Citibank has extended its 25,000 miles sign-up bonus on the Citi PremierMiles Card, which now applies to applications submitted by 31 July 2022.

|

|

| Apply | |

| ❓ New-to-bank Definition |

|

| New-to-bank customers are defined as those who do not currently hold a principal Citi card, and have not in the 12 month period before application. Debit cards, supplementary cards and corporate cards do not count. |

New-to-bank customers will receive either 5,000 or 25,000 bonus miles with S$800 spend, depending on whether they pay the annual fee.

While existing customers could previously receive 3,500 bonus miles + S$100 Kaligo e-voucher with S$9,000 spend and payment of the annual fee, this option has now been removed and existing customers only qualify for an annual fee waiver (see below for a better offer via SingSaver)

|

| Apply |

| All Citi PremierMiles Cards applied for via SingSaver will automatically receive a first year fee waiver |

Should this not tickle your fancy, an alternative option (valid for applications till 7 July) exists for applications made via SingSaver. New-to-bank customers who spend at least S$500 within 30 days of approval can pick one of the following gifts:

- Dyson Supersonic (worth S$699)

- Samsonite Straren Spinner 67/24 (worth S$600)

- Dyson Air Purifier TP00 (worth S$549)

- S$350 cash

Existing customers will receive S$30 cash, with no minimum spend required.

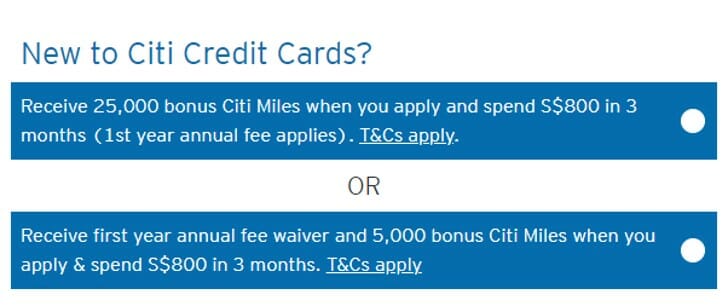

Sign-up offer for new-to-bank customers

New-to-bank customers can choose from two different sign-up offers at the point of application.

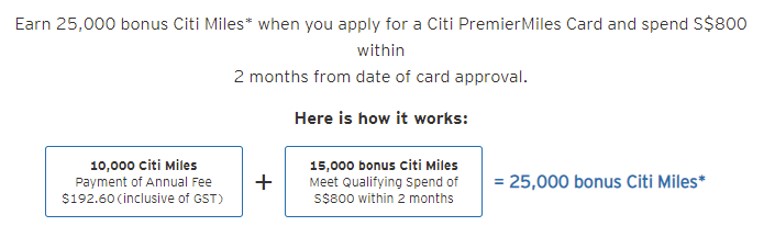

Option 1: Spend S$800, get 25,960 miles

New-to-bank customers who pay the S$192.60 annual fee and spend S$800 within 3 months of approval will receive a total of 25,960 miles. This is broken down into:

- 960 miles for spending S$800 @ 1.2 mpd

- 15,000 miles for meeting the spending requirement

- 10,000 miles for paying the S$192.60 annual fee

| 📅 Qualifying Spend Period |

|

Citi defines “3 months” as the period from approval date till the end of two calendar months after. For example, if approval is granted on 14 April 2022, the period runs till 30 June 2022. This means you have anywhere between 2-3 months to make the minimum spend, and it’s advisable to apply as early in the month as possible. Do note that this represents a change in policy; prior to 14 April 2022, customers had 3-4 months to make the minimum spend. |

Bonus miles will be credited within 3 months after the qualifying spend has been met. The T&C for this sign up offer can be found here.

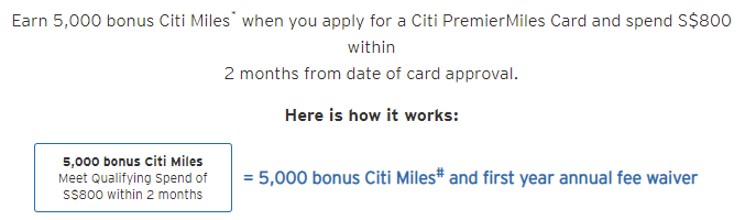

Option 2: Spend S$800, get 5,960 miles plus fee waiver

New-to-bank customers who prefer not to pay the annual fee can still get a smaller sign-up bonus.

