After a pre-launch period with more leaks than the RMS Titanic, the DBS Vantage has finally made its debut.

This marks DBS’s first foray into the $120K segment, and the good news is that it’s an altogether better product than the leaked version we saw in February. That doesn’t mean the DBS Vantage is suddenly king of the market, but at least it’s not dead-on-arrival like the previous iteration would have been.

Compared to the leaked version, DBS has:

- Reduced the annual fee from S$736 to S$588.50

- Added airport lounge access with 10 complimentary visits

- Added 4 mpd on dining and petrol

- Removed the tiered miles earning system in favour of 1.5/2.2 mpd on all local/foreign currency transactions

- Retained the Accor Plus Explorer membership with one free hotel night

- Tacked on a sign up bonus of up to 80,000 miles (only for applications by 27 June with the code VTMILES)

I’ll be doing a full review in the weeks to come, but in the meantime, here’s what DBS Vantage cardholders can expect.

Overview: DBS Vantage

DBS Vantage DBS Vantage |

||

| Apply Here |

||

| Card T&Cs | ||

| Sign-Up Bonus T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$120,000 |

S$588.50 | 3.25% |

| Regular Earn | Bonus Earn | Miles with AF |

| 1.5 mpd (SGD) 2.2 mpd (FCY) |

4 mpd on dining & petrol (cap at S$2K per c. month) |

25,000 miles |

|

||

The DBS Vantage comes in metal cardstock, with a minimum income requirement of S$120,000 p.a. and an annual fee of S$588.50.

The first year annual fee must be paid. Subsequent years’ can be waived if cardholders spend at least S$60,000 per membership year.

No annual fee applies for supplementary cards.

Welcome miles and sign-up bonus

DBS Vantage cardholders receive 25,000 miles (in the form of 12,500 DBS Points) upon paying the annual fee each year.

This puts the it roughly in the middle of the $120K pack in terms of the cost per mile, though obviously there’s much more to benefits than just miles alone.

| Card | Annual Fee | Miles | CPM |

SCB VI SCB VI |

S$588.50 | 35K miles (1st yr. only) |

1.68 |

HSBC VI HSBC VI |

S$650 (HSBC Premier: S$488) |

35K miles (1st yr. only) |

1.86 (HSBC Premier: 1.39) |

Citi Prestige Citi Prestige |

S$535 | 25K miles | 2.14 |

DBS Vantage DBS Vantage |

S$588.50 | 25K miles | 2.35 |

UOB VI Metal Card UOB VI Metal Card |

S$642 | 25K miles |

2.57 |

OCBC VOYAGE OCBC VOYAGE |

S$488* |

15K miles |

3.25 |

Maybank VI Maybank VI |

S$600 (1st yr. free) |

None | N/A |

AMEX Plat. Reserve AMEX Plat. Reserve |

S$535 | None |

N/A |

| *Alternative option: Pay S$3,210 for 150,000 miles |

|||

On top of this, customers who apply with the promo code VTMILES by 27 June 2022 (with approval by 11 July 2022) and spend S$8,000 within 60 days of approval will receive further bonus miles as follows:

- New-to-bank customers: 55,000 miles

- Existing customer: 35,000 miles

New-to-bank customers are defined as those who do not currently hold any principal DBS/POSB credit cards, and have not cancelled any in the past 12 months. The bonus will be credited within 60-80 days from the date of fulfilling the qualifying spend.

This is a very decent sign-up bonus, all things considered. A new-to-bank cardholder who pays the annual fee and spends S$8,000 in local currency would be looking at 92,000 miles in total, split into:

- 25,000 welcome miles

- 55,000 sign-up bonus miles

- 12,000 base miles (S$8,000 @ 1.5 mpd)

The only catch is the short timeframe to apply (by 27 June), which is clearly a FOMO tactic- though frankly speaking, I’d rather take a short timeframe than a “first X” style offer.

