered a grab express delivery which took 90 minutes from pick up to drop off- I could see the driver on my screen stopped at a location (housing block) with my item. When he arrived he wouldn’t explain any reason (lunch? Nap?) I complained to grab that I had paid $30 for an express item and asked for a refund- they gave me $3. Another time had a beach pick up, over one week later had a call from grab asking me to pay $20 to vacuum the… Read more »

The number match, i have the same amount charge to my card then after few day, the same merchant charge to my card again.

Guys, be alert !!

Seem like Grab account been havked

Tell me about it..I lost my physical Grabpay card in Apr,called the number for them to help me block n cancel the card(as I was overseas and no Wi-Fi) sounded easy right?horror of horror.. It’s been 1mth and I can’t use Grabpay for anything else other than the occasional online purchase thru my linked account. They still can cancel the lost card nor can they send me a new card. Am I’m perplexed as the rest of my other bank cards have been resolved within 3-5days, This is the longest worst encounter I’ve ever faced with a pre paid debit… Read more »

same goes to me as well but different story i use grabpay for my travel card e.g. buses mrt when the point of that i top up $25 after 2 days its says that [ Pay Off this outstanding card ammout to unlock your GrabPay Card Buses/MRT 144577108\9 MA SGD 16.29 Late Deduction ] I don’t understand why they don’t want to cut when I use it where I have $25

Delete all the garbage fintech la

Grab standard has really dropped significantly ever since they went IPO. Booked a ride booking with Grab but the ride got cancelled by the driver and Grab still charged me cancellation fees. Raised a ticket to Grab support and they just replied me with a standard template saying that Grab will not charge any fees and the driver under monitoring blablabla. It has been months now and there is still no resolution despite multiple correspondence.

Grab need to hire the correct person who have handle chargeback/dispute before to design the correct process.

In this case, there is no transaction information for the card holder, how would he/she approach the merchant which the merchant will obviously ask for this information?

Pardon me but I came from this industry and I am sure this process is totally wrong.

me too.. got 2x unauthorised transaction from primefilmshop.com & 2x from jumpermedia.net .. been 4 days since I called the grab helpline & no reply yet

Hey me too! I have 4 transactions, 3 weeks after contacting and still no reply from GRAB. They said escalated to finance department to investigate, no updates at all and even closed my case on their own. I’m trying to email them to reopen the case again.

did u get back the money from chargeback in the end?

I have an ongoing dispute with Grab over fraudulent transactions which they kept denying that there is a glitch in their Indonesia arm. The Grab team are very unprofessionally trained with zero customer service skills. I also blasted my credit card company for not disclosing any details to me n siding the merchant yesterday.