By spending S$800 within 3 months of approval, they’ll earn a total of 5,960 miles. This is broken down into:

- 960 miles from spending S$800 @ 1.2 mpd

- 5,000 miles for meeting the spending requirement

| 📅 Qualifying Spend Period |

|

Citi defines “3 months” as the period from approval date till the end of two calendar months after. For example, if approval is granted on 14 April 2022, the period runs till 30 June 2022. This means you have anywhere between 2-3 months to make the minimum spend, and it’s advisable to apply as early in the month as possible. Do note that this represents a change in policy; prior to 14 April 2022, customers had 3-4 months to make the minimum spend. |

Bonus miles will be credited within 3 months after the qualifying spend has been met. The T&C for this sign-up offer can be found here.

What counts as qualifying spend?

Qualifying spend refers to retail transactions charged to the card, and excludes the following:

| i. annual fees, interest charges, late payment charges, GST, cash advances, instalment/easy/ extended/equal payment plans, preferred payment plans, balance transfers, cash advances, quasi-cash transactions, all fees charged by Citibank or third party, miscellaneous charges imposed by Citibank (unless otherwise stated in writing by Citibank); ii. funds transfers using the card as source of funds; iii. bill payments (including via Citibank Online or via any other channel or agent); iv. payments to educational institutions; v. payments to government institutions and services (including but not limited to court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases); vi. payments to insurance companies (sales, underwriting, and premiums); vii. payments to financial institutions (including banks and brokerages); viii. payments to non-profit organizations; ix. betting or gambling (including lottery tickets, casino gaming chips, off-track betting, and wagers at race tracks) through any channel; x. any top-ups or payment of funds to payment service providers, prepaid cards and any prepaid accounts; xi. transit-related transactions; xii. transactions performed at establishments/businesses/merchants that fall within an excluded Merchant Category or a merchant that has been excluded by the bank, as sent out in www.citibank.com.sg/rwdexcl (this list of excluded Merchant Categories or merchants may be updated from time to time at our discretion and Eligible Cardmembers shall refer to this list for any updates) |

Notice that point xii. refers customers to a separate list of exclusions, which includes other items like GrabPay top-ups and utilities bills.

For avoidance of doubt, Citi PayAll transactions will count towards the minimum spend. In fact, there’s a fantastic opportunity right now to earn 2.5 mpd on PayAll transactions (including income tax), with a minimum spend of S$5,000.

Great deal: Citi PayAll offering 2.5 mpd on all payments (including tax); buy miles at 0.8 cents

What can you do with Citi Miles?

Citi PremierMiles cardholders get access to 10 different frequent flyer programs and one hotel partner, the widest selection of any bank in Singapore.

Points can be transferred to miles at a rate of 10,000 Citi Miles= 10,000 miles. There are some great sweet spots with programmes like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles. Even the newly-revitalised Qatar Privilege Club might be a good bet (but heads up: they’ve sneakily reintroduced award segment fees!)

| Partner | Transfer Ratio |

|

1:1 |

| 1:1 | |

| 1:1 | |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

| 1:1 |

A S$26.75 conversion fee applies for every transfer, and do note that Thank You points earned on the Citi Prestige/Citi Rewards cards do not pool with Citi Miles, so you’ll have to redeem them separately.

Overview: Citi PremierMiles Card

Apply Here Apply Here |

|||

| Income Req. | S$30,000 p.a. | Points Validity | No Expiry |

| Annual Fee | S$192.60 (First Year Free) |

Min. Transfer |

10,000 Citi Miles (10,000 miles) |

| Miles with Annual Fee |

10,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$26.75 |

| Local Earn | 1.2 mpd | Points Pool? | No |

| FCY Earn | 2.0 mpd | Lounge Access? | Yes: 2 x Priority Pass |

| Special Earn | 10 mpd on Kaligo | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The Citi PremierMiles Card earns 1.2 mpd on local spend and 2.0 mpd on overseas spend. Citibank awards points on every dollar of spending, and the minimum spend to earn points is S$1.

The Citi PremierMiles Card comes with a Priority Pass membership that provides two complimentary visits per calendar year. Note that this is slightly different from most other credit cards on the market, which award their free visits per membership year.

Read a full review of the Citi PremierMiles Card here.

Conclusion

Citibank has extended its excellent sign up bonus on the Citi PremierMiles Card till 31 July 2022, with the opportunity to take home 25,000 bonus miles for just S$800 spend.

Even if you don’t fancy miles (what are you doing here?), you can get S$350 cash or a Dyson gift as a new-to-bank customer who spends at least S$500 within 30 days of approval- simply apply via SingSaver.

Despite its non-pooling points and average earn rates, I’d consider the Citi PremierMiles Card to be one of the better general spending cards on the market, thanks to its wide range of transfer partners and Citibank’s frequent miles purchase offers. You’ll also enjoy a Priority Pass with two complimentary lounge visits, and getting a fee waiver in subsequent years has never been an issue in my experience.

Can I have both 25000 miles reward and singsaver dyson reward?