The full T&Cs of the sign-up bonus can be found here. For a full rundown on how to maximise this, refer to the article below.

Earn rates

DBS Vantage cardholders earn 1.5 mpd on all local spend, and 2.2 mpd on all foreign currency spend. No minimum spend nor caps apply to these rates.

This is very competitive for a $120K card, with only the SCB Visa Infinite performing better- and even that requires a minimum spend of S$2,000 per statement month.

| Card | SGD | FCY |

SCB VI SCB VI |

Up to 1.4 mpd* | Up to 3 mpd* |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd |

2.2 mpd |

HSBC VI HSBC VI |

Up to 1.25 mpd^ | Up to 2.25 mpd^ |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2 mpd |

Citi Prestige Citi Prestige |

1.3 mpd | 2 mpd |

Maybank VI Maybank VI |

1.2 mpd | 2 mpd |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

| *Min. S$2,000 spend per statement month, otherwise 1 mpd for both SGD and FCY ^Min S$50,000 spend in the previous membership year, otherwise 1 mpd (SGD) and 2 mpd (FCY) |

||

It gets even better when you consider the tactical promotion that DBS is running till 31 December 2022, which offers 4 mpd on local and overseas dining and petrol capped at S$2,000 per calendar month.

| 🍽️ Dining | ⛽ Petrol |

|

|

|

Examples (non-exhaustive)

|

|

Do note the exclusion of MCC 5814 (Fast Food), so this isn’t the card to use if the KFC craving hits. MCC 5462 (Bakeries) and MCC 5451 (Dairy Products Stores) are also excluded, so you’ll need to be careful if you’re grabbing a bite at a place that doesn’t have a waiter.

Out of the 4 mpd:

- 1.5 mpd (SGD) or 2.2 mpd (FCY) will be awarded upfront when the transaction posts

- The remaining 2.5 mpd (SGD) or 1.8 mpd (FCY) will be awarded by the 11th of the following calendar month, or the next working day if the 11th is not a working day.

Points expiry & transfer partners

DBS Vantage points expire after three years from date of accrual.

It’s slightly annoying that DBS has decided against giving the DBS Vantage non-expiring points, since even holders of the entry-level DBS Altitude don’t need to worry about expiry!

As a reminder, DBS points can be transferred to the following partners with a S$26.75 admin fee. This fee is not waived for DBS Vantage cardholders.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

Lounge access

DBS Vantage cardholders receive 10 complimentary lounge visits per membership year. While it would have been nice to have unlimited visits, 10 passes will likely be more than sufficient for the casual traveller who doesn’t have kids.

That said, it’s decidedly average compared to other $120K cards.

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC VI HSBC VI |

LoungeKey | ∞ | ∞ |

Citi Prestige Citi Prestige |

Priority Pass | ∞ + 1 guest | N/A |

OCBC VOYAGE OCBC VOYAGE |

Plaza Premium | ∞ | ∞ |

Maybank VI Maybank VI |

Priority Pass | ∞ | N/A |

DBS Vantage DBS Vantage |

Priority Pass | 10 | N/A |

SCB VI SCB VI |

Priority Pass | 6 | N/A |

UOB VI Metal Card UOB VI Metal Card |

Dragon Pass | 4 | N/A |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A | N/A |

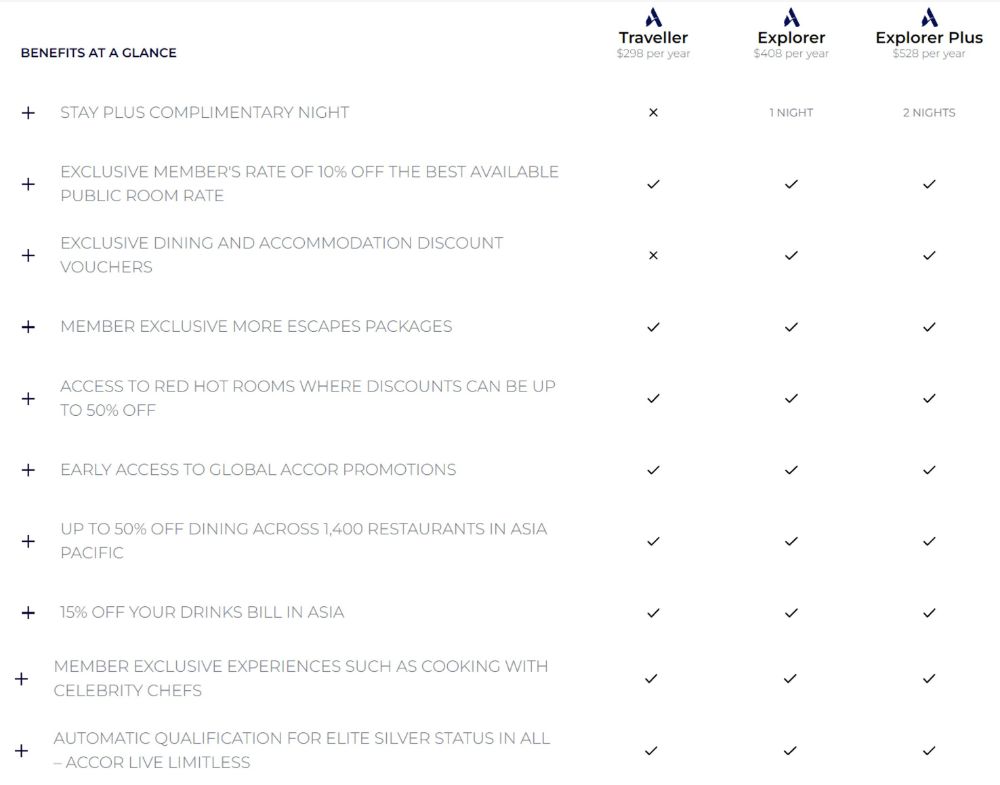

Accor Plus membership

DBS Vantage cardholders receive a complimentary Accor Plus Explorer membership with one complimentary hotel night each year.

This retails for S$408, and includes benefits such as:

- Up to 50% off dining at participating Accor hotels across Asia Pacific

- 15% off drinks bill in Asia

- 10% off the best available public rate

- Access to Red Hot Room sales with up to 50% off

- Accor Live Limitless Silver status

The full list of benefits can be found below.

It’s a solid benefit for sure, though it’d be good to remember that applicants for the UOB Visa Infinite Metal Card can opt for an Accor Plus membership with 2-3 complimentary nights as their welcome gift. However, they must forgo the 25,000 welcome miles for that, whereas DBS Vantage offers 25,000 miles and Accor Plus with one complimentary night.

Dining discounts

DBS Vantage cardholders can enjoy “members-only discounts at over 80 of Singapore’s finest dining establishments”. This is administered through a partnership with Dining City.

The discounts are mostly 15% off, which means this isn’t anything life-changing.

Is it worth it?

Here’s a rough valuation of the benefits of the DBS Vantage:

|

|

| DBS Vantage |

|

| Benefit | Value |

| 25,000 miles | S$375 |

| 55,000 miles (sign-up bonus; first year only) |

S$825 |

| Accor Plus Explorer | S$408 |

| 10 lounge visits | US$299 (~S$414) |

| Dining City discounts | S$100 |

| Total | >S$2,000 |

Now, we can have endless debates about the figures above, like why 10 lounge visits should be worth US$299 (a proxy figure based on the Priority Pass Standard Plus membership; but really depends on whether you’d be willing to pay US$29.90 per lounge visit), or why 1 mile should be worth 1.5 cents (see this article for more details). In the case of dining discounts, I’ve just used S$100 as a placeholder figure, and that’s completely arbitrary.

All this to say you can definitely cover the S$588.50 annual fee, but it boils down to how you value things. If you were already planning to buy an Accor Plus Explorer and Priority Pass Standard Plus membership, then it’d be cheaper to get a DBS Vantage than signing up for each of them individually. The 25,000 miles welcome gift and sign up bonus is just the icing on the cake in that case.

That’s a big if, however, so you’ll need to look at your own travel and lifestyle patterns to see if the DBS Vantage fits.

Conclusion

DBS Vantage DBS Vantage |

||

| Apply Here |

I’m personally not in the market for a $120K card since my AMEX Platinum Charge eats up my entire annual fee budget while covering much of what the DBS Vantage has to offer.

However, my overall take is that the Vantage is at the very least competitive, thanks to its earn rates, sign-up bonus and Accor Plus membership.

There are certainly things it could have done better: non-expiring points is such a low hanging fruit I’m shocked they didn’t take it, and capping lounge visits at 10 will likely be insufficient for road warriors or those who travel with family in tow.

Will it convince Citi Prestige or OCBC VOYAGE members to switch en masse? I have my doubts, but we’ll need to see. One thing’s for sure: this year’s $120K card showdown just got a whole lot more interesting.

Will you be getting a DBS Vantage?

I am going to apply it now lol

Any word on exclusions for the 8k bonus spend?

Is grabfood considered eating places?

Yes Grabfood falls under 5812 unless its fast food which is 5814

Great thanks!

DBS Vantage points pool with other dbs cards?

yes.

Thanks, Aaron!

Applied, Approved and now loaded and ready for use on Apple Pay!

How do you get the card details? Esp the CVV number?

You card number will appear in your DBS App.. card has been loaded onto Apple Wallet and ready for immediate use.. There is no need for CCV on Apple Wallet.. physical card will be mailed to me (at some point in time) but I’m in no hurry to receive it, seeing it’s on Apple Wallet.

when I tried to add the card in my apple wallet, it asked me for the CVV number. May I check with you how did you add it without the CVV number pls? Thanks!

I’m afraid I have no answer for you cos when I added my card to my Apple Wallet I wasn’t asked.. I just made first transaction this afternoon without any issue

Add it via the Digibank app.

How fast did the approval take?

It was immediate.

Going to cancel my citi prestige now. Unlimited PP visits is an underutilised benefit for most and one of the few reasons to hold the card

While subjective, 10x PP access would likely be inadequate even for the median solo traveller. At the most, that’s good for 5 round-trips trips–assuming no lounge hopping or layovers–and last I checked, the average Singaporean took 5.2 overseas trips in a year pre-covid.

I’m 11 months into my current Citi Prestige membership year, and during that period: my PP card has been swiped 33 times and I’ve received ~S$1.4k in 4NF rebates. Those 33 times exclude guest utilizations btw, and as an OW Emerald, Star Gold, and SkyTeam Elite Plus, PP lounges aren’t usually my first choice at most airports…

Depends on the traveller, for myself I prefer to just check in near departure time and board the plane, unless i’m travelling biz class when I can get champagne and nice food in the lounge. Even tho I hold AMEX platinum I rarely use it for the PP benefit, i’m not gonna reach Changi airport earlier just to use SATS premier lounge lol. Time is money

CSB la. College student with prestige?

If I sign up for this card online now, pay the annual fee, I then spend S$60,000. Do I get the annual fee refunded when I call DBS pls?

from what i see, main benefits would be the miles and 1 night hotel, given mile devaluations are upcoming/ have already occurred, will have to rethink whether this is still viable esp with a min 8k spend

It is a pity that the 4mpd on petrol is only a temporary benefit.

As an existing Citi Prestige card holder with unlimited PP access and existing DBS card holder, I wished there were more compelling reasons to sign up if I’m not after the Accor / Dining City perks. Of the 72k miles (60K+12k from actual $8k spend), I’m already paying for 39233 miles (valued at 1.5c) with the $588.50 annual fee, That means I’m only earning 4.1 miles/dollar (rounded to 1 decimal place) for that $8k spend (for the remaining 32767 miles) within 60 days.

60k for existing customer. Bonus for spending 8k during first 2 months is the only difference.

The only reason you are willing to buy miles at 0.8 cents is because you value them much higher than that. If you value miles at 0.8 cents you might as well earn cashback

Is it me or does the vantage card (unfortunately) resemble a premium version of a priority pass card?

If I sign up for the card as existing dbs card holder, from Aaron’s table in the article, I’d get:

25k welcome miles

35k sign-up bonus miles

12k base miles (S$8,000 @ 1.5 mpd)

tempted to sign up but scared won’t be able to find any redemption tickets from SQ to SFO

You won’t. I am using KF miles for *A tickets on weird looking itineraries for trips a few months out. Emptied my SC VI balance into Mileage Plus at a ridiculous transfer rate just to book UA2/UA1 for a July trip that I cannot avoid. The value of a miles cache will remain grossly overrated over the next 12-18 months.

No, I am giving this a miss. Stingy PP benefits is a pinprick but not a deal breaker. However, expiring points and lack of variety is transfer partners is unacceptable for a $120K card. With OCBC VM, you get around this problem in a manner of speaking and Citi doesn’t have this problem (except Mileage Plus). FWIW, even restricted, the 4th night free benefit saved me $1400 last year on Citi, not to mention bargain basement pricing on PayAll mile purchases. DBS is far too late and brings far too little to this game. To think they waited this long… Read more »

Amazing that for a high-end card DBS would be stingy and not give free transfers to KF. This is already offered by OCBC and UOB.

for a card that has a $588 annual fee, please give free transfers to Kris Flyer

Thanks for the info! I’ve just applied but i do not see anywhere whereby i can key in the promo code?

same; not sure if this would affect our application.

I think it may and worst part is, the application was approved instantly. I can’t even resubmit the application. I’ve called the RM to talk to the credit card dept to cancel if they cant offer the promo. I think you should try contacting the bank just to be sure.

i read a couple of data points that people were able to contact customer service and get the code added retroactively. no promises it’ll work, but worth a try.

Thanks Aaron!! The RM msg me today and managed to add in the promo code. phewwwww!

For those who didnt key in the promo code like myself, try calling them.

Almost at the end of the application form, there is “How would you like to receive DBS marketing & promotion materials?” The promo code is just right below

Thank u!!! I think i need a new pair of glasses. I totally missed that

Not sure if this is a “to get” or “forget” for me since I’m currently holding the Amex platinum charge.

The dining privileges seem to range from free glass of champagne to 15% off, hardly groundbreaking stuff

Does the supplementary card holder enjoy the same PP benefits?

Would Cardup transactions made on this card be considered or will they be excluded (as part of $8000 spend)?

Keen to know this too. Anyone can clarify?

Curious to know this too!

Does a POSB everyday card make it impossible to get new-to-bank bonus customer miles?

Yes, by definition in T&Cs

Does this card comes with paywave function?

Is there a travel insurance free? I didnt see or read for that part..

No. do not have

Woahhh.. with this type of card, no free insurance in booking air tickets? Hmmmm

This is by far the best miles card in my opinion. For people who just want to 2 keep two cards, 1 women card (for online spending) and 1 general card, this vantage seems like a no brainer, simply for the fact that DBS pool the points together. I am not really excited on the welcome gift or the perks, they are good to have. I finally can retire by attitude card hehe.

Same here! The best two card combo. And usually only one card in wallet because WWMC only use online.

Lol!!!!!!

I have Citi Prestige. Deal breaker for me is the limited lounge visits, otherwise I would switch over to this card. I travel 3-4 times a year with my wife, 1 trip is at least 4 lounge visits each.

With the exclusion of MCC 5499, I’m confused as to why DBS has included Deliveroo and Foodpanda as examples under Eating Places & Restaurants?

Because deliveroo and Foodpanda code as restaurants now.

Thanks!!

Sorry not sure how to work maths here. Is the 8k spend on DBS to get 55k+12k miles worse or better than 8k on citi pay all?

Hi, fellow minion here along with rest of minions from dbs commenting here to drive up engagement! Get this card now!

does seems like over-zealous bots….

Just realized that restaurants within hotel establishments will probably have hotel MCC, and hence for those you can’t stack Dining City discounts with 4mpd (at least until 31 Dec 2022).

On another note, I’m eager to know how the card will fare post-2022 after the 4mpd has been nerfed. I really hope they would add other 4mpd categories to keep customers engaged. Otherwise, it’s going to suffer from the same fate as X Card.

4 miles/$ isn’t a standard offering for 120k income bracket cards.

Can it be used with cardup?

I was hoping for limo rides…

It’s basically just a Grab premium, i’m sure with 120k/year you can afford it…

Seems like only applepay, no paywave i think

It’s a metal card so paywave would not work.

I was just at DBS asking this – they’ve confirmed that despite being a metal card, it has paywave functionality.

Hard pass. Would have been great without the annual fee.

All the benefits are so mid, the card is a kinda good but not the best in every category. uninteresting.

Hi Aaron, what’s the cpm for fx transactions on this card?

As a DBS Vantage Visa Infinite Principal Cardmember, you will receive 10 complimentary airport lounge visits each membership year to share with your guest. For any additional cardmember & guest visit(s), a fee of US$32 per person per visit will be charged to your DBS Vantage Visa Infinite Card => Does this mean i can use the 10 x complimentary for guest as well, i.e. if i travel with a family of 4, i can use up 4 lounge visit to cover without paying any fee?

Hi Aaron, the card TnC mentioned “3.75 DBS Points for every S$5 local spend”. Does that mean any transaction with less then S$5 will not earn miles/cashback?

No. The calculation is the number round down to whole number, times 3.75/5 and round down again.

Minimum spend is 2. Because 2*3.75/5=1.5 round down to 1 points.

min spend to earn points is $1.34 for SGD and $0.91 for FCY- confirmed with DBS.

Thanks so much for your info & reply, Jack & Aaron!

Hi, does linking this card to GrabPay and make payments from there count as part of the 8K?

no. Only three Amex can do grab pay too . Which is ending end July anyway. Grab game has ended.

Does payment of insurance premium count as “local spend” and generate the base 1.5mpd?

No. Insurance is exclude

Has anyone received the physical card already? Interested to know how long is the lead time. Have a big payment coming up but pay wave is not supported and not sure if the physical card will arrive in time.

Just got mine today, i applied june 23.

The actual physical card looks bad. Not full metal, but some sort of weird combination of metal and plastic! The Vantage logo makes card looks like being cut across. There is also this weird horizontal “cut line” from edge to the chip.

Agreed! Im not impress with the card. The funny thing is the cutline at the edge of the chip. From back to front.

Yup, the horrendous cut line is there for insignia as well. not very premium looking at all.

Hi all, wondering if paying for a health screening with Fullerton Health through Kris+ counts towards the $8k spend?

Hi Aaron do you know if private hospital spend e.g. Thomson medical hospital bills is counted towards the 8k spend? Thanks.

Sorry, a bit URGENT:

How do we find out when the official approval date was? My wife applied for the card, but it took a bit longer owing to DBS asking for more docs, and now we are trying to calculate when the “60th day from approval date” would be for us.

Thank you!

Has anyone NOT got the bonus miles under this promotion? It looks like we got nothing, apart from the 12,500 DBS points for paying the annual fee straight away. We definitely cleared the $8k minimum spend within the first 60 days, but we cannot see any bonus miles having been posted at